Decentralized finance (DeFi) is evolving rapidly, and 2025 has brought a new wave of user-friendly platforms designed specifically for retail investors. Among these, StackFi on Base stands out for its intuitive approach to lending, borrowing, and yield generation. If you’re seeking a practical way to earn passive income or access leverage in the crypto markets without advanced technical know-how, StackFi offers a compelling entry point. Let’s break down how StackFi works on the Base blockchain and why it’s gaining traction among everyday users.

Why Retail Investors Are Flocking to DeFi Lending in 2025

The DeFi lending market has hit a milestone with active loans surpassing $24 billion, reflecting strong confidence in decentralized lending protocols. Platforms like Aave and Compound paved the way, but StackFi’s integration with the Base network introduces enhanced scalability, lower fees, and improved risk management, features that resonate with retail users seeking both security and attractive yields.

Retail investors are increasingly attracted by:

- Simplified interfaces: No need for complex DeFi navigation or coding skills.

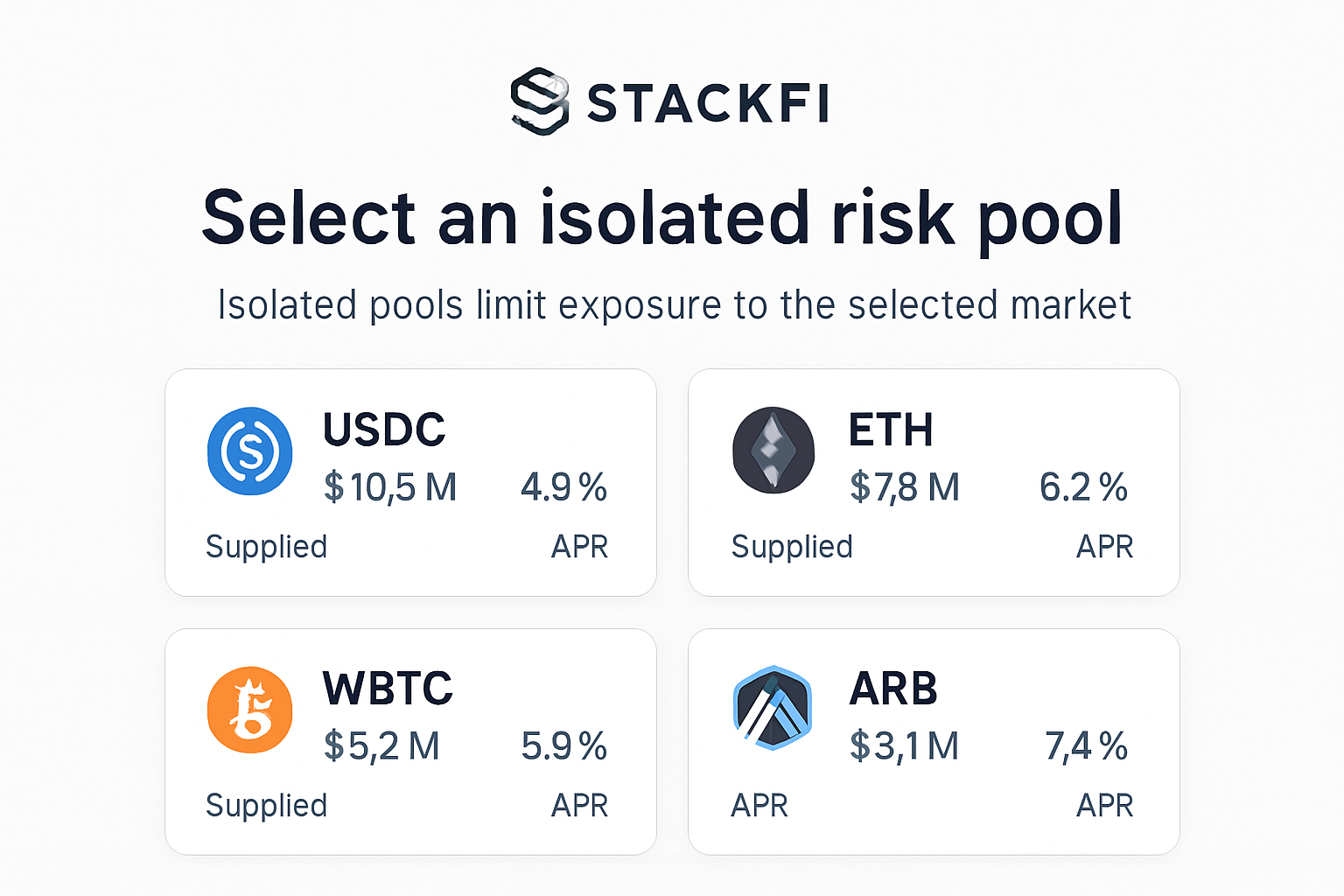

- Isolated risk pools: Each asset pool is siloed to limit exposure.

- Dynamic APYs: Interest rates adjust automatically based on demand and supply within each pool.

- sTokens: ERC-4626 yield-bearing tokens that accrue interest automatically in your wallet.

Lending on StackFi: How It Works for Beginners

Lending your assets on StackFi is straightforward. Here’s how you can get started as a retail user:

- Connect Your Wallet: Use any Web3-compatible wallet (such as Coinbase Wallet or MetaMask) to connect securely to the StackFi app on the Base network.

- Select an Asset Pool: Choose from popular single-asset pools like USDC, WETH, or WBTC. Each pool displays its current APY, utilization rate, and risk level.

- Lend and Earn sTokens: Deposit your chosen asset into the pool. You’ll receive sTokens (e. g. , sUSDC) representing your share plus accrued yield. These tokens automatically appreciate in value as interest accumulates from borrowers.

The yield you earn comes from borrowers who tap into these pools via credit accounts. Thanks to StackFi’s utilization curve model, APYs can rise during periods of high demand, for example, if a USDC pool reaches certain utilization thresholds (like U1 = 70% or U2 = 90%), rates might jump sharply up to r3 = 100%. This dynamic structure rewards early lenders while balancing risk across participants.

The Borrowing Experience: Safe Leverage for Everyday Users

If you’re looking to borrow against your crypto holdings, perhaps to access liquidity without selling assets, StackFi makes this process accessible even for first-timers. Here’s what sets it apart:

- Credit Accounts: Open a credit account by depositing collateral (such as ETH or stablecoins). This unlocks borrowing power based on your collateralization ratio.

- Leverage Options: Borrowers can use leverage within safe boundaries established by the protocol’s risk engine. This means you can amplify returns while keeping downside risks isolated from other pools.

- Dynamic Rates: Just like with lending, borrowing rates are governed by real-time utilization curves, ensuring fair pricing whether demand is high or low.

This approach demystifies safe borrowing for retail participants and reduces systemic risks often associated with pooled lending platforms of previous years.

Beyond the basics of lending and borrowing, StackFi on Base introduces innovative yield generation mechanisms tailored for retail investors. Once you’ve deposited assets and received sTokens, you can further boost your returns by staking these tokens to earn extra rewards, such as STACK tokens, on top of your base APY. These additional incentives are distributed via gauges, which allocate rewards dynamically across different pools and the StackFi DAO.

Key Benefits of StackFi Yield Farming for New Users

-

Automated Yield Accrual with sTokens: When you lend assets on StackFi, you receive ERC-4626 yield-bearing tokens (like sUSDC or sWETH) that automatically accumulate interest, simplifying passive income generation.

-

Additional Rewards via STACK Token Staking: By staking your sTokens, you can earn extra STACK token rewards on top of regular interest, boosting your overall yield potential.

-

Isolated Risk Pools for Safer Participation: StackFi features isolated risk pools, so your exposure is limited to the specific pool you join, reducing the impact of potential issues elsewhere on the platform.

-

Dynamic APYs Driven by Utilization: StackFi’s utilization curve model means APYs adjust based on pool demand, allowing for potentially higher returns during periods of high utilization.

-

Composability and Leverage Options: The platform’s design allows for composable leverage through Credit Accounts, letting advanced users maximize strategies while keeping things simple for beginners.

StackFi’s composable leverage feature is especially noteworthy for those seeking to maximize their passive income. By allowing users to participate in leveraged strategies within isolated risk pools, StackFi ensures that retail users are not exposed to cascading liquidations or cross-pool contagion, a common concern in older DeFi protocols. This architecture delivers a blend of flexibility and safety that aligns with the needs of everyday investors.

Yield Farming Simplified: How to Optimize Returns on StackFi

Yield farming on StackFi is designed to be approachable, even for beginners. After lending assets and receiving sTokens, you can:

- Stake sTokens: Lock your sTokens into dedicated staking modules to earn STACK token rewards. Remember, these must be claimed manually through the platform interface.

- Monitor Gauges: Check which asset pools are currently offering boosted rewards via gauges, these change based on DAO governance decisions and market demand.

- Diversify Pools: Spread your lending across multiple isolated pools (e. g. , USDC, WETH) to manage risk while capturing different APYs.

This process allows even small-scale participants to access strategies once reserved for DeFi power users. The platform’s transparent dashboards make it easy to track yields, utilization rates, and pending rewards in real time, no spreadsheets or manual calculations required.

Risk Management: What Every Retail User Should Know

No DeFi protocol is without risk, but StackFi’s design on Base incorporates several layers of protection:

- Isolated Risk Pools: Each asset pool operates independently, so issues in one do not threaten others.

- Smart Contract Audits: Regular third-party reviews help minimize vulnerabilities.

- Transparent Liquidation Mechanisms: Collateral ratios are clearly displayed, with real-time alerts if positions approach liquidation thresholds.

A key point for 2025: As DeFi matures and more retail users enter the space, platforms like StackFi are leading the way in prioritizing user education and robust security practices. Always review platform documentation and start with small amounts when testing new features.

Getting Started: Your First Steps with StackFi on Base

If you’re ready to explore decentralized lending or yield farming as a retail investor in 2025, here’s a quick checklist for onboarding safely with StackFi:

- Create or connect a secure Web3 wallet, such as Coinbase Wallet or MetaMask.

- Select your preferred asset pool, reviewing current APYs and utilization rates directly within the app dashboard.

- Lend assets, receive sTokens automatically in your wallet, and consider staking them for extra STACK token rewards.

- Monitor positions regularly, claim earned rewards manually when available, and adjust allocations based on market conditions or personal goals.

The combination of intuitive design, dynamic yields, isolated risks, and educational support makes StackFi one of the most retail-friendly DeFi platforms operating on Base today. Whether you’re looking for stablecoin yields or exploring safe leverage opportunities without deep technical knowledge, 2025’s DeFi landscape offers unprecedented access, and platforms like StackFi are lowering barriers every step of the way.