Cross-chain DeFi is rapidly becoming the backbone of a more open, accessible blockchain ecosystem. As of September 2025, Base stands out as a leading Layer 2 solution, offering Ethereum-grade security with much lower fees and faster transactions. For retail users, this means the ability to engage with decentralized finance across multiple blockchains without technical headaches or prohibitive costs.

Why Cross-Chain DeFi Matters for Retail Users

Historically, blockchain networks operated like isolated islands. If you held tokens on Ethereum but wanted to use an app on Solana or Base, you were stuck – unless you used a centralized exchange or took on complicated manual swaps. Cross-chain DeFi changes that by letting your assets flow freely between chains. This opens up new opportunities for yield farming, lending, borrowing, and trading – all from your preferred wallet.

“Bridging is not just about moving tokens – it’s about unlocking access to new markets and tools that were previously siloed off from each other. “

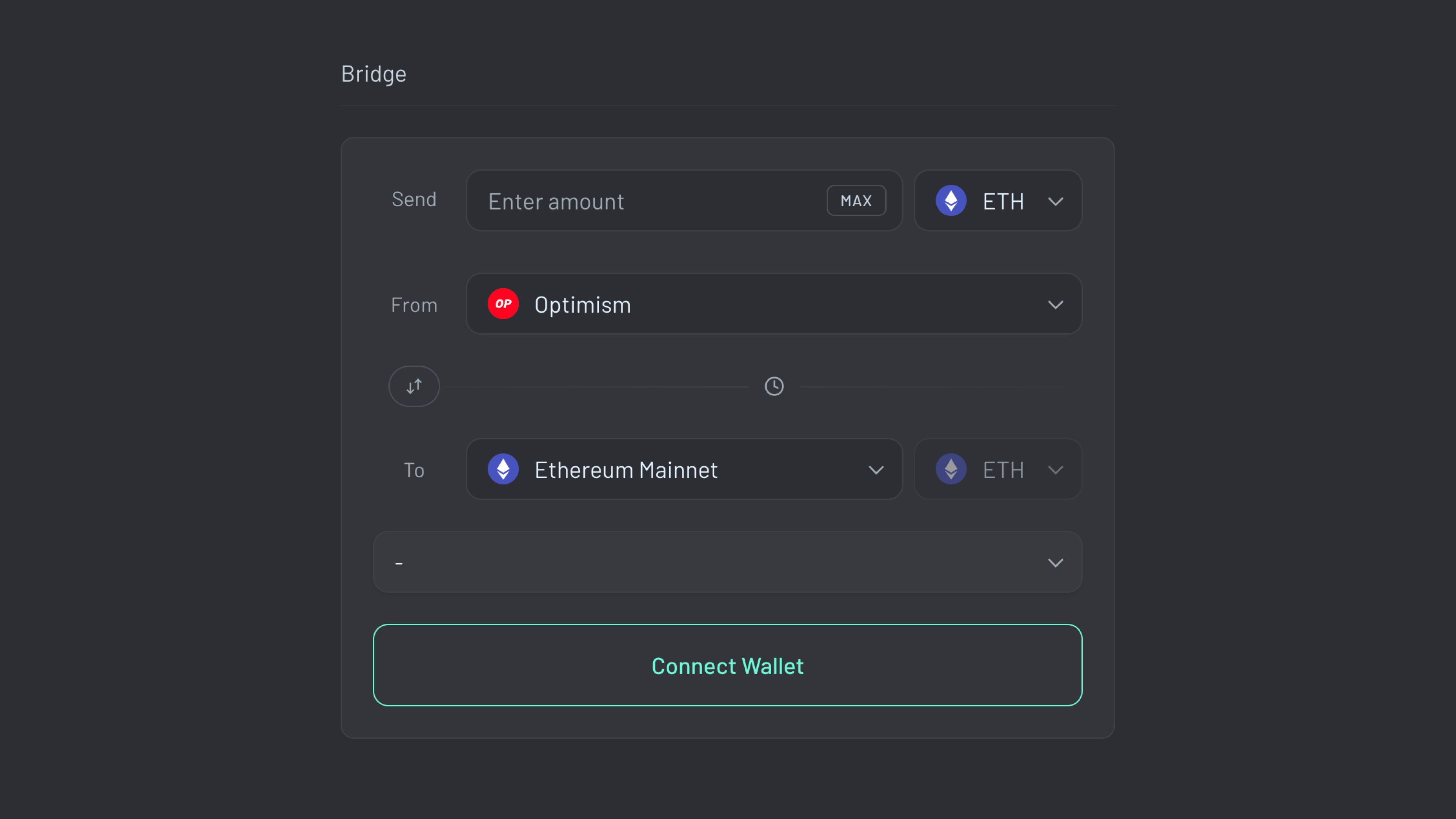

The Mechanics: How to Bridge Assets to Base

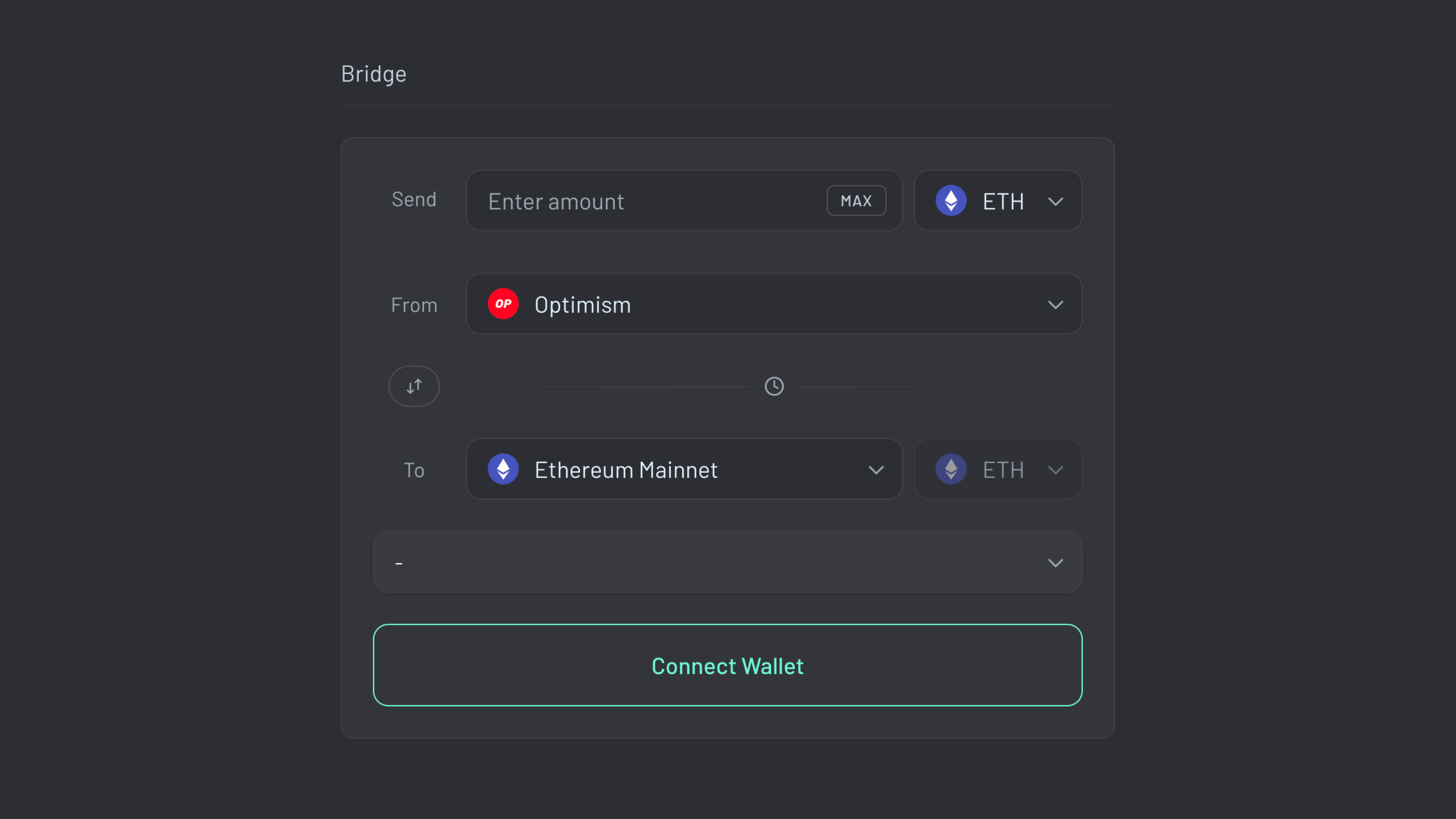

To participate in multichain DeFi on Base, you’ll need to bring assets over from another blockchain (like Ethereum or Solana). The process typically involves:

How to Bridge Assets from Ethereum or Solana to Base

-

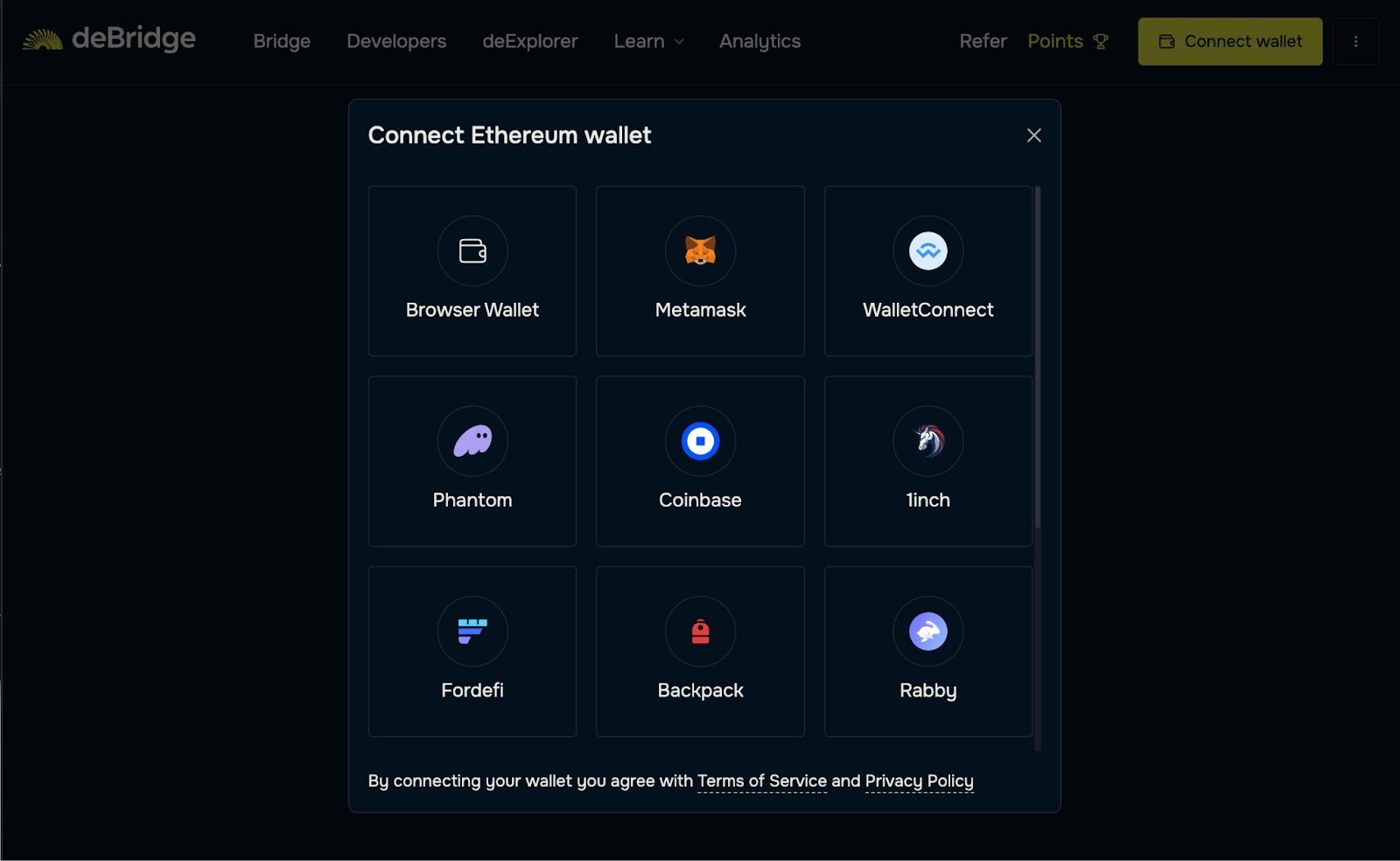

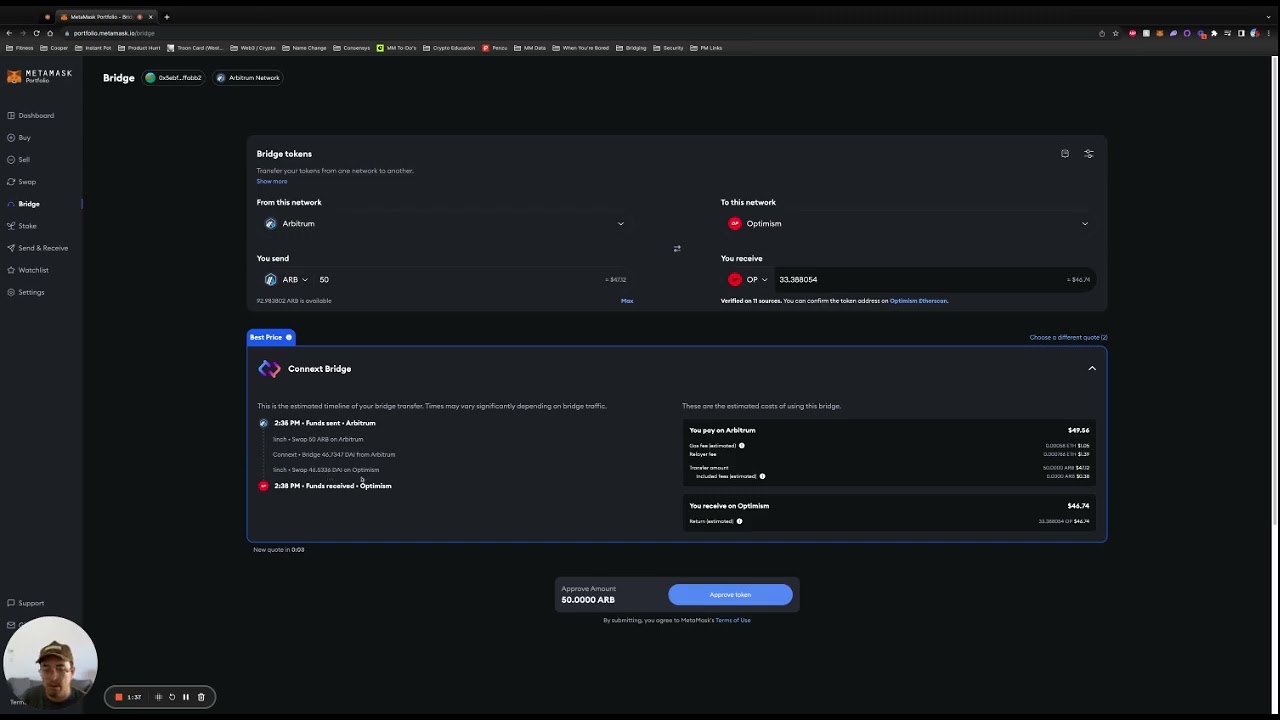

Connect your wallet to a supported cross-chain bridge. Use a reputable wallet such as MetaMask (for Ethereum) or Phantom (for Solana), and access a well-known bridge like deBridge, Synapse Protocol, or Across Protocol that supports transfers to Base.

-

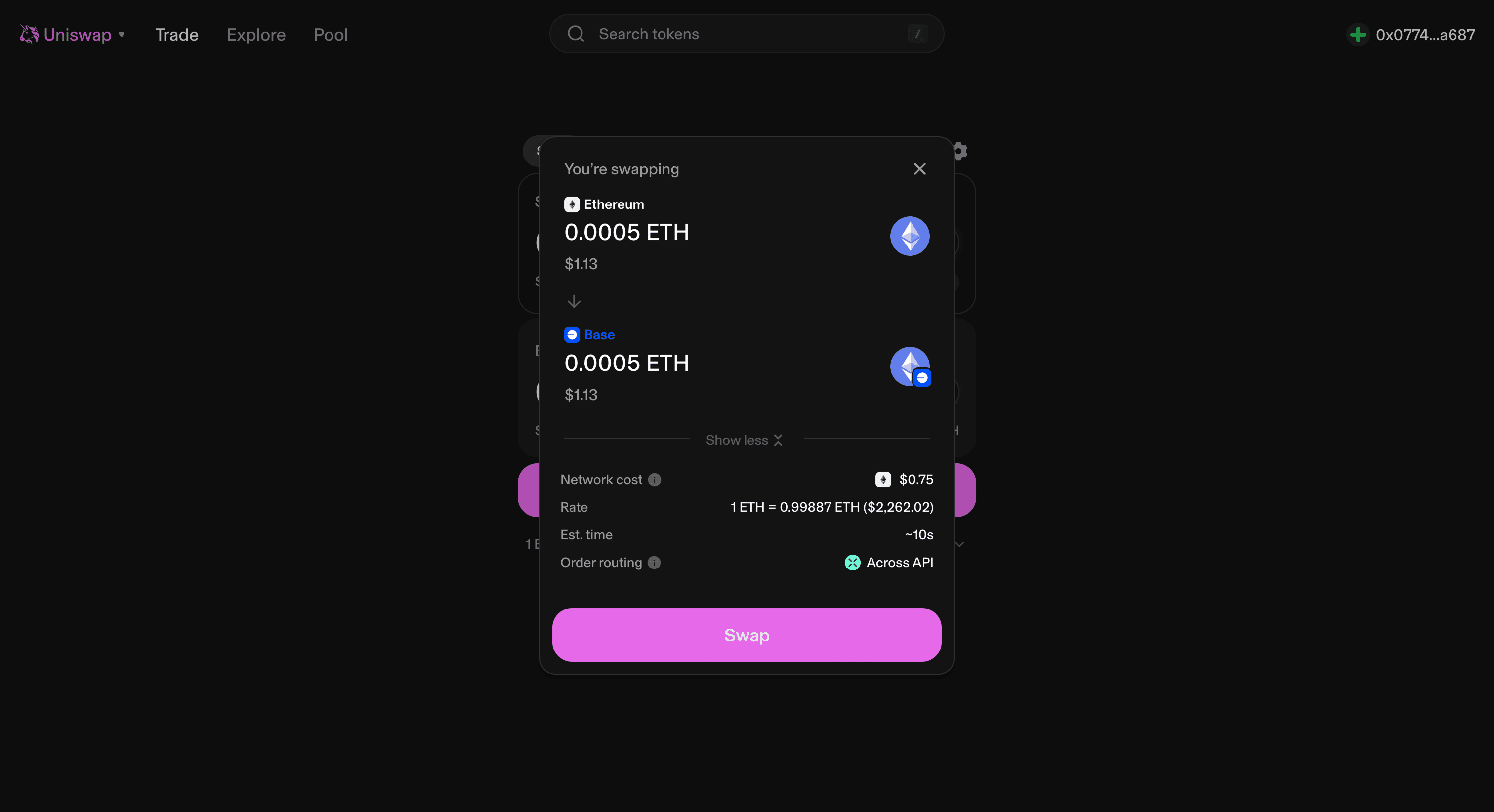

Select the source and destination blockchains. Choose Ethereum or Solana as your source chain and Base as the destination. Ensure the bridge supports both chains for your asset type.

-

Choose the asset and input the transfer amount. Pick a supported token (such as ETH, USDC, or USDT) and specify the amount you want to bridge. Double-check token compatibility with Base.

-

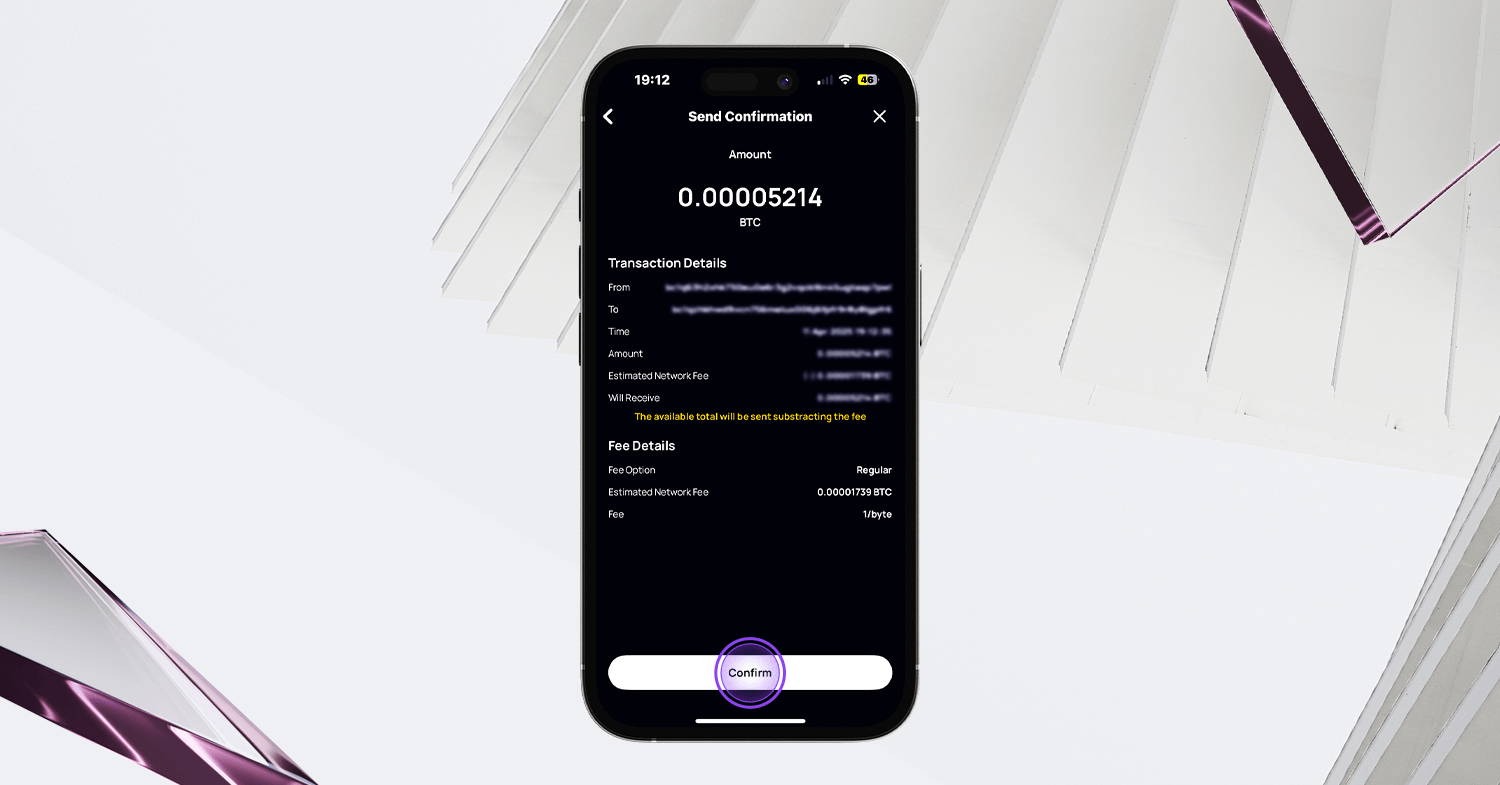

Confirm transaction details and approve in your wallet. Review all details, including fees and estimated arrival time. Approve the transaction in your wallet (e.g., MetaMask or Phantom), which may require signing and paying a network fee.

-

Wait for the bridge to process and mint assets on Base. The bridge will lock or burn your tokens on the source chain and mint or release equivalent tokens on Base. Processing times can vary from a few minutes to around an hour, depending on network congestion.

-

Verify receipt of assets on Base and add Base network to your wallet. Check your wallet on the Base network to confirm the arrival of bridged assets. If Base is not yet added, use Chainlist to add Base Mainnet RPC details to your wallet.

This process relies on cross-chain bridges, which use mechanisms like ‘lock and mint. ‘ Here’s how it works:

- Your original asset (say ETH) is locked in a smart contract on the source chain.

- A wrapped version (wETH) is minted on the target chain (Base).

- You interact with DeFi apps using this wrapped asset.

If you want to move your asset back later, simply reverse the process – burn the wrapped token on Base and unlock your original ETH.

Choosing a Secure Bridge: What to Look For

Security is paramount when bridging assets. Not all bridges are created equal. Some have suffered exploits due to smart contract bugs or weak validation processes. When evaluating which bridge to use for moving funds onto Base:

- Check for audits: Reputable bridges will have undergone third-party security reviews.

- User volume and reputation: Popular bridges tend to be more battle-tested.

- Supported chains and assets: Make sure your desired token and network are covered.

You can find step-by-step guides for specific bridges (including how to bridge from Ethereum or Solana) at sources like deBridge and CoinMarketCap’s guide on adding Base Mainnet RPC details (How To Bridge to Base Mainnet). Always double-check URLs and official documentation before connecting your wallet.

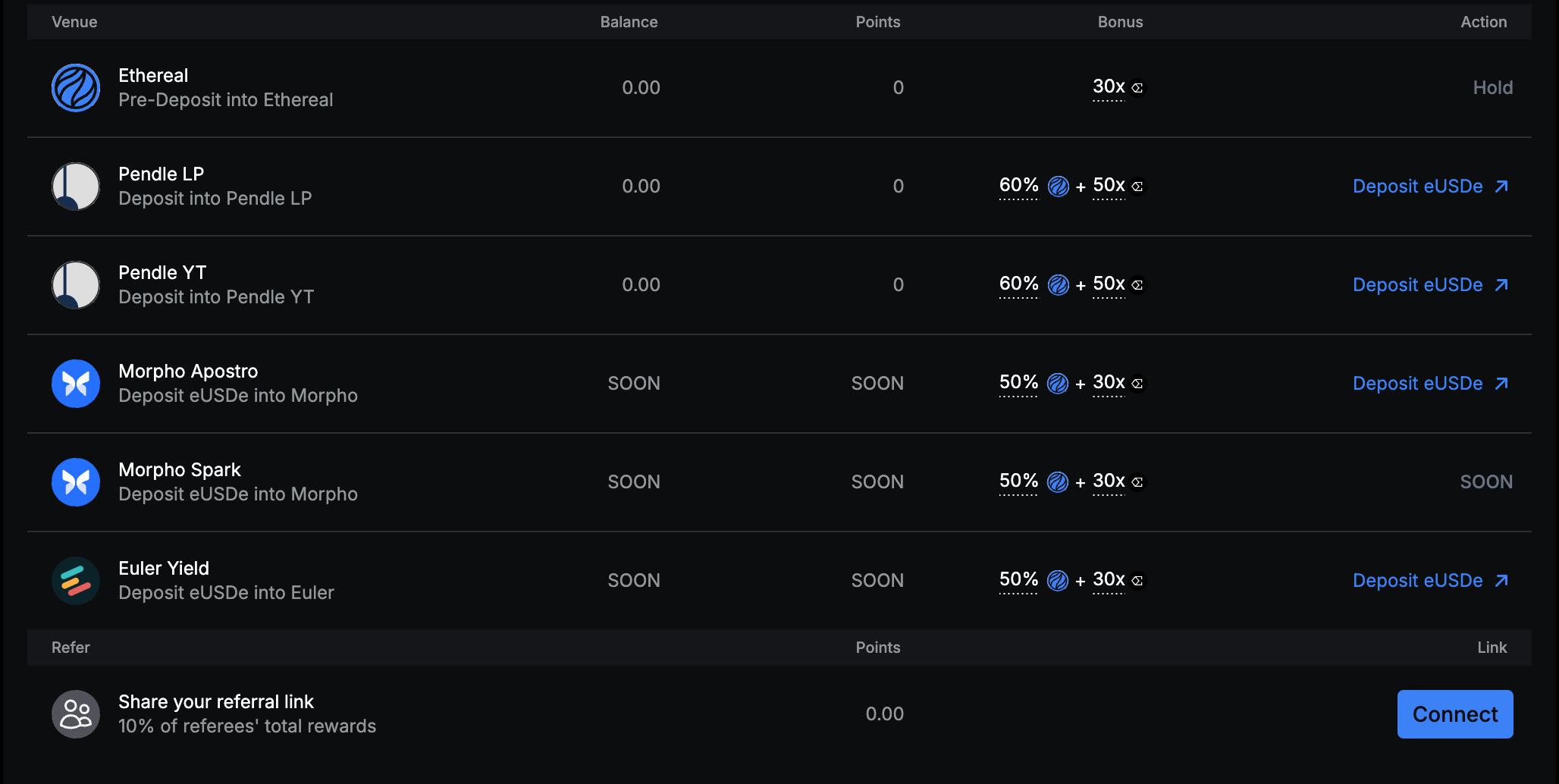

Multichain Features: What You Can Do After Bridging

The real magic happens after your funds arrive on Base. Thanks to cross-chain interoperability:

Key Multichain DeFi Features on Base After Bridging

-

Cross-Chain Lending & Borrowing with Aave: Deposit bridged assets on Base to earn yield or borrow against them, leveraging Aave’s multichain protocol to manage positions across multiple networks.

-

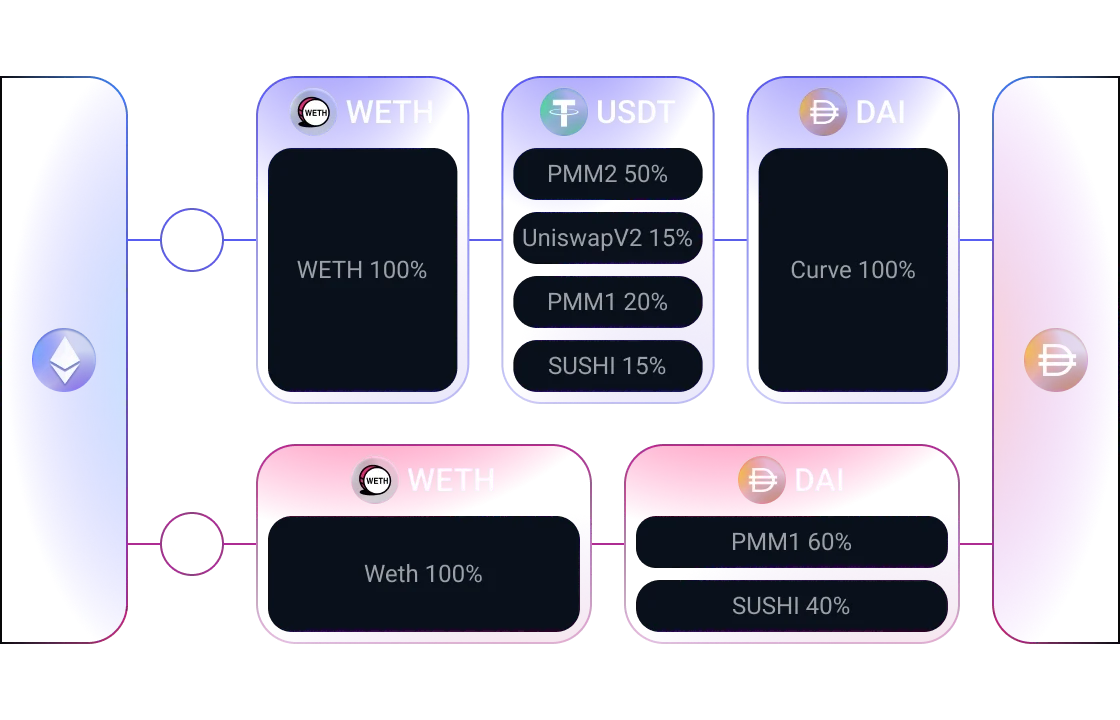

Liquidity Aggregation on 1inch: Access the best available rates for swaps by aggregating liquidity from multiple chains and decentralized exchanges, optimizing trade execution on Base.

-

Yield Farming & Staking with Curve Finance: Provide liquidity to multichain pools on Curve after bridging assets to Base, earning rewards and fees from cross-chain stablecoin swaps.

-

Cross-Chain NFT Transfers via LayerZero: Move NFTs between Base and other EVM-compatible chains, unlocking new use cases and liquidity for digital assets.

This means you can deposit collateral from one chain and borrow against it on another, execute swaps that tap into liquidity pools across networks, or participate in yield programs that aggregate opportunities wherever they’re most lucrative. The result? Stronger capital efficiency and broader access – all while paying minimal fees thanks to Layer 2 scaling.

It’s important to remember that while multichain DeFi unlocks new flexibility, it also requires a bit of extra diligence from users. Each bridge and protocol may have its own quirks, transaction times, and fee structures. Take the time to familiarize yourself with the specific steps for bridging to Base, especially if you’re coming from a non-EVM chain like Solana. Some bridges offer single-click solutions, while others may require manual confirmation or token approvals.

Best Practices for Safe Bridging and Multichain Use

To keep your assets secure as you explore cross-chain DeFi on Base, consider these best practices:

Best Practices for Safe Cross-Chain DeFi on Base

-

Choose Well-Established Bridges: Use reputable cross-chain bridges like Base Bridge, Synapse Protocol, or Across Protocol that support Base and have a proven track record for security and reliability.

-

Verify Bridge Security and Audits: Before initiating any transfer, confirm that the bridge has undergone independent security audits and is transparent about its security practices. Look for audit reports from reputable firms and check for any recent vulnerabilities or incidents.

-

Double-Check Destination Addresses and Networks: Always ensure you are bridging to the correct Base network address and that your wallet is set to the official Base Mainnet. Mistakes here can result in permanent loss of funds.

-

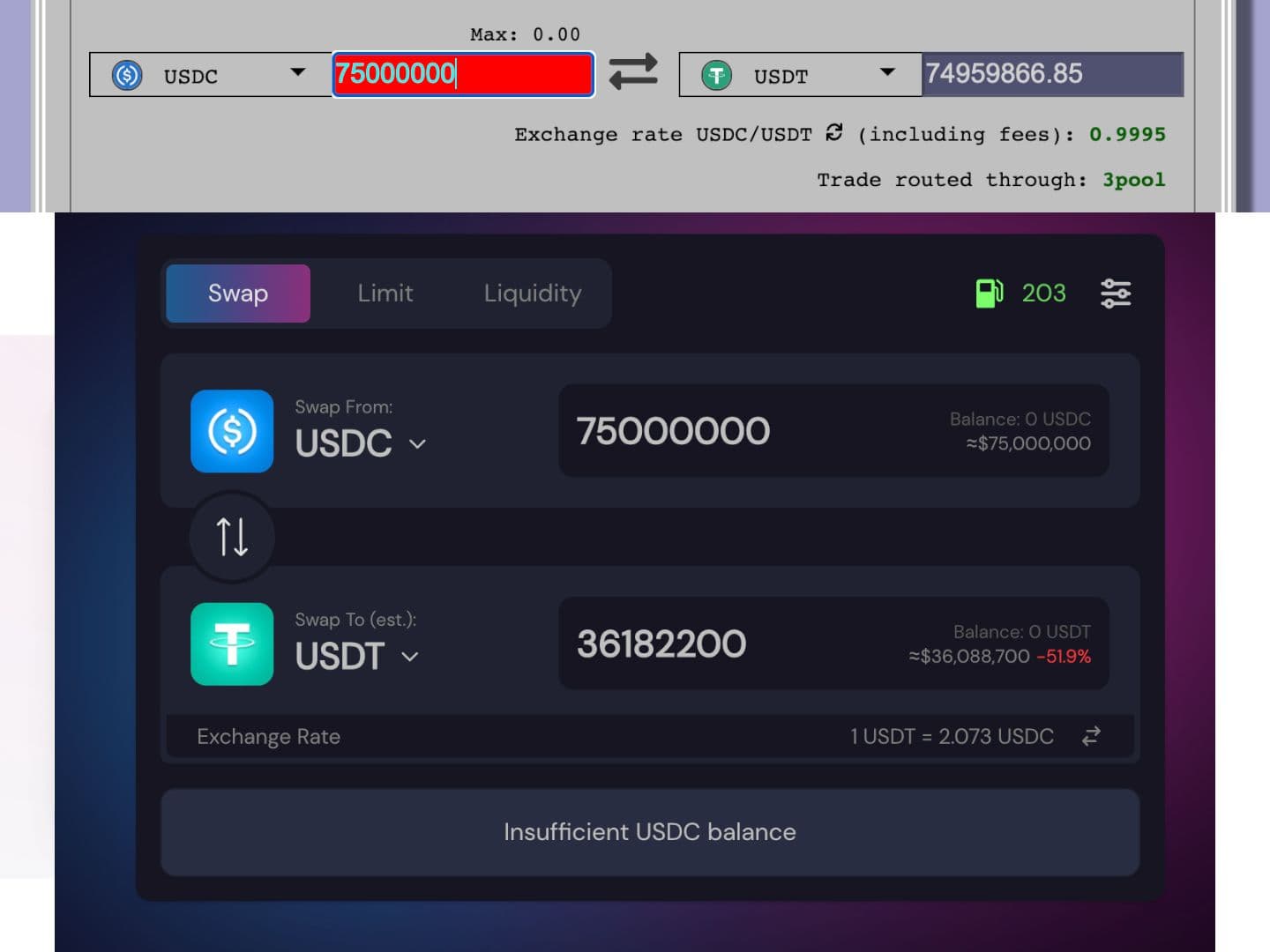

Start with Small Test Transfers: When using a new bridge or DeFi protocol, begin with a small transaction to confirm that the process works as expected before transferring larger amounts.

-

Stay Informed About Bridge and Protocol Updates: Follow official channels for Base and your chosen bridge to receive timely updates on upgrades, maintenance, or potential vulnerabilities. This helps you avoid bridging during risky periods.

-

Monitor Transaction Fees and Network Congestion: Check current gas fees and network status before bridging or executing DeFi transactions to avoid overpaying or getting stuck in pending states.

Always verify you’re on the official bridge website by checking URLs directly from trusted sources (such as project documentation or reputable aggregators). Never rush through transactions, double-check destination addresses and network details before confirming.

Managing Multichain Portfolios

Once your assets are on Base, managing a multichain portfolio becomes much more streamlined. Many DeFi dashboards now support Base alongside other major blockchains, letting you track balances, yield positions, and lending activity in one place. Automated tools can help you rebalance positions or move liquidity between chains when opportunities arise.

“The future of DeFi isn’t siloed, it’s interconnected. Retail investors who master cross-chain tools like Base gain access to deeper liquidity and more dynamic strategies. “

For those seeking advanced strategies, consider exploring protocols that enable cross-chain swaps or aggregated lending markets. This allows you to capitalize on price differences or interest rate variations between networks, without ever leaving the security of your preferred wallet environment.

Frequently Asked Questions: Cross-Chain DeFi on Base

The landscape is evolving quickly. As more protocols adopt cross-chain standards and bridges improve their security models, expect even greater ease-of-use for retail participants. Keep an eye out for emerging bridge solutions that offer faster transfers and lower fees, these can make a big difference in optimizing your returns.

Key Takeaways for Retail-Friendly Cross-Chain DeFi

- Base offers fast, low-cost access to Ethereum-level security with robust support for multichain activity.

- Choose reputable bridges, always check audits and user reviews before transferring funds.

- Diversify your strategies: After bridging, explore lending, swapping, yield farming, and more across multiple blockchains, all within the Base ecosystem.

- Stay informed about risks: Follow updates from both bridge providers and the wider DeFi community for best practices and potential vulnerabilities.

If you’re ready to experience seamless cross-chain finance with retail-friendly tools and security-first design principles, bridging assets to Base is an excellent starting point. With careful research and smart risk management, everyday users can now tap into the full spectrum of decentralized finance, no matter where their crypto journey began.