In 2026, with Ethereum’s ETH trading at $1,940.01 after a 2.70% dip over the past 24 hours, retail DeFi beginners are eyeing Base blockchain for its low fees and speed. Bridging ETH to Base unlocks a secure Layer-2 playground built by Coinbase, where transactions zip along without Ethereum’s gas pains. But safety first: one wrong bridge, and your funds vanish into the void. This guide cuts through the noise, arming you with strategic steps to bridge ETH to Base confidently.

Base isn’t just another chain; it’s Ethereum’s reliable sidekick, inheriting top-tier security while slashing costs by up to 99%. For retail investors juggling volatile markets, this means more yield farming or lending without bleeding fees. Recent data shows 62% of crypto users now run multiple wallets for cross-chain swaps, a smart pivot as bridges like Across and deBridge dominate 2026 rankings for Base transfers.

Why Base Stands Out for Safe Retail DeFi Onboarding

Picture this: Ethereum’s mainnet chugs at high gas during peaks, but Base processes thousands of transactions per second at pennies. In a year where DeFi TVL on Layer-2s surges, Base’s Coinbase backing adds institutional-grade trust. Beginners often overlook chain verification, yet sources like LinkedIn warn: double-check networks or risk exploits. My take? Prioritize bridges audited multiple times, like those topping Gate. io’s 2026 Base list: Across for speed, deBridge for security. This adaptability keeps your portfolio agile amid ETH’s swings from $1,927.72 to $2,035.08 daily.

Ethereum (ETH) Price Prediction 2027-2032

Bullish outlook driven by Base DeFi catalysts and Ethereum Layer-2 adoption

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $2,500 | $4,000 | $6,000 | +106% |

| 2028 | $3,500 | $6,000 | $9,000 | +50% |

| 2029 | $4,000 | $7,500 | $12,000 | +25% |

| 2030 | $5,000 | $10,000 | $15,000 | +33% |

| 2031 | $6,000 | $12,000 | $18,000 | +20% |

| 2032 | $7,000 | $15,000 | $22,000 | +25% |

Price Prediction Summary

Ethereum (ETH) is forecasted to experience robust growth from 2027 to 2032, propelled by surging Base DeFi activity, improved cross-chain bridging, and Ethereum’s scaling advancements. Average prices could climb to $15,000 by 2032 amid bullish market cycles, with min/max ranges accounting for volatility and corrections.

Key Factors Affecting Ethereum Price

- Explosive DeFi TVL growth on Base blockchain attracting retail users

- Seamless ETH bridging to Base via secure protocols like Superbridge and deBridge

- Ethereum Layer-2 scalability reducing fees and boosting transaction throughput

- Regulatory tailwinds favoring compliant DeFi innovations

- Institutional adoption of ETH-based L2 ecosystems

- Historical bull cycles amplified by 2026-2027 adoption trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

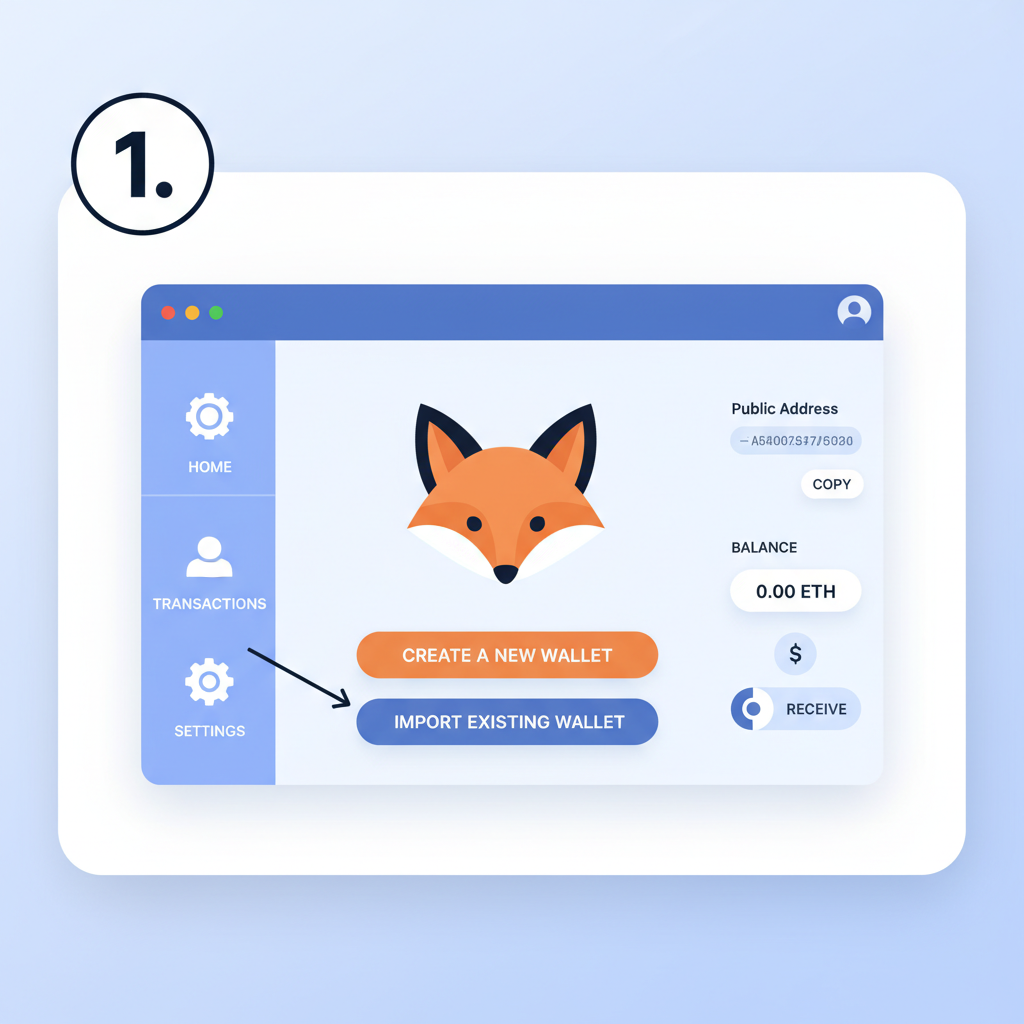

Select a Battle-Tested Wallet for Bridging ETH to Base

Skip flashy apps; stick to proven wallets handling cross-chain seamlessly. MetaMask leads for its Base integration, followed by Coinbase Wallet for noobs and Rabby for multi-chain pros. Money. com’s 2026 picks highlight wallets supporting Wormhole or Stargate, essential as 62% of users multi-wallet now. Update to latest versions, enable hardware ledger if holding over $1,000 ETH equivalent. Pro tip: Rabby’s simulation feature previews bridge fees, saving you from surprises when ETH hovers at $1,940.01.

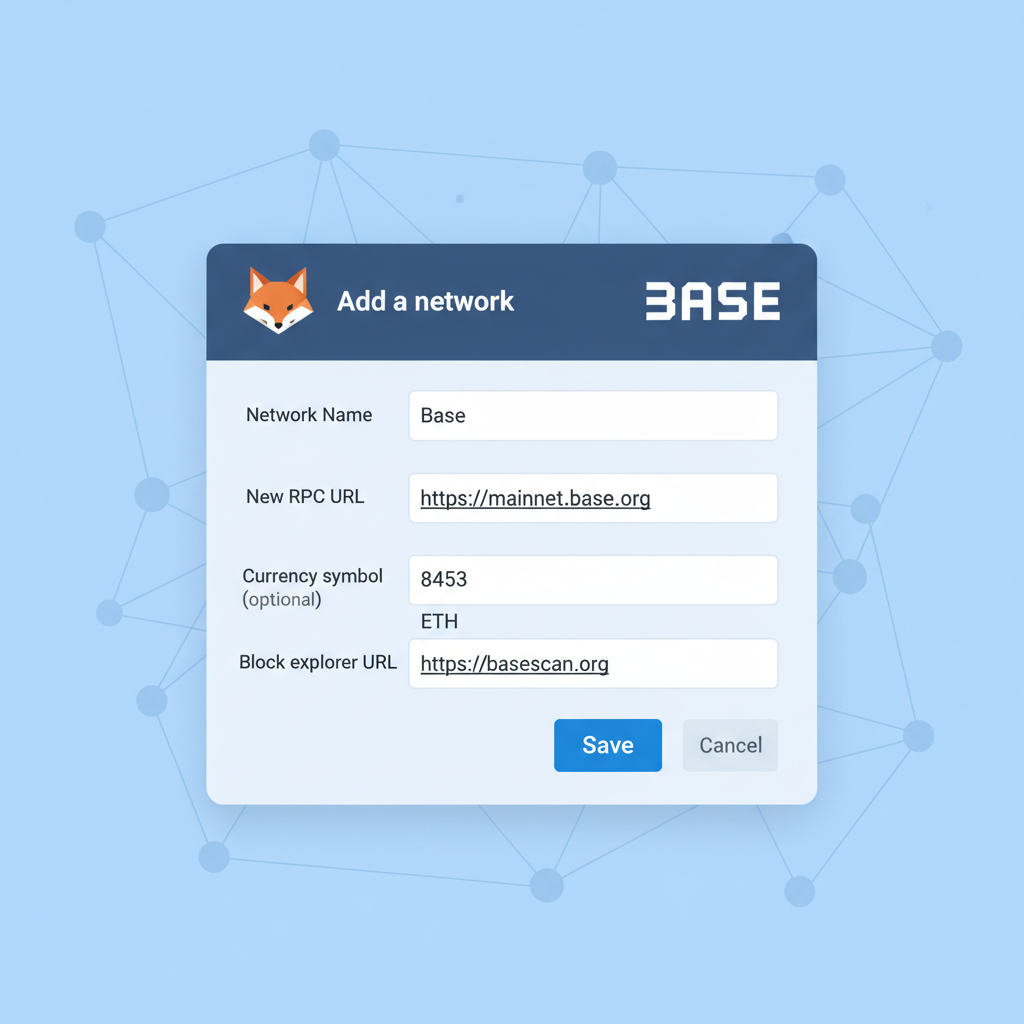

Security hinges on wallet choice. Avoid unverified dApps; use only EIP-1559 compliant ones. For Base, ensure RPC points to https://mainnet.base.org to dodge phishing clones.

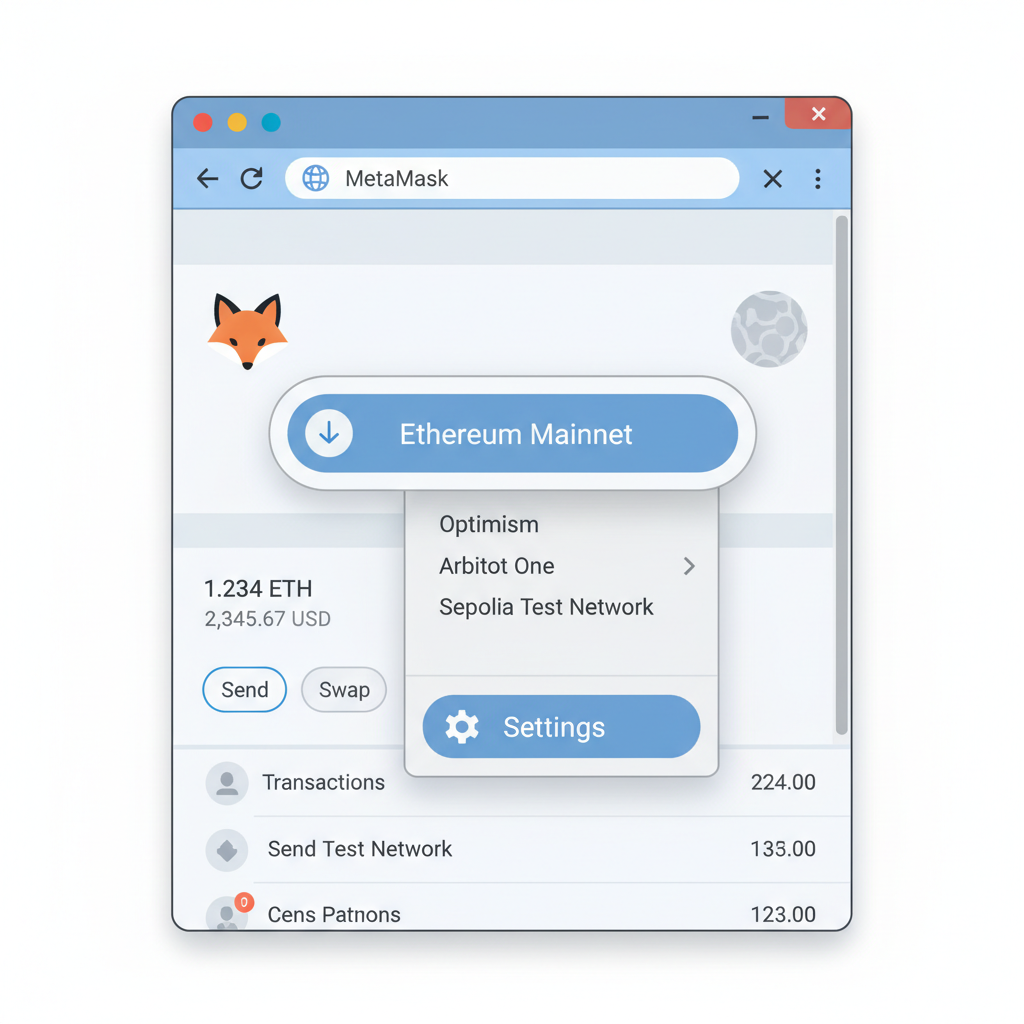

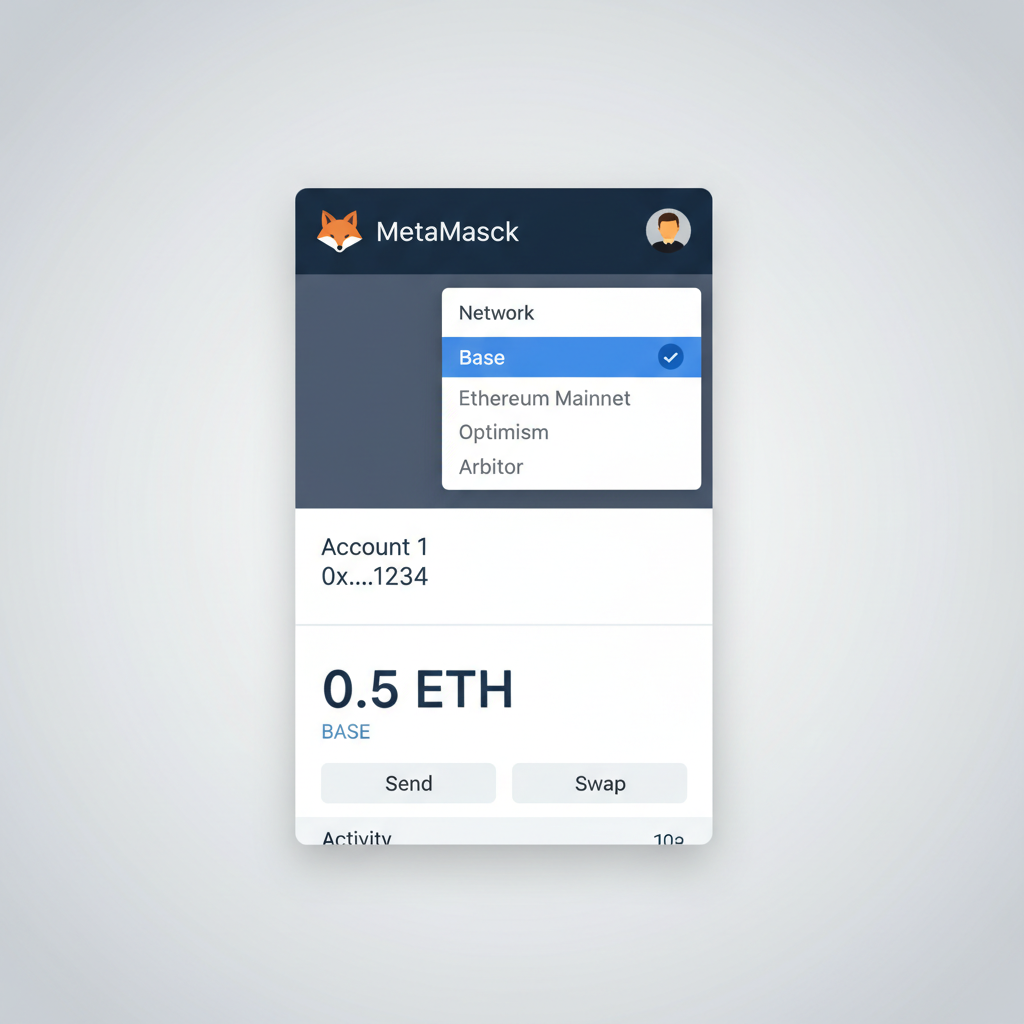

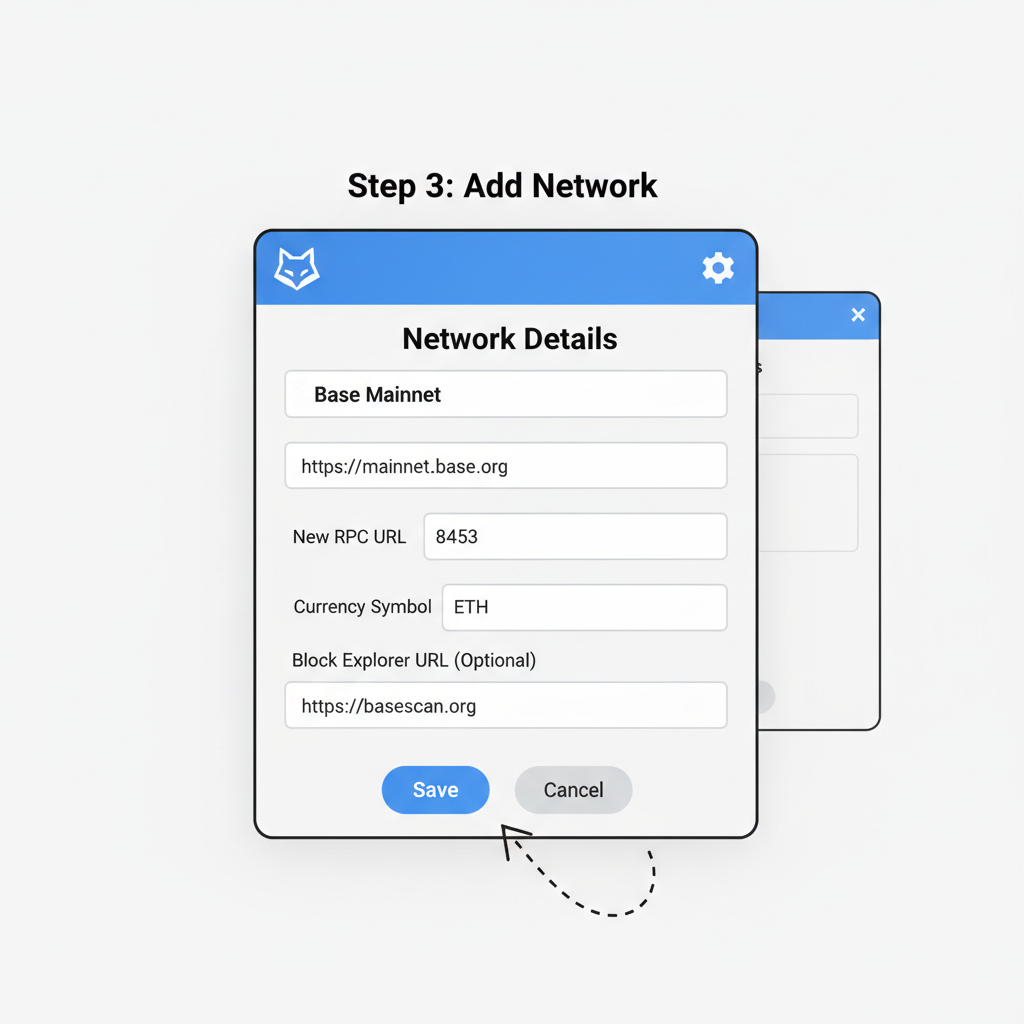

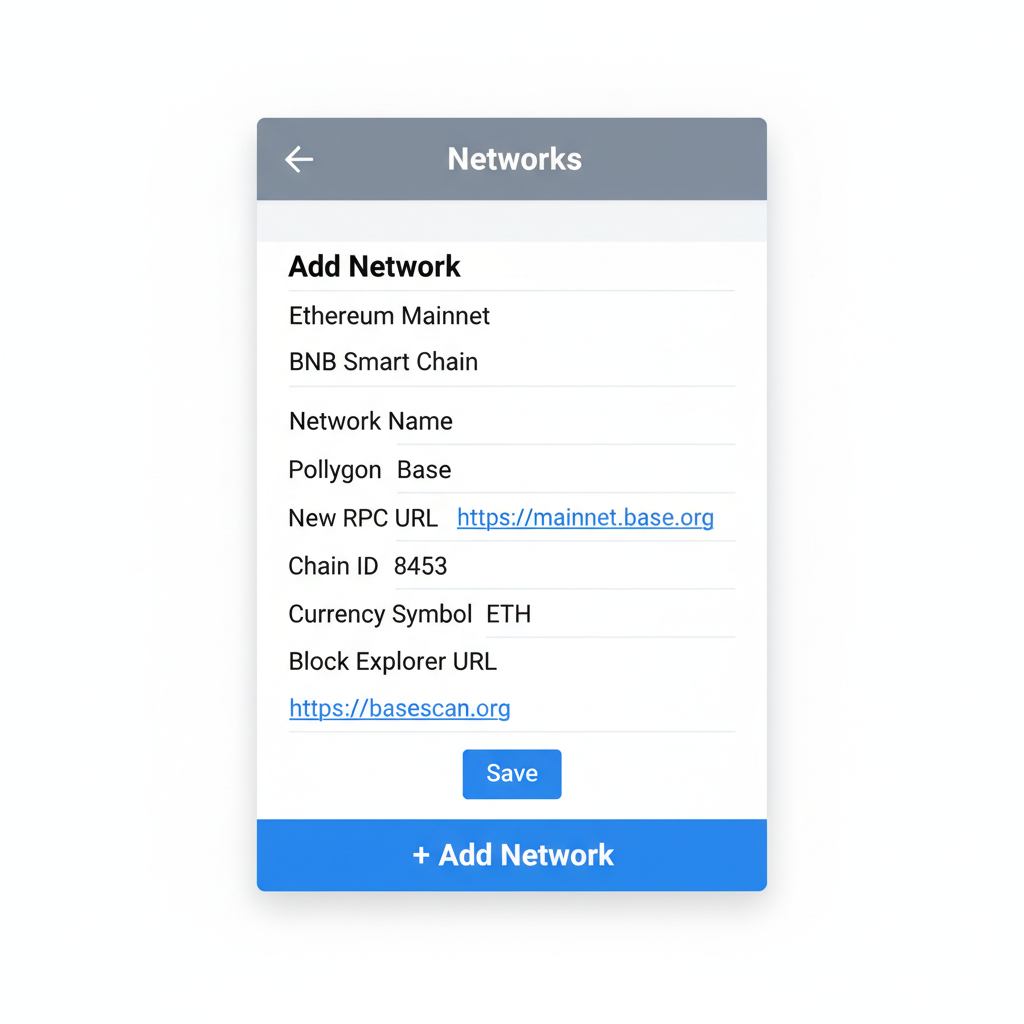

Configure Base Network in Your Wallet Effortlessly

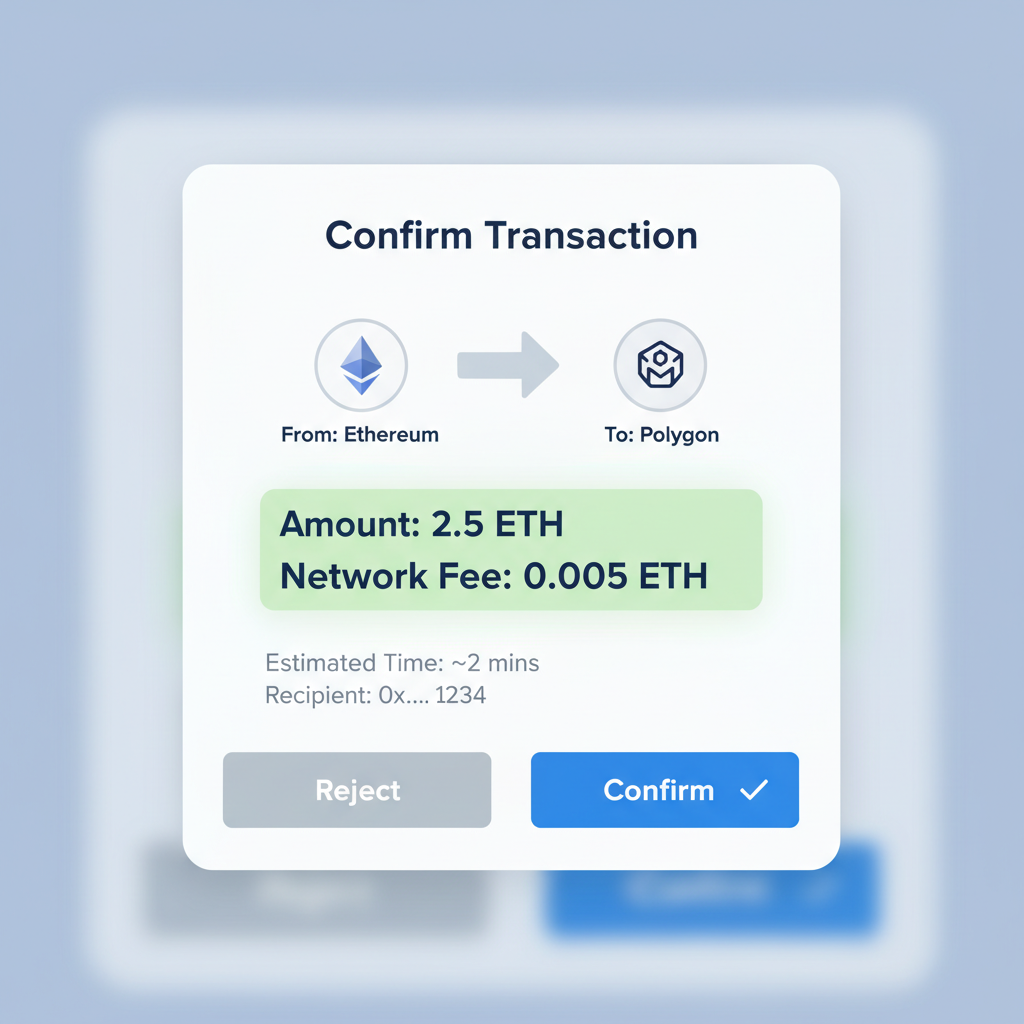

Before bridging, add Base manually, a five-minute task preventing 90% of beginner errors. Wallets like OKX Web3 simplify, but MetaMask remains king for control. Always verify Chain ID 8453 via Basescan. org; mismatches scream scam.

Once set, switch networks and check balance. Test with $10 ETH first, watching explorer for arrival. This methodical setup builds muscle memory for frequent DeFi hops. Bridges evolve fast, but wallet prep stays constant, positioning you strategically as Base DeFi matures.

Next, we’ll dive into top bridges, but mastering this foundation ensures your ETH lands safely every time.

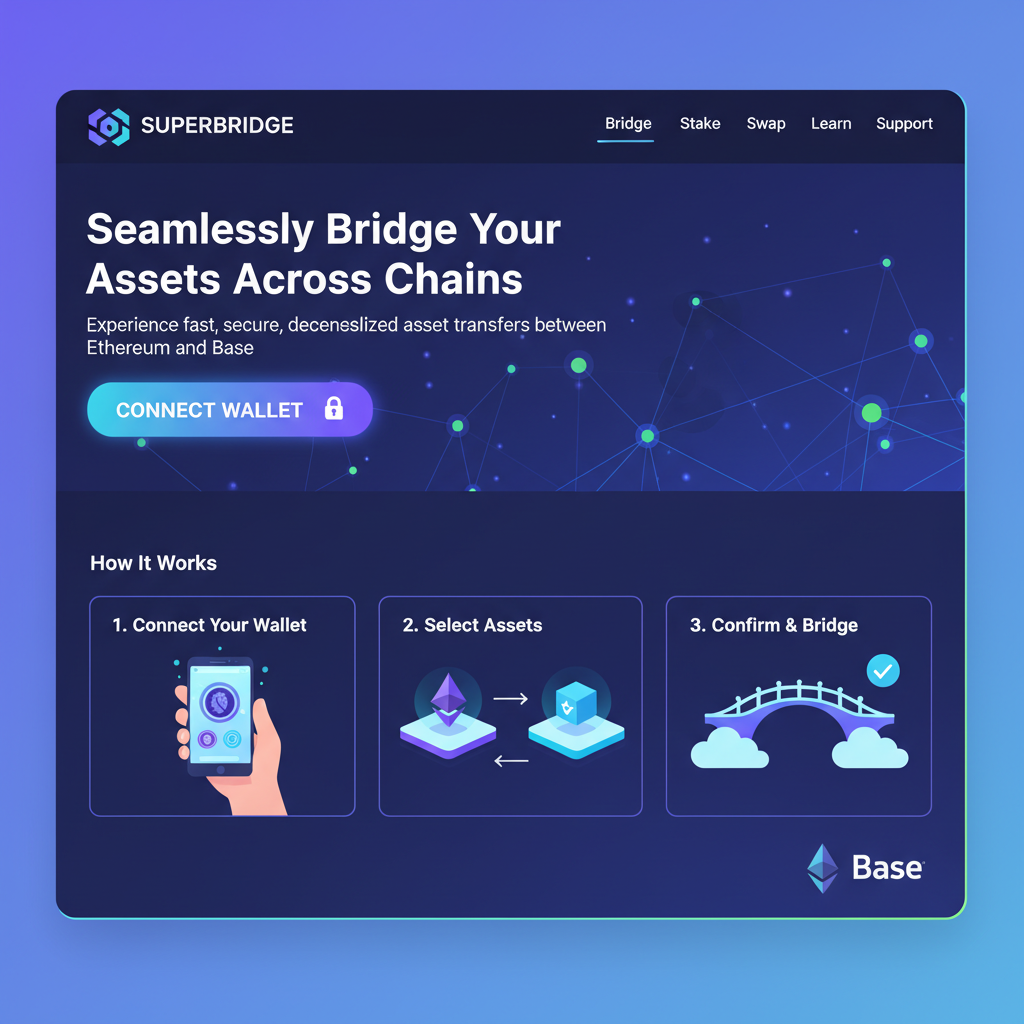

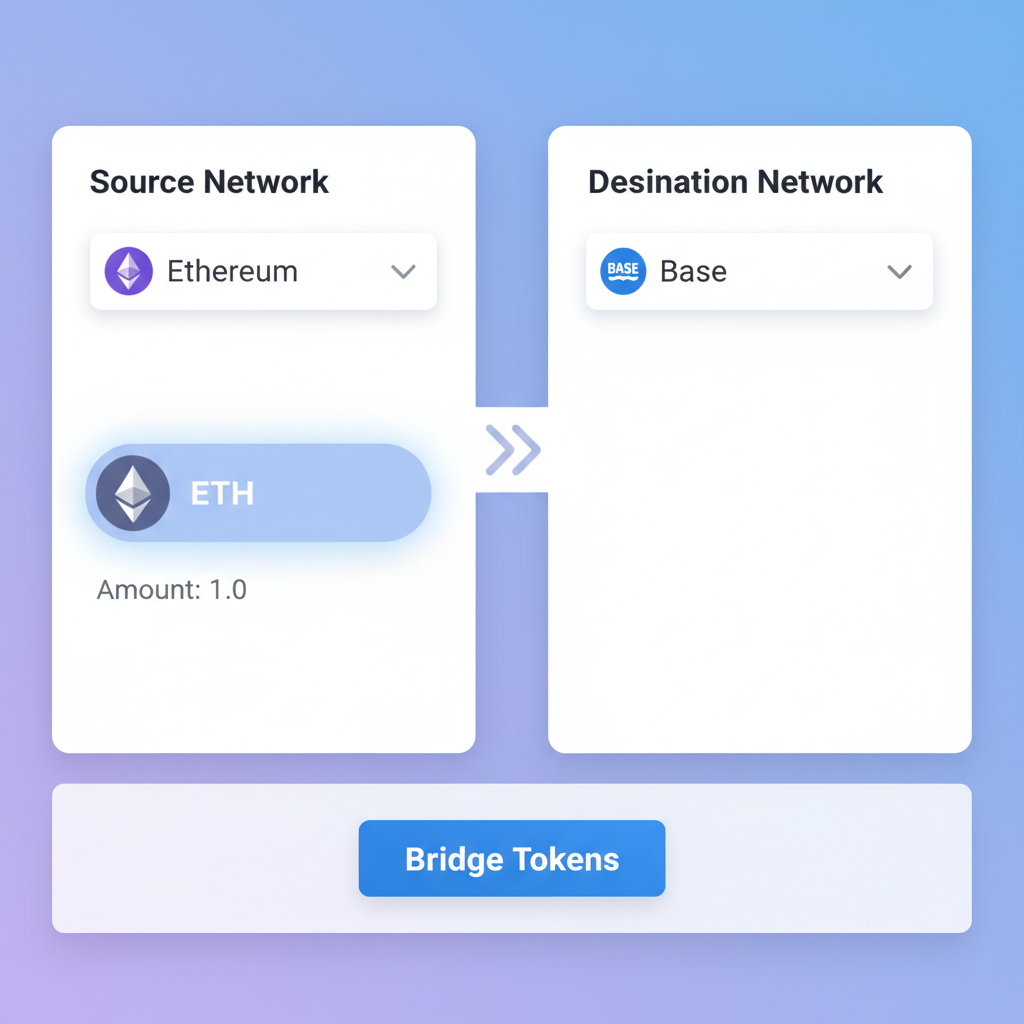

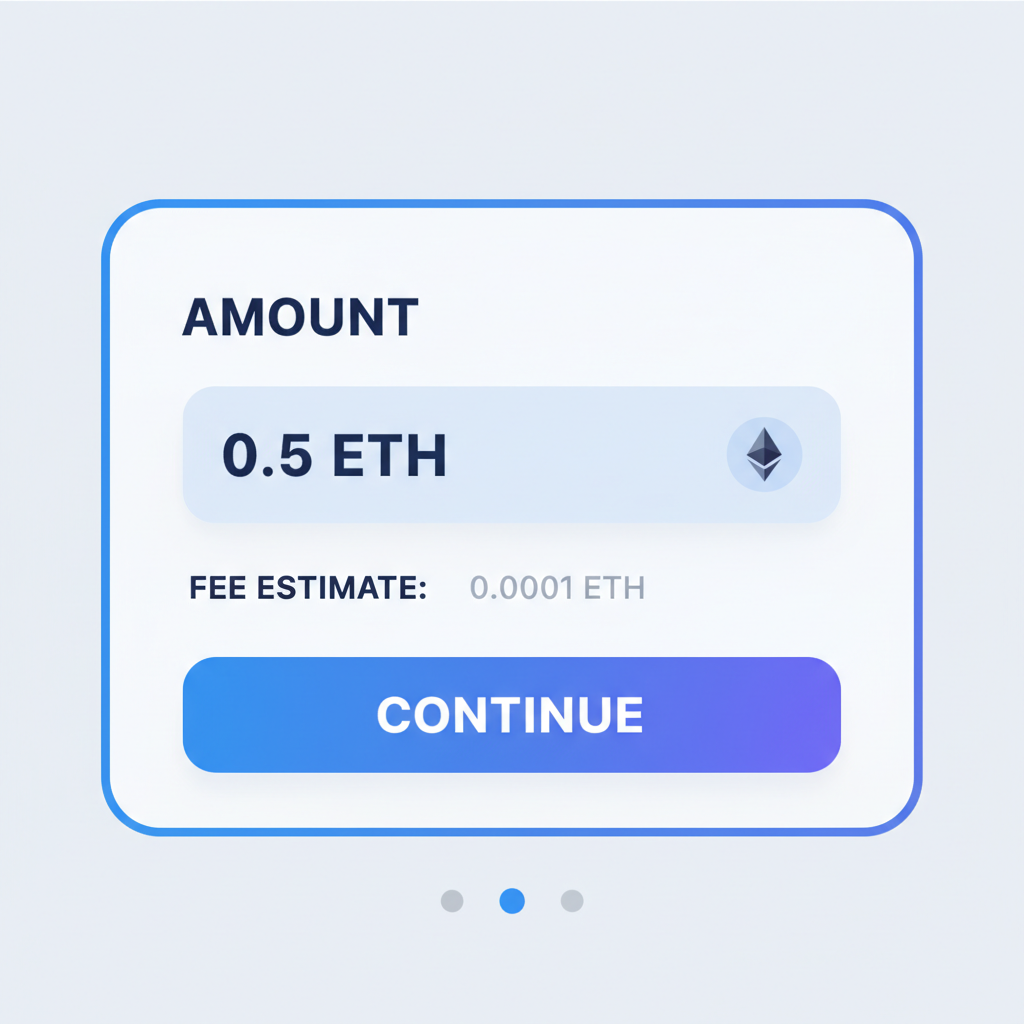

Time to bridge: pick from 2026’s elite like Superbridge for simplicity, Across for lightning speed, or deBridge for ironclad security. These outpace Wormhole or Stargate in Base-specific rankings from Gate. io and Defiway, blending low fees with audited code. With ETH at $1,940.01, even a 0.1% bridge fee stings less on Base’s efficient rails. My strategy? Match bridge to your style – speed for traders, security for holders.

Execute the Bridge with Precision Using Superbridge

Superbridge shines for beginners, channeling Coinbase’s ecosystem directly to Base. No convoluted swaps; just pure ETH transfer inheriting Ethereum’s proof-of-stake backbone. Fees? Pennies compared to mainnet’s $20 and spikes. Head to superbridge. app, but only after wallet setup confirms Chain ID 8453.

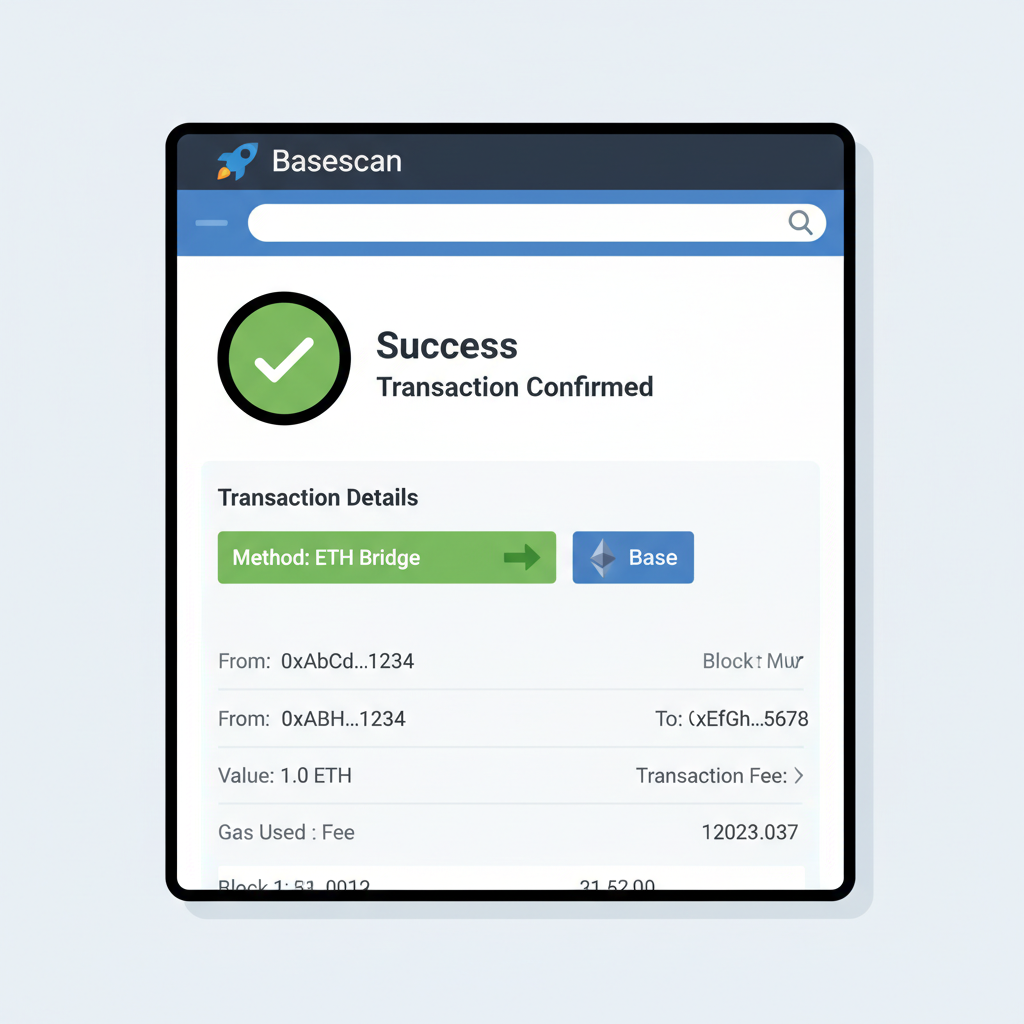

Post-confirmation, track via Basescan. org. Funds hit Base in minutes, not hours, letting you pivot to DeFi yields amid ETH’s 24-hour range of $1,927.72 to $2,035.08. If delays creep in, check Base status pages – network congestion is rare but real.

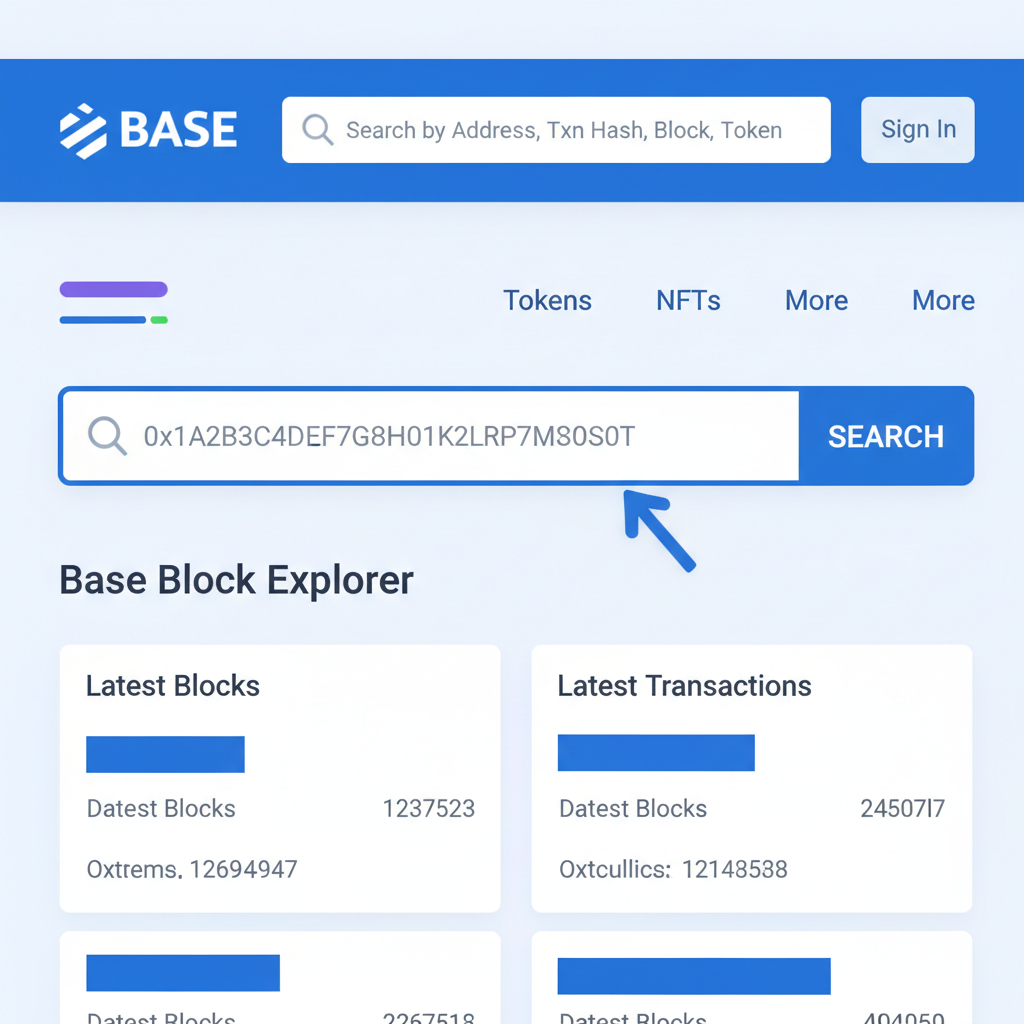

Verify and Secure Your Bridged Assets on Base

Arrival doesn’t mean party time. Scour Basescan for your tx hash, confirming ETH balance matches minus fees. Counterfeit tokens lurk; paste contract addresses into BaseScan’s verifier before any DeFi dip. LinkedIn pros nail it: cross-reference multiple sources or sit out. For retail edge, simulate interactions via Rabby – it flags malicious approvals.

Pro move: Layer on hardware like Ledger for bridges over $500 ETH equivalent. In 2026’s multi-wallet era, segregate Base funds from Ethereum holdings, dodging single-point failures as 62% of users do per Money. com.

Test Small, Scale Smart: Your First Base DeFi Moves

Bridge $20 ETH first. Success? Ramp to full position. Base unlocks Aerodrome for liquidity mining or Moonwell for lending, all at sub-cent costs. Watch gas mimic Ethereum’s but optimized – strategic for ETH’s current $1,940.01 dip, farming yields to offset volatility.

Monitor via Coinbase’s Base dashboard or Dune Analytics for TVL trends. Bridges like Orbiter add multichain flair later, but master ETH-to-Base first. This phased approach adapts to macro shifts, from Fed whispers to crypto winters.

Staying sharp means official channels: Base Discord, Ethereum. org alerts. Fees flux with ETH price, so time bridges post-dips like today’s 2.70% slide. Base’s trajectory? Explosive for retail, blending Coinbase trust with DeFi freedom. You’ve got the toolkit – bridge boldly, trade wisely, thrive adaptively.

Ready for deeper Base DeFi? Explore this step-by-step onboarding guide tailored for beginners.