For retail investors exploring decentralized finance (DeFi) on the Base blockchain, the right set of tools can make all the difference. As Base cements its place as a leading Layer 2 network, offering reduced fees and faster transactions, retail users are empowered to manage portfolios, analyze opportunities, and optimize yield with unprecedented ease. But with a rapidly expanding ecosystem, navigating which tools best fit your needs can be overwhelming. Below, we break down seven essential DeFi platforms designed for analytics, tracking, and yield optimization, each tailored for everyday users seeking clarity and control in their Base DeFi journey.

DeBank: The Retail User’s Analytics Powerhouse

DeBank stands out as a comprehensive dashboard for tracking DeFi portfolios across over 30 EVM-compatible chains, including full support for Base. Its intuitive interface delivers real-time balances, protocol-specific breakdowns, and deep analytics on lending markets, stablecoins, and margin trading platforms. For retail users juggling multiple dApps or experimenting with new protocols on Base, DeBank’s consolidated view is invaluable.

The platform also shines in risk assessment. Users can monitor wallet exposures and historical yield data at a glance, empowering smarter decisions without needing to sift through endless transaction logs or block explorers. As the Base ecosystem grows more complex in 2025, DeBank’s reputation as a “single pane of glass” only becomes more relevant.

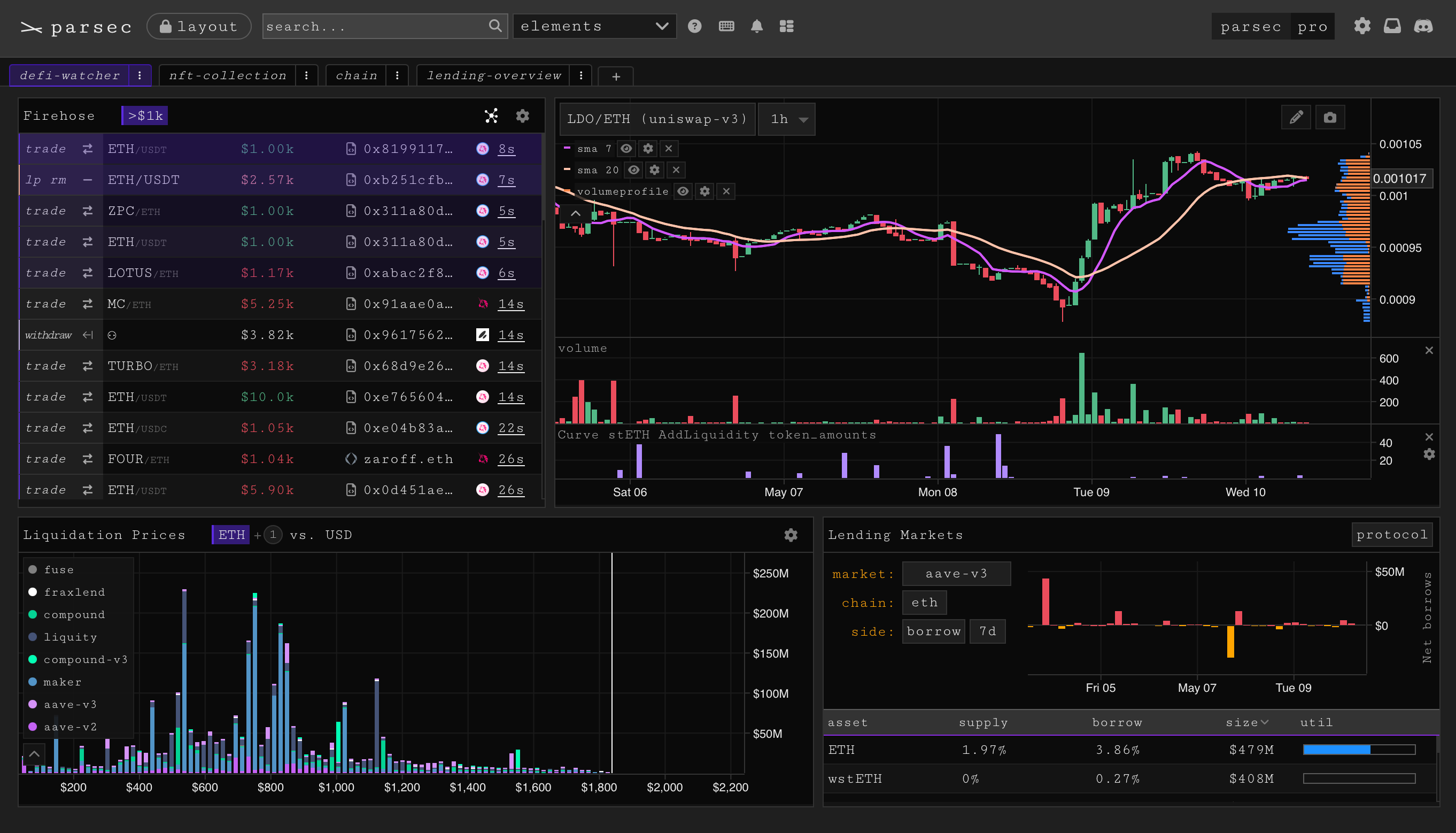

Parsec Finance: Advanced Analytics Without the Learning Curve

If you crave deeper insights into market trends but want to avoid technical overload, Parsec Finance is your ally. Parsec specializes in real-time DeFi analytics, offering granular data on liquidity pools, token flows, and whale activity across major chains like Base. What sets it apart is its user-friendly dashboards that distill complex on-chain information into actionable signals for everyday investors.

Retail users benefit from customizable alerts for price movements or protocol updates, a crucial feature when volatility strikes or new opportunities emerge on Base-native assets. With Parsec’s visualizations and smart filtering tools, even newcomers can spot patterns that might otherwise be reserved for institutional traders.

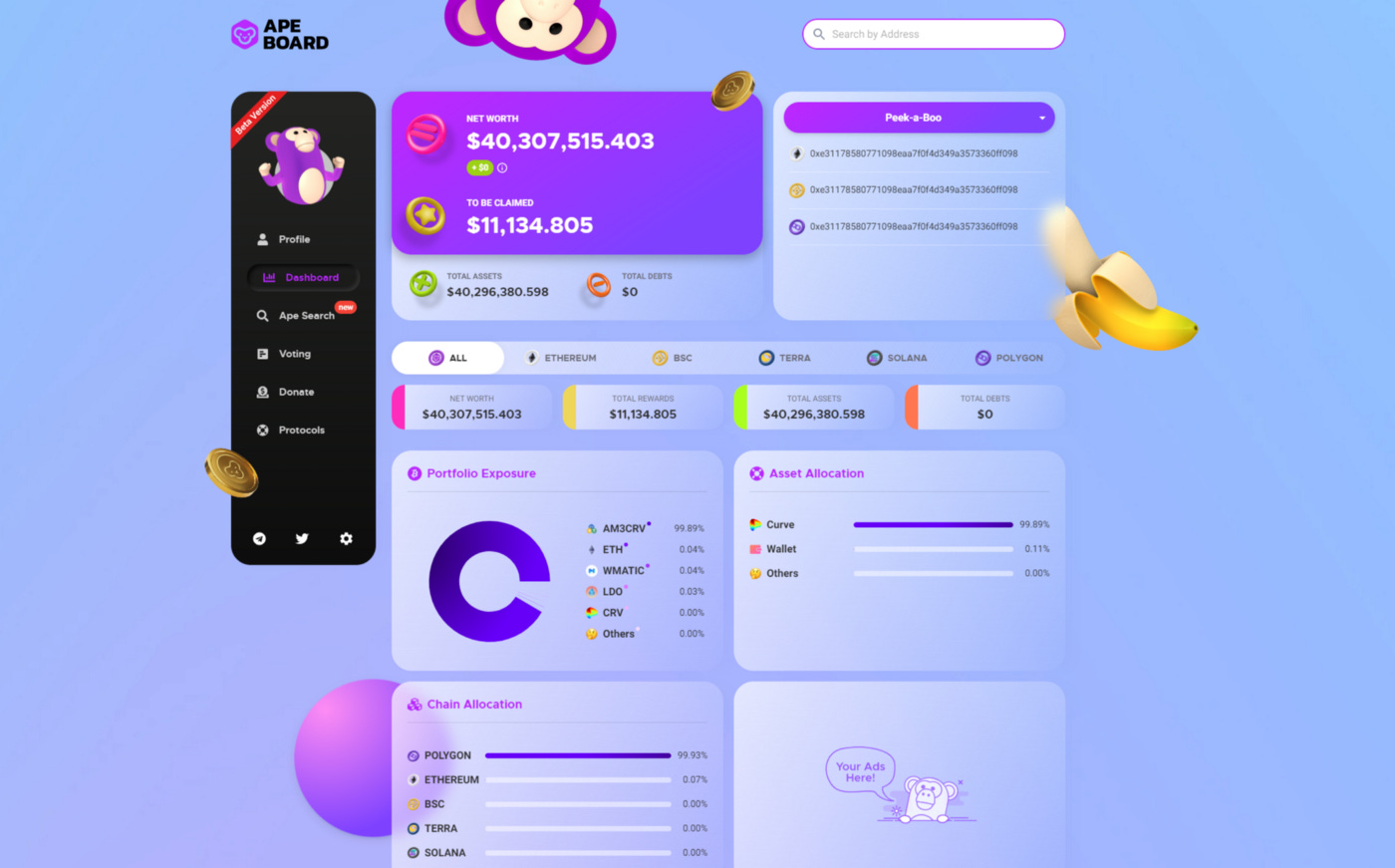

Nansen Portfolio and DappRadar Portfolio Tracker: Holistic Tracking Meets Community Insights

Nansen Portfolio merges sophisticated blockchain analytics with an approachable portfolio tracker. Its integration with Base allows users to visualize holdings across wallets while tapping into Nansen’s signature wallet labeling, revealing what top-performing addresses are doing in real time. This community-driven intelligence helps demystify market movements so retail investors can learn from smart money flows without being overwhelmed by data noise.

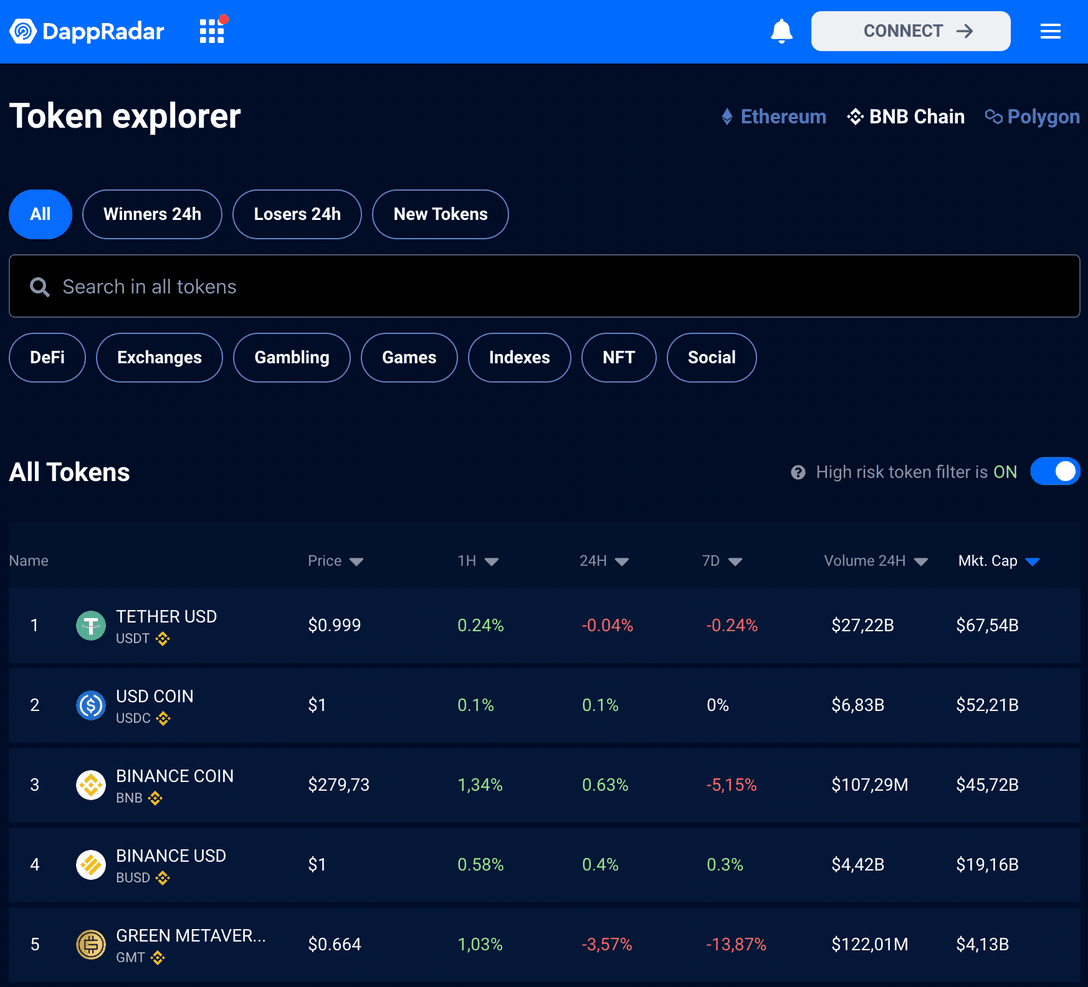

DappRadar Portfolio Tracker, meanwhile, provides a seamless experience for those who want to track assets and dApp interactions across multiple chains, including full support for Base-based protocols. Its clean UI makes it easy to monitor historical performance or discover trending applications within the rapidly evolving Base ecosystem.

Top DeFi Tools for Retail Users on Base

-

DeBank: A comprehensive DeFi dashboard supporting over 30 EVM-compatible chains, including Base. DeBank provides real-time portfolio analytics, protocol-specific breakdowns, and wallet tracking, making it indispensable for users managing diverse DeFi assets.

-

Parsec Finance: Known for its advanced on-chain analytics, Parsec Finance delivers granular DeFi data, wallet activity tracking, and real-time protocol monitoring. It empowers users to make informed decisions with visualized DeFi metrics on Base.

-

Nansen Portfolio: Nansen Portfolio aggregates wallet balances, DeFi positions, and NFT holdings across multiple chains, including Base. Its smart wallet labeling and analytics help users uncover trends and optimize their DeFi strategies.

-

DappRadar Portfolio Tracker: DappRadar’s tracker enables users to monitor DeFi assets, token balances, and NFT collections on Base. The platform offers actionable analytics and portfolio insights in an intuitive interface.

-

Boost: A Base-native yield optimizer, Boost automates yield farming strategies to maximize returns. It offers real-time APY tracking, auto-compounding, and seamless integration with Base DeFi protocols.

-

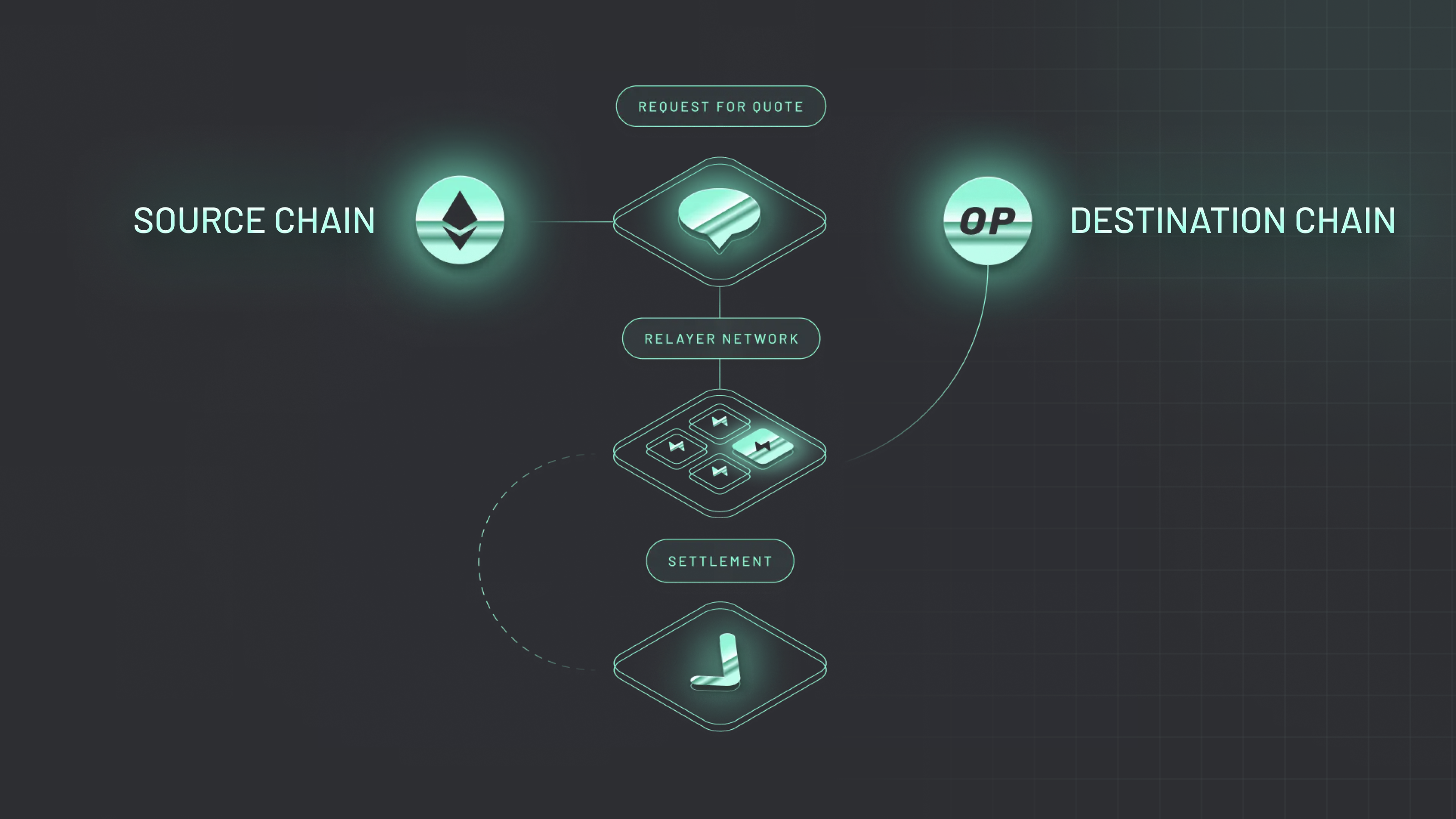

Superbridge: Superbridge facilitates efficient cross-chain bridging for Base users, enabling seamless asset transfers and liquidity movement. Its analytics tools help users monitor bridge activity and optimize cross-chain strategies.

-

LayerZero: LayerZero delivers omnichain interoperability and analytics, allowing users to interact with and analyze assets across multiple blockchains, including Base. Its infrastructure supports secure messaging and data transfer for DeFi applications.

Boost and Superbridge: Yield Optimization and Seamless Cross-Chain Access

No guide to best DeFi tools on Base would be complete without addressing yield optimization and interoperability, the two pillars enabling retail users to maximize returns while minimizing friction.

Boost, a yield optimizer built natively for the Base network, automates farming strategies by reallocating liquidity based on real-time APY comparisons across supported protocols. This hands-off approach lets users capture higher yields without constant manual intervention, a game-changer given how quickly rates shift in today’s market.

Superbridge simplifies cross-chain asset transfers into or out of Base with minimal fees and near-instant settlement times. For retail participants diversifying across ecosystems (or hunting new incentives), Superbridge removes much of the technical headache associated with bridging funds between Layer 1s and Layer 2s.

Rounding out the toolkit for Base users is LayerZero, an omnichain interoperability protocol that’s quietly transforming how retail investors interact with DeFi analytics and cross-chain data. LayerZero’s infrastructure enables seamless messaging and asset transfers between Base and other supported chains, but its real value for everyday users lies in its analytics layer. By aggregating on-chain metrics from multiple networks, LayerZero empowers retail investors to spot arbitrage opportunities, monitor liquidity shifts, and track asset flows, all from a single interface.

For those who want to go beyond simple portfolio tracking, LayerZero provides context-rich dashboards that visualize network health, protocol adoption, and even cross-chain yield differentials. This means you can compare APYs or liquidity pool performance on Base versus other ecosystems without juggling multiple tabs or tools. In 2025’s increasingly interconnected DeFi landscape, this level of holistic insight is indispensable for staying ahead of market trends.

Choosing the Right Tools for Your Base DeFi Strategy

With so many analytics tools and yield optimizers available on the Base blockchain, it’s important to match your selection to your personal risk tolerance and experience level. For newcomers prioritizing simplicity, DappRadar Portfolio Tracker or Nansen Portfolio offer intuitive overviews with minimal setup. If you’re ready to dive deeper into data-driven strategies, Parsec Finance and DeBank deliver granular analytics without overwhelming complexity.

Boost is ideal for those seeking passive income from yield farming, automating the hunt for optimal returns across Base-native protocols. Meanwhile, Superbridge ensures that moving assets between networks remains frictionless, critical if you’re chasing incentives or diversifying exposure beyond Base. Finally, LayerZero ties it all together by providing a unified lens into multi-chain activity and opportunity.

Best Practices: Security and Staying Retail-Friendly in 2025

The power of these platforms comes with responsibility. Always double-check contract addresses when bridging or interacting with new dApps, phishing risks remain a concern as Base grows in popularity. Leverage built-in audit features (like those found in DeBank) to assess smart contract safety before deploying significant funds. And remember: start small when testing new strategies or protocols.

If you’re serious about maximizing your DeFi journey on Base while minimizing headaches, consider creating a checklist before diving into any new tool:

The future of retail-friendly DeFi lies in transparency and accessibility, and these seven tools are leading the charge on Base. By combining user-centric design with robust analytics and automation features, they make navigating decentralized finance not just possible but genuinely rewarding for everyone.