Retail investors are entering a new era of decentralized finance (DeFi) on Base, thanks to the emergence of AI-powered tools that make complex crypto operations feel as easy as sending a text. For years, the biggest barrier to DeFi adoption has been its intimidating interfaces and steep learning curve. Now, intuitive AI copilots like HeyElsa and advanced trading platforms like Avantis are lowering these barriers, empowering everyday users to participate confidently in the Base blockchain ecosystem.

AI DeFi Tools: The New Gateway for Retail Investors

The fusion of AI and DeFi is revolutionizing how retail investors approach decentralized finance. No longer reserved for the technically savvy, platforms like HeyElsa and Avantis are leveraging artificial intelligence to transform the user experience on Base. According to recent insights from Blockchain Council and QuickNode, AI tools are enabling smarter strategies, personalized yield optimization, and seamless onboarding for retail users.

With over 247 DeFi tools now available across major blockchains (Alchemy, 2025), competition is fierce to provide the most user-friendly, accessible solutions. Base, with its Coinbase-backed security and low fees, stands out as a prime destination for retail adoption. The real game-changer? AI copilots that demystify DeFi for beginners and seasoned users alike.

HeyElsa: Conversational DeFi for Base Users

HeyElsa is not just another crypto wallet – it’s an AI-powered assistant designed to make DeFi operations as simple as chatting with a friend. By harnessing natural language processing, HeyElsa lets users execute trades, bridge assets, purchase NFTs, and even set stop-loss orders using plain English commands. Imagine telling your app, “Swap 1 ETH for USDC at the best rate, ” and watching it happen instantly. That’s the seamless experience HeyElsa brings to Base users.

But HeyElsa’s innovation goes deeper than just interface design. Its architecture includes a User Profile Agent for personalization, a Chain Analyzer Agent for real-time blockchain data, an Intent Agent to interpret user goals, and a Risk Management Engine to keep your assets safe. Together, these AI-powered components create a tailored, secure DeFi journey that removes the guesswork for retail investors.

One standout feature is HeyElsa’s Multi-Party Computation (MPC) wallet technology. Traditional wallets force users to memorize or securely store seed phrases – a major pain point for newcomers. With MPC wallets, users enjoy institutional-grade security without ever dealing with seed phrases, making asset management across chains like Base, Ethereum, and Solana both safe and effortless.

For a deeper dive into how AI copilots like HeyElsa are making DeFi accessible on Base, check out our detailed guide: How AI Co-Pilots Like HeyElsaAI Are Making Base DeFi Accessible for Retail Investors.

Avantis: Leveraged Trading for All on Base

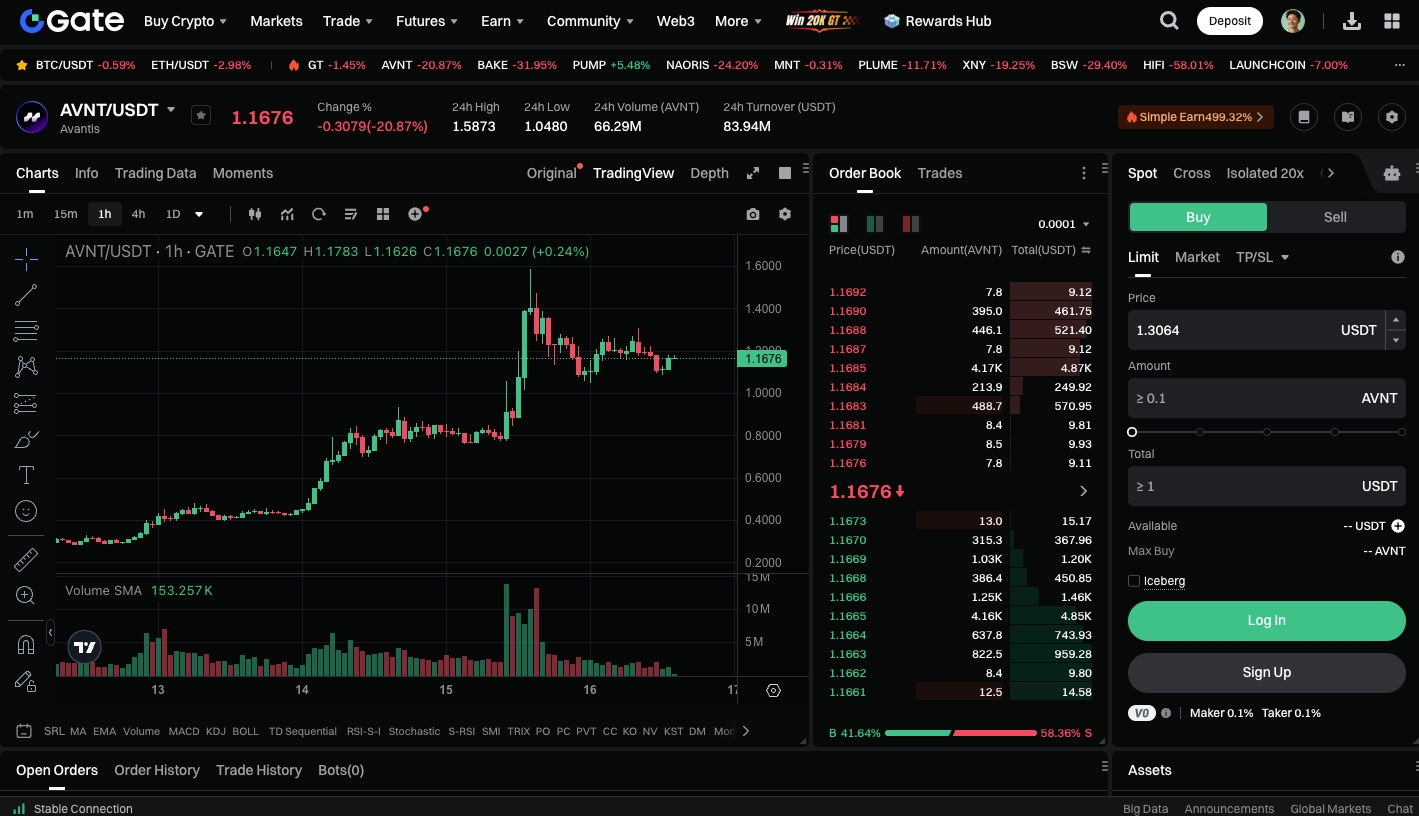

While HeyElsa focuses on simplifying DeFi for everyday actions, Avantis brings advanced trading capabilities directly to retail investors on Base. Avantis is an on-chain leveraged trading platform that supports up to 100x leverage on cryptocurrencies and real-world assets – all powered by decentralized infrastructure. Built on the Optimism Superchain and soon launching on Base mainnet, Avantis uses USDC stablecoins as collateral for transparent, efficient trading.

What sets Avantis apart is its integration with low-latency oracles from Pyth and Chainlink. These oracles provide accurate, real-time price feeds from both centralized and decentralized markets, ensuring that retail traders on Base can access fair pricing and deep liquidity across a range of assets, including Bitcoin, Ethereum, and major forex pairs.

Avantis’s interface is designed with accessibility in mind, making leveraged trading approachable even for those new to DeFi. As more retail investors look for ways to diversify and amplify their portfolios, platforms like Avantis are bridging the gap between traditional finance and crypto-native opportunities on Base.

The Rise of User-Friendly DeFi on Base

The synergy between AI copilots like HeyElsa and next-gen DEX platforms like Avantis is reshaping how retail investors interact with DeFi on Base. The result is a more inclusive financial ecosystem where anyone can participate – no coding or crypto jargon required.

What’s truly remarkable is how these AI DeFi tools are removing friction at every step. Whether you’re a first-timer swapping tokens or a seasoned trader seeking leveraged exposure, the combination of AI-driven guidance and intuitive design means fewer mistakes, less anxiety, and more confident participation. For Base users, this translates into a smoother onboarding experience and the ability to explore new financial strategies without the fear of getting lost in technical details.

Top 5 User-Friendly AI DeFi Tools on Base (2025)

-

HeyElsa: An intuitive AI-powered crypto assistant that lets users trade, bridge, and manage DeFi assets on Base using simple conversational commands. Features MPC wallets for enhanced security and supports multiple blockchains for seamless cross-chain operations.

-

Avantis: A decentralized leverage trading platform offering up to 100x leverage on cryptocurrencies and real-world assets. Powered by AI-driven risk management and real-time oracles, Avantis delivers a streamlined experience for both beginners and advanced traders on Base.

-

Boost: This AI-powered DeFi yield optimizer helps users maximize returns by automatically allocating funds across top Base protocols like Aerodrome. Its smart algorithms analyze market trends and user risk profiles to build personalized, hands-off portfolio strategies.

-

Parsec AI Trading Suite: Parsec delivers AI-driven analytics and trading tools for retail investors on Base. The suite offers real-time data, automated trading signals, and portfolio tracking, making advanced DeFi strategies accessible to beginners.

-

Superbridge AI Portfolio Manager: Superbridge simplifies cross-chain DeFi investing with AI-powered portfolio management. Users can bridge assets, track performance, and rebalance portfolios across Base and other chains—all through a user-friendly interface.

Security remains a top concern for retail investors venturing into DeFi. Here again, HeyElsa and Avantis set themselves apart. HeyElsa’s MPC wallets eliminate single points of failure, while Avantis’s reliance on reputable oracles like Pyth and Chainlink helps ensure price integrity and transparency. These advances are making it possible for everyday users to trust in the safety of their assets on Base, without sacrificing usability or control.

Empowering Retail Investors: Real-World Impact and Community Momentum

The impact of accessible AI DeFi tools goes beyond just technology, it’s about empowering people. Retail investors who once felt excluded from opportunities in decentralized finance are now finding their place in the new digital economy. The community buzz around Base is growing, with users sharing stories about their first successful trades or yield strategies powered by HeyElsa’s conversational interface.

As more platforms adopt these user-centric innovations, we’re witnessing an acceleration in DeFi adoption rates among retail participants. According to basetoken. org, tools like Boost, Superbridge AI Portfolio Manager, Parsec AI Trading Suite, and IAESIR AI Yield Optimizer are also contributing to this shift, offering everything from portfolio tracking to automated yield farming with just a few clicks.

If you’re curious about how to get started or want to compare different user-friendly options on Base, explore our hands-on guide: How Retail Investors Can Safely Get Started with DeFi on Base: A Step-by-Step Guide for 2025.

What Comes Next?

The rapid evolution of AI DeFi tools on Base blockchain is just beginning. As developers continue refining interfaces and expanding integrations, expect even more seamless experiences tailored for retail investors, whether that means easier cross-chain swaps, smarter yield recommendations, or community-driven governance models that put power directly in users’ hands.

Ultimately, the collaboration between cutting-edge platforms like HeyElsa and Avantis signals a new chapter for accessible DeFi on Base. By prioritizing clarity, security, and simplicity without compromising performance or opportunity, these solutions are paving the way for mass adoption among everyday investors.