Imagine parking your crypto on the Base blockchain and watching it grow at double-digit yields without the hassle of complex setups. That’s the appeal of QuickSwap staking on Base, where retail users like you can tap into QuickSwap Base staking opportunities right now. With QUICK trading at $10.18, up $0.59 in the last 24 hours, it’s a prime moment for beginner staking QuickSwap Base. QuickSwap, the go-to DEX on Base and Polygon, turns trading fees into real rewards for stakers, making Base DeFi staking retail accessible and profitable.

QuickSwap Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:QUICKUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

As a balanced technical analyst with 5 years experience focusing on pure price action and key indicators, I recommend drawing a primary downtrend line connecting the swing high on 2026-10-15 at $10.21 to the recent swing low on 2026-02-14 at $9.53 using ‘trend_line’ tool. Add horizontal support at $9.53 (24h low) and resistance at $10.21 (24h high) with ‘horizontal_line’. Mark the recent consolidation zone as a ‘rectangle’ from 2026-02-10 to 2026-02-14 between $9.53-$10.00. Use ‘arrow_mark_up’ at the small green candle on 2026-02-14 indicating potential short-term bounce. Place ‘callout’ on volume spikes during down moves labeling ‘Bearish volume confirmation’. Draw ‘fib_retracement’ from $10.21 high to $9.53 low, highlighting 38.2% retracement at ~$9.95 as entry zone. Add ‘text’ notes for MACD bearish divergence.

Risk Assessment: medium

Analysis: Downtrend intact but oversold bounce with positive staking news flow; medium risk tolerance favors defined entries

Market Analyst’s Recommendation: Consider longs on support hold above $9.53 targeting $10.50, stake rewards for yield while holding

Key Support & Resistance Levels

📈 Support Levels:

-

$9.53 – 24h low acting as key support, recent bounce origin

strong -

$9.8 – Minor support from prior session lows

moderate

📉 Resistance Levels:

-

$10.21 – 24h high resistance, trendline confluence

strong -

$10.18 – Current price level, intraday pivot

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$9.95 – Fib 38.2% retracement in consolidation with volume pickup

medium risk -

$9.6 – Dip buy near strong support if holds

high risk

🚪 Exit Zones:

-

$10.5 – Measured move target above resistance

💰 profit target -

$9.4 – Below 24h low invalidates bounce

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on downside, low on recent bounce

Confirms bearish pressure but divergence on green candle suggests weakening sellers

📈 MACD Analysis:

Signal: Bearish but histogram contracting

MACD line below signal, potential bullish crossover if price holds support

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

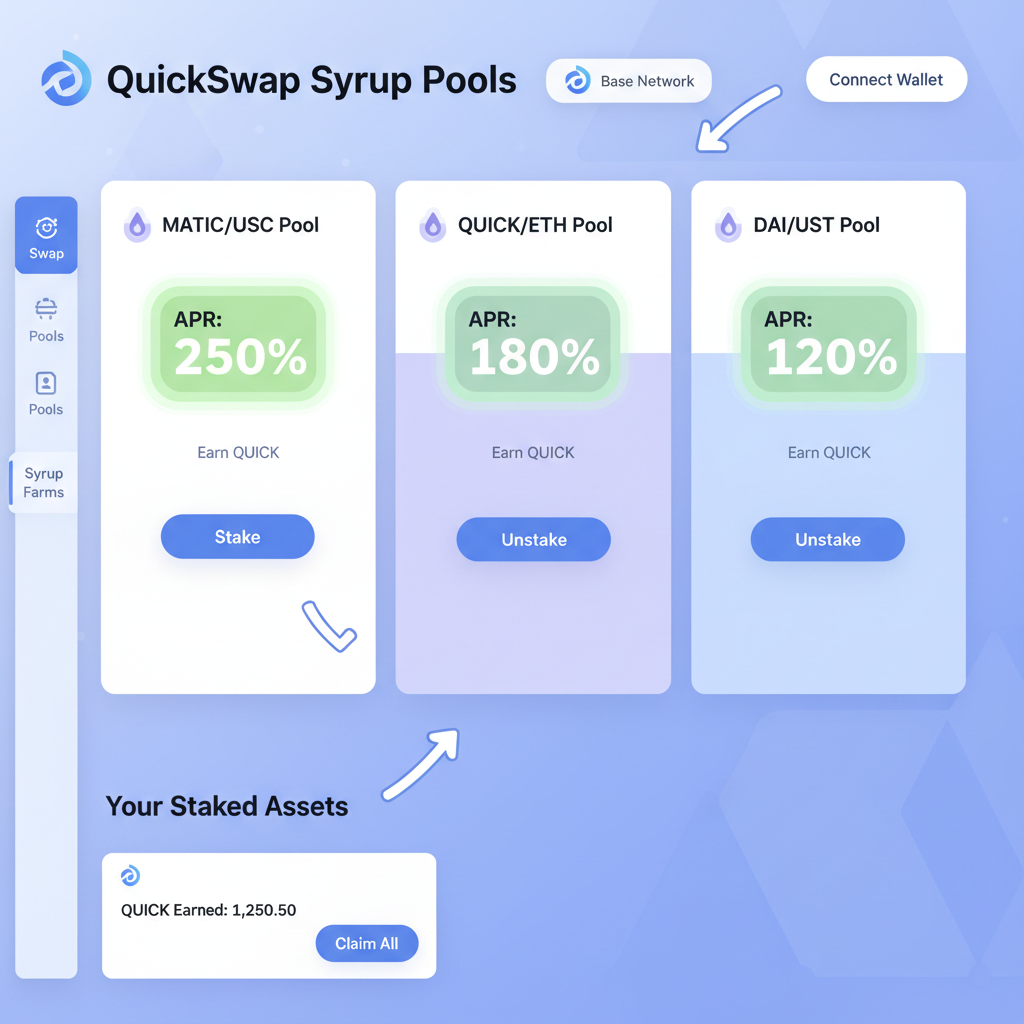

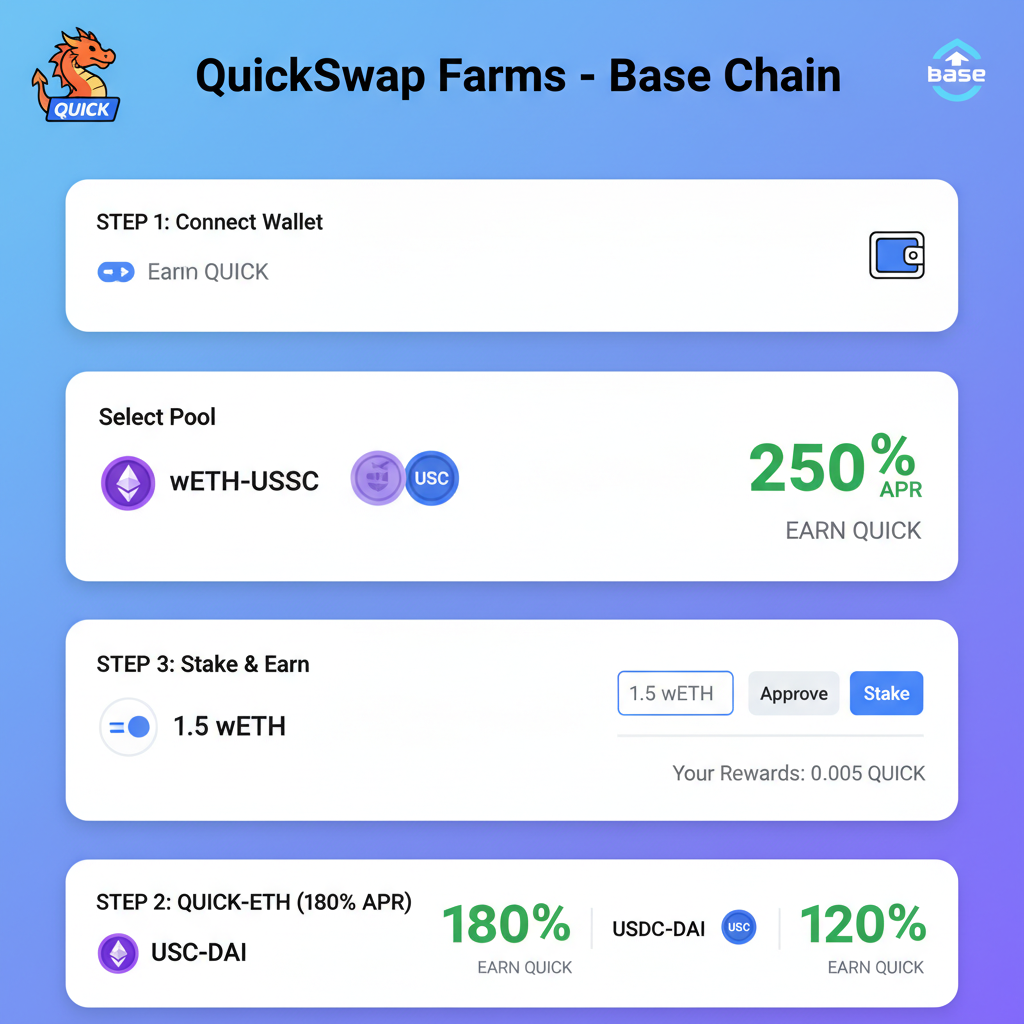

QuickSwap stands out in the crowded DeFi space by blending low-cost Base transactions with proven liquidity pools. As Coinbase’s Layer 2, Base keeps gas fees minimal, letting you stake without burning through ETH. Current pools offer enticing QuickSwap APR Base rates, from steady fee shares to boosted farms hitting 300% and, though always balance those highs with smart risk management. I’ve swung traded QUICK myself, and staking adds that passive edge to momentum plays.

Unlocking QUICK Token Power on Base

The QUICK token fuels QuickSwap’s ecosystem, and on Base, its utility shines brighter than ever. Stake QUICK to get dQUICK, a receipt token that earns from 0.04% of every V2 swap fee – that’s part of the 0.3% charged per trade. Picture this: traders swap billions, and you collect a slice passively. Recent expansions like the Syrup pool deliver staking rewards, while farms crank up to 300% and APR. For retail investors chasing retail investor Base yields, this setup demystifies high returns.

But don’t chase APRs blindly. High yields like stratUSD’s 319.35% on V4 USDC pairs come with impermanent loss risks in volatile markets. Start small, say with $100 in QUICK at $10.18, to test the waters. On-chain data shows consistent fee generation, backing sustainable rewards even as markets shift.

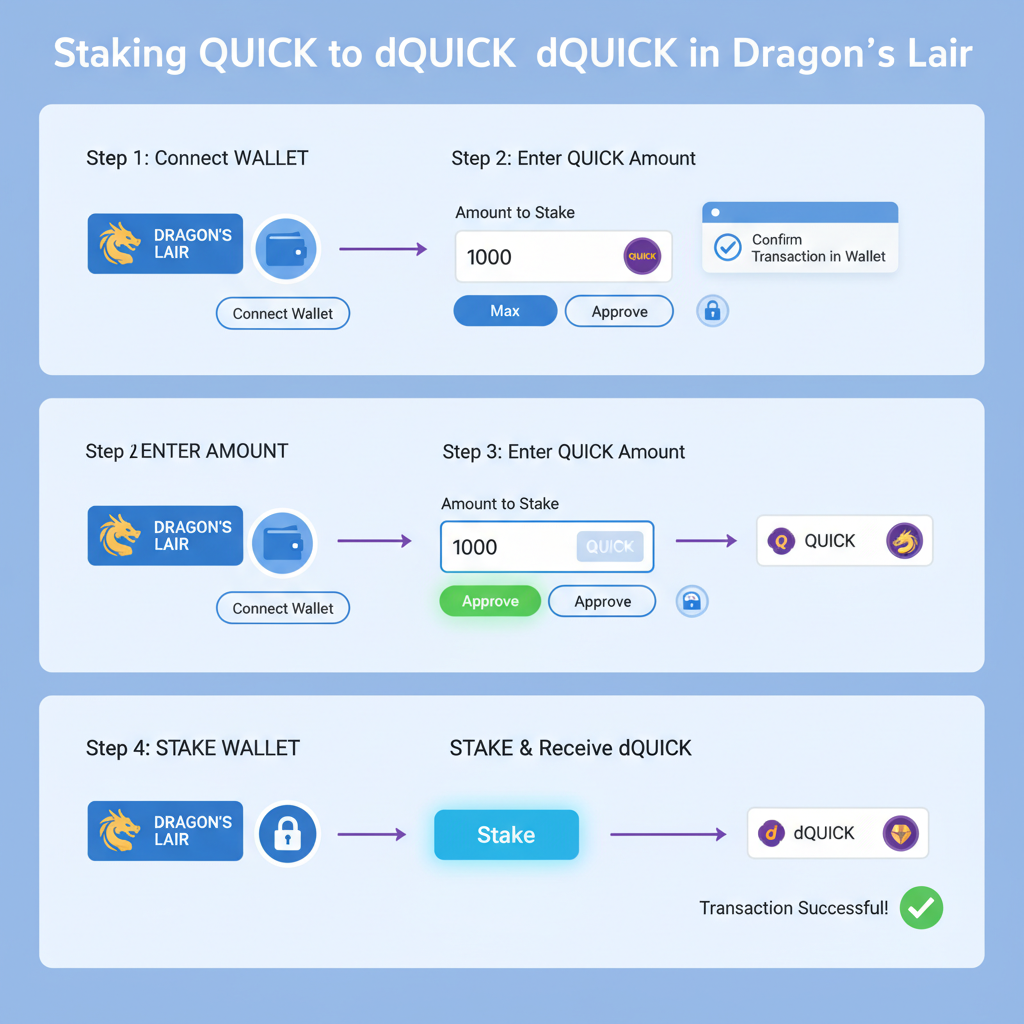

Staking Mechanics: From QUICK to Rewarding dQUICK

Staking on QuickSwap is straightforward: deposit QUICK into the Dragon’s Lair pool via their dApp, receive dQUICK, and watch rewards accrue. dQUICK appreciates over time from buybacks funded by protocol fees. No lockups in basic staking means flexibility – unstake anytime, though fees apply. For beginners, this beats rigid PoS like Ethereum staking at 4.5% APR on Coinbase.

Base’s scalability amplifies this. QuickSwap’s perps DEX even runs points programs paying 168,000 QUICK in rewards, layering extra incentives. I’ve seen stakers compound dQUICK into farms for amplified QuickSwap APR Base, but always DYOR on pool health via DefiLlama or Dune Analytics.

QUICK Token (QUICK) Price Prediction 2027-2032

Forecasts based on Base chain expansion, high staking APRs, DeFi adoption, and market cycles (from 2026 baseline avg ~$15)

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY Change |

|---|---|---|---|---|

| 2027 | $18.00 | $25.00 | $35.00 | +67% |

| 2028 | $25.00 | $40.00 | $65.00 | +60% |

| 2029 | $35.00 | $60.00 | $95.00 | +50% |

| 2030 | $50.00 | $85.00 | $135.00 | +42% |

| 2031 | $70.00 | $120.00 | $190.00 | +41% |

| 2032 | $95.00 | $160.00 | $250.00 | +33% |

Price Prediction Summary

QUICK token is forecasted to experience strong growth from current $10.18 levels, driven by QuickSwap’s leadership on Base and Polygon, high APR staking (up to 300%+), fee rewards, and perps trading. Minimum prices reflect bearish cycles or competition; maximums capture bull runs and adoption surges. By 2032, average price could hit $160, a 10x+ increase, assuming favorable regulations and Base ecosystem boom.

Key Factors Affecting QUICK token Price

- Base chain growth and QuickSwap TVL/fee volume increases

- High staking rewards (e.g., 45-300% APR) and dQUICK utility

- DeFi adoption trends and institutional staking interest

- Crypto market cycles (bull peaks in 2028/2032)

- Regulatory clarity for DEXs and Polygon ecosystem

- Competition from Uniswap/Aerodrome and impermanent loss risks

- Tech upgrades like V4 DEX, perps, and AI staking strategies

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

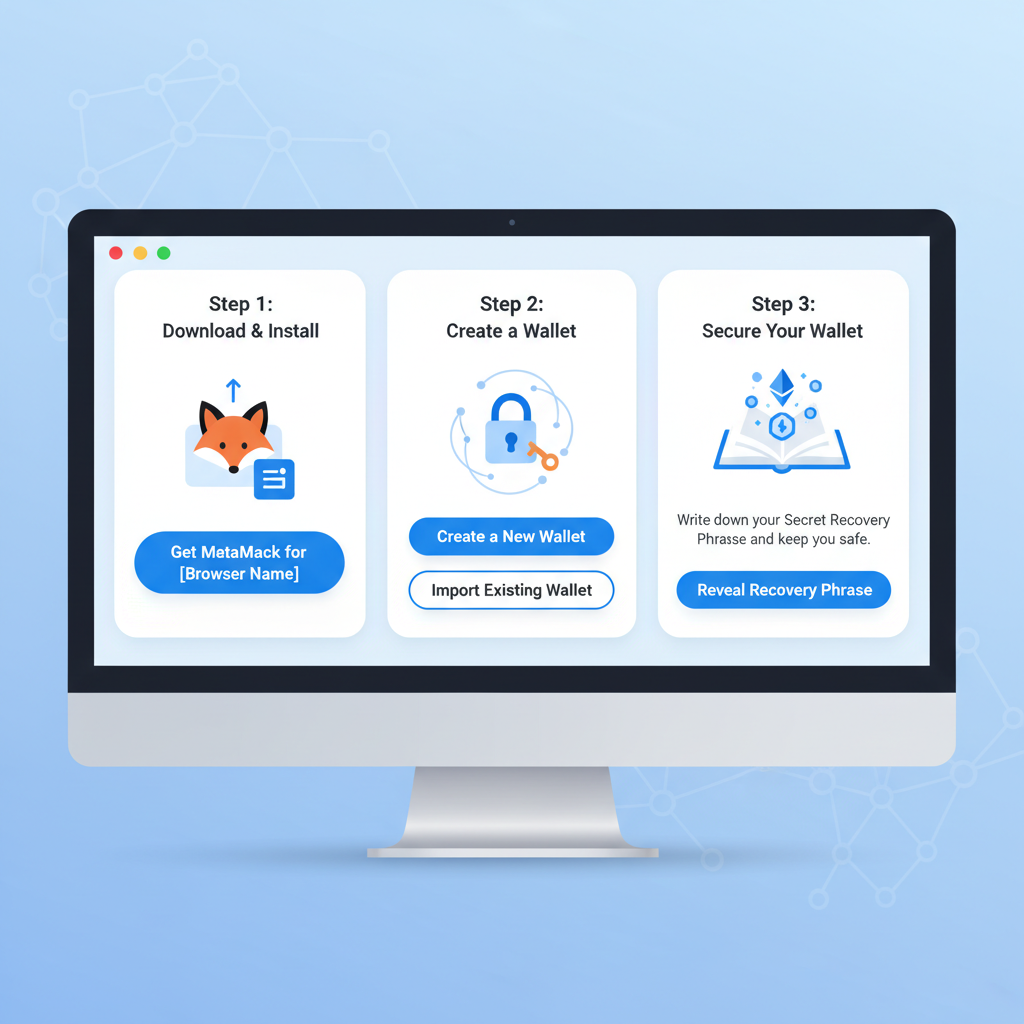

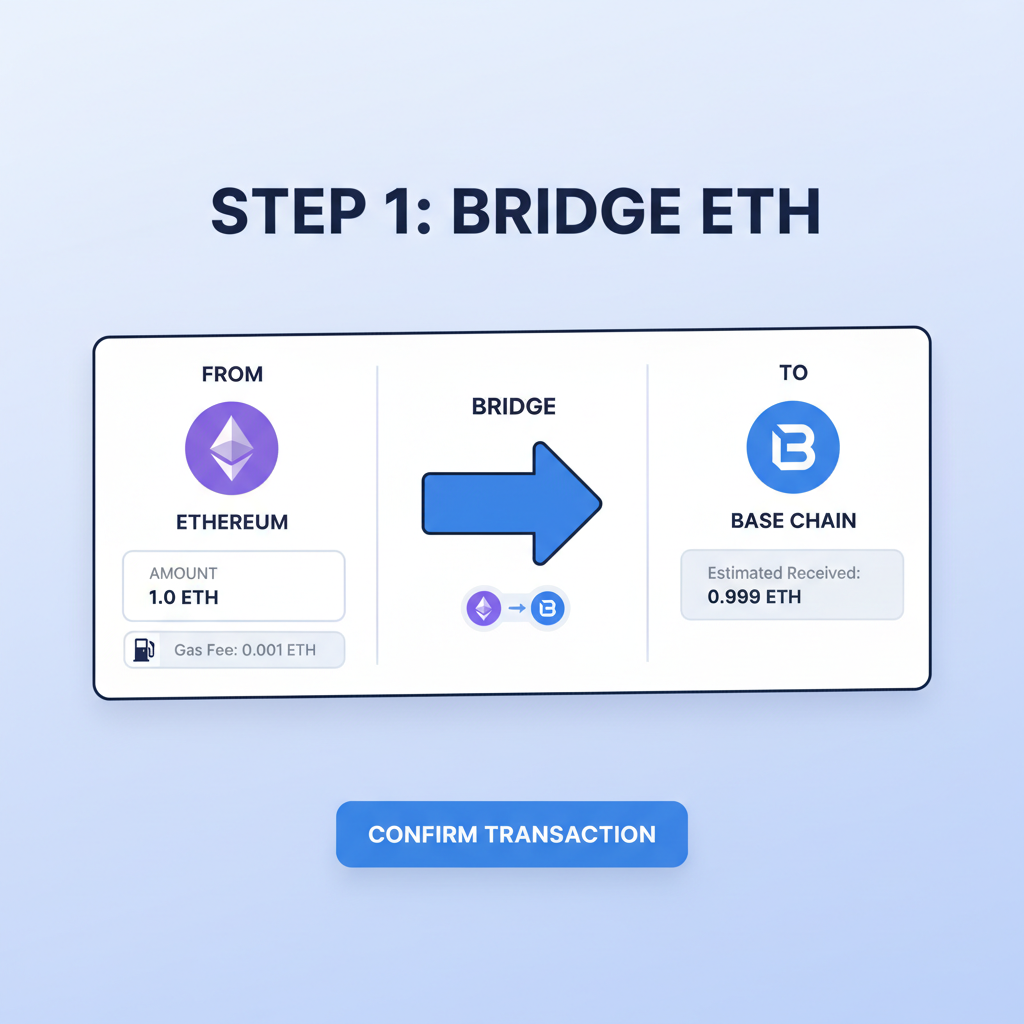

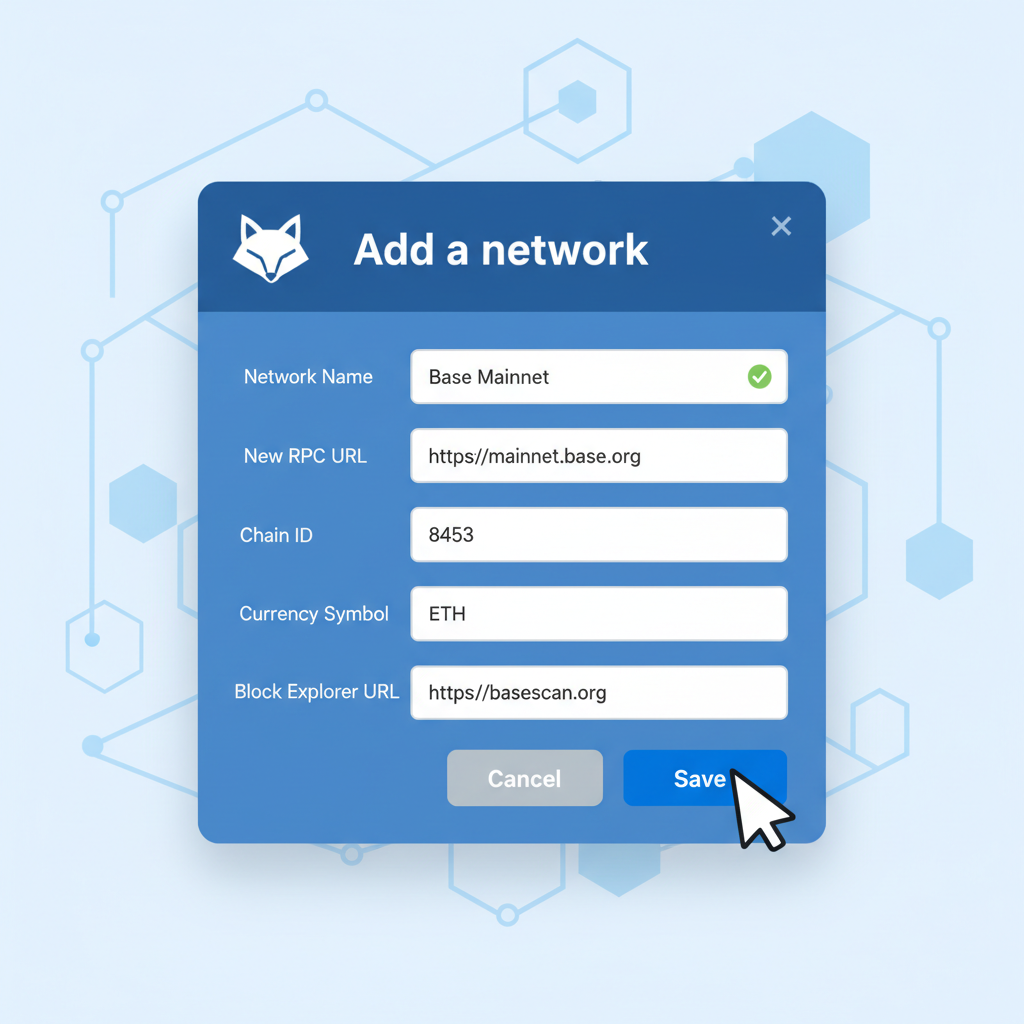

Your First Steps into QuickSwap Base Staking

Ready to dive in? First, grab a wallet like MetaMask or Coinbase Wallet, fund with ETH, and bridge to Base using official tools. Head to QuickSwap’s Base app at app. quickswap. exchange. Connect, swap ETH for QUICK at $10.18 spot, then navigate to ‘Earn’ > ‘Dragon’s Lair’. Approve, stake, and boom – you’re earning.

For seamless onboarding, check our Base DeFi beginner guide. Pro tip: Monitor APRs live; they fluctuate with liquidity. Stake during dips for better entry, respecting that risk-reward balance I live by.

Once connected, approve the QUICK spend and confirm the stake transaction – Base’s low fees mean you’re in for pennies. Rewards start accruing immediately in dQUICK form, which you can redeem or compound into farms for those eye-popping QuickSwap APR Base boosts.

Visual learners, this process mirrors setups I’ve guided dozens of retail traders through. Farms on QuickSwap Base layer on top: pair your QUICK with stablecoins or other assets in liquidity pools to chase retail investor Base yields. Recent stratUSD pools on V4 hit 319.35% APR with USDC, but pair that firepower with caution – impermanent loss lurks if prices swing wildly.

Boosting Yields: Farms, Syrup Pools, and Perps Points

Staking alone nets steady fee shares, but farms supercharge it. Deposit LP tokens from QuickSwap pairs into farm contracts for QUICK emissions – think 300% APR in hot pools, per recent Syrup updates. The perps DEX adds points programs, distributing 168,000 QUICK to traders and stakers alike. As a swing trader, I pair staking with these for momentum: stake core holdings, farm aggressively during uptrends.

Compound weekly to let rewards snowball. Track via the dApp dashboard or tools like Zapper. fi. With QUICK at $10.18 and Base TVL climbing, liquidity supports these rates better than choppier chains.

Smart Strategies: Risk Management for Retail Stakers

Base DeFi staking retail shines for beginners, but respect the risks. Impermanent loss hits liquidity providers when paired assets diverge – mitigate by sticking to correlated tokens or stables. Smart contract audits from QuickSwap’s track record help, yet no DeFi is risk-free; diversify across 2-3 pools max. Volatility? QUICK’s 24-hour range from $9.53 to $10.21 shows swings, so dollar-cost average stakes.

Gas on Base stays under $0.01, unlike Ethereum’s spikes, letting you adjust positions freely. Set alerts for APR drops below 16% – that baseline keeps it worthwhile for passive plays. I’ve exited farms at peaks, banking 2x returns, then restaked during dips.

Tax note: Track stakes as they may count as income; tools like Koinly simplify reporting. For beginner staking QuickSwap Base, aim for 20-50% portfolio allocation, balancing with stables.

Tracking and Exiting Your Stake Like a Pro

Monitor via DefiLlama for pool TVL, QuickSwap analytics for fees, and on-chain explorers like Basescan. When APRs fade or markets top, unstake: redeem dQUICK for QUICK at appreciated value, swap back to ETH if needed. No lockups mean agility – a huge win over legacy staking.

QuickSwap’s Base expansion, with zero-gas swaps and perps, cements it as a retail powerhouse. Pair this with Coinbase’s ecosystem for that trusted feel. Start with $500 in QUICK at $10.18 today; at 16-300% APRs, it compounds fast. Ride the Base trend, but always size positions to sleep easy.

| Pool Type | Est. APR | Risk Level | Best For |

|---|---|---|---|

| Dragon’s Lair (QUICK Stake) | 16-45% | Low | Beginners |

| Syrup Farms | Up to 300% | Medium | Momentum Traders |

| stratUSD V4 | 319.35% | High | Experienced |

QuickSwap Base staking delivers real QuickSwap Base staking alpha for everyday users. With fees fueling rewards and Base scaling seamlessly, it’s primed for growth. Grab your slice – yields wait for no one.