Passive income in DeFi is no longer reserved for crypto insiders. Thanks to Coinbase’s latest integration of decentralized finance (DeFi) lending on the Base blockchain, earning yield on your digital dollars is now as simple as holding USDC in your Coinbase account. With the price of Coinbase Global Inc (COIN) currently at $324.58, and DeFi yields reaching up to 10.8% APY, retail users have unprecedented access to competitive returns without the complexity that once defined this space.

Coinbase DeFi Lending on Base: A Game-Changer for Retail Yield

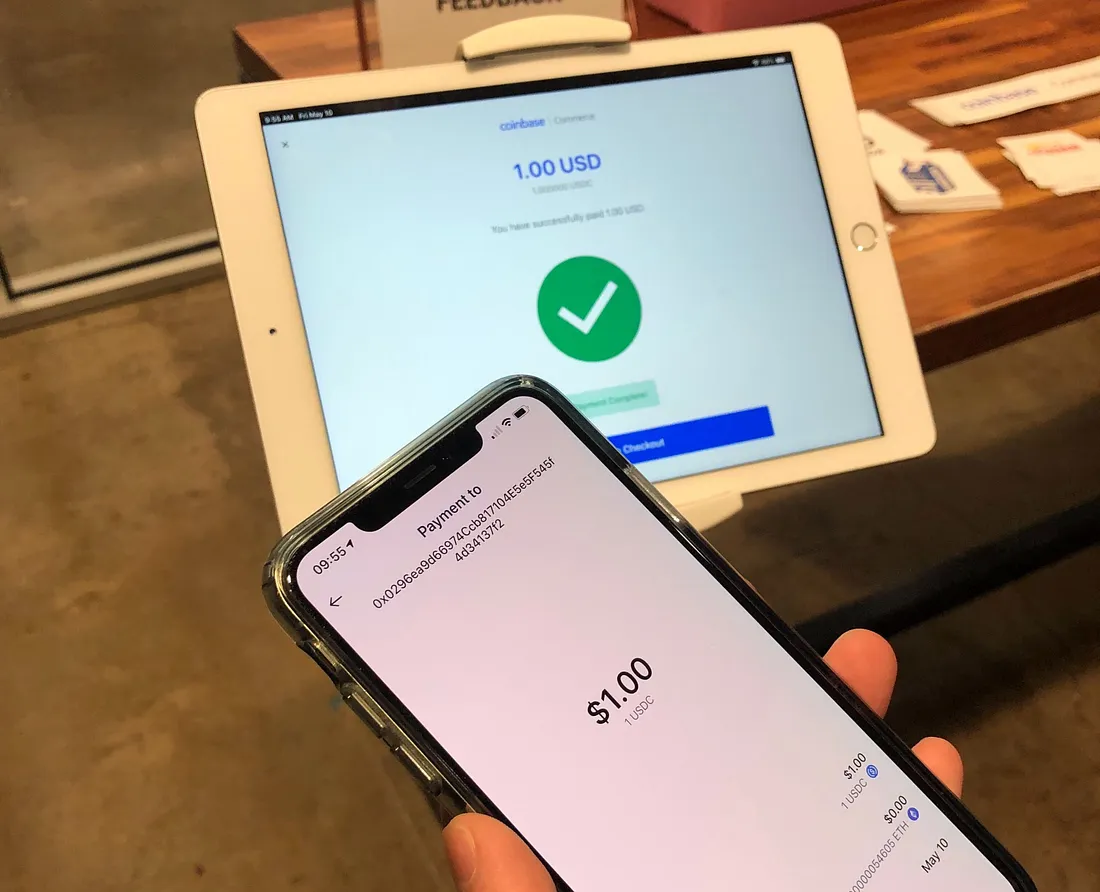

The landscape for retail DeFi passive income has shifted dramatically. Previously, navigating DeFi meant juggling multiple wallets, deciphering arcane protocols, and braving risky websites. Now, Coinbase’s integration with the Morpho protocol, powered by Steakhouse Financial and running on Base, lets you lend your USDC directly through the familiar Coinbase interface.

This isn’t just a small tweak; it’s a fundamental shift in how everyday people can participate in decentralized finance. No more copy-pasting contract addresses or sweating over slippage settings. Instead, you get a streamlined experience where you can deposit USDC and start earning up to 10.8% APY, with full transparency and the ability to withdraw anytime.

Why This Matters: Security, Simplicity, and Real Returns

Security is top-of-mind for anyone entering DeFi, and rightfully so. By leveraging Base (Coinbase’s own layer-2 blockchain) and integrating established protocols like Morpho, users benefit from institutional-grade security while enjoying all the advantages of open finance.

Simplicity is another pillar here. You don’t need to be a coder or a DeFi power user; if you can use the Coinbase app, you can start earning yield on your stablecoins today. The process is built for clarity: no hidden fees, no lock-ups, no confusing steps.

The current rollout covers select regions including the U. S. (excluding New York), Bermuda, and others, so check your eligibility before diving in.

Earning Yield on USDC: How It Works Step by Step

Lending your USDC is as easy as a few taps:

- Select USDC in your Coinbase app wallet

- Tap “Earn” or “Lend” options presented for eligible users

- Review current APY rates (up to 10.8%) powered by Morpho

- Confirm your deposit amount and start earning instantly

- You can withdraw anytime with no penalties or lock-ups

This seamless process removes nearly all of the friction that has historically kept retail investors at bay.

The Power of Stablecoin Lending Without Complexity

If you’ve ever wanted to put your idle digital dollars to work but felt overwhelmed by technical barriers or security fears, this new offering is tailor-made for you. With stablecoins like USDC, which are always redeemable 1: 1 for USD, you sidestep volatility while still capturing attractive yields that far outpace traditional savings accounts.

Transparency and control are front and center in this new paradigm. Unlike legacy DeFi, where users often have to trust unknown smart contracts or third-party interfaces, Coinbase’s integration with Morpho on Base means you can track your yield, see your positions, and withdraw funds whenever you like, all within the trusted Coinbase ecosystem. This is a big step forward for retail DeFi passive income, especially for those who value both security and ease of use.

Top Benefits of Coinbase USDC Lending on Base for Beginners

-

Earn Attractive Yields—Up to 10.8% APY: Beginners can earn up to 10.8% annual yield on their USDC holdings, with rates optimized by Morpho and Steakhouse Financial on the Base network.

-

Simple, In-App Experience: Lend your USDC directly through the Coinbase app—no need to navigate complex DeFi platforms or manage multiple wallets.

-

Flexible Withdrawals Anytime: Withdraw your USDC and earned rewards whenever you want, with no lock-up periods or penalties, making it ideal for newcomers.

-

Enhanced Security & Trust: Enjoy the security of Coinbase’s regulated platform and the transparency of onchain lending powered by Morpho on Base.

-

No Minimums or Conversion Fees: Start earning with any amount of USDC; there are no minimum deposit requirements or conversion fees for USDC lending.

Let’s not overlook the significance of real-time yields. Yields on USDC lending via Coinbase fluctuate based on market demand but have reached as high as 10.8% APY. For context, traditional bank savings rates remain well below 1% in most regions. While rates can change, the ability to earn a meaningful return, without sacrificing liquidity or taking on crypto price risk, is a game changer for anyone seeking passive income.

What Sets Coinbase DeFi Lending Apart?

Coinbase’s approach isn’t just about plugging into DeFi protocols; it’s about curating a retail-friendly experience that demystifies yield generation. By collaborating with Steakhouse Financial to optimize liquidity across Morpho-powered markets, users benefit from competitive rates while sidestepping the risks of manual protocol selection. The process is designed for everyday investors, no jargon, no hidden traps.

And with COIN trading at $324.58, Coinbase continues to reinforce its reputation as a bridge between traditional finance and the decentralized future. Their user-first approach is evident: clear disclosures, simple interfaces, and robust educational support help newcomers get started safely.

Getting Started: Tips for Newcomers

If you’re new to DeFi or stablecoin lending, here are a few tips to boost your confidence:

- Start small: Test the waters with a modest amount of USDC before scaling up.

- Stay informed: Monitor APY rates regularly, yields can change based on market conditions.

- Keep security top-of-mind: Use strong passwords and enable two-factor authentication in your Coinbase account.

- Understand eligibility: Confirm that your region supports USDC lending on Base before proceeding.

The Future of Retail-Friendly DeFi

The arrival of seamless USDC lending via Base marks a pivotal moment for retail investors seeking passive crypto income. By abstracting away technical hurdles and prioritizing user safety, Coinbase is making it easier than ever to participate in decentralized finance, without needing an advanced degree in blockchain engineering!

This is just the beginning. As more protocols integrate with Base and as educational resources expand, expect even more accessible opportunities for earning yield on digital assets, all from your mobile device or desktop dashboard.

If charts tell us anything, it’s that financial empowerment starts with access, and now that access is just a tap away.