In the fast-evolving world of decentralized finance, Base stands out as a beacon for beginners eyeing safe yield farming without the sting of high gas fees. Built by Coinbase as an Ethereum Layer 2 solution, Base combines robust security with transaction costs that often dip below a penny, making it a retail-friendly DeFi base chain ideal for passive income strategies. As we hit 2026, protocols on Base deliver steady yields through audited smart contracts and intuitive interfaces, letting everyday investors farm rewards on stablecoins and blue-chip assets minus the complexity.

![]()

Yield farming on Base isn’t about chasing moonshot APYs; it’s about sustainable growth. Platforms here leverage the chain’s scalability to offer low-fee yield farming Base 2026 opportunities that prioritize capital preservation. Think providing liquidity to stablecoin pools where impermanent loss is minimal, or staking wrapped ETH for compounded returns. This approach suits retail users who want to dip toes without diving into high-risk volatility.

Why Base Excels for Safe, Beginner Yield Farming

Base’s architecture shines for novices. Its optimistic rollups batch transactions off-chain before settling on Ethereum, slashing fees by over 99% compared to mainnet. This efficiency translates to real gains: a $100 deposit might yield 5-15% APY net of costs, far better than eroded returns elsewhere. Security is non-negotiable too; Base inherits Ethereum’s battle-tested proofs while adding Coinbase’s institutional-grade oversight.

From my 16 years tracking markets, I’ve seen DeFi cycles swing wildly, but Base protocols emphasize safe DeFi protocols Base blockchain. They feature timelocks, multi-sig governance, and insurance funds against exploits. Recent data highlights Aave and Curve as frontrunners, now deeply integrated on Base for seamless, low-slippage farming.

Key Low-Fee Protocols Powering Base Yields

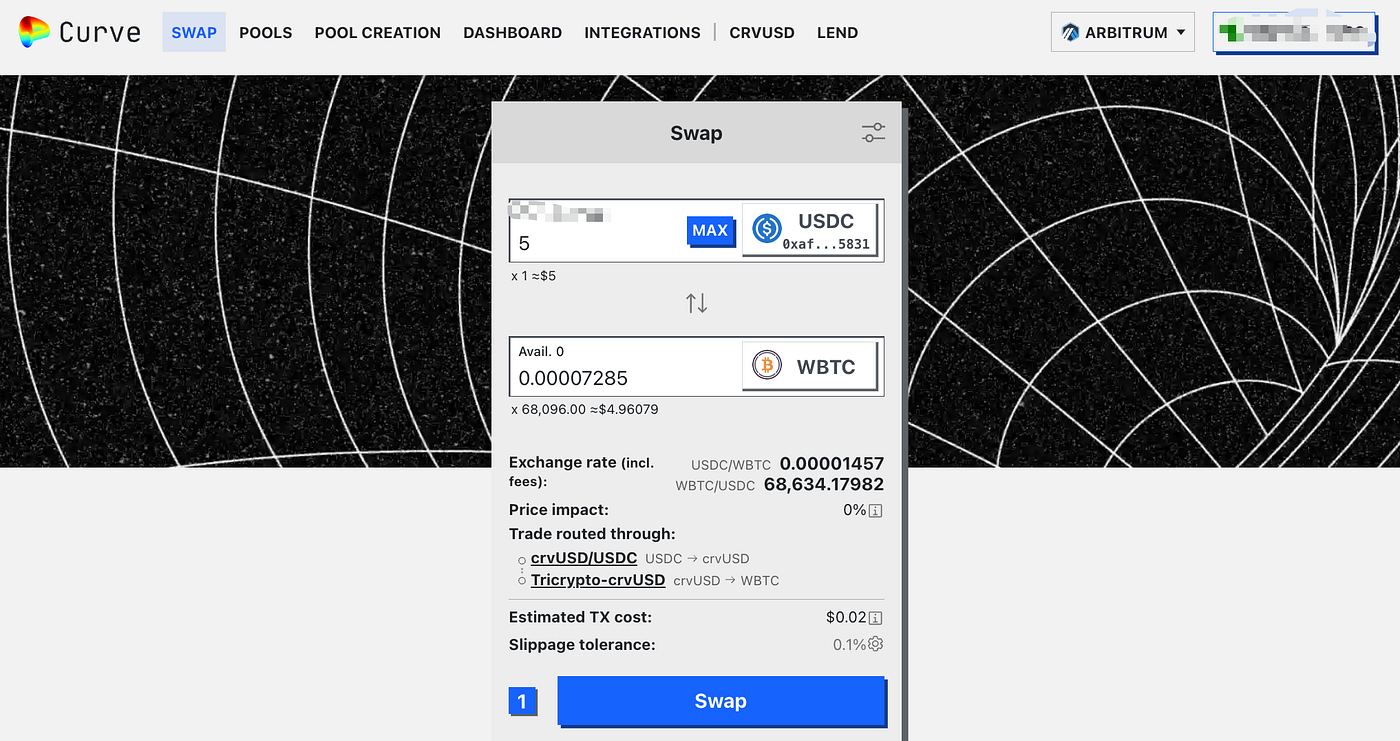

Aave leads with lending pools where supplying USDC or ETH earns interest from genuine borrowers, not speculative incentives. On Base, fees hover under $0.01, letting small stakes compound effectively. Curve Finance follows, its stablecoin swaps minimizing slippage for conservative farmers chasing 4-8% yields backed by trading volume.

Benefits of Top Base Protocols

-

Aave: Secure lending yields backed by real loan activity and robust risk mechanisms on low-fee Base.

-

Curve: Stablecoin pools with low impermanent loss (IL) and steady trading fee rewards.

-

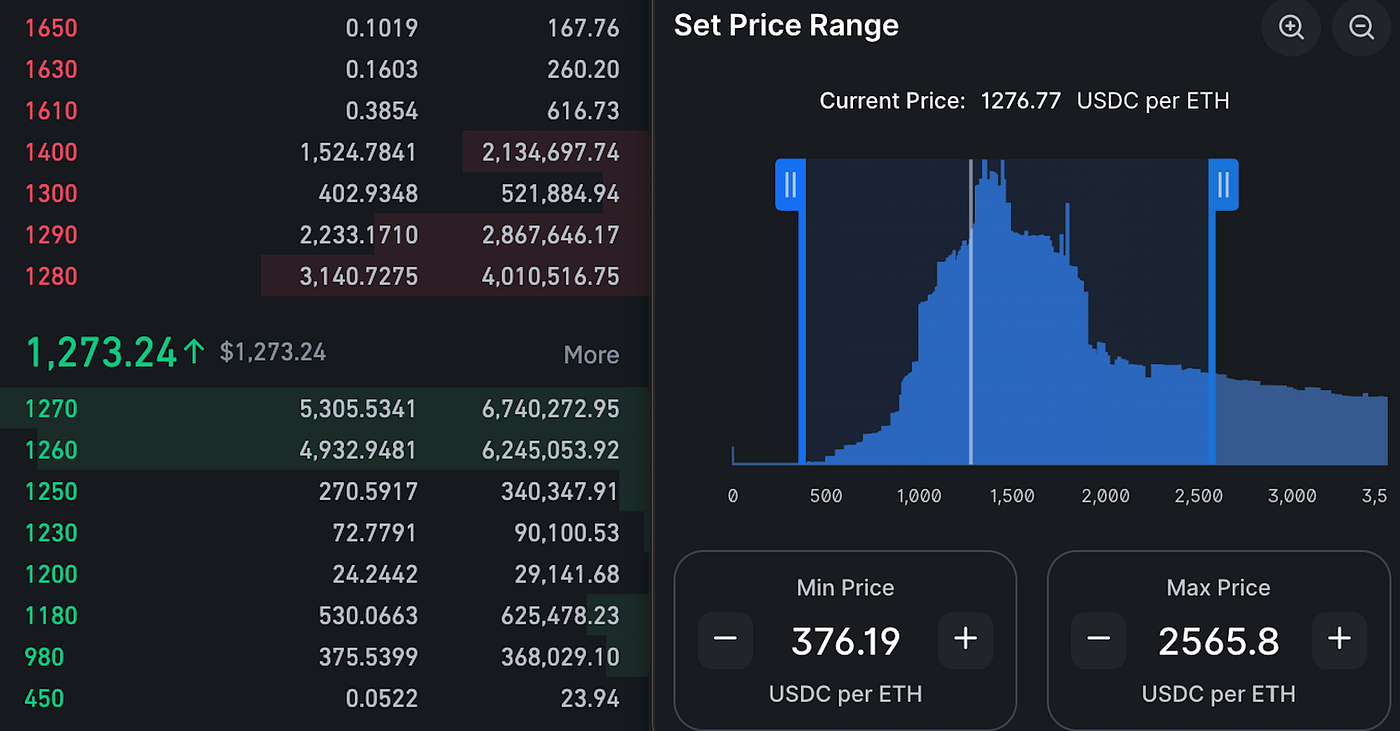

Uniswap V3: Concentrated liquidity for higher capital efficiency and targeted price range yields.

-

Lido: Liquid staking without locks, earning ETH rewards while using staked tokens in DeFi.

-

Aerodrome: Base-native auto-compounder for effortless reward reinvestment and optimized yields.

Uniswap V3’s concentrated liquidity lets you focus capital in stable ranges, boosting returns while curbing losses. Lido adds staking derivatives like stETH, usable across Base DeFi for layered yields. These aren’t gimmicks; they’re vetted by millions in TVL and third-party audits.

For passive income Base DeFi retail setups, start with stable pairs. A Curve 3pool on Base might net 6% APY from fees alone, plus CRV boosts. Risks? Smart contract bugs loom, but Base’s youth brings fresh audits. Always check De. Fi scanners for real-time APYs across chains.

Step-by-Step Entry into Base Yield Farming

Bridge assets via Coinbase Wallet or official Base bridge – it’s free for most transfers. Connect to Aerodrome or SushiSwap on Base for liquidity provision. Deposit equal-value stables, approve once, and harvest rewards weekly. Tools like Zapper automate compounding, keeping it hands-off.

Read our guide on earning high yields on Base DeFi without high gas fees for detailed walkthroughs. Beginners thrive by allocating 70% to stables, 30% to ETH pairs, rebalancing monthly. This balances yield with safety, mirroring strategies from top 2026 platforms.

Pendle Finance innovates here too, tokenizing future yields for hedging – a sophisticated yet accessible twist on Base. Pair it with Aave for yields on yields, all under low fees that preserve margins.

While Pendle opens intriguing doors to yield trading, balancing innovation with caution remains key for beginners. Base’s ecosystem thrives because it pairs cutting-edge tools with time-tested safeguards, allowing retail investors to capture passive income Base DeFi retail without sleepless nights.

Navigating Risks with Confidence

Impermanent loss tops the concern list for liquidity providers, yet Base protocols minimize it through stablecoin dominance. In Aave’s lending pools, there’s no pairing risk; you simply supply assets and earn from borrower demand. Curve’s optimized math further slashes losses in 3pool variants, often keeping them under 0.5% annually. Smart contract exploits? Less likely on Base, where protocols undergo regular audits from firms like PeckShield and Quantstamp. I’ve watched DeFi mature over cycles, and Base’s integration with Coinbase’s infrastructure adds an extra trust layer few chains match.

Market volatility can erode gains, but diversified strategies shine. Allocate across lending, stable swaps, and liquid staking to smooth returns. Tools like De. Fi or Zapper. fi provide real-time dashboards, flagging anomalies before they bite. For 2026, expect APYs settling at 4-12% on safe pools, outpacing traditional savings amid inflation.

Comparison of Top Low-Fee Base Yield Protocols

| Protocol | Est. APY | Fees | Key Risk | Best For |

|---|---|---|---|---|

| Aave | 5-10% | < $0.01 | Low IL | Lending stables |

| Curve | 4-8% | < $0.01 | Minimal slippage | Stable swaps |

| Uniswap V3 | 6-15% | < $0.01 | IL in ranges | Concentrated LP |

| Lido | 3-7% | < $0.01 | Staking slash | Liquid ETH |

| Pendle | 5-12% | < $0.01 | Yield vol | Future yield trades |

Review this table before diving in; it distills hours of research into actionable insights. Notice how Base’s fee structure amplifies net yields across the board.

Optimizing Your Base Farming Portfolio

Build a portfolio mirroring institutional playbooks: 50% in Aave or Compound lending for steady interest, 30% Curve stables for fee capture, 20% Lido staking for Ethereum exposure. Rebalance quarterly using on-chain analytics. Aerodrome, Base’s rising star, auto-compounds rewards via ve-token voting, turning passive positions active without effort. Pair with Uniswap for ETH-USDC ranges around current pegs, targeting 10% and efficiency.

Check out our step-by-step onboarding to low-fee swaps and yields on Coinbase’s Layer 2 for seamless setup. This setup demands under 30 minutes weekly, fitting busy retail schedules.

Explore yield-bearing stables for an extra edge, as detailed in specialized guides on top protocols.

Base DeFi’s retail-friendly design shines in its accessibility. No PhD required; intuitive apps guide deposits, and mobile wallets handle approvals. Community governance evolves protocols democratically, with proposals vetted for security. As TVL climbs past billions, liquidity deepens, stabilizing rates.

Monitoring sustains success. Platforms like De. Fi aggregate Base APYs, while Dune dashboards track pool health. Withdraw seasonally to fiat via Coinbase ramps, locking gains. In my view, Base redefines DeFi entry: secure, scalable, and sensible for long-term wealth building.

Retail-Friendly DeFi on Base empowers you with these tools, turning crypto curiosity into compounded reality. Start small, learn continuously, and watch your assets grow steadily in this low-fee haven.