Decentralized finance is no longer reserved for crypto insiders. In 2024, the Base blockchain has made DeFi more accessible than ever, especially for retail investors seeking straightforward tools and transparent interfaces. If you’re new to the space, choosing the right apps can mean the difference between a smooth onboarding and a frustrating experience.

Why Base Blockchain Is Attracting Retail Investors

Base’s rise isn’t accidental. Backed by Coinbase and engineered for speed and low fees, it’s become a magnet for user-friendly DeFi platforms. On Base, retail investors enjoy reduced transaction costs, faster confirmations, and a growing ecosystem of apps designed with simplicity in mind. This environment is perfect if you’re just starting your DeFi journey or want to manage risk with smaller investments.

Top 7 Beginner-Friendly DeFi Tools on Base (2024)

Let’s break down the seven essential tools every new retail investor should know. Each platform below was selected for its intuitive design, security features, and popularity among everyday users.

Top 7 Beginner-Friendly DeFi Tools on Base Blockchain

-

BaseSwap — A leading decentralized exchange (DEX) on Base, BaseSwap offers a simple swap interface, ultra-low fees, and fast transaction speeds. Its intuitive design makes swapping tokens easy for beginners.

-

Aerodrome Finance — Aerodrome is a popular liquidity hub and DEX on Base, known for its user-friendly dashboard and transparent yield farming opportunities. New users can easily provide liquidity and earn rewards.

-

RocketSwap — RocketSwap stands out for its streamlined swapping experience and robust security features. It’s designed to help newcomers trade tokens on Base with minimal friction and clear instructions.

-

Base Portfolio by DeBank — This portfolio tracker lets users monitor DeFi assets across Base with a clean, visual dashboard. It’s ideal for beginners who want to see all holdings and yields in one place.

-

Velocimeter — Velocimeter is a decentralized exchange and liquidity protocol on Base, offering a straightforward interface for token swaps and liquidity provision. Its analytics tools help users make informed decisions.

-

BaseLend — BaseLend is a lending and borrowing platform tailored for Base users. Its clear interest rates and easy onboarding process make it accessible for those new to DeFi lending.

-

Coinbase Wallet with Base Integration — This non-custodial wallet supports seamless access to Base DeFi apps. Its familiar interface, strong security, and direct Base integration make it a top choice for retail investors starting out.

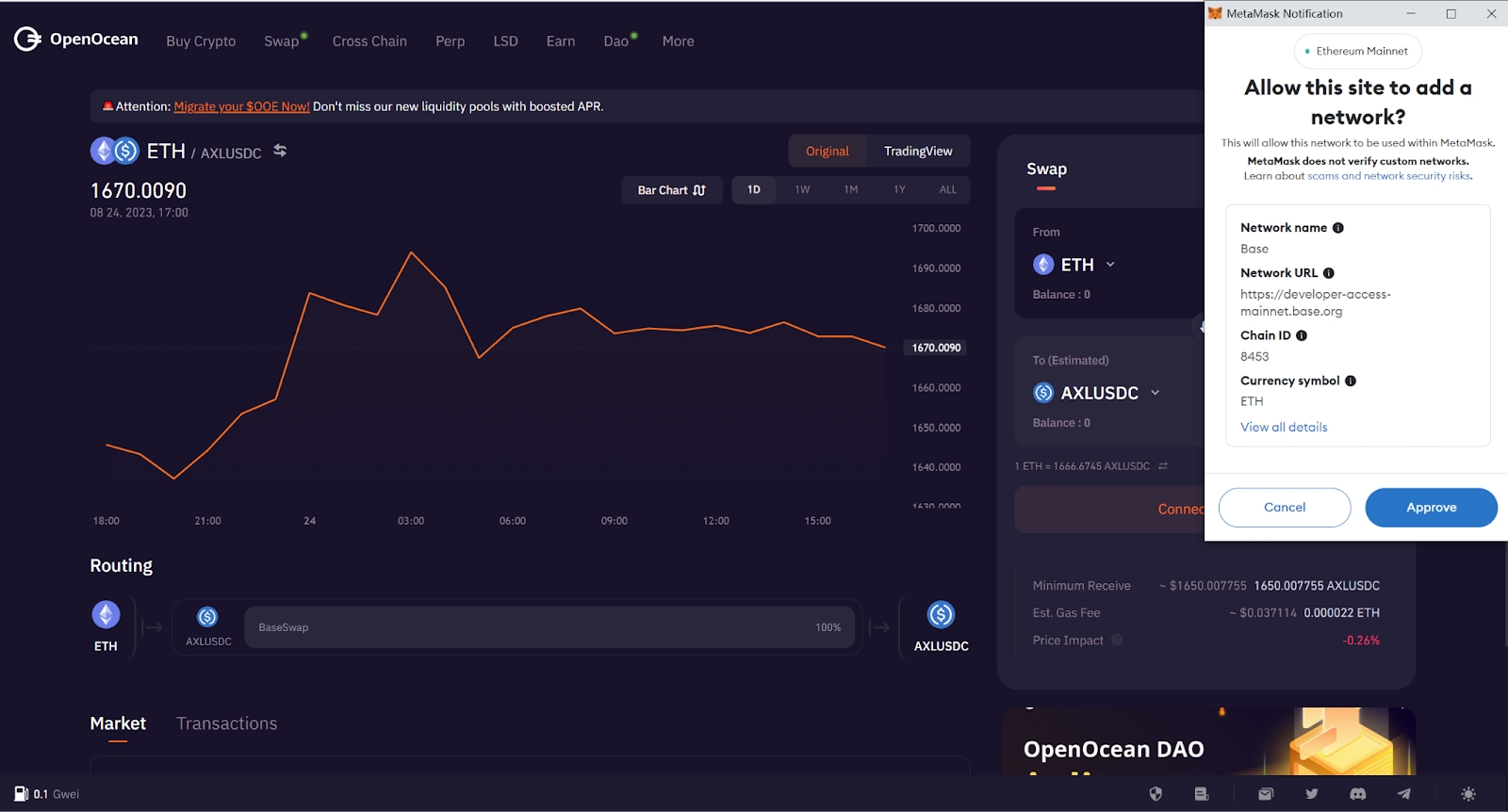

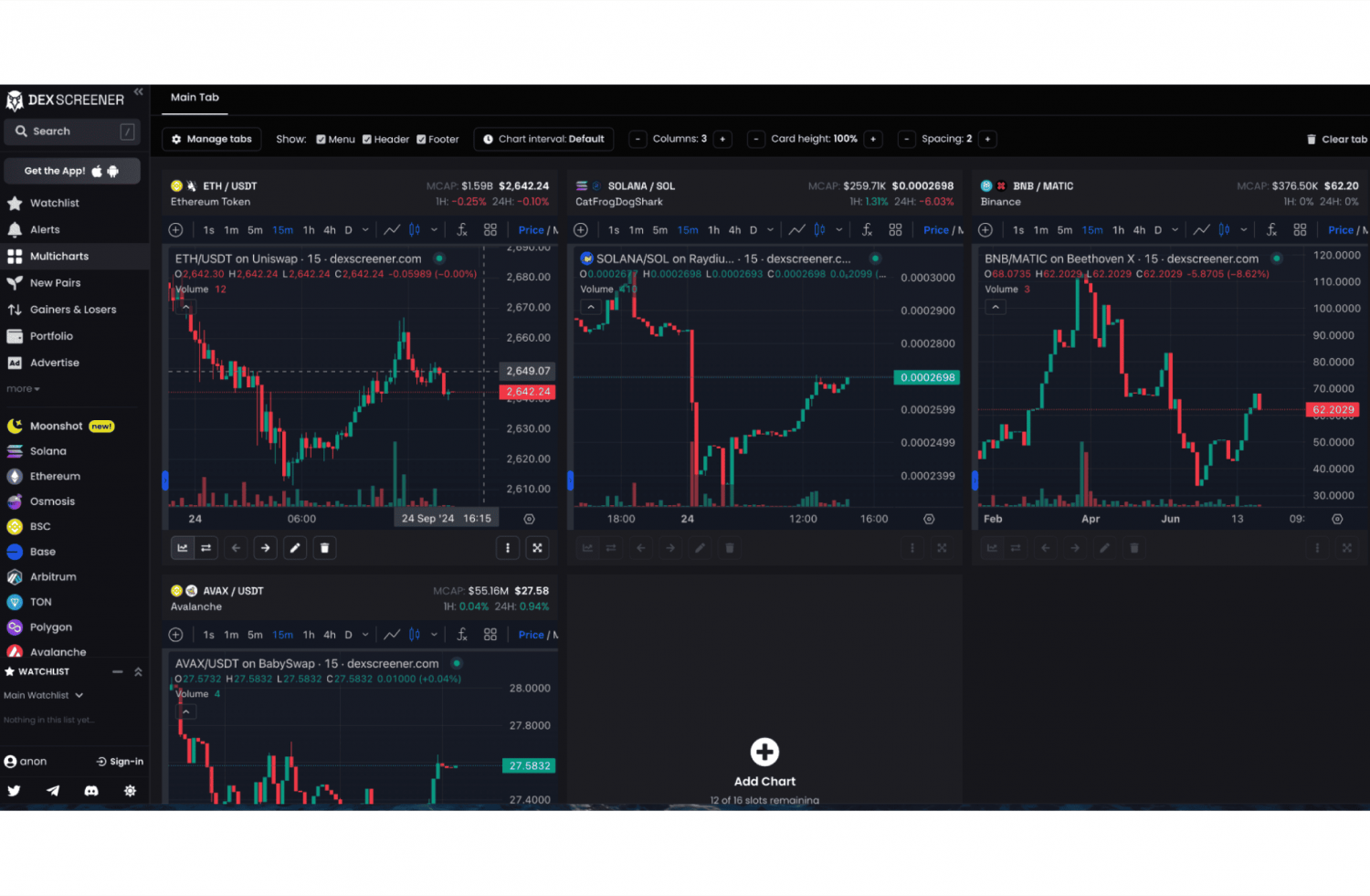

1. BaseSwap: Effortless Swaps With Ultra-Low Fees

BaseSwap has quickly become a favorite for newcomers thanks to its clean interface and nearly instant token swaps. With ultra-low gas fees on Base (often just cents per transaction), you can experiment with swapping tokens without worrying about high costs eating into your returns. The swap process is simple: connect your wallet, select tokens to exchange, confirm, and you’re done.

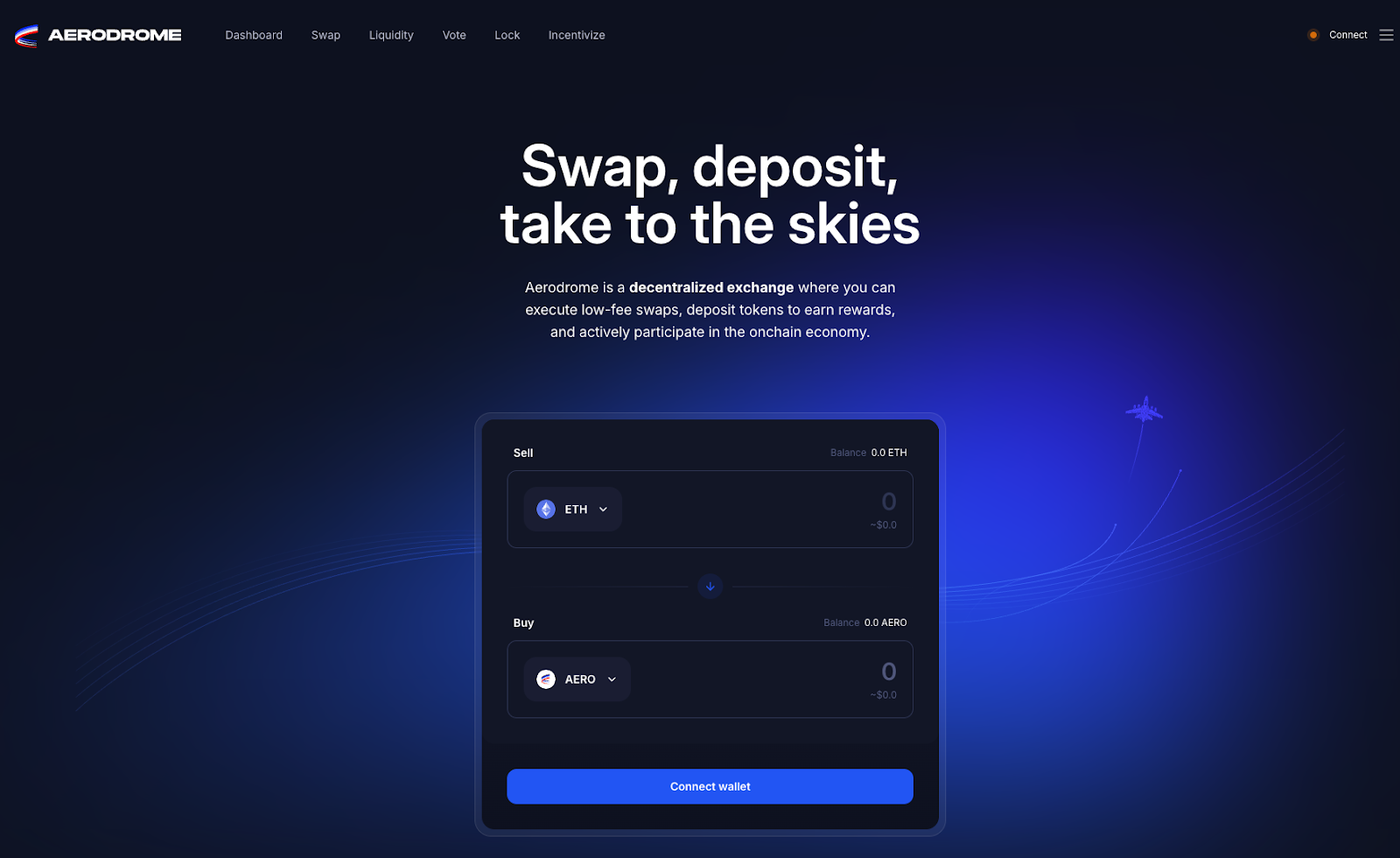

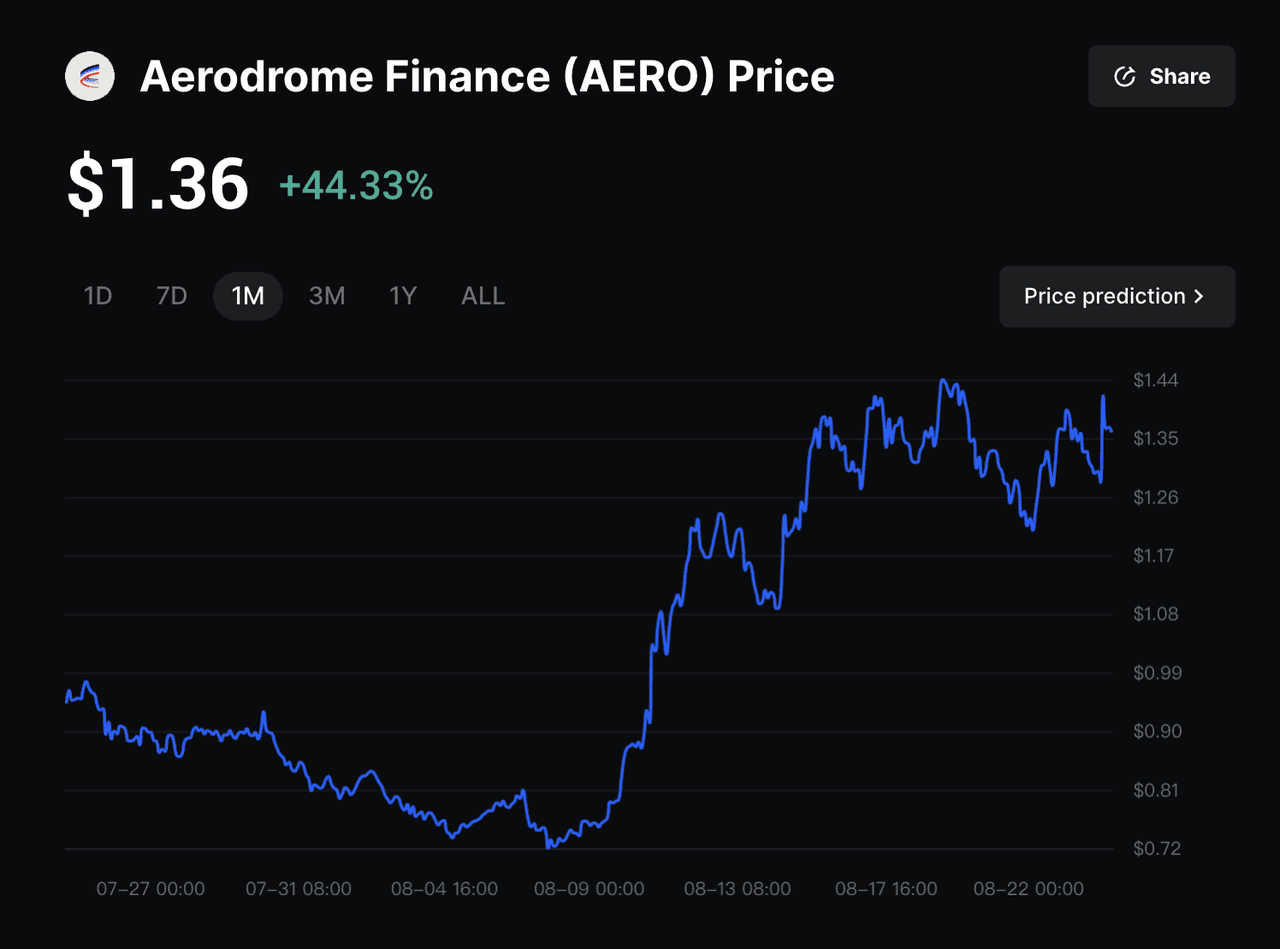

2. Aerodrome Finance: Advanced Liquidity Made Simple

If you’re curious about earning passive income from liquidity pools but intimidated by complex dashboards, Aerodrome Finance offers a streamlined solution. Its guided onboarding helps users provide liquidity or participate in yield farming with minimal jargon and built-in risk reminders. Aerodrome’s analytics even break down earnings projections in plain English, ideal if you want to dip your toes into advanced DeFi without getting lost.

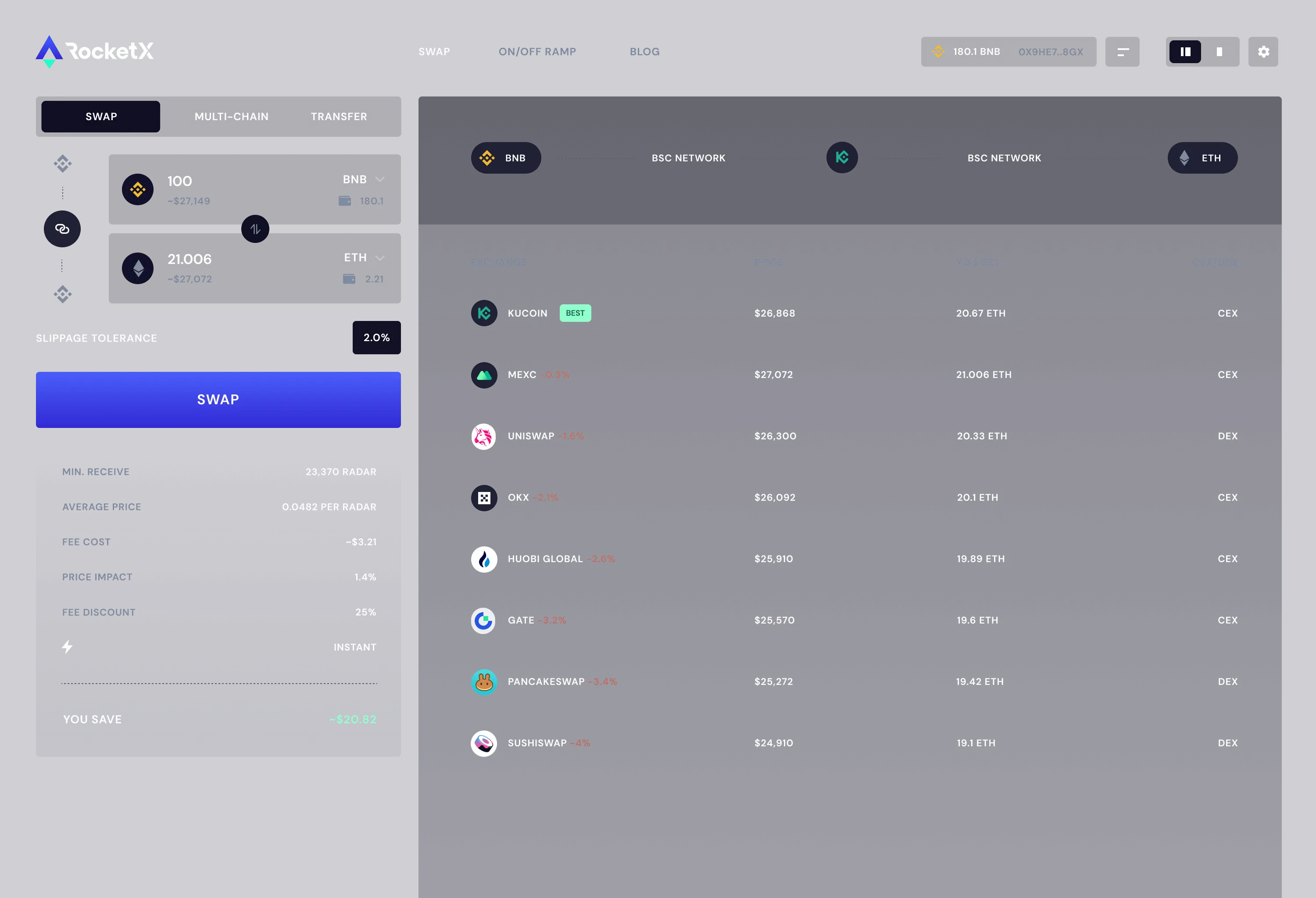

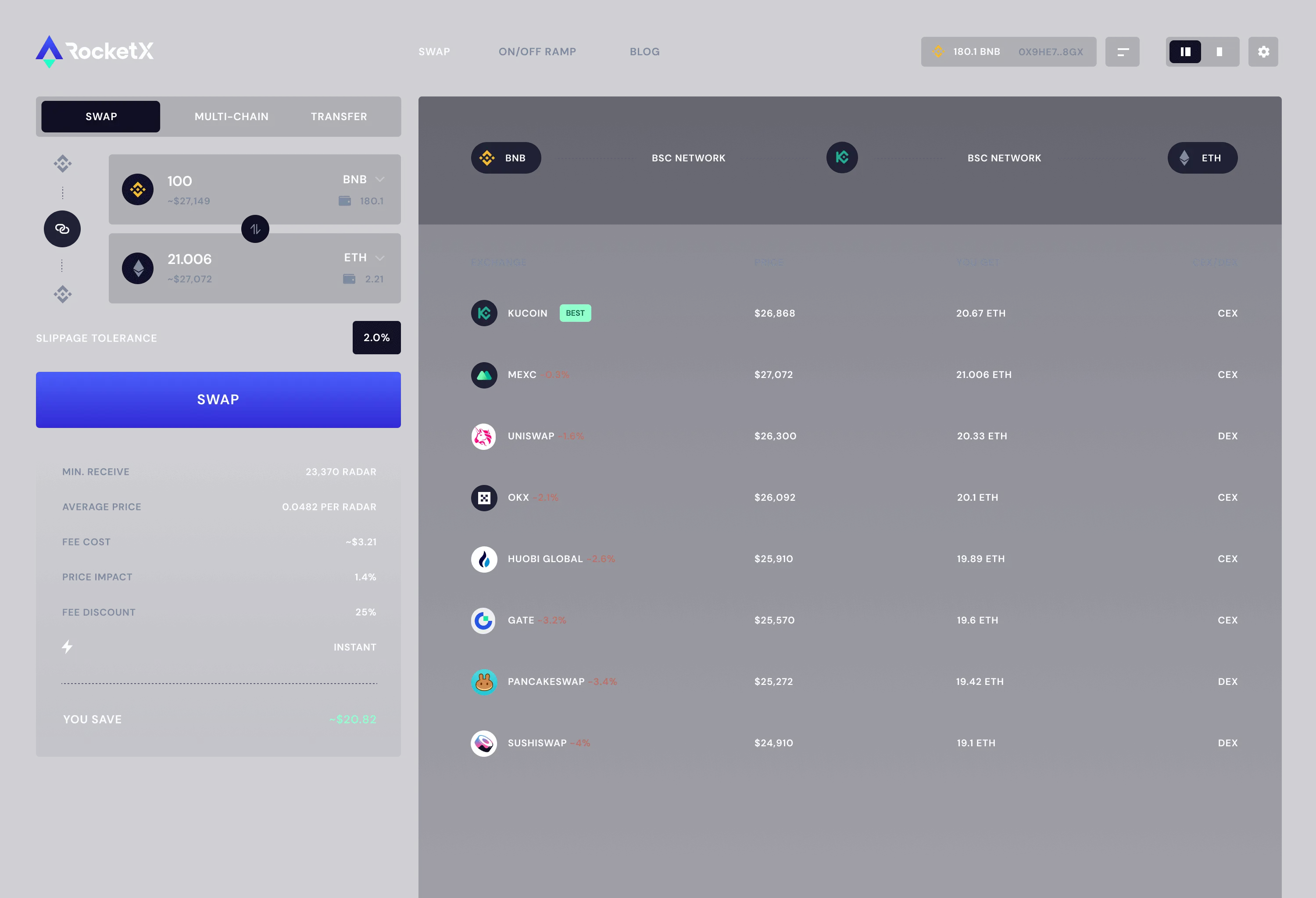

3. RocketSwap: Fast Trading With Clear Pricing

RocketSwap is another top pick for beginners who value speed and transparency. Its interface highlights real-time pricing and slippage warnings before every trade, empowering you to make informed decisions even if you’ve never used a DEX before. The platform also supports limit orders so you can set your price targets without constantly monitoring the market.

If you want more details about these platforms or need step-by-step guides tailored for new users, check out our comprehensive resource at Best User-Friendly DeFi Tools on Base for Retail Investors (2024 Guide).

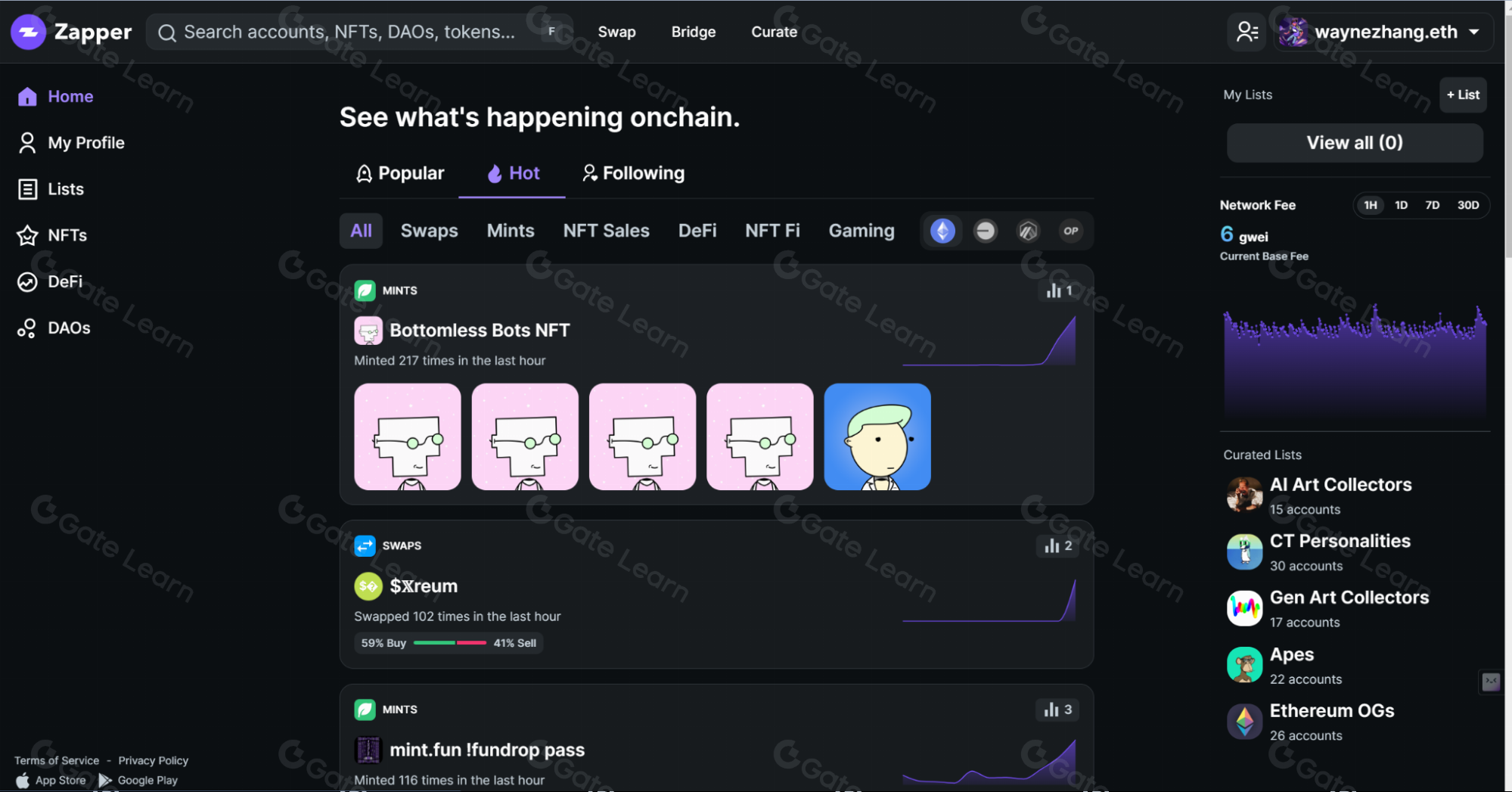

4. Base Portfolio (by DeBank): See Your Whole DeFi Life in One Place

Tracking multiple DeFi positions can quickly become overwhelming, but Base Portfolio by DeBank solves this with a single dashboard. Instantly view your token balances, lending positions, and yield farms across the Base ecosystem, all in real time. The visual interface is clean and beginner-friendly, making it easy to spot changes in your portfolio value or track rewards over time. If you’re new to DeFi analytics on Base blockchain, this tool cuts through the noise and helps you stay organized from day one.

5. Velocimeter: Dynamic Swaps and Stablecoin Pools

Velocimeter stands out for its focus on efficient swaps, especially for stablecoins and highly liquid tokens. The platform’s clear fee breakdowns and pool analytics take the guesswork out of trading, while its simple onboarding process ensures even first-timers can participate without hassle. For retail investors seeking predictable returns or low-slippage trades, Velocimeter is a go-to option on Base.

6. BaseLend: Borrowing and Lending Without Headaches

Lending protocols are often intimidating for beginners, but BaseLend delivers an approachable experience with transparent rates and step-by-step guidance. Deposit your crypto to earn passive interest or borrow against your assets with just a few clicks, no credit checks or paperwork required. The protocol’s risk dashboard highlights collateral ratios and liquidation warnings clearly so you always understand your position. This simplicity empowers new users to participate in decentralized lending confidently.

7. Coinbase Wallet with Base Integration: Safe Access to the Entire Ecosystem

No list of beginner-friendly DeFi tools on Base would be complete without Coinbase Wallet. Its seamless integration with the Base blockchain means you can manage assets, connect to dApps like BaseSwap or Aerodrome Finance, and sign transactions securely, all from one mobile app or browser extension. With built-in tutorials and strong security features backed by Coinbase’s reputation, it’s the ideal starting point for anyone entering DeFi for the first time.

The Bottom Line: Start Simple, Stay Secure

The best DeFi tools for beginners aren’t about chasing hype, they’re about safety, clarity, and control over your assets. Each platform above was chosen because it removes friction from onboarding and prioritizes user protection without hiding advanced features behind jargon.

If you’re ready to explore further or want more detailed walkthroughs of these platforms, including how to avoid common mistakes, visit our full guide at Best DeFi Tools for Retail Investors on Base: Simple Apps for Beginners (2025 Guide).

Essential Checklist Before Using DeFi on Base

-

Research each DeFi tool’s reputation and security—start with trusted options like BaseSwap, known for its simple swap interface and user-friendly design.

-

Understand how to use decentralized exchanges—practice small swaps on Aerodrome Finance to get familiar with swapping tokens and liquidity pools.

-

Test trading on a beginner-friendly DEX—try RocketSwap for straightforward token swaps and liquidity provision.

-

Track your portfolio with a reliable dashboard—use Base Portfolio by DeBank to monitor assets, yields, and transaction history in one place.

-

Compare rates and pools before swapping—explore Velocimeter for analytics and optimized trading routes on Base.

-

Review lending and borrowing terms—check out BaseLend to understand interest rates, collateral requirements, and risks before participating.

-

Set up a secure, non-custodial wallet—use Coinbase Wallet with Base integration for easy access to Base DeFi apps and safe asset management.

The future of finance is open, and thanks to these user-friendly tools on Base blockchain, it’s never been easier to get started as a retail investor.