Retail investors are the engine driving crypto’s next adoption wave, but many still gravitate toward centralized exchanges (CEXs) rather than decentralized finance (DeFi) platforms, especially when exploring opportunities on the Base blockchain. While DeFi promises open access and self-custody, real-world usage data and user feedback reveal persistent barriers that keep everyday users anchored to CEXs. Let’s break down the three biggest obstacles holding retail investors back from embracing DeFi on Base, using fresh market context and a data-driven lens.

Barrier 1: Complex and Unfamiliar User Experience

The promise of financial sovereignty is powerful, but for most retail users, DeFi’s learning curve is steep. Platforms built on Base require users to manage non-custodial wallets, sign cryptographic transactions, and interact with interfaces that often lack the polish of their centralized counterparts. For those accustomed to the streamlined experience of CEXs, where onboarding, trading, and portfolio management are bundled into a single app, DeFi can feel intimidating.

Features like MetaMask wallet connections, network switching, or understanding gas fees create friction points that deter newcomers. According to recent industry analysis, CEXs continue to win over retail traders with advanced charting tools, simple fiat-to-crypto ramps, and intuitive mobile apps. In contrast, DeFi platforms on Base are still catching up when it comes to interface design and seamless workflows.

Barrier 2: Perceived Security Risks and Lack of Custodial Protection

Security remains a top concern for retail participants venturing into DeFi. While CEXs have dramatically improved their safety protocols, think two-factor authentication, cold storage solutions, and routine third-party audits, DeFi platforms have struggled with high-profile exploits. In 2022 alone, smart contract vulnerabilities accounted for 96% of all crypto theft losses, according to Cointelegraph. The absence of custodial protection means that if a user loses their private keys or falls victim to a phishing attack on Base-based protocols, funds are likely gone for good.

This risk profile sharply contrasts with the insurance policies and recovery processes offered by leading CEXs. For risk-averse investors or those new to digital assets, this difference in custodial security is often a dealbreaker.

Barrier 3: Onboarding Friction and Limited Fiat Integration

The third major barrier is the cumbersome process of moving from fiat currency into the Base blockchain ecosystem. Unlike CEXs, which offer direct fiat onramps via bank transfers or credit cards, DeFi onboarding often requires multiple steps: converting fiat to crypto on an exchange, bridging assets onto Base-compatible networks, then connecting wallets to access DeFi protocols. Each step introduces more complexity, and more opportunities for error or lost funds.

This fragmented experience stands in sharp contrast to the one-stop-shop model perfected by CEXs. As highlighted in recent market coverage (Outlook India), seamless fiat integration is a decisive advantage for centralized platforms competing for mainstream adoption.

Top 3 Barriers to DeFi Adoption on Base

-

Complex and Unfamiliar User Experience: DeFi platforms on Base often require users to manage wallets, sign transactions, and navigate interfaces that are less intuitive than CEXs. This creates a steep learning curve for retail investors, especially those accustomed to the streamlined, user-friendly dashboards and mobile apps offered by leading CEXs like Coinbase and Binance.

-

Perceived Security Risks and Lack of Custodial Protection: Retail users are deterred by concerns over smart contract vulnerabilities, phishing attacks, and the absence of custodial safeguards that CEXs provide. Unlike CEXs, which offer features like two-factor authentication and asset insurance, DeFi protocols on Base leave users fully responsible for their funds, amplifying fears of loss and theft.

-

Onboarding Friction and Limited Fiat Integration: The process of converting fiat to crypto and bridging assets onto Base DeFi protocols is often cumbersome. With fewer direct fiat onramps compared to CEXs, everyday users face more steps and potential confusion, making seamless entry into DeFi less accessible than using platforms like Kraken or Gemini.

Why These Barriers Matter Now More Than Ever

Despite strong growth in decentralized finance overall, the top 10 DEXs processed $877 billion in Q2 2025 compared to $3.9 trillion by top CEXs, the gap remains wide when it comes to retail engagement (Cointelegraph DEX volumes Q2 2025). Until these three core challenges are addressed head-on by DeFi projects building on Base, mainstream adoption will lag behind centralized alternatives.

But the story doesn’t end with obstacles. The DeFi landscape on Base is evolving rapidly, and there’s increasing momentum to close these gaps. By dissecting each barrier, we can pinpoint where innovation is most needed and how the next wave of DeFi products could finally tip the scales for retail adoption.

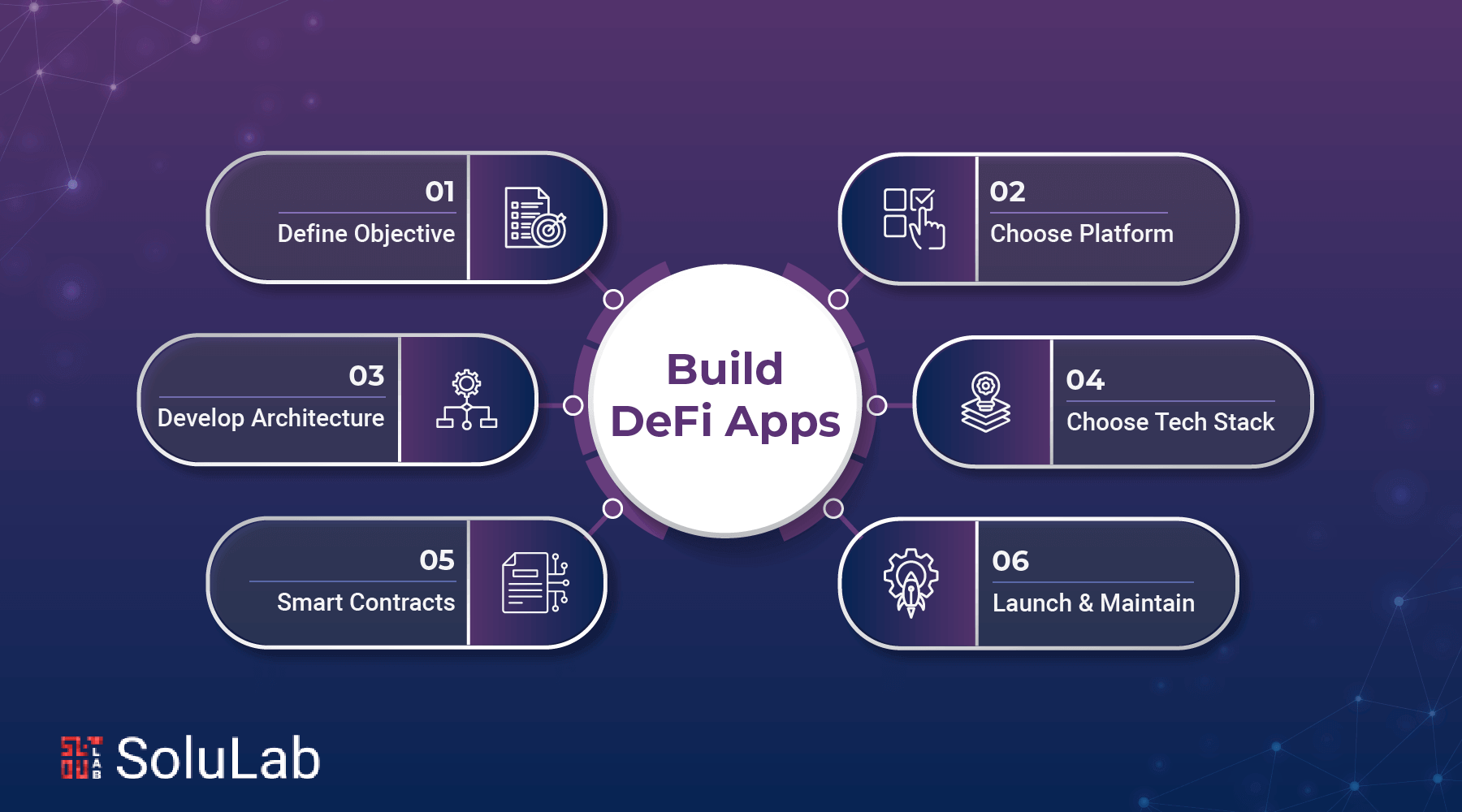

Solving for Simplicity: User Experience as a Competitive Edge

Forward-thinking teams in the Base ecosystem are laser-focused on reducing complexity. We’re seeing early experiments with social logins, gas fee abstraction, and walletless onboarding, features designed to hide blockchain’s technical underbelly from everyday users. The goal: make trading, staking, and yield earning on DeFi protocols as easy as buying coffee through a mobile app.

Projects that prioritize intuitive design and clear guidance will capture the next wave of users. Expect to see more “DeFi-lite” interfaces, guided onboarding flows, and educational overlays that demystify concepts like liquidity pools or slippage tolerance. As competition intensifies, UX is quickly becoming the new battleground for retail DeFi adoption.

Building Trust: Security Standards and Custody Innovations

Addressing perceived security risks isn’t just about patching code, it’s about building trust at every layer of the user journey. Some Base-based protocols are now introducing insurance funds, bug bounty programs, and even non-custodial recovery options (like social recovery wallets) to provide safety nets for retail users.

Meanwhile, CEXs are doubling down on hybrid models that blend self-custody with institutional-grade protection. For example, platforms like Coinbase are integrating DeFi access directly into their secure environments (PANews), allowing users to interact with decentralized apps while still benefiting from familiar security rails. This convergence could eventually blur the lines between CEXs and DeFi entirely, removing one of retail’s biggest sticking points.

Streamlining Entry: Onramps and Fiat Integration on Base

The future of onboarding lies in collapsing steps and integrating fiat ramps directly into DeFi experiences on Base. Expect more partnerships between payment processors, stablecoin issuers, and wallet providers to deliver instant fiat-to-DeFi access, no more juggling exchanges or bridges just to get started.

Some projects are piloting direct bank integrations or leveraging Layer 2 solutions for near-instant settlements with minimal fees. As these pipelines mature, friction will drop dramatically, and so will user drop-off rates at critical onboarding moments.

Top 3 Barriers to DeFi Adoption on Base

-

Complex and Unfamiliar User Experience: DeFi platforms on Base often require users to manage non-custodial wallets, sign blockchain transactions, and navigate interfaces that are less intuitive than those of centralized exchanges (CEXs). This creates a steep learning curve for retail investors, especially those new to crypto.

-

Perceived Security Risks and Lack of Custodial Protection: Retail users are deterred by concerns over smart contract vulnerabilities, phishing attacks, and the absence of custodial safeguards that CEXs provide. The self-custody model in DeFi means users are solely responsible for their funds, making them wary of potential losses from hacks or user error.

-

Onboarding Friction and Limited Fiat Integration: The process of converting fiat to crypto and bridging assets onto Base DeFi protocols is often cumbersome. With fewer direct fiat onramps compared to CEXs, everyday users face significant hurdles, discouraging seamless entry into the DeFi ecosystem.

The Road Ahead: Retail-Friendly DeFi Is Within Reach

The data is clear: until complex UX hurdles, security anxieties, and fiat onboarding friction are tackled head-on, CEXs will continue to dominate retail flows, even as DEX volumes hit records like $877 billion in Q2 2025 (Cointelegraph DEX volumes Q2 2025). But the momentum is shifting.

Base-based builders who focus relentlessly on usability and safety stand poised to unlock a massive new cohort of everyday investors ready for decentralized finance, but only if they meet users where they are today. Watch this space closely: as these barriers fall one by one, the next crypto bull run could be powered not by whales or institutions but by millions of empowered retail participants finally making DeFi their home turf.