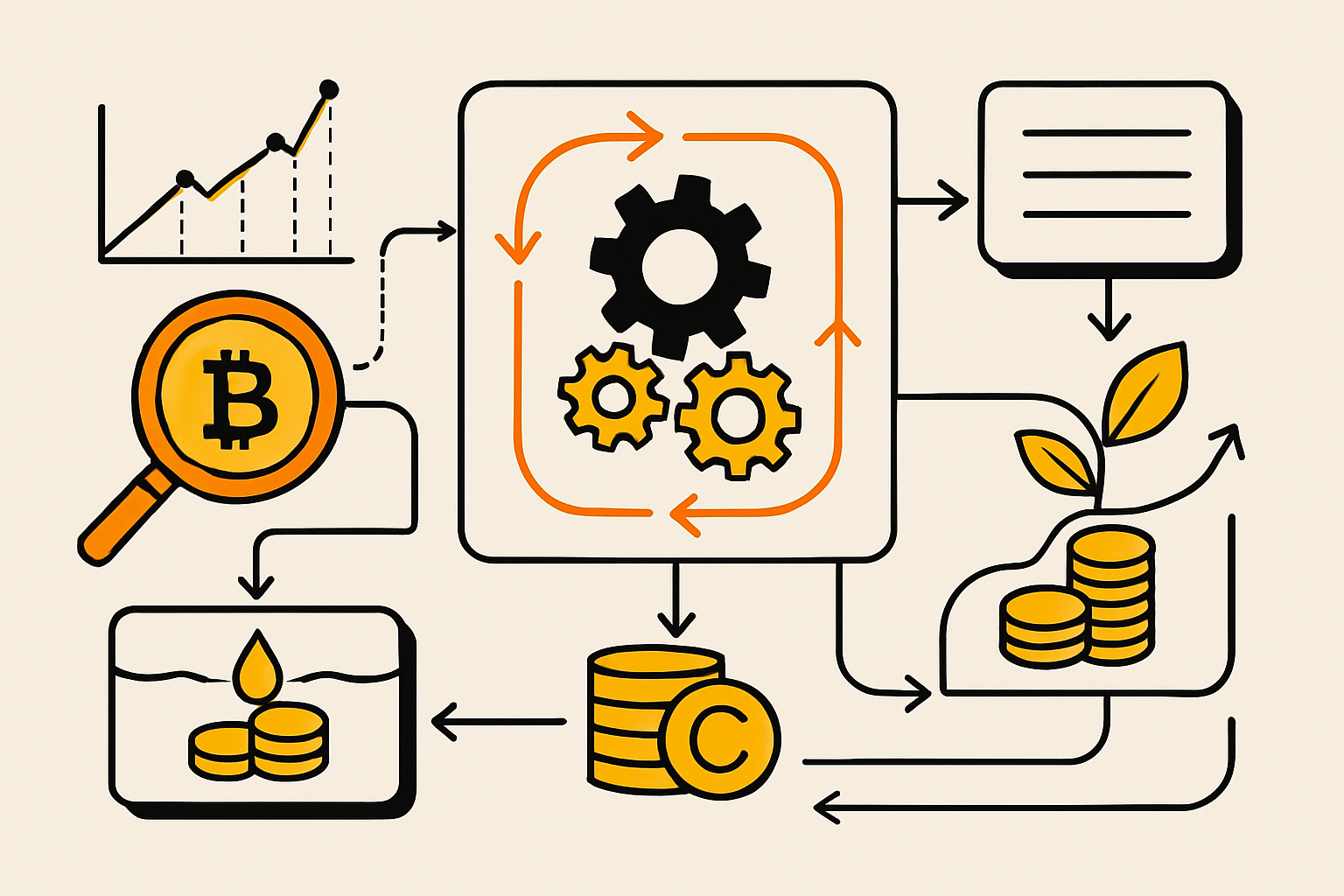

Decentralized finance (DeFi) on the Base blockchain is rapidly becoming more accessible to everyday investors. But with opportunity comes responsibility: onboarding safely is essential, especially as new users navigate evolving platforms and market conditions. As of October 27,2025, Ethereum (ETH) stands at $4,129.89, reflecting a stable yet dynamic crypto environment that underscores the need for careful entry into DeFi ecosystems.

Why Retail Investors Are Choosing Base for DeFi

The Base blockchain, built as an Ethereum Layer-2 solution and backed by Coinbase, offers low fees, fast transactions, and a familiar user experience. For retail investors, these features reduce barriers to entry and make DeFi participation less intimidating. But with growing interest comes increased risk of scams and missteps, so understanding safe onboarding is more important than ever.

Base’s integration with Coinbase means users can leverage trusted infrastructure while exploring decentralized protocols. This hybrid approach appeals to those who want both convenience and security. Still, even with these advantages, each step, from wallet creation to making your first swap, demands attention to best practices.

Step One: Secure Your Starting Point

Your journey into Base DeFi should always begin with security. Start by creating a Coinbase account if you don’t already have one. Use a strong password, ideally generated by a password manager, and immediately enable two-factor authentication (2FA). This extra layer of protection can prevent unauthorized access even if your login details leak.

Once your account is set up, familiarize yourself with the Coinbase interface and Base wallet options. The official Base wallet or any reputable self-custody wallet that supports the Base network will allow you to interact with DeFi apps directly while retaining control over your funds. Never share your seed phrase or private keys; store them offline in a secure location.

Navigating Your First On-Chain Actions

After securing your wallet, it’s time to bridge funds onto the Base network or purchase supported assets through Coinbase. Always double-check destination addresses and confirm you are using official bridging tools or DApps recommended by the community or trusted sources. Phishing sites often mimic legitimate platforms, bookmark official links and verify URLs before connecting your wallet.

Consider starting small: transfer only what you’re comfortable risking as you learn the ropes. Remember that transaction fees on Base are much lower than Ethereum mainnet, so there’s no need to rush large amounts at once.

- Tip: Check live price widgets for ETH ($4,129.89) before swapping assets, market volatility can impact transaction outcomes.

- Tip: Use resources like our step-by-step onboarding guide for detailed walkthroughs tailored for beginners.

The Importance of Research and Community Verification

The DeFi space evolves quickly; not all projects are created equal. Before interacting with any protocol on Base:

- Research the development team: Look for transparency and proven track records.

- Audit reports matter: Prioritize platforms that have undergone third-party security audits.

- Community sentiment counts: Join forums or Discord groups focused on Base DeFi to see how experienced users view different projects.

If you’re unsure about a project’s legitimacy or safety features, it’s best to wait or seek advice from trusted community members before proceeding further.

Ongoing Security: Protecting Your Assets After Onboarding

Once you’ve completed your initial onboarding, your vigilance shouldn’t stop there. The landscape of DeFi is always shifting, and new threats can emerge unexpectedly. Regularly update your wallet software and any browser extensions you use; outdated tools are a common vulnerability. If possible, enable notifications for all transactions so you’re instantly aware of any activity on your account.

Consider using a hardware wallet for larger holdings. Hardware wallets keep your private keys offline, making them immune to most online attacks. When interacting with new DApps, always review the permissions you grant, only allow access to the specific assets needed for the transaction.

Learning from the Community and Staying Informed

The power of Base DeFi comes partly from its vibrant community. Engage with others on social platforms, follow reputable developers and educators, and participate in AMAs or community calls when possible. This not only helps you stay ahead of scams but exposes you to emerging opportunities and best practices.

Don’t underestimate the value of community alerts about phishing attempts or contract exploits, these warnings can save you from costly mistakes. For instance, when major market events occur (like Ethereum’s price holding steady at $4,129.89), scammers often ramp up their activity by impersonating support channels or offering fake incentives.

Practical Tips for Everyday Users

- Bookmark official resources: Always access Base DeFi apps through verified links.

- Avoid sharing sensitive info: No legitimate team will ask for your seed phrase or passwords via DM.

- Practice small test transactions: Before sending significant amounts, send a small test first to confirm everything works as expected.

- Diversify risk: Don’t put all your funds into one protocol, spread them across reputable platforms to minimize exposure.

Resources to Build Your Confidence

If you’re feeling uncertain at any stage, take advantage of educational content designed specifically for retail investors exploring Base DeFi. Our curated guides walk you through every step, from wallet setup to advanced yield strategies, so that even if you’re brand new, you’ll never feel lost.

- Comprehensive onboarding checklist for retail investors

- 2025 beginner’s guide to safe DeFi exploration on Base

The journey into decentralized finance doesn’t have to be intimidating. By combining smart security habits with ongoing learning and community engagement, retail investors can confidently tap into everything Base has to offer while minimizing risks along the way.