Imagine turning your stablecoins into a steady stream of passive income without the Wall Street middlemen or sky-high fees. That’s the promise of DeFi yield farming on the Base blockchain, a Layer 2 solution built by Coinbase that slashes costs while keeping Ethereum’s security intact. For retail investors dipping toes into crypto, Base makes safe yield farming on Base chain not just possible, but straightforward and rewarding. In early 2026, with platforms like Aave and Uniswap thriving here, yields are competitive, often hitting double digits on stable pairs, all while transaction fees stay under a penny.

Yield farming isn’t about chasing moonshots; it’s strategic liquidity provision. You deposit assets into pools, earn fees from trades plus protocol tokens, and watch your holdings compound. Base shines because its scalability handles high-volume DeFi without congestion. Recent data from De. Fi highlights top APYs on Base for staking and farming, outpacing many chains for retail DeFi Base blockchain users. But safety first: I’ve seen too many newcomers burn funds on risky plays. Stick to audited protocols, and you’ll build wealth steadily.

Unlocking Base’s Edge for Retail Yield Farmers

Why Base over Ethereum mainnet or Solana? Low fees – think $0.01 per swap versus $5 and – make it ideal for base blockchain DeFi for retail investors. As a Coinbase-backed L2, it inherits Ethereum’s robustness, with over $2 billion in TVL across protocols as of February 2026. Lending giants like Aave offer interest-based yields from real borrowing demand, while Uniswap’s liquidity pools reward providers efficiently. Sources like Token Metrics rank Aave and Uniswap among 2026’s top DeFi protocols, and Base versions benefit from this ecosystem.

“Aave is the backbone of DeFi lending. ” – XT Exchange insights on top protocols.

Retail-friendly? Absolutely. No KYC hurdles, intuitive interfaces, and educational dashboards demystify everything. Bitget’s Earn products echo this simplicity, but pure DeFi on Base takes it further with full control. My take: if you’re new, Base’s blend of speed, security, and yields beats CeFi hybrids every time.

Your First Moves: Wallet Setup and Asset Prep

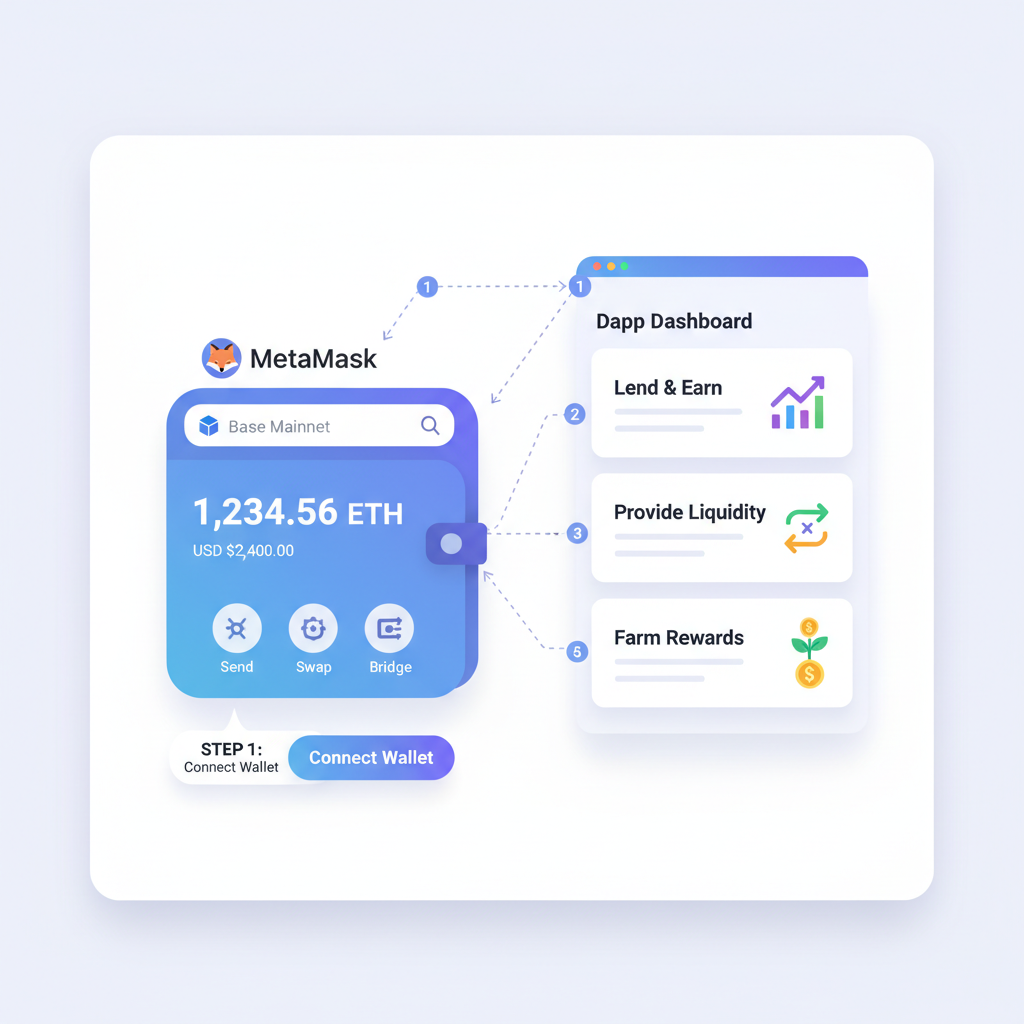

Starting base DeFi yield farming for beginners demands a rock-solid foundation. Grab MetaMask or Trust Wallet, add Base network via chainlist. org (search ID 8453), and fund it securely. Buy ETH or USDC on Coinbase – seamless since Base is their baby – then bridge over via official tools. Pro tip: enable hardware wallet integration early; it’s non-negotiable for sums over $1,000.

Security isn’t optional. Use a dedicated hardware device, never share seeds, and enable 2FA everywhere. Yellow. com outlines 10 essential steps, starting here. I’ve guided dozens through this; the peace of mind lets you focus on yields, not worries.

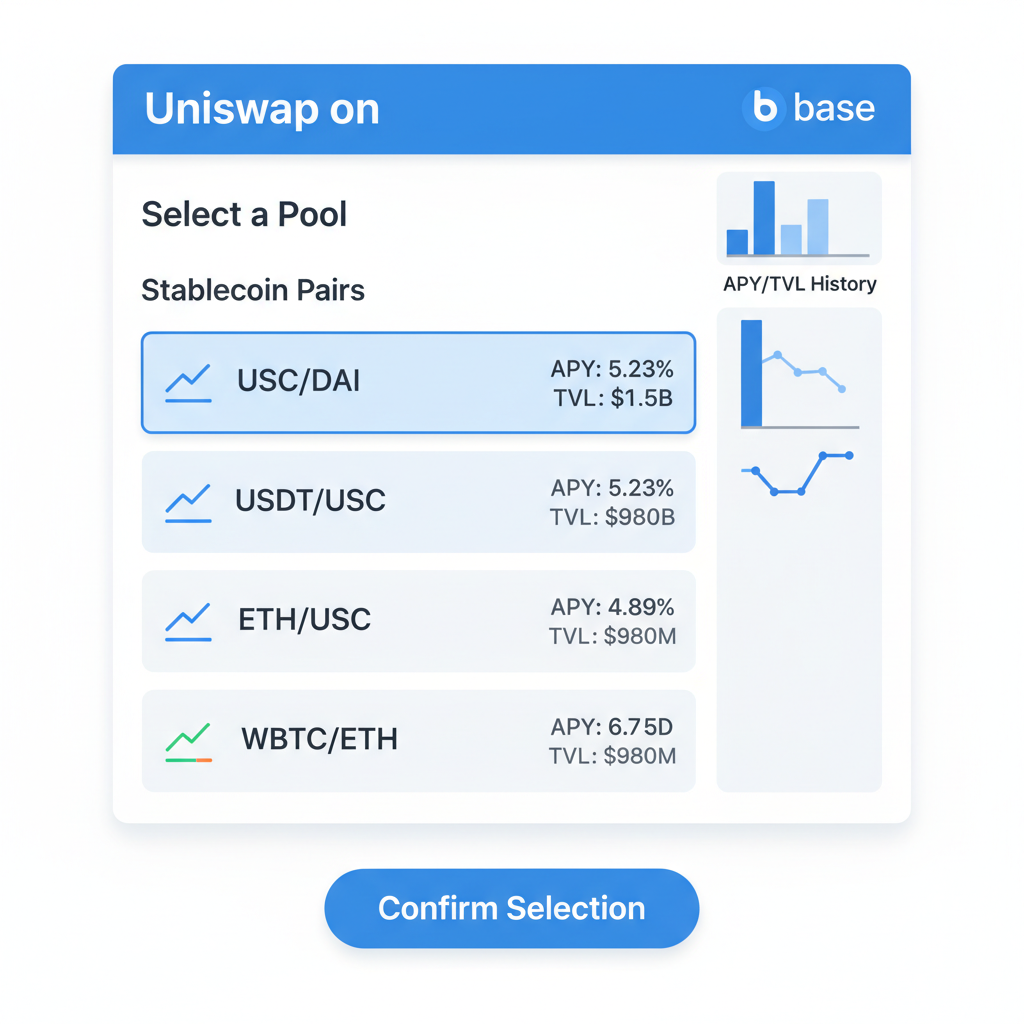

Once set, scout pools. De. Fi scanner shows real-time APYs; prioritize stablecoin pairs like USDC-USDT to dodge volatility. TVL over $100M signals trust – Aerodrome or BaseSwap often lead here.

Spotting Safe Opportunities Amid the Hype

Not all farms are equal. In 2026, MEXC lists Uniswap and Aave as yield kings for their deep liquidity and borrowing-backed returns. On Base, these ports shine with low fee DeFi protocols on Base. Curve and Pendle also deliver, per Coinspeaker tests, blending stability with upside.

Dive into research: Check Dune Analytics for TVL trends, read audits on DefiLlama. Opinion: Skip hyped meme farms; real yields come from battle-tested lending and AMMs. Aave’s collateralized borrowing creates genuine demand, fueling sustainable APYs around 5-15% on stables.

For more on onboarding, explore our step-by-step Base DeFi guide. Next, we’ll cover providing liquidity without impermanent loss pitfalls and monitoring tools that keep you ahead.

Ready to farm? Base empowers everyday investors like you to claim DeFi’s riches safely. Data-driven choices turn risks into rewards – let’s build that portfolio.

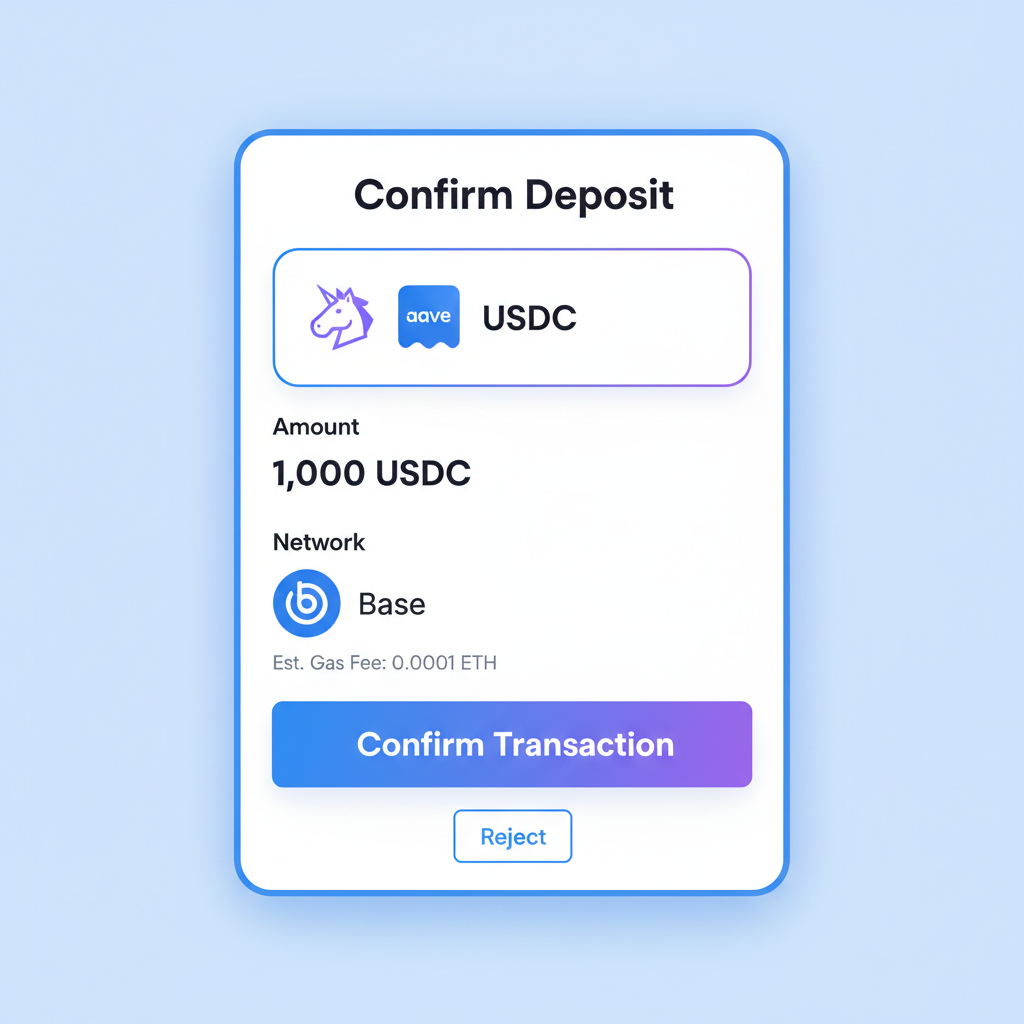

Providing liquidity starts simple on Base. Head to Uniswap’s interface, connect your wallet, select a stablecoin pair like USDC-ETH, approve the spend, and deposit. Fees? Pennies. Rewards accrue automatically, often boosted by governance tokens. Aave differs: deposit assets to earn lending interest, no pairing needed. This retail DeFi Base blockchain approach suits beginners perfectly, minimizing complexity while maximizing control.

Mastering Risks in Base Yield Farming

Impermanent loss hits when paired assets diverge in price, eroding your principal versus holding. Solution: stick to correlated stables, where loss nears zero. Smart contract risks loom too; always verify audits on platforms like DefiLlama. Base’s youth means fewer exploits than Ethereum mainnet, but vigilance counts. Market swings amplify losses if leveraged, so under 20% portfolio allocation rules my strategy. Rug pulls? Vet teams via social proof and locked liquidity.

| Protocol | Est. APY (Stables) | TVL (Feb 2026) | Key Risk | Mitigation |

|---|---|---|---|---|

| Aave | 5-12% | $500M and | Liquidation | Conservative LTV |

| Uniswap | 8-20% | $1B and | Impermanent Loss | Stable Pairs |

| Aerodrome | 10-25% | $300M and | Token Inflation | Vote-Lock |

| Curve | 4-10% | $200M and | Low Volume | High TVL Pools |

| Pendle | 12-30% | $150M and | Yield Volatility | Fixed Yields |

These picks draw from 2026 rankings by MEXC, Token Metrics, and Coinspeaker, emphasizing Base’s stars. Aave leads for lending purity; Uniswap for liquidity depth. I’ve farmed here profitably, netting 15% annualized on stables amid volatility.

Stay Sharp: Monitoring and Exit Strategies

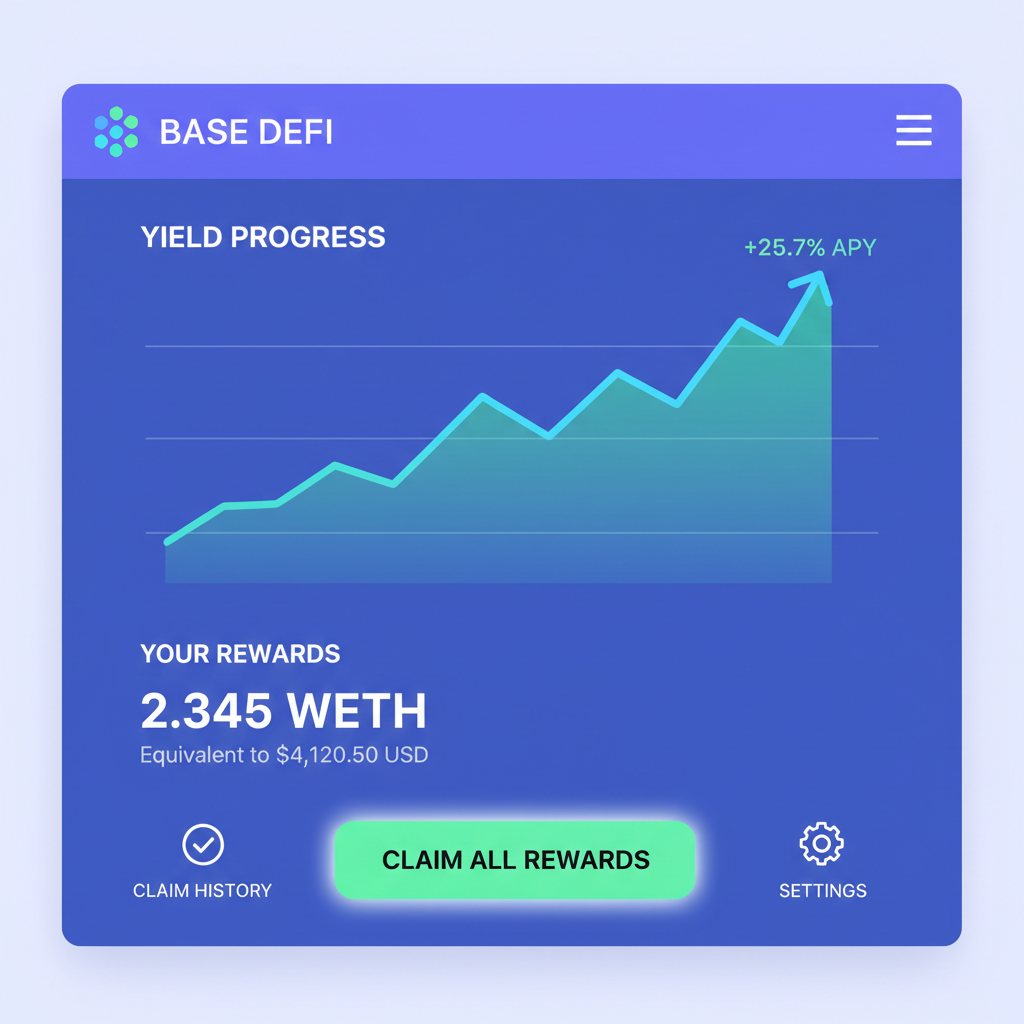

Tools like De. Fi and Zapper aggregate positions across Base protocols, alerting on APY drops or exploits. Set notifications for TVL shifts; a 20% dip signals exit. Compound rewards weekly to harness growth. When to pull out? If real yields dip under 5%, or hacks surface. Diversify: split across three protocols minimum.

For deeper dives, check our Base blockchain guide for beginners. These habits turned my experimental farms into consistent income streams.

Base DeFi empowers retail with yields that rival TradFi, minus the suits. Quicknode ranks it top for scalability.

Sustainable farming builds legacies. Start small on Base, learn from each cycle, and scale with data. Platforms evolve, but proven plays like Aave endure. You’ve got the blueprint; now execute. Your portfolio awaits those first deposits.