Retail investors entering the world of decentralized finance (DeFi) on the Base blockchain in late 2025 are encountering a fundamental shift: AI-powered platforms are transforming yield strategies from manual, high-friction processes into seamless, automated experiences. The days when users had to constantly monitor APYs, rebalance portfolios, and navigate complex protocols are rapidly fading. Instead, intelligent DeFi agents and aggregators are taking center stage, making advanced yield optimization accessible to everyday users, even those with limited technical backgrounds.

AI-Driven Yield Aggregators: Core Innovations for Retail Users

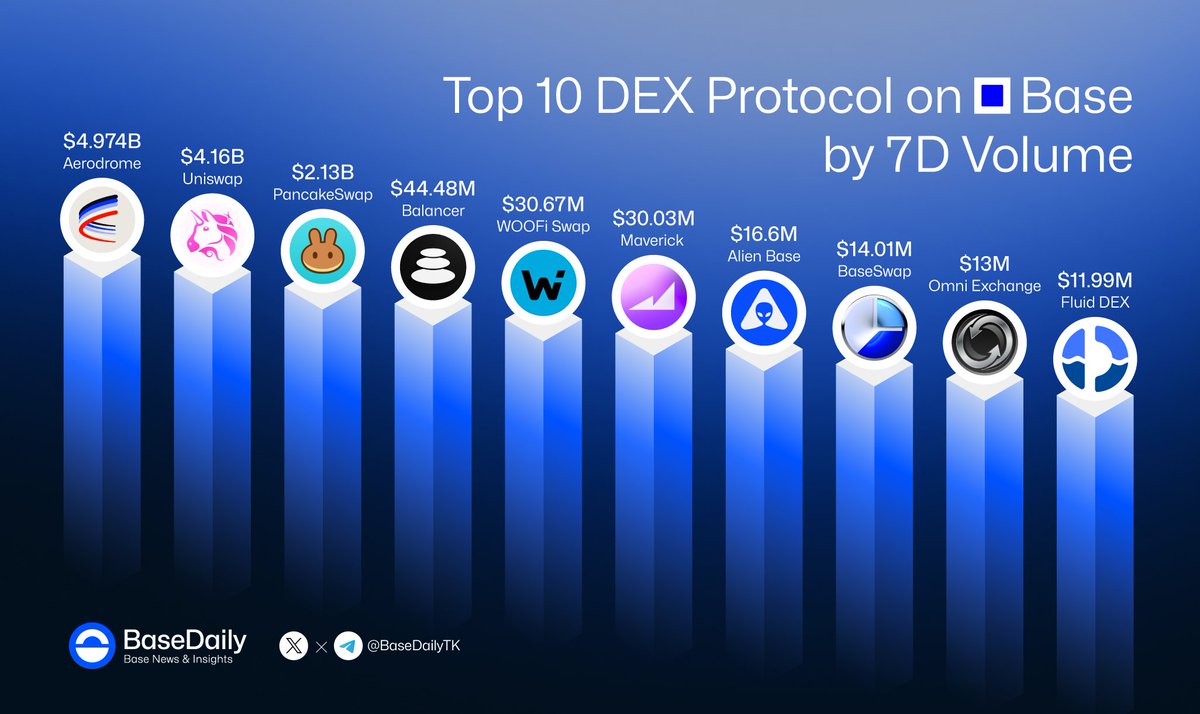

The current generation of AI DeFi Base blockchain tools is defined by automation and accessibility. Seven leading platforms, Veda Protocol, maxAPY, Beefy Finance (Base deployment), Yearn Finance (Base integration), Aerodrome Finance, Summer. fi (formerly Oasis. app), and BaseSwap, are at the forefront. These platforms leverage artificial intelligence not just for basic automation but for continuous optimization across multiple protocols and assets.

Top 7 AI-Powered DeFi Yield Aggregators on Base

-

Veda Protocol: This trustless, AI-powered DeFi platform is designed to help users achieve maximum returns with minimal risk. Veda Protocol embeds yield strategies across multiple blockchains and protocols, making it a versatile choice for retail investors seeking automated, optimized yield harvesting on Base.

-

maxAPY: maxAPY leverages advanced AI algorithms to automate and optimize DeFi yield farming 24/7. It supports over 100 strategies across 20+ protocols, allowing users to maximize returns with a single deposit while minimizing manual intervention and risk exposure.

-

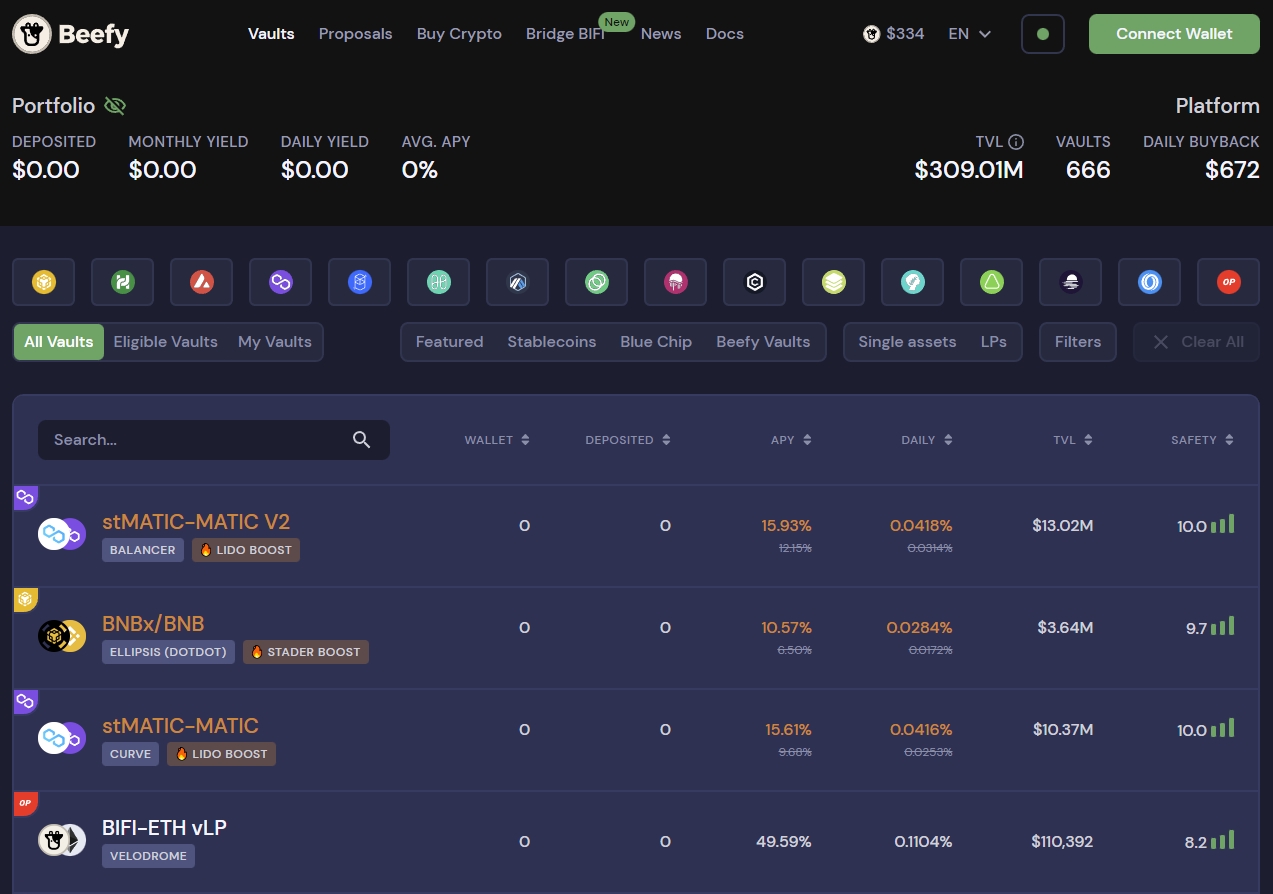

Beefy Finance (Base deployment): Beefy Finance is a well-established yield optimizer that has integrated with the Base blockchain. Its AI-driven vault strategies automatically compound yields, enabling users to benefit from efficient, hands-off yield farming across multiple DeFi protocols.

-

Yearn Finance (Base integration): Yearn Finance, a pioneer in DeFi yield optimization, now offers native support for the Base blockchain. Its AI-powered strategies automate asset allocation and rebalancing, providing transparent, risk-adjusted returns for retail users.

-

Aerodrome Finance: Aerodrome Finance brings AI-driven liquidity management and yield aggregation to Base. The platform continuously monitors market conditions to optimize liquidity provision and maximize APY for users, all through a streamlined, user-friendly interface.

-

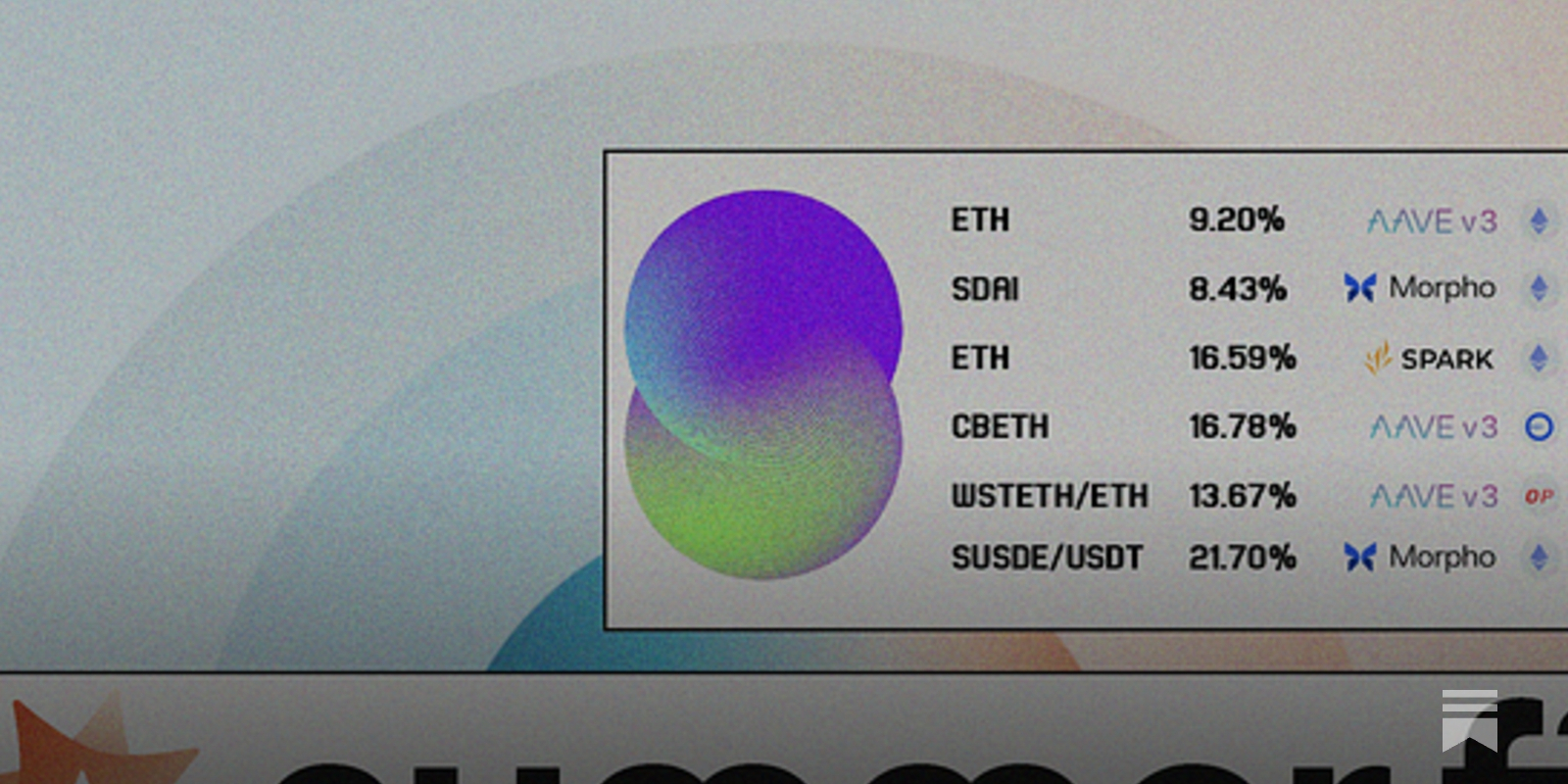

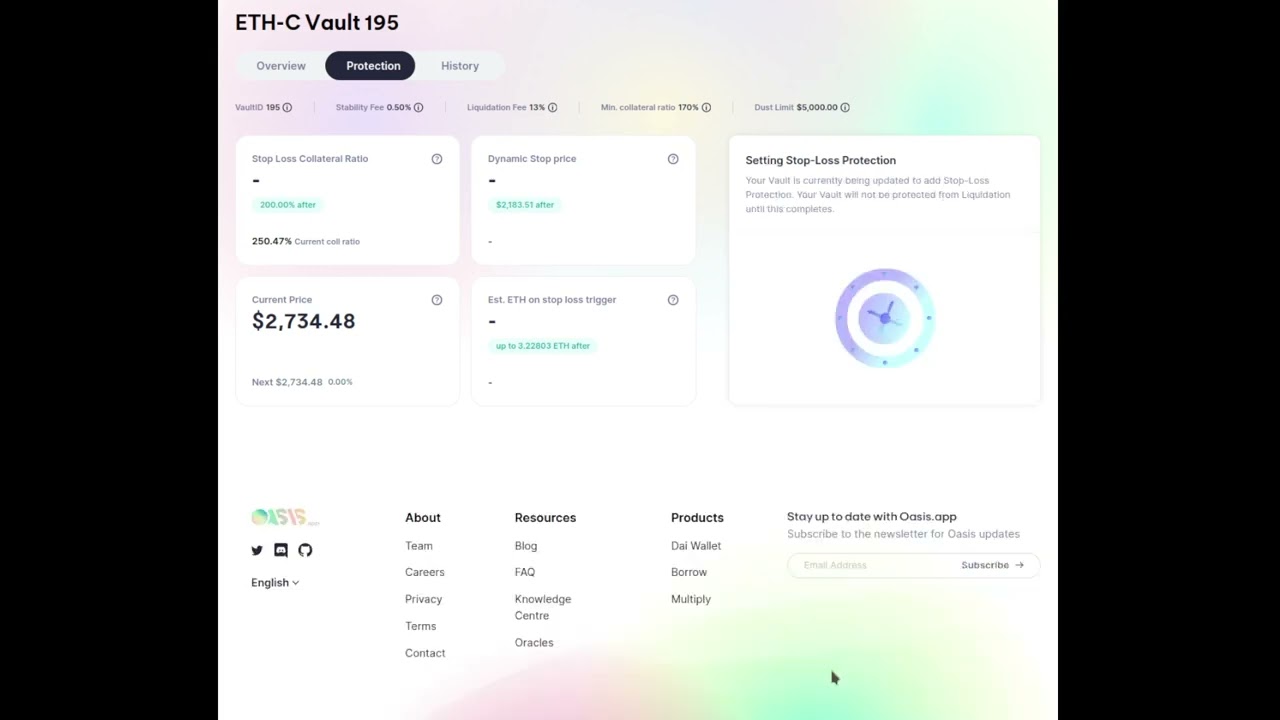

Summer.fi (formerly Oasis.app, Base support): Summer.fi, previously known as Oasis.app, has expanded to support the Base blockchain. Its AI-powered tools automate lending, borrowing, and yield farming, making complex strategies accessible and manageable for everyday users.

-

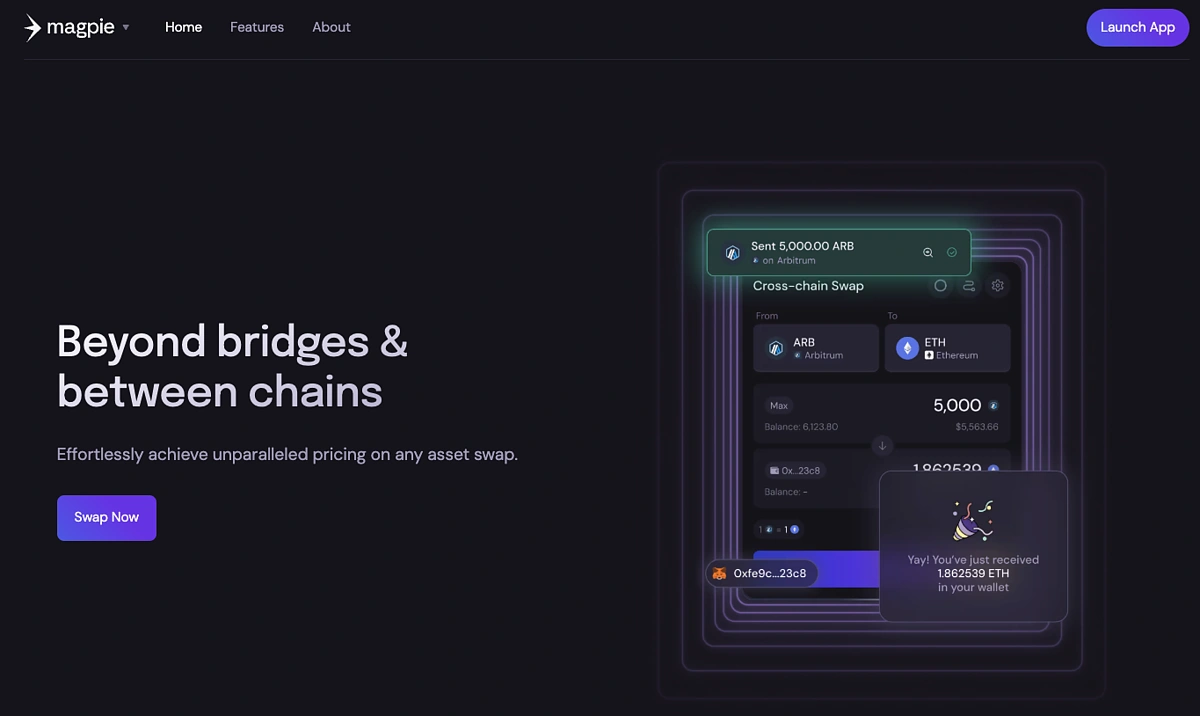

BaseSwap: BaseSwap integrates AI-driven analytics to identify optimal yield opportunities and manage risk. Its automated tools simplify the process of swapping, staking, and farming on Base, offering retail users an efficient gateway to DeFi yields.

Veda Protocol stands out for its cross-chain capabilities and trustless architecture. By embedding yield strategies across multiple blockchains and protocols, Veda enables users to access optimized returns without having to manage bridging or manual strategy selection. Its AI engine dynamically reallocates capital based on real-time market signals, ideal for retail investors seeking simplicity without sacrificing performance.

maxAPY offers round-the-clock automation across more than a hundred strategies on over twenty protocols. Its promise is clear: maximize APY while minimizing risk exposure through adaptive AI models. For retail participants who lack the time or expertise to track dozens of pools or lending markets simultaneously, maxAPY’s hands-off approach is a game changer.

Beefy Finance, long respected in multi-chain DeFi circles, has brought its vault-based approach to the Base ecosystem. On Base, its smart vaults use algorithmic rebalancing to harvest yields efficiently while optimizing gas costs, a critical consideration as transaction fees fluctuate even on scalable chains like Base.

User Experience: Lowering Barriers with Intelligent Automation

The most significant impact of these platforms is their ability to demystify DeFi for everyday users on Base. Where once only seasoned crypto enthusiasts could confidently navigate yield farming or liquidity provision, now intuitive dashboards and AI-driven recommendations guide newcomers through each step. Retail investors can simply deposit USDC or ETH into an aggregator like Yearn Finance (now fully integrated with Base) or Aerodrome Finance and let the underlying algorithms handle everything from pool selection to compounding rewards.

This democratization of access is further amplified by platforms like Summer. fi, which evolved from Oasis. app and now supports seamless asset management directly within the Base environment. Summer. fi’s user-centric design allows even first-timers to set risk parameters and investment goals while delegating execution entirely to automated agents.

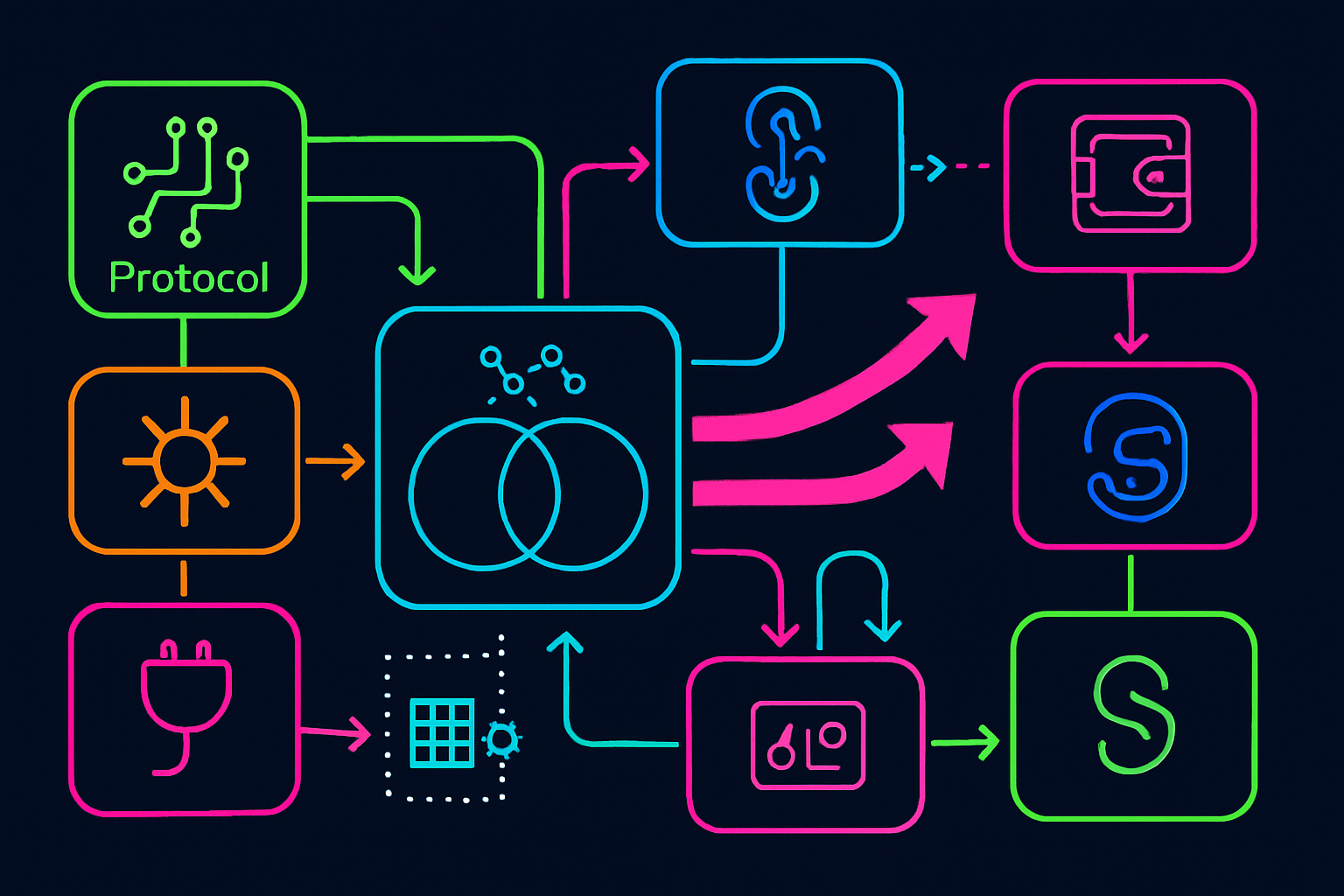

The Mechanics Behind AI Yield Optimization on Base

What sets these solutions apart is not just their interface but their underlying intelligence. For example:

- Yearn Finance’s Boost module: Uses machine learning to scan hundreds of liquidity pools in real time; it reallocates assets automatically based on changing APYs while factoring in gas efficiency and risk thresholds.

- Aerodrome Finance: Integrates predictive analytics that anticipate volatility spikes or liquidity shifts before they occur, allowing proactive rather than reactive allocation adjustments.

- BaseSwap: Employs algorithmic arbitrage between DEXes within the Base ecosystem so that idle assets can be instantly deployed where they earn most.

This convergence of automation and advanced analytics means retail investors no longer need professional-grade skills or hours of daily monitoring; instead they benefit from AI asset management tailored specifically for their needs.

Risk management is another critical advantage of AI-powered DeFi platforms on Base. Historically, retail users faced two major challenges: overexposure to volatile pools and the lack of timely exit signals. Modern aggregators like Veda Protocol and maxAPY address these pain points by continuously assessing protocol health, yield sustainability, and market shocks. Their AI modules can automatically rebalance portfolios away from underperforming or high-risk pools, preserving capital and smoothing returns, a level of discipline that’s nearly impossible to replicate manually.

Summer. fi, with its roots in Oasis. app, exemplifies how user-centric design converges with AI yield optimization. Its Base support enables everyday investors to set personalized risk tolerances and investment horizons while delegating execution to smart agents. This hands-off approach is particularly powerful for those new to DeFi, allowing them to benefit from sophisticated strategies without deep technical knowledge or active management.

Aerodrome Finance and BaseSwap further push the envelope on automation by integrating predictive analytics and real-time arbitrage engines. Aerodrome’s predictive tools help anticipate liquidity shifts before they impact yields, while BaseSwap’s algorithms move idle capital between decentralized exchanges (DEXes) within the Base ecosystem for optimal gains. Together, these innovations reduce slippage, boost APYs, and minimize missed opportunities for retail participants.

Comparing User Benefits Across Leading Platforms

The diversity among these seven top AI-powered DeFi platforms on Base ensures there is a solution for every type of retail user:

- Veda Protocol: Best for users seeking cross-chain exposure with automated risk controls.

- maxAPY: Ideal for those wanting maximum returns through aggressive strategy cycling across many protocols.

- Beefy Finance (Base): Appeals to cost-conscious investors focused on gas efficiency alongside reliable vault performance.

- Yearn Finance (Base): Suits users who value transparency in reporting and the ability to customize risk settings within an intuitive dashboard.

- Aerodrome Finance: Attracts those looking for proactive yield management that adapts instantly to market shifts.

- Summer. fi: Designed for new entrants who want a guided experience with minimal manual input but robust safety nets.

- BaseSwap: For opportunistic users interested in algorithmic arbitrage opportunities within the Base ecosystem.

This variety allows retail participants to select platforms aligned with their goals, whether prioritizing simplicity, cross-chain access, aggressive yield chasing or conservative growth. Importantly, all seven emphasize security through transparent smart contracts and regular audits, reducing counterparty risks that have historically challenged DeFi adoption among non-institutional investors.

Top AI-Powered DeFi Yield Aggregators on Base

-

Veda Protocol: Specializes in trustless, AI-driven yield optimization across multiple blockchains and protocols. Veda’s embedded yield engine automatically reallocates assets for maximum returns and minimal risk, making it highly accessible for retail users.

-

maxAPY: Utilizes advanced AI algorithms to automate and optimize DeFi yield farming 24/7. Supports over 100 strategies on 20+ protocols, allowing users to maximize APY with a single deposit and minimal manual intervention.

-

Beefy Finance (Base deployment): A multi-chain yield optimizer with a dedicated Base deployment. Beefy’s automated vaults use AI to monitor and compound yields, offering retail users efficient, hands-off strategies and robust security audits.

-

Yearn Finance (Base integration): Renowned for pioneering automated yield strategies, Yearn’s Base integration leverages machine learning to scan and allocate assets to top-performing pools, ensuring users benefit from both high yields and minimized risk.

-

Aerodrome Finance: Combines AI-powered analytics with automated liquidity provision on Base. Aerodrome’s smart contracts dynamically adjust positions based on real-time market data, optimizing returns for both liquidity providers and yield farmers.

-

Summer.fi (formerly Oasis.app, Base support): Offers AI-enhanced portfolio management and automated yield strategies. With Base support, Summer.fi enables users to deploy capital efficiently across lending, borrowing, and yield farming protocols with intuitive risk controls.

-

BaseSwap: Integrates AI-driven routing and yield optimization within its decentralized exchange on Base. BaseSwap’s algorithms identify the best routes for swaps and staking, maximizing user returns while minimizing slippage and fees.

What’s Next? The Road Ahead for Retail-Friendly DeFi on Base

The rapid adoption of AI-driven yield aggregators signals a broader trend: as decentralized finance matures on scalable chains like Base, retail investors are no longer relegated to the sidelines. Instead, they are empowered by automation that matches, if not exceeds, the sophistication of institutional strategies. As more platforms integrate advanced analytics and user-friendly interfaces, expect competition to drive even greater transparency, lower fees, and higher net yields across the ecosystem.

The bottom line: whether you’re a crypto novice or a seasoned investor seeking efficiency gains, leveraging these seven leading AI-powered DeFi platforms on Base offers a path toward smarter asset growth without complexity overload. For deeper dives into specific strategies or onboarding guidance tailored for everyday users, explore our resource hub at How Base Blockchain Is Making DeFi Simple For Retail Investors.