Retail investors are driving the next wave of decentralized finance (DeFi) adoption on Base, seeking transparent, intuitive, and secure tools that make DeFi accessible without the learning curve or technical jargon. In 2025, the Base blockchain stands out for its robust ecosystem of user-friendly DeFi apps designed specifically for non-institutional participants. This guide cuts through the noise to spotlight the seven most effective and approachable tools for retail users who want to trade, lend, learn, and manage portfolios with confidence.

Why Retail Investors Choose Base for DeFi

The Base chain’s integration with Coinbase’s security stack and its low fees have made it a magnet for new and seasoned retail users alike. The best DeFi tools on Base are not just technically advanced – they’re built from the ground up with everyday investors in mind. Features like one-click swaps, interactive education, real-time analytics, and mobile-first wallets set a new standard for accessibility in decentralized finance.

Top 7 Retail-Friendly DeFi Tools on Base Blockchain

Top 7 User-Friendly DeFi Tools on Base (2025)

-

BaseSwap: The leading decentralized exchange (DEX) on Base, BaseSwap enables users to swap tokens, provide liquidity, and earn yield with a simple, intuitive interface. Its low fees and deep liquidity pools make it ideal for retail investors seeking efficient trading on Base.

-

Layer3 Quests: This platform offers interactive tutorials, quests, and rewards to help users learn DeFi basics on Base. Layer3 Quests is perfect for onboarding newcomers, providing hands-on experience and incentives for completing educational tasks.

-

Aave on Base: Aave brings its trusted lending and borrowing protocol to the Base network, allowing users to supply and borrow assets securely. With transparent rates and robust risk controls, Aave on Base is a top choice for earning interest or accessing liquidity.

-

Compound Base Markets: Compound’s Base deployment lets retail investors lend and borrow crypto assets with automated interest rates. The protocol’s user-friendly dashboard and proven security make it a staple for passive income strategies on Base.

-

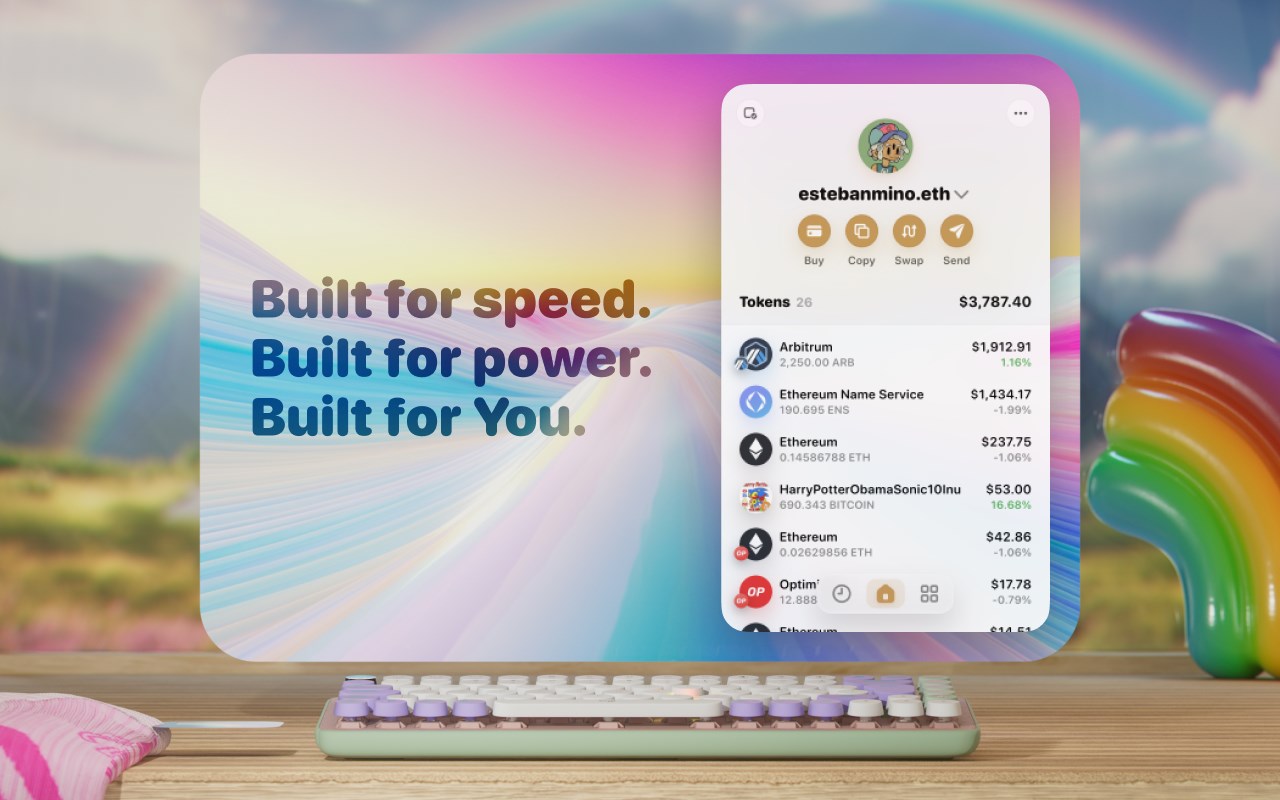

Rainbow Wallet (Base support): The popular Rainbow Wallet now supports Base, offering a visually engaging, easy-to-use mobile wallet for managing assets, NFTs, and DeFi interactions. Its seamless integration with Base dApps ensures smooth onboarding for all users.

-

Nansen Portfolio Tracker: Nansen’s advanced portfolio tracker provides real-time analytics, wallet insights, and DeFi performance tracking tailored to Base. Retail investors can monitor holdings, analyze trends, and make data-driven decisions with ease.

-

Safe (formerly Gnosis Safe) for Base: Safe delivers multi-signature wallet security and collaborative asset management on Base. It’s ideal for individuals and groups seeking enhanced protection and governance for their DeFi funds.

1. BaseSwap: Secure DEX Trading Made Simple

BaseSwap is the go-to decentralized exchange (DEX) for retail traders seeking fast swaps with minimal slippage and transparent fees. Its clean interface strips away complexity while still offering advanced features like limit orders and liquidity provision. For those just starting out or looking to avoid hidden costs common on other chains, BaseSwap is a clear winner.

2. Layer3 Quests: Interactive Learning and Onboarding

Layer3 Quests transforms onboarding into an engaging experience by rewarding users as they complete hands-on tutorials covering staking, swapping, lending, and more, all directly on the Base network. This platform lowers barriers to entry by letting users earn tokens while learning how to navigate real DeFi protocols safely.

3. Aave and Compound: Lending Protocols Built for Everyone

Lending remains a core pillar of any DeFi portfolio strategy. Aave on Base and Compound Base Markets bring trusted money market infrastructure to retail investors with simple deposit/borrow flows and risk transparency dashboards. Both platforms offer competitive yields on major stablecoins as well as blue-chip crypto assets, without requiring technical background or large capital.

User-Friendly Wallets and Portfolio Trackers: Control at Your Fingertips

The right wallet can make or break your DeFi experience. Rainbow Wallet (with native Base support) delivers a visually rich mobile interface that lets you track balances across assets and interact directly with dApps, no browser extensions required. For those managing larger portfolios or collaborating in groups, Safe (formerly Gnosis Safe) for Base introduces multi-signature security without sacrificing usability.

No matter your experience level or investment size, these wallets empower you to keep control of your funds while minimizing friction during transactions.

Nansen Portfolio Tracker: Data-Driven Decisions Made Easy

Nansen’s Portfolio Tracker brings institutional-grade analytics down to earth for retail users by aggregating wallet data across all major protocols, including every asset you hold on Base. Instantly see your portfolio allocation, P and L breakdowns by token or protocol, and even benchmark performance against market trends, all from one dashboard.

If you’re looking to compare more options or want deeper dives into each tool’s features and safety practices, including step-by-step onboarding tips, check out our expanded guides such as Best DeFi Tools for Retail Investors on Base: Simple Apps.

Security and simplicity are not mutually exclusive on Base. The best DeFi apps for retail users now offer robust protection layers without the headaches of self-custody or complex setup. Safe (formerly Gnosis Safe) for Base, for example, is engineered for everyday investors who want multisig security, a feature once reserved for DAOs or whales. With Safe, you can require multiple approvals for transactions, reducing the risk of accidental transfers or unauthorized access. This is a game-changer for anyone managing funds with friends, family, or small investment clubs.

Rainbow Wallet stands out as the most approachable mobile wallet with native Base support. It’s designed to make asset management and dApp interaction as intuitive as checking your email. Features like instant notifications, NFT galleries, and built-in swap functionality mean you don’t need to juggle multiple apps to stay on top of your assets.

How These Tools Empower Retail Investors

The days of needing a technical background to participate in DeFi are over. With these seven tools, BaseSwap, Layer3 Quests, Aave on Base, Compound Base Markets, Rainbow Wallet (Base support), Nansen Portfolio Tracker, and Safe, retail users can:

- Trade securely with transparent fees and minimal slippage (BaseSwap)

- Learn by doing, earning rewards while mastering DeFi basics (Layer3 Quests)

- Earn passive income through lending/borrowing on trusted protocols (Aave and Compound)

- Track performance across all assets in real time (Nansen Portfolio Tracker)

- Keep funds safe with user-friendly wallets and advanced security (Rainbow Wallet and Safe)

If you’re just starting out or want a refresher on onboarding safely into the Base ecosystem, explore our hands-on walkthrough at How Retail Investors Can Safely Get Started With DeFi on Base: A Step-by-Step Guide for 2025.

Tips for Using DeFi Tools Effectively in 2025

- Start small: Test new features or protocols with modest amounts before scaling up.

- Monitor portfolio health: Use analytics from Nansen Portfolio Tracker to spot risks early.

- Avoid phishing traps: Always verify contract addresses, especially when bridging or swapping assets.

- Diversify strategies: Mix trading, lending, and staking across platforms like Aave and Compound to balance risk and reward.

- Engage with community quests: Platforms like Layer3 keep you updated on new opportunities while rewarding learning.

The gap between pro traders and everyday investors is closing quickly thanks to these user-centric solutions. Whether your goal is steady yield generation or simply exploring new financial tools without fear of loss or confusion, the current suite of retail-friendly DeFi apps on Base gives you every advantage.

If you’re looking for more detailed breakdowns, including analytics dashboards and cross-protocol comparisons, visit our deep-dive resource at Best DeFi Tools for Retail Users on Base: Analytics and Yield Optimization.