Decentralized finance is rapidly evolving, but for most retail users, the learning curve remains steep. Complex interfaces, high gas fees, and the headache of managing multiple wallets across chains have kept DeFi out of reach for many everyday investors. However, innovative platforms on the Base blockchain are changing this narrative. Two names stand out in this new wave of retail-friendly DeFi: Vooi and Tria. In this article, we’ll break down how these projects are streamlining DeFi for beginners and why their approach matters for the future of accessible finance.

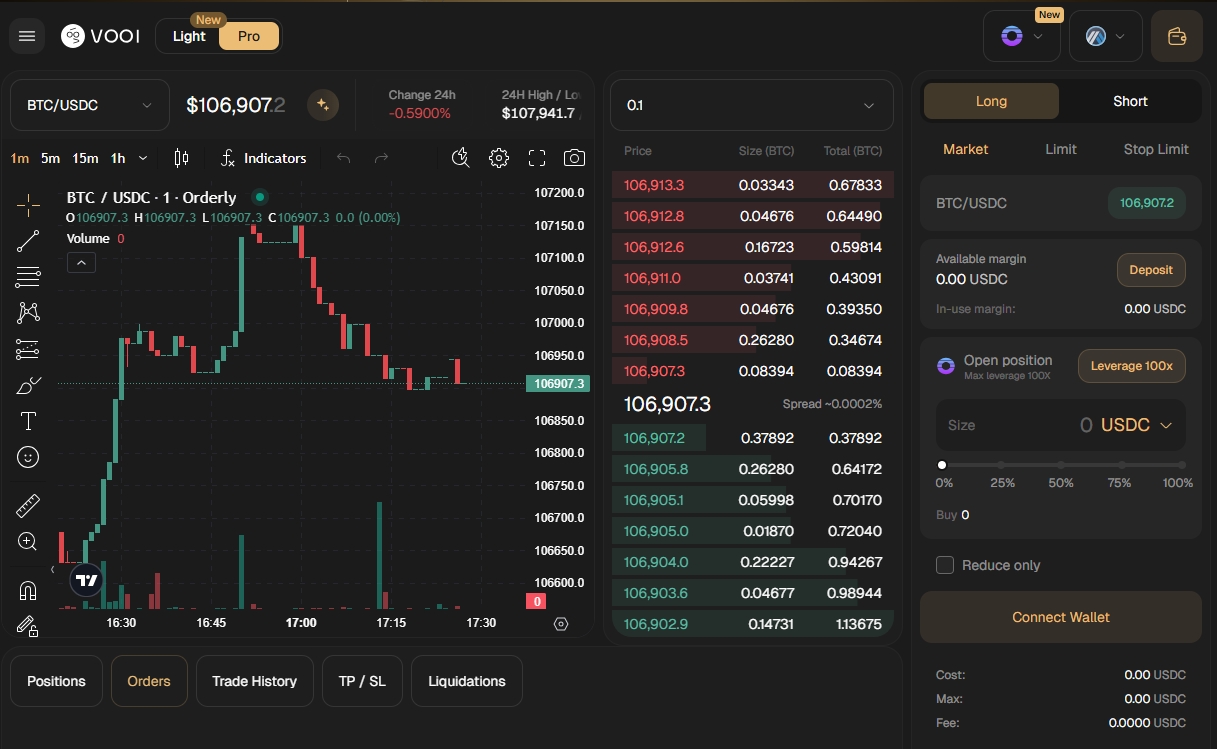

Vooi V2: Gasless Trading and True Chain Abstraction

Vooi has quickly become a leader in retail-focused DeFi solutions on Base. With its recent V2 mainnet launch, Vooi is setting new standards by tackling the pain points that have long plagued less-experienced users. The platform’s chain abstraction technology allows users to interact with assets across multiple blockchains without ever worrying about bridging or swapping wallets. Even better, Vooi’s gasless transactions mean users can trade without ever thinking about network fees, a game changer for those who have been burned by unpredictable costs elsewhere.

One of Vooi’s standout features is its unified balance system. Rather than forcing users to manually move funds between chains or wallets, Vooi pools your assets in a single dashboard. This not only simplifies portfolio management but also reduces the risk of sending funds to the wrong address or getting stuck in a failed bridge transaction.

User Experience: From Social Login to AI Copilot

Onboarding into DeFi has never been easier thanks to Vooi’s mobile-first interface, which includes social login options familiar to anyone who’s ever signed up for an app. Forget seed phrases and complicated wallet setups, Vooi lets you get started with just a few taps.

The platform caters to both casual and advanced traders with two tailored interfaces: Vooi Light, designed for straightforward spot trading, and Vooi Pro, which unlocks advanced tools like take profit/stop loss orders and stop limits. For those new to trading or simply looking to automate their strategies, Vooi offers an integrated AI copilot that provides guidance based on real-time market data.

This commitment to accessibility is more than just talk, since its V2 launch, Vooi has processed over $8.5 billion in trading volume from more than 60,000 users. Its integration with leading platforms like Orderly, HyperLiquid, SynFutures, and Ostium means retail investors have access to deep liquidity across crypto assets as well as stocks, forex pairs, commodities, game assets, and even tokenized real-world assets.

The New Standard: Zero Gas Fee DeFi Tools on Base

Top 5 Zero Gas Fee DeFi Tools for Beginners on Base

-

Vooi V2: Vooi V2 offers gasless, cross-chain trading for spot and perpetual assets on Base. Features like social login, AI copilot, and a mobile-first interface make DeFi accessible for beginners. Users benefit from a unified balance across chains and no need for multiple wallets or manual bridging.

-

BaseSwap: A leading decentralized exchange (DEX) on Base, BaseSwap provides zero gas fee trading for select tokens, making it easy for retail users to swap assets without worrying about transaction costs. Its simple UI is tailored for beginners.

-

Superbridge: Superbridge enables gasless bridging of assets to and from Base, streamlining the onboarding process for new DeFi users. Its intuitive design reduces friction for those new to cross-chain transactions.

-

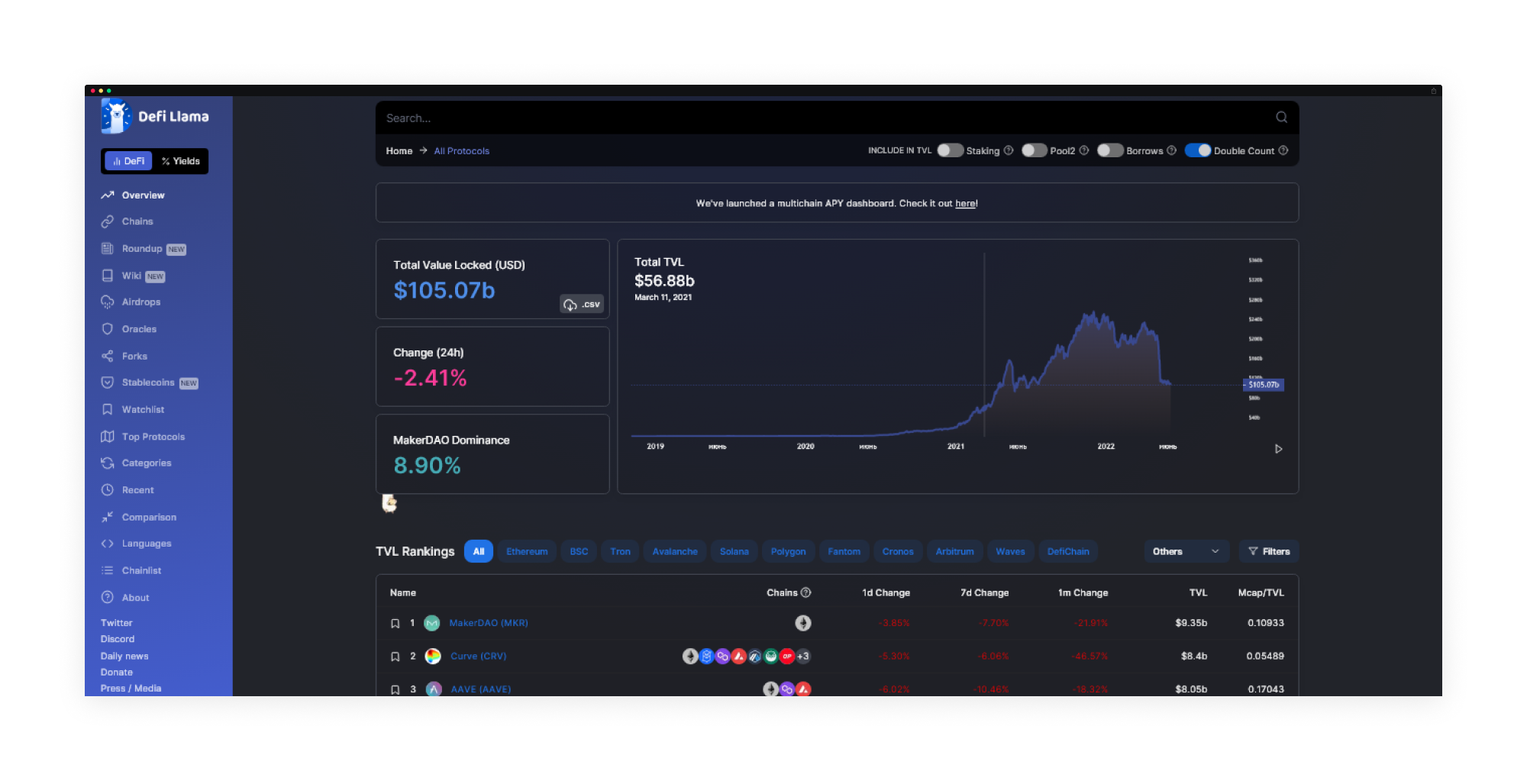

DeFiLlama (Base Integration): DeFiLlama offers real-time analytics and portfolio tracking for Base users, with zero gas fee data queries. Beginners can monitor their DeFi activity and explore protocols without incurring extra costs.

-

Boost: Boost is a user-friendly DeFi tool on Base that provides zero gas fee yield optimization for beginners. It automates staking and yield farming strategies, helping users maximize returns with minimal effort and no transaction fees.

The Base blockchain is quickly becoming home to some of the most user-friendly DeFi platforms anywhere, especially those targeting retail investors who value simplicity and security above all else. While Vooi leads the pack with its chain abstraction and unified balance features, other tools are also making waves by eliminating hidden costs and technical barriers.

If you’re curious about which apps are truly beginner-friendly or want to explore more about how platforms like Vooi are transforming decentralized investing on Base, check out guides such as “Best DeFi Tools for Retail Investors on Base” at basetoken. org for a broader view of what’s available.

As the DeFi landscape matures, we’re seeing a clear shift toward platforms that prioritize ease of use and security. Vooi’s rapid adoption on the Base network is a testament to the demand for solutions that remove friction from every step of the user journey. From social login to gasless, cross-chain trading, Vooi is not just simplifying DeFi, it’s redefining what everyday investors should expect from their financial tools.

What Sets Vooi Apart?: Unified Experience and Real Results

A major pain point in DeFi has always been the fragmentation of assets and interfaces. Vooi’s unified dashboard, with its ability to manage crypto, stocks, forex, and even game assets in one place, represents a leap forward in accessibility. This is especially valuable for retail users who may not have the time or technical background to juggle multiple wallets or navigate complex bridging protocols.

The platform’s integration with established liquidity sources like Orderly and HyperLiquid means users benefit from tight spreads and reliable execution, two factors that can make or break the trading experience for newcomers. With over $8.5 billion in trading volume processed since its V2 mainnet launch in October 2025, Vooi is proving that retail-friendly design doesn’t have to come at the expense of depth or sophistication.

Chain Abstraction in Action: Why It Matters

Chain abstraction isn’t just a buzzword, it’s a practical solution to one of DeFi’s thorniest problems: interoperability. By letting users interact with assets across multiple chains without manual bridging or swapping wallets, Vooi removes both risk and wasted time. For beginners especially, this means fewer opportunities for costly mistakes and more confidence when exploring new asset classes.

Tria: Still Under Wraps?

While Tria has been mentioned alongside Vooi as part of Base’s push toward retail-friendly DeFi, there is currently no detailed public information about its specific offerings or impact on chain abstraction for retail users. This lack of transparency makes it difficult to evaluate Tria’s true value proposition compared to platforms like Vooi that have already delivered tangible improvements for everyday investors.

If Tria follows through on promises around chain abstraction or simplified onboarding, it could become another important player in this space. For now, though, retail users looking for proven solutions will find more immediate benefits by exploring platforms with an established track record.

Why Retail-Friendly DeFi Matters Now

The next wave of decentralized finance will be defined by how well it serves non-experts, people who want access to new investment opportunities without having to become blockchain engineers overnight. Features like zero gas fees, social logins, unified balances, and AI-powered guidance are quickly becoming table stakes rather than nice-to-haves.

Smart risk management starts with smart design. Platforms that hide complexity without sacrificing power are giving retail investors real agency over their digital assets, and setting a new bar for what’s possible on networks like Base.

If you’re ready to dive into easy DeFi for beginners or simply want to optimize your portfolio without hidden fees or technical headaches, now is the time to explore what Base-based platforms like Vooi have to offer. The path from first-time user to confident investor has never looked more approachable, or more rewarding.