Decentralized finance (DeFi) has long promised to democratize access to financial services, but for many retail investors, the reality has been a maze of complex tools, high fees, and intimidating jargon. Today, Base blockchain, Coinbase’s Layer 2 solution, is rewriting the DeFi playbook with a focus on simplicity, affordability, and mass adoption. By leveraging its integration with Coinbase and a rapidly growing ecosystem of user-friendly platforms, Base is positioning itself as the go-to network for everyday users who want to participate in DeFi without the headaches.

Why Base Blockchain Is Attracting Retail Investors

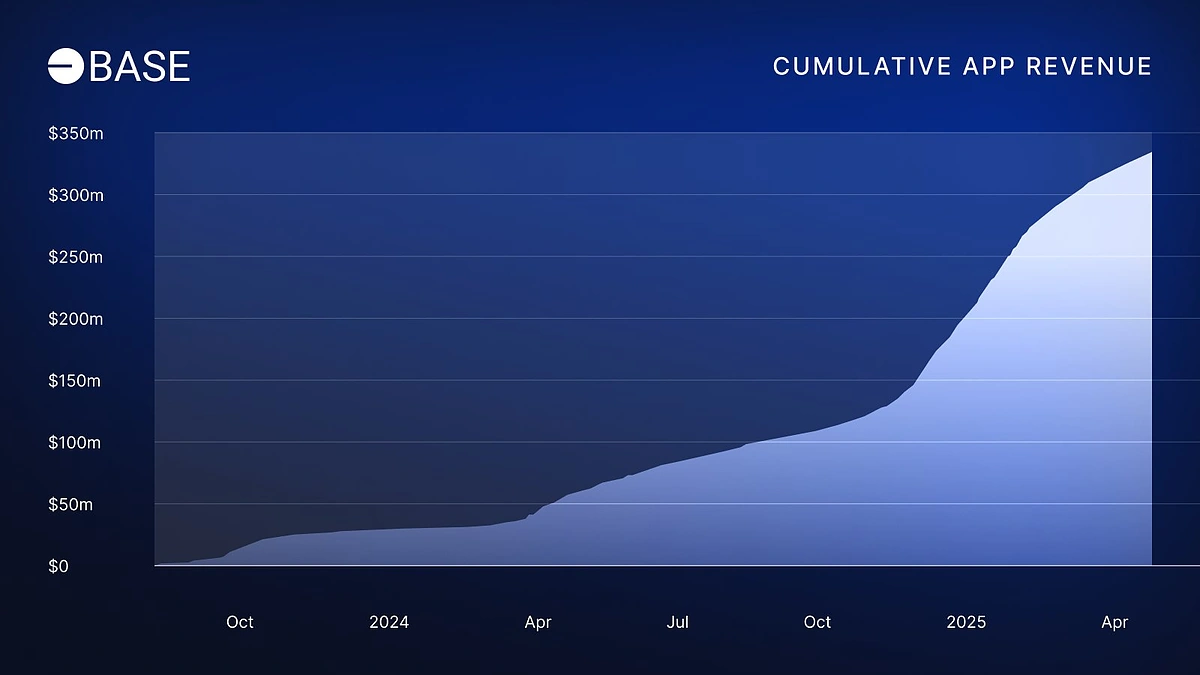

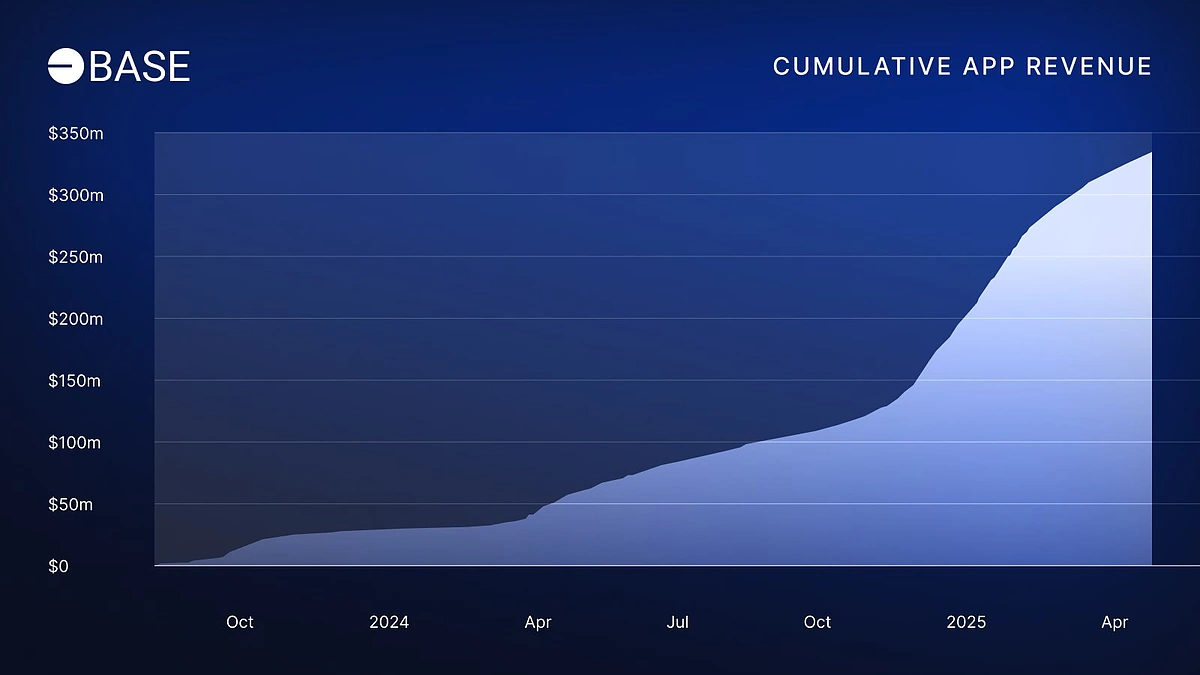

Base has quickly become one of the most active Layer 2 networks in crypto. In Q1 2025 alone, applications built on Base generated $193.4 million in fees, a clear indicator of robust usage and growing trust within the ecosystem (source). With transaction costs routinely under $0.05, even during periods of high network activity, Base makes it feasible for users to experiment with DeFi protocols or execute small trades without worrying about prohibitive gas fees (source).

This affordability is complemented by an emphasis on cultural scalability. From memecoins like Brett and Base God (TYBG) going viral to seamless onboarding via Coinbase’s familiar interface, Base is lowering barriers for both new entrants and experienced traders alike. The result? Daily active addresses have soared to 2.9 million as of September 2025 (source), cementing Base’s reputation as a hub for retail DeFi activity.

The Tools Powering Simple DeFi on Base

The magic behind Base’s retail-friendly approach lies in its curated suite of tools designed specifically for ease of use, transparency, and cost efficiency. Here are the three most impactful platforms making DeFi accessible for everyone:

Top Tools Simplifying DeFi on Base Blockchain

-

Base-native DeFi Aggregators (e.g., De.Fi on Base): De.Fi offers a comprehensive dashboard for exploring high-APY yield farming, staking, and lending opportunities on Base. Its intuitive interface and automated risk analysis help retail investors maximize returns while managing exposure across multiple protocols.

-

Onchain Analytics and Portfolio Tracking Tools (e.g., Defiprime’s Base Project Listings): Defiprime curates a transparent, up-to-date directory of DeFi projects on Base, enabling users to discover new protocols and track their onchain assets and portfolio performance with ease.

-

Ultra-Low Fee, User-Friendly DEXs (e.g., Aerodrome Finance on Base): Aerodrome Finance is a decentralized exchange purpose-built for Base, offering ultra-low transaction fees (often under $0.05) and a streamlined trading experience, making it ideal for both beginners and experienced DeFi users.

1. Base-Native DeFi Aggregators: De. Fi

For newcomers overwhelmed by the sheer number of yield farming opportunities, De. Fi’s aggregator on Base is a game-changer. This platform streamlines discovery by surfacing the best staking pools and high-APY farms in real time, no deep technical knowledge required. With just a few clicks, users can compare returns across protocols native to the Base blockchain and deploy capital efficiently (source). This level of accessibility not only reduces research time but also helps investors avoid common pitfalls like rug pulls or unsustainable yields.

2. Onchain Analytics and Portfolio Tracking: Defiprime’s Project Listings

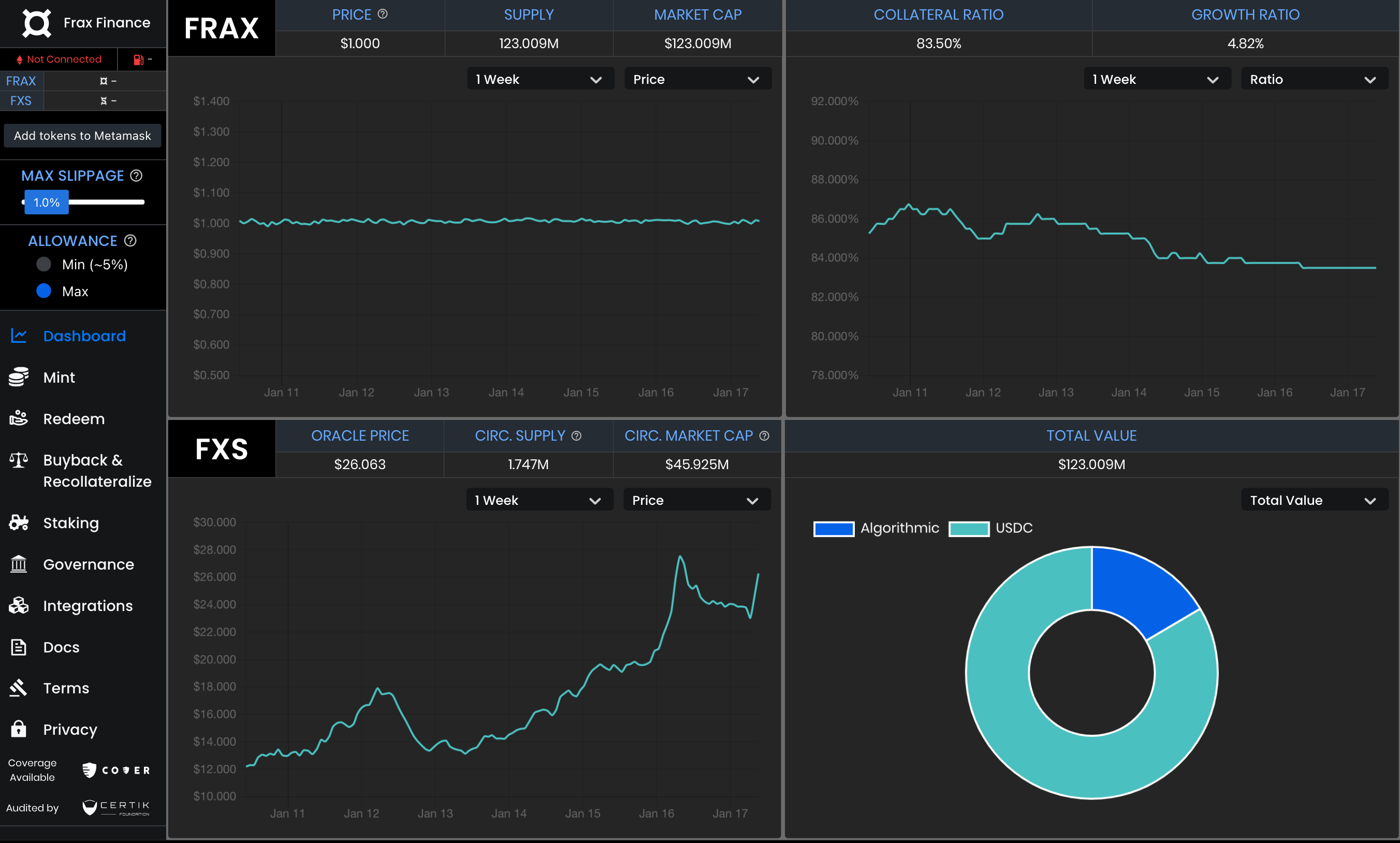

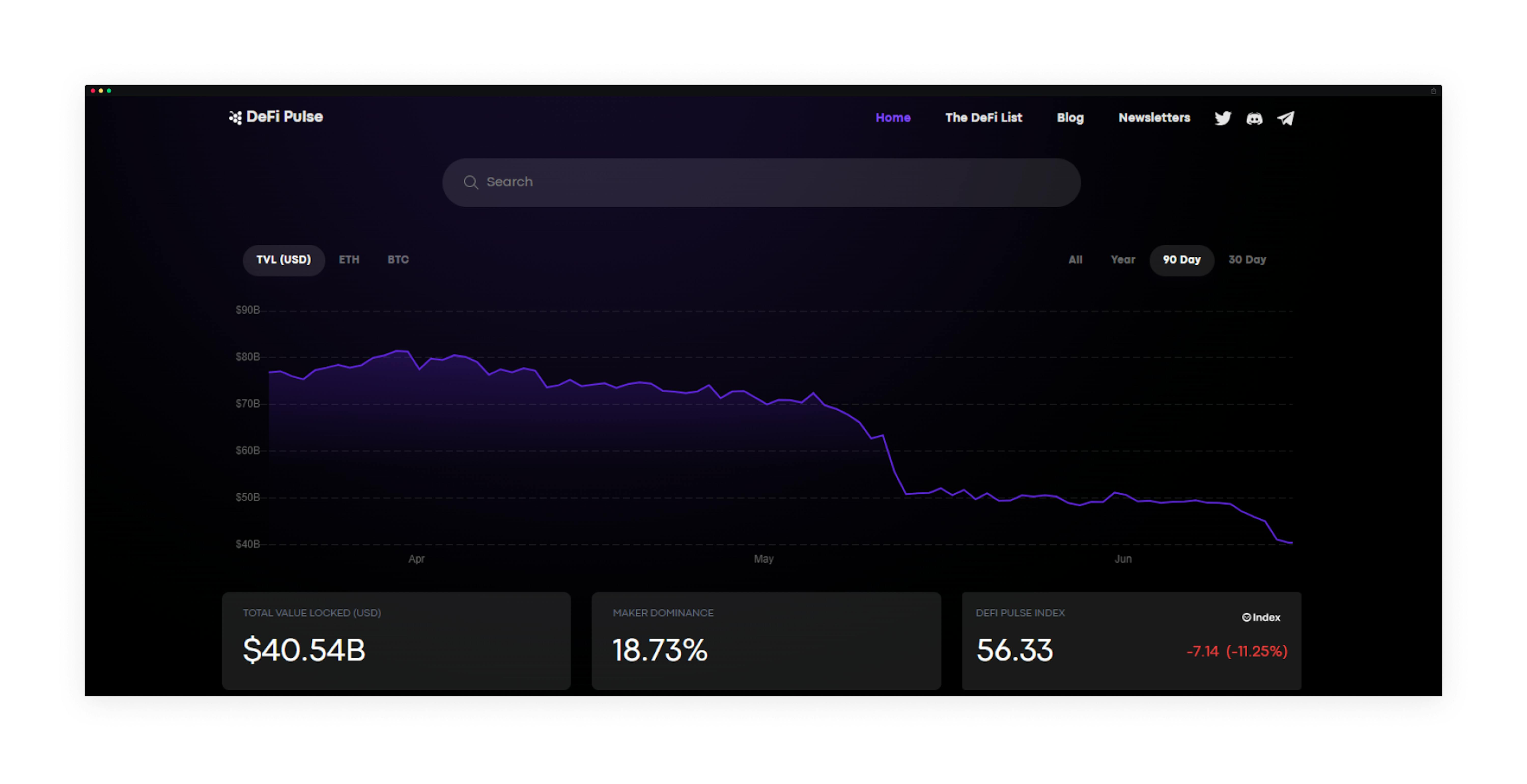

Navigating dozens of new projects can be daunting without reliable data. Defiprime’s comprehensive listings offer an essential resource for both beginners and seasoned users looking to monitor their investments or discover emerging trends within the Base ecosystem (source). These tools provide transparent information about project credibility, TVL (Total Value Locked), APYs, contract audits, and more, empowering users to make informed decisions without needing advanced blockchain expertise.

User-Friendly DEXs: Ultra-Low Fees Meet Seamless Trading

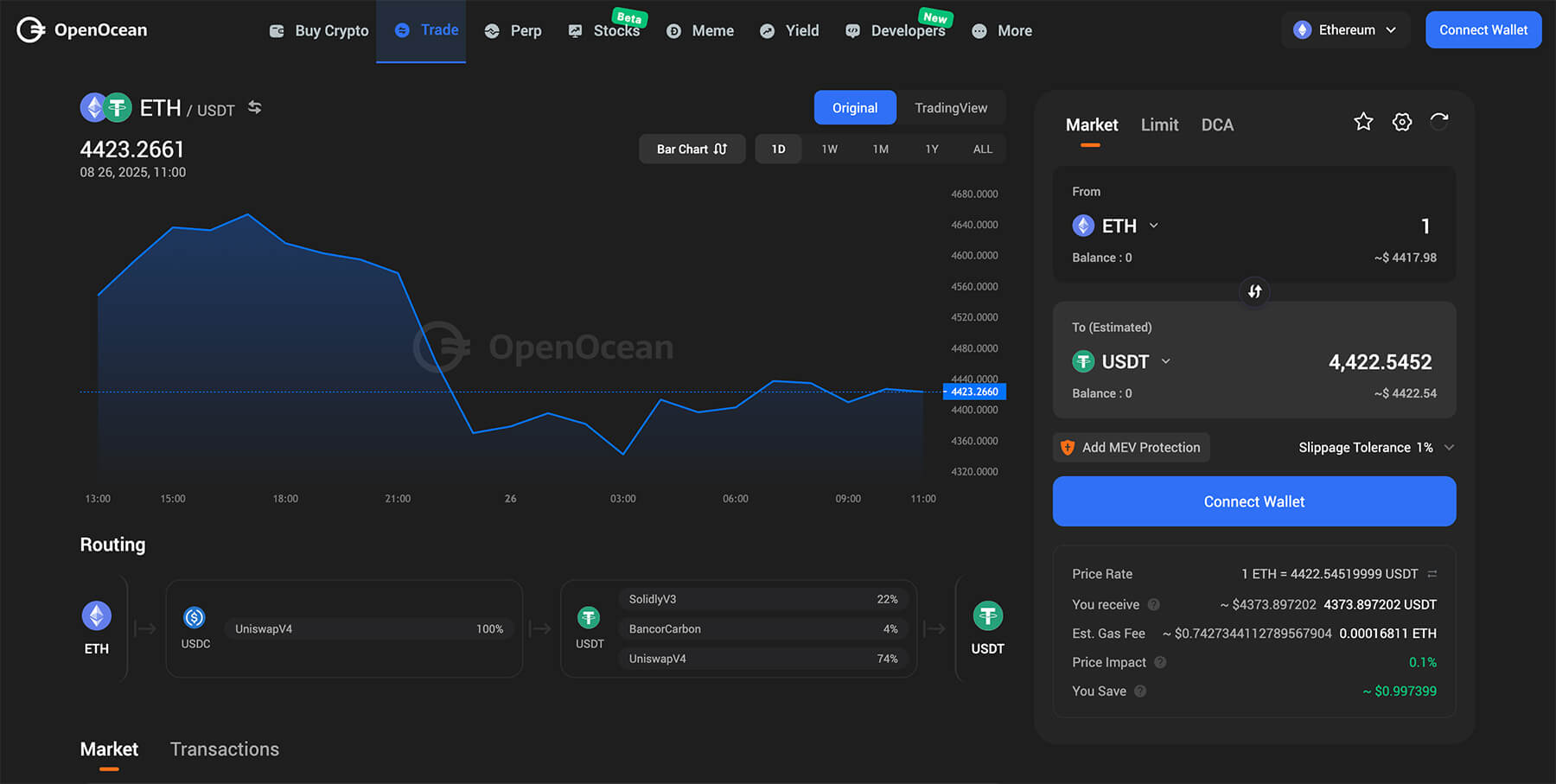

No discussion about simple DeFi would be complete without mentioning Aerodrome Finance, one of the leading decentralized exchanges (DEXs) built natively on Base. Aerodrome sets itself apart with an interface that feels instantly familiar, even to those coming from centralized exchanges, and transaction fees consistently below $0.05 per swap (source). This means retail investors can trade tokens or provide liquidity without sacrificing returns to network costs.

By focusing on intuitive design and cost efficiency, Aerodrome Finance empowers users to execute trades, participate in liquidity pools, or explore new tokens with minimal friction. For retail investors accustomed to high mainnet fees or clunky interfaces, this represents a meaningful leap forward in DeFi accessibility. The platform’s integration with popular Base wallets and its transparent fee structure further reinforce trust and usability for all levels of experience.

Collectively, these three pillars, De. Fi’s aggregator, Defiprime’s analytics suite, and Aerodrome’s ultra-low fee DEX, are transforming the way everyday users interact with decentralized finance. Rather than navigating a fragmented landscape of tools and protocols, retail participants now benefit from a curated ecosystem purpose-built for simplicity and transparency.

Why This Matters for Mass Adoption

The impact of these innovations is already visible in Base’s explosive growth metrics. With 299 million transactions processed monthly and daily active addresses nearing 3 million, the network is rapidly closing the gap between crypto-native users and mainstream adoption (source). Lowering transaction costs to under $0.05 removes one of the most persistent barriers in DeFi, making it viable for micro-investing, experimentation, and learning by doing.

Just as importantly, platforms like De. Fi and Defiprime help demystify yield opportunities and project discovery. Retail users no longer need to spend hours cross-referencing Telegram groups or Discord channels; instead, they can rely on real-time data feeds and community-vetted analytics tailored specifically for the Base blockchain ecosystem.

Key Base Tools Making DeFi Simple for Retail Investors

-

Base-native DeFi Aggregators (e.g., De.Fi on Base): These platforms let users quickly discover and access top yield farming and staking opportunities on Base, streamlining the process of earning passive income and optimizing returns—all from a single dashboard.

-

Onchain Analytics and Portfolio Tracking Tools (e.g., Defiprime’s Base Project Listings): Tools like Defiprime provide transparent project discovery, real-time analytics, and portfolio management, helping investors make informed decisions and track their assets across the Base ecosystem with ease.

-

Ultra-Low Fee, User-Friendly DEXs (e.g., Aerodrome Finance on Base): Decentralized exchanges such as Aerodrome Finance offer seamless, low-cost trading experiences on Base, with transaction fees under $0.05 even during peak times—making DeFi accessible and affordable for everyday users.

The Path Forward: Trustless Finance Within Reach

As Base continues to attract both developers and end-users at record pace, its retail-friendly approach is setting a new industry standard. By combining affordable transactions with best-in-class discovery tools and seamless trading experiences, the network is removing friction at every step of the user journey.

This isn’t just about lowering fees or offering prettier dashboards, it’s about fundamentally reimagining what financial participation looks like in an onchain world. When anyone can access high-yield opportunities through a few clicks on De. Fi, track their positions transparently via Defiprime listings, or swap assets instantly using Aerodrome Finance without worrying about hidden costs or technical hurdles, the promise of decentralized finance comes into sharper focus.

For those seeking an entry point into crypto that balances innovation with accessibility, Base blockchain for retail stands out as an ecosystem where knowledge truly becomes your best investment.