Imagine holding Bitcoin but earning yields like a DeFi pro, all without leaving the trusted Coinbase ecosystem. In 2026, cbBTC and Coinbase wrapped assets on the Base blockchain make this a reality for retail investors. These tools bridge traditional crypto holdings with decentralized finance, offering safe DeFi yields on Base through protocols like Aave and Aerodrome. No more idle BTC sitting in a wallet; now it generates returns while you sleep.

Base, powered by Coinbase’s layer-2 magic, scales Ethereum’s security at low fees. cbBTC steps in as the star: a 1: 1 wrapped Bitcoin token custodied by Coinbase. Send BTC from your Coinbase account to Base, and it auto-converts to cbBTC. Reverse the process anytime to unwrap back to native BTC. This frictionless setup is perfect for beginners dipping into cbBTC Base DeFi.

Why cbBTC Stands Out in the Wrapped Assets Arena

Coinbase wrapped assets aren’t just wrappers; they’re a trust layer for DeFi. cbBTC is fully collateralized by actual BTC in Coinbase vaults, minimizing counterparty risks that plague lesser tokens. Unlike generic wrapped BTC, cbBTC integrates natively with Base’s ecosystem, unlocking lending, borrowing, and liquidity provision. I’ve traded swings on Base, and cbBTC’s stability shines during volatility – no depegs in sight.

Take cbETH, another powerhouse. It represents staked ETH, letting you trade or yield-farm while capturing staking rewards. On Base, these assets fuel Coinbase wrapped assets Base strategies. Protocols like Curve and Uniswap list cbBTC pairs, offering competitive APYs without the wild impermanent loss swings of edgier pools.

Top cbBTC Benefits on Base

-

1:1 backing by Coinbase for total peace of mind – your BTC is securely custodied.

-

Auto-wrapping simplifies transfers – send BTC from Coinbase, get cbBTC on Base instantly.

-

Access audited protocols like Aave, Aerodrome, Curve, and Uniswap for safe yields.

-

Low Base fees keep more yields in your pocket – L2 efficiency shines.

-

Unwrap anytime to native assets – seamless back to BTC on Coinbase.

Seamless Bridge from Coinbase Wallet to Base DeFi Action

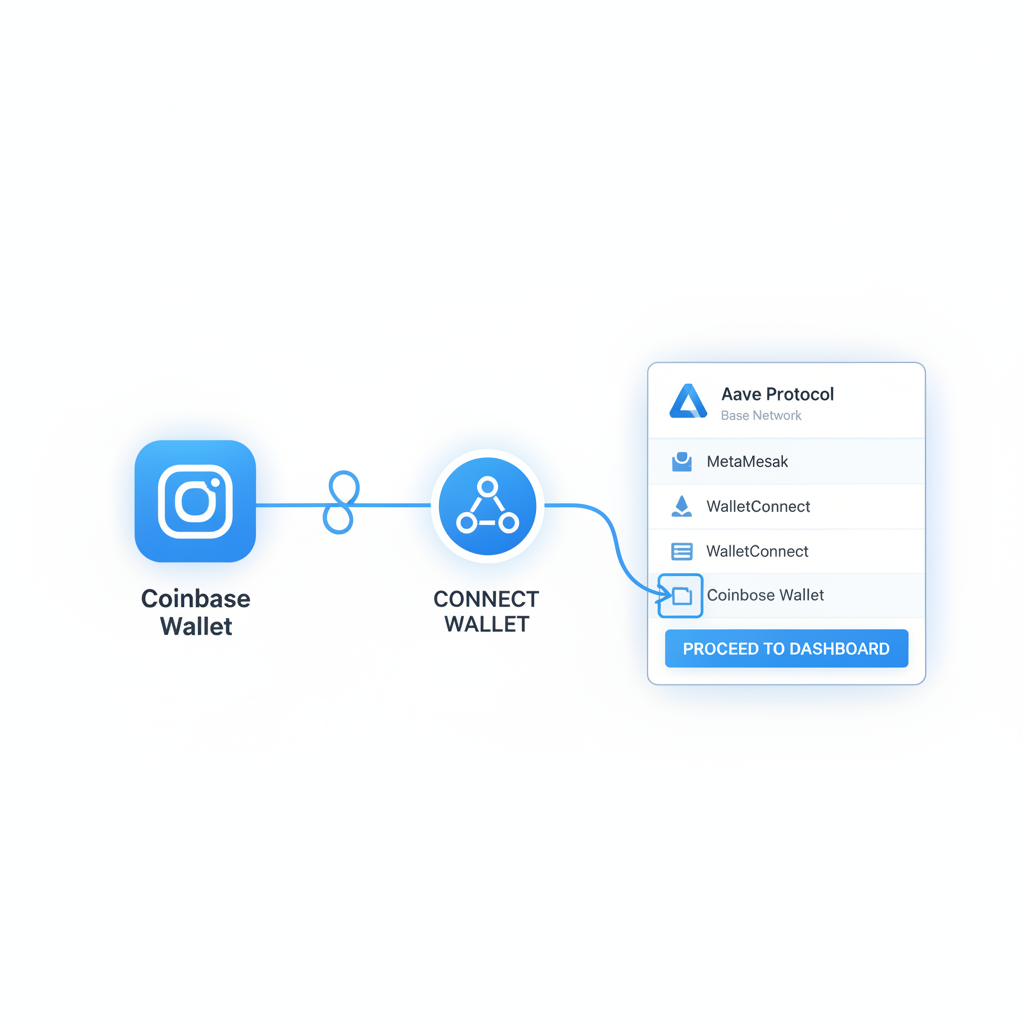

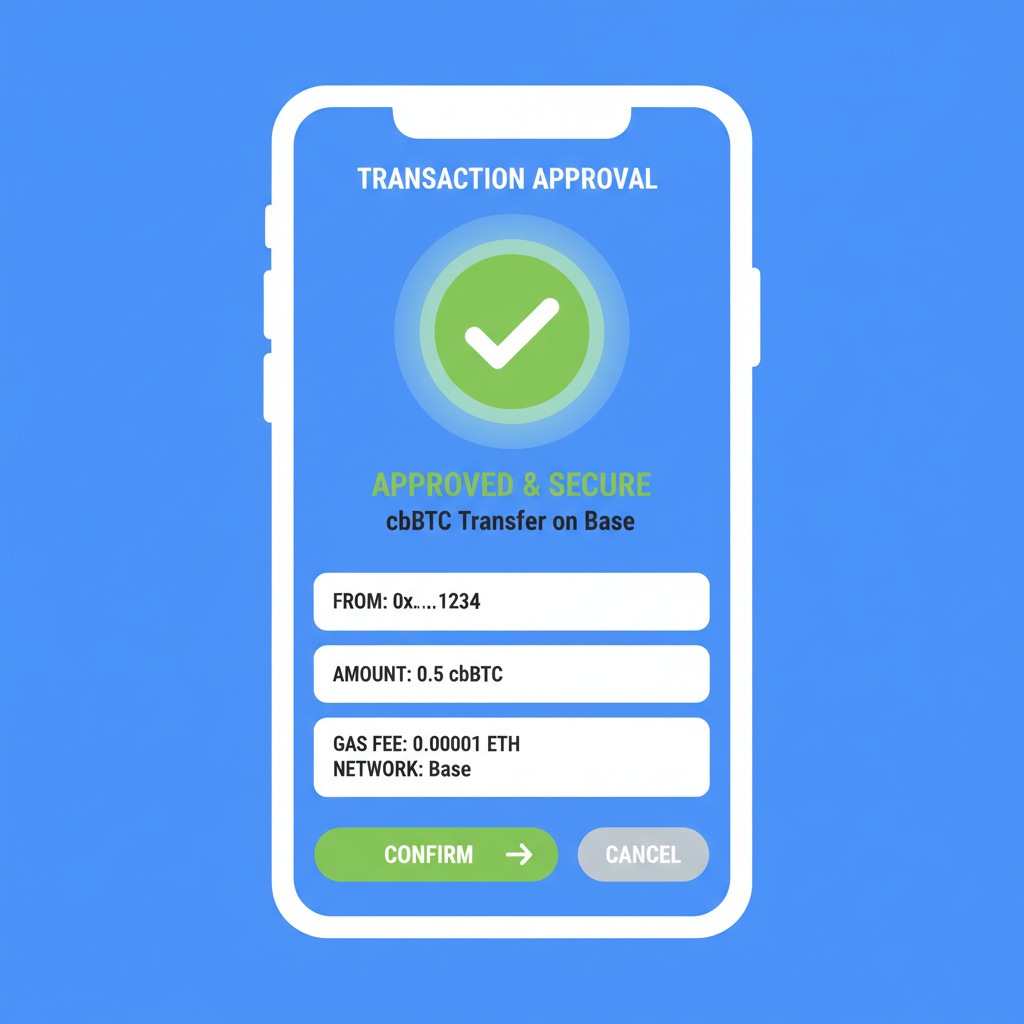

Getting started feels like using the Base app – Coinbase’s everything hub blending chat, social, and trading. Download it, link your account, and send BTC to your Base address. Boom: cbBTC lands ready for action. No bridges, no manual wrapping; Coinbase handles it securely. This is safe Base DeFi for beginners at its best.

For yields, deposit cbBTC into Aerodrome for liquidity mining or Aave for lending. As of early 2026, integrations span multiple apps, even expanding to Solana for cross-chain plays. Yields hover attractively, but I always stress: check real-time APYs and gas costs. My swing trading eye spots cbBTC’s momentum building as more retail piles in.

Building Safe Yield Strategies with cbBTC and cbETH

Diversify smartly. Pair cbBTC with stablecoins on Uniswap V3 for concentrated liquidity, or lend cbETH on Aave for borrower demand. These aren’t roulette spins; Base’s Coinbase backing adds oversight. Risks exist – smart contracts can falter, volatility bites – but sticking to top protocols cuts them sharply. For detailed steps, check this guide on earning yields safely.

Opinion: cbBTC flips Bitcoin from store-of-value to yield machine without selling. Retail investors, this is your 2026 edge in retail DeFi yields Base 2026. I’ve seen setups where disciplined positions net 5-15% APY, compounding nicely amid bull runs. Next, we’ll dive into protocol specifics and risk hedges.

Aerodrome leads the pack for liquidity provision. Slip your cbBTC into the cbBTC-USDbC pool, and snag trading fees plus token incentives. I’ve charted its momentum; volume spikes signal juicy entry points for cbBTC Base DeFi. Expect 10-20% APYs in hot markets, but watch for IL – that’s impermanent loss for newbies.

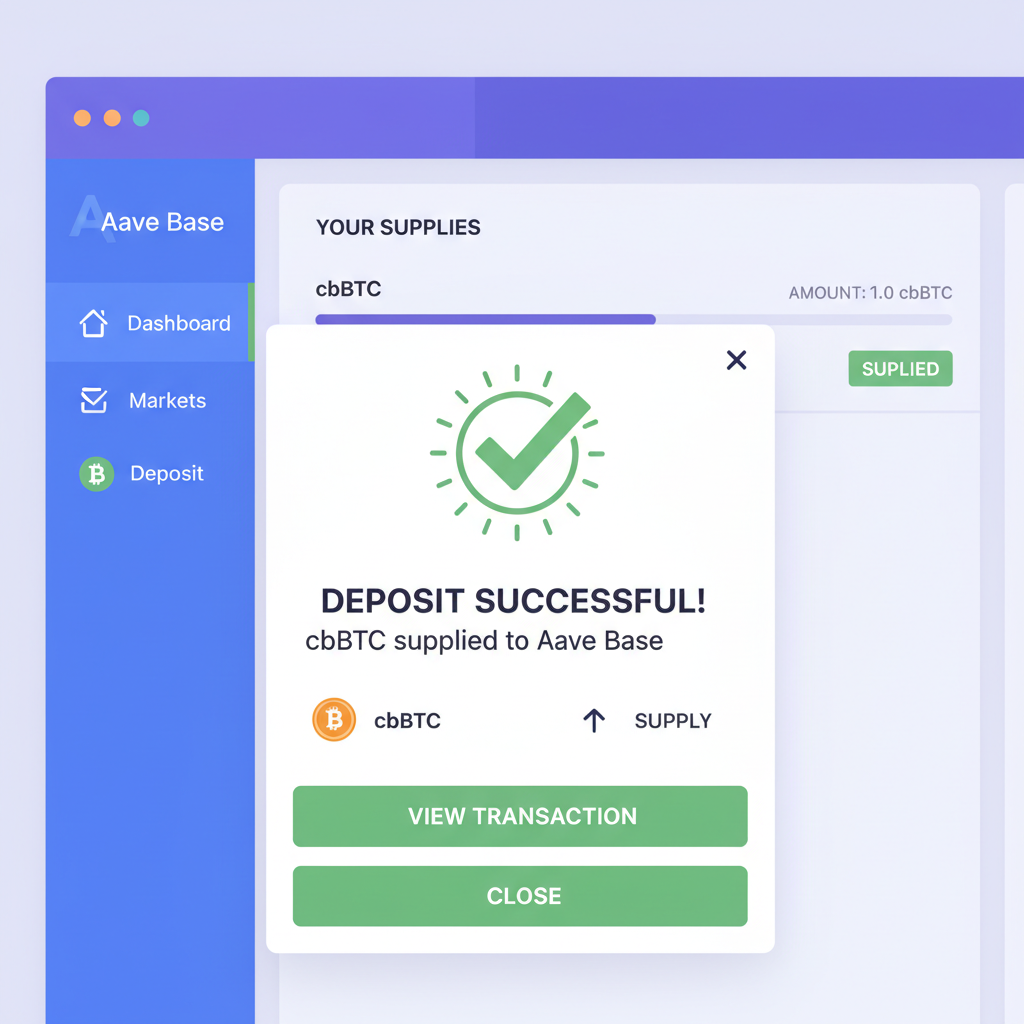

Aave: Lending cbBTC and cbETH Like a Pro

Aave on Base turns your holdings into passive income machines. Supply cbBTC, earn interest from borrowers chasing leverage. cbETH shines here too, blending staking rewards with lending premiums. Data shows steady demand; as a technical chartist, I favor Aave’s health factor metrics to gauge safety. Pair it with cbETH lending Base blockchain for diversified flows.

Uniswap V3 and Curve round out the arsenal. Uniswap’s concentrated liquidity lets you farm cbBTC-wstETH ranges precisely – my swing setups thrive on those tight bands. Curve’s stable pools minimize volatility, ideal for conservative retail plays in Coinbase wrapped assets Base.

Yield Comparison Across Base Protocols

Current APYs for cbBTC and cbETH on Base Protocols (as of Feb 2026)

| Protocol | cbBTC Supply APY | cbBTC LP APY | cbETH Lending APY | Risk Level |

|---|---|---|---|---|

| Aerodrome | 4.2% | 9.1% | 3.5% | Low 🟢 |

| Aave | 3.7% | N/A | 2.8% | Low 🟢 |

| Uniswap | N/A | 7.3% | N/A | Medium 🟡 |

| Curve | 2.4% | 5.8% | 2.1% | Low 🟢 |

These numbers shift daily, but Base’s low fees – often under $0.01 – amplify net gains. In 2026, retail DeFi yields Base 2026 hit new highs thanks to cbBTC’s traction.

Hedging Risks in Safe Base DeFi

No yield without risk, right? Smart contract bugs top the list, but audited protocols like Aave (multiple times over) slash that threat. Market dips? cbBTC tracks BTC spot tightly, no nasty depegs like some wrappers. My discipline rule: never over-leverage; keep utilization under 70%. Use stop-losses on positions and diversify – 40% lending, 30% LP, 30% hold.

Volatility’s my playground as a momentum trader, but for retail folks, start small. Test with $100 cbBTC, scale on proven swings. Coinbase’s custody adds that extra trust layer, making safe Base DeFi for beginners legit.

cbBTC and wrapped assets evolve fast. Solana expansion hints at multi-chain yields ahead. Watch Aerodrome emissions and Aave upgrades; they’ll dictate next momentum bursts. For hands-on tactics, dive into this guide on earning yields safely. Discipline plus data: that’s how we make every swing count in Base DeFi.