In 2026, staking USDC on Base DeFi protocols stands out as a straightforward path for retail beginners to generate passive income without the wild swings of volatile tokens. Base, Coinbase’s Layer 2 network, combines Ethereum’s security with rock-bottom fees and lightning-fast transactions, making base defi staking USDC accessible even if you’re new to crypto. Yields from lending and liquidity provision hover around 4-8% APY on top protocols, backed by audited smart contracts and deep liquidity pools.

USDC, the leading dollar-pegged stablecoin, lets you earn while preserving capital stability. Unlike riskier yield farming, stake USDC base blockchain focuses on lending to overcollateralized borrowers or providing liquidity, minimizing impermanent loss. Recent data highlights Aave V3 as the go-to on Base for USDC, alongside emerging players like Morpho for optimized lending rates.

Base’s Edge Over Ethereum Mainnet for Retail DeFi

Base processes transactions for pennies and confirms them in seconds, a game-changer for retail defi base beginners. Traditional Ethereum gas fees could eat 10-20% of small stakes during peaks; Base slashes that to under $0.01. Its integration with Coinbase simplifies onboarding, letting you buy USDC directly and bridge seamlessly. I favor Base for its battle-tested infrastructure; over $10 billion in TVL underscores protocol maturity without the hype-driven exploits plaguing newer chains.

Stability reigns here. USDC on Base benefits from Circle’s reserves and real-time attestations, ensuring 1: 1 backing. Protocols like Aave enforce conservative loan-to-value ratios, reducing liquidation risks even in downturns. Compare this to CeFi alternatives like Nexo or Kraken, which offer similar yields but custody your keys; DeFi hands control back to you.

Top USDC Staking Yields on Base DeFi Protocols in 2026

| Protocol | Estimated APY | TVL | Safety Score |

|---|---|---|---|

| Aave V3 | 5.2% | $1.45B | 🟢🟢🟢🟢🟢 |

| Morpho Blue | 6.1% | $520M | 🟢🟢🟢🟢🟡 |

| Moonwell | 4.5% | $280M | 🟢🟢🟢🟢🟢 |

| Compound V3 | 3.8% | $190M | 🟢🟢🟢🟡🟡 |

Selecting the Best Protocols for Safe USDC Yields

For 2026, prioritize protocols with proven audits, high TVL, and transparent risk parameters. Aave V3 leads Base DeFi for passive income base defi 2026, supplying USDC to earn variable or stable rates around 5-7% APY. Its risk isolation means one bad borrow doesn’t tank the pool. Morpho Blue, optimized on Base, pushes efficiency with peer-to-peer matching, sometimes edging 1-2% higher yields for the same risk.

Avoid flash-in-the-pan farms; stick to battle-tested names. DeFiLlama data shows Aave capturing 60% of Base lending volume, with USDC as the top asset. Maple offers institutional-grade credit but suits larger stakes. My analytical take: blend Aave for liquidity and Morpho for yield boost, always starting small to test withdrawals.

Safest DeFi lending protocols combine deep liquidity, robust oracles, and clean track records – exactly what Base delivers.

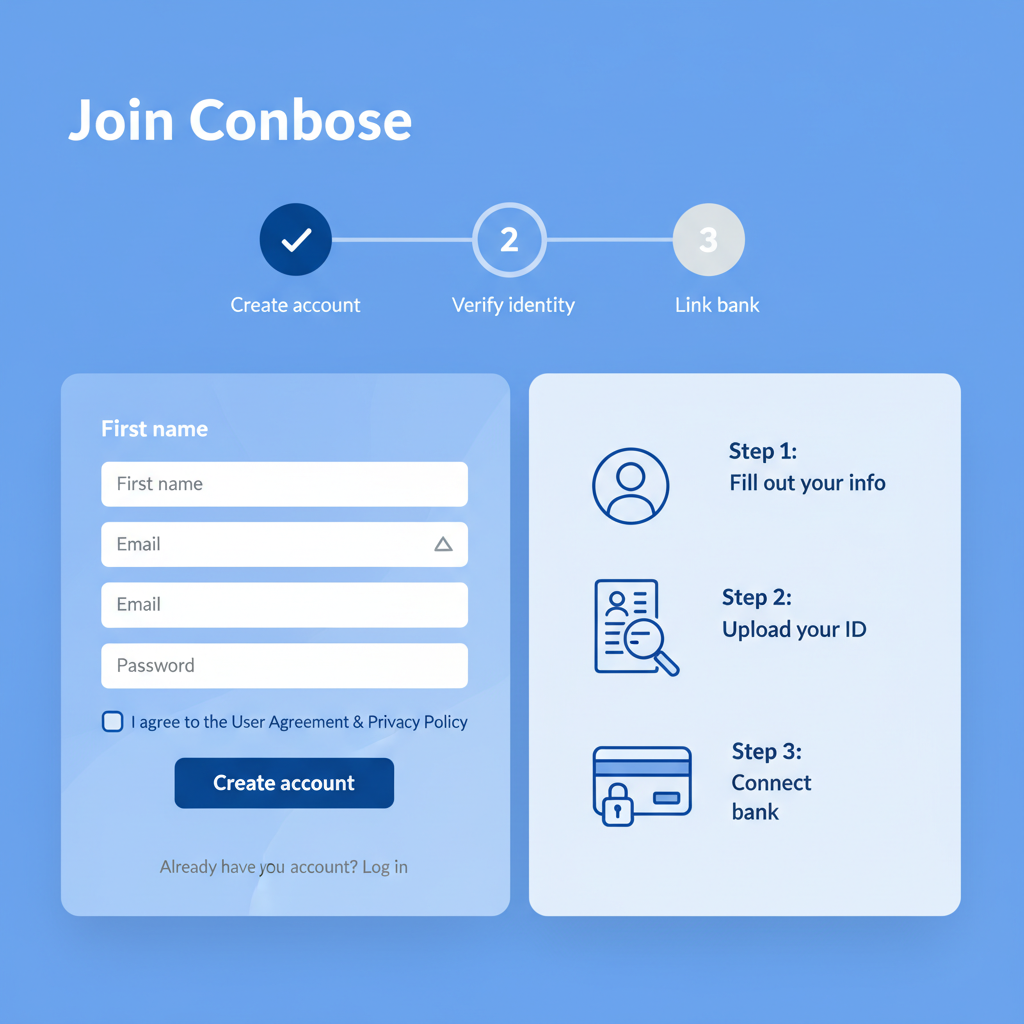

Essential Setup Before Your First Stake

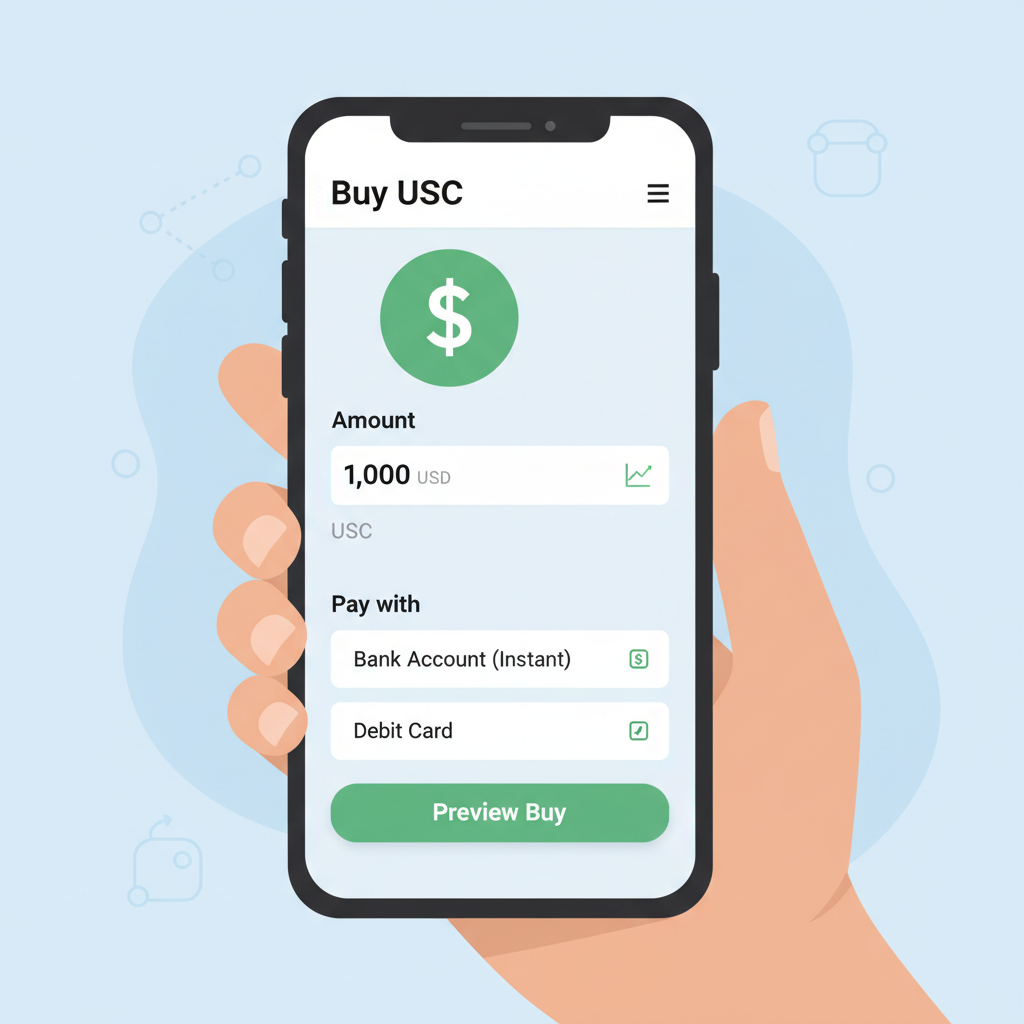

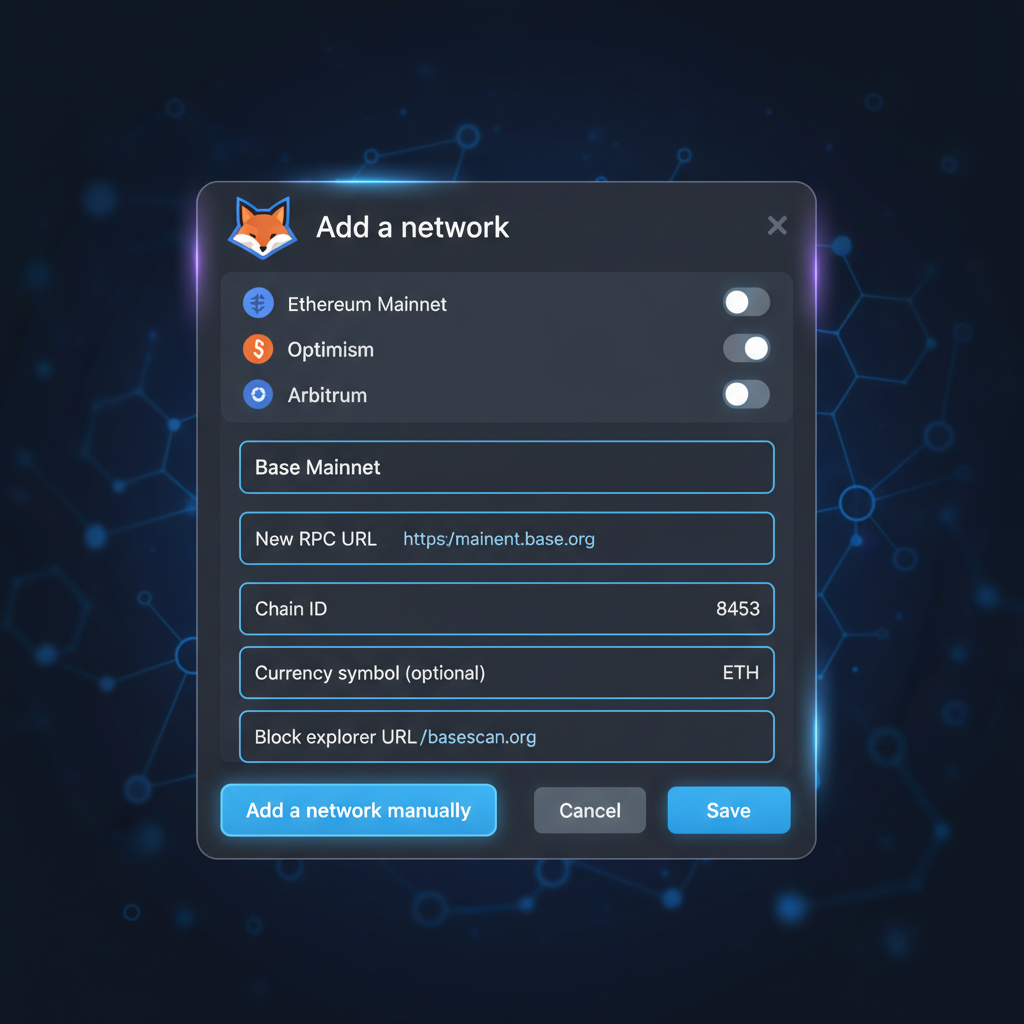

Before diving into safe staking protocols base, secure your foundation. A non-custodial wallet is non-negotiable; self-custody aligns with DeFi’s ethos. MetaMask or Coinbase Wallet handle Base effortlessly. Fund via Coinbase: deposit fiat, buy USDC, withdraw to Base network – no bridges needed.

Check gas limits and slippage; Base’s optimism keeps costs trivial. Verify protocol addresses on official sites to dodge phishing. This prep builds confidence, turning intimidation into routine. Next, we’ll walk through the deposit process hands-on.

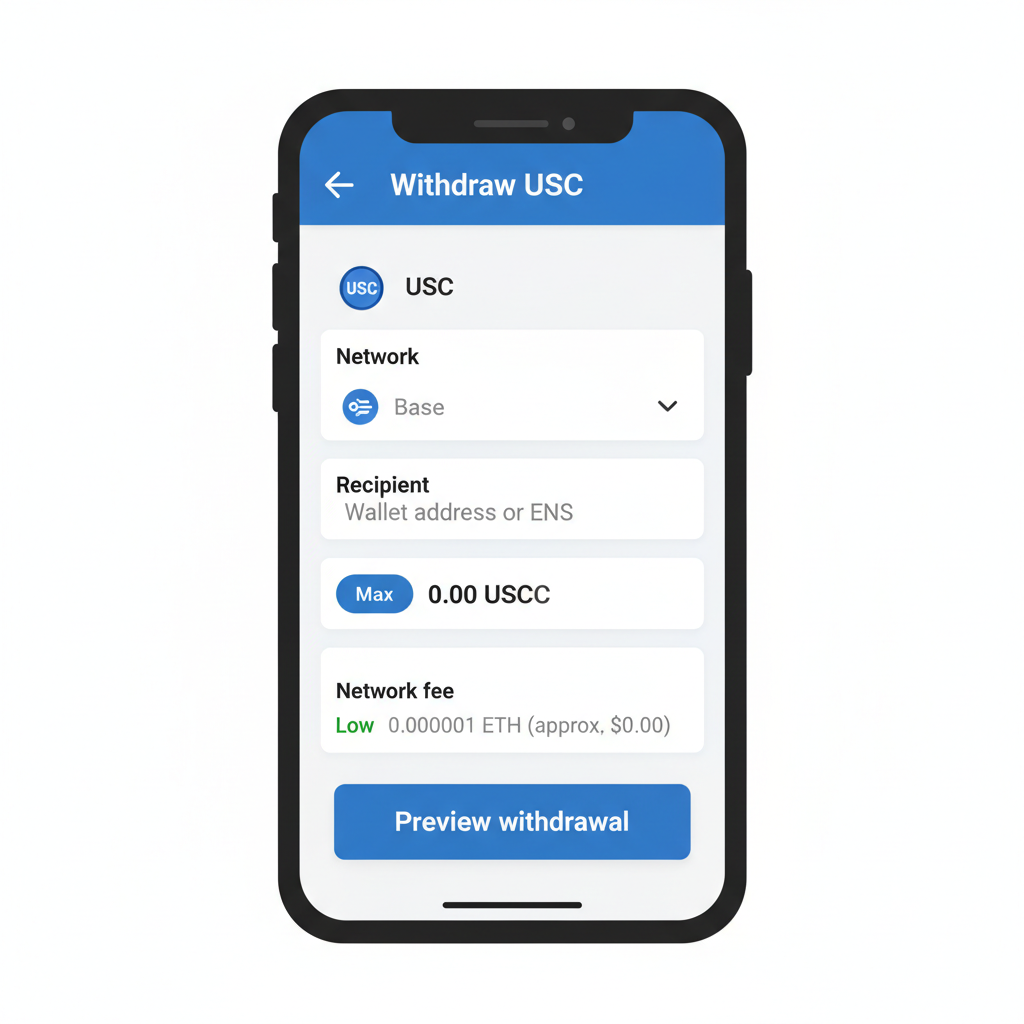

Now that your wallet hums along on Base, connected to Aave V3, the actual staking boils down to a few clicks. Navigate to the ‘Supply’ tab, select USDC from the asset list, and enter your deposit amount. Aave displays real-time borrow demand driving your APY; expect 4-6% variable rates in steady markets, dipping lower during liquidity gluts. Confirm the transaction, approve the spend if prompted, and watch your position accrue rewards compounded automatically. Withdrawals are instant barring extreme congestion, a far cry from locked CeFi terms.

Optimizing Yields: Aave V3 vs. Morpho on Base

Aave V3 sets the benchmark for base defi staking USDC, with over $500 million in USDC supplied and battle-tested risk engines. Its e-mode for correlated assets like stablecoins squeezes extra basis points. But Morpho Blue, live on Base, refines this via targeted lending vaults. Supply USDC to a Morpho market matched against precise collateral, netting 6-8% APYs on select curves without diluting pool-wide rates. My portfolio lens favors Morpho for marginal gains on larger positions, allocating 70% Aave for safety, 30% Morpho for alpha.

Both shine against Ethereum counterparts; Base’s throughput keeps utilization high without fee spikes. DeFiLlama confirms USDC dominates Base lending at 40% of TVL, fueling sustainable passive income base defi 2026. Skip hyped restaking wrappers here; pure lending suffices for beginners chasing stability over moonshots.

Aave V3 vs Morpho Blue on Base Comparison

| Feature | Aave V3 🟢 | Morpho Blue 🔵 |

|---|---|---|

| APY Range | 4-7% 📈 | 5-8% 📈 |

| TVL | $500M 💰 | $200M 💰 |

| Withdrawal Times | Instant ⚡ | Instant ⚡ |

| Key Risks | Utilization ⚠️ | Allocator choices ⚠️ |

Navigating Risks with Eyes Wide Open

No yield comes risk-free, yet Base protocols tilt odds favorably. Smart contract exploits top the list; Aave’s 50 and audits and $100 million bug bounty provide armor. Oracle failures could misprice liquidations, but Chainlink feeds on Base have spotless uptime. Stablecoin depegs haunt dreams post-2022 flashbacks, though USDC’s $35 billion reserves and daily proofs dwarf threats. Impermanent loss? Negligible in single-sided lending.

Counterparty risk lingers in undercollateralized borrows, but Aave caps LTV at 80% for stables. My strategy: diversify across two protocols, stake under 10% of net worth, and set alerts for utilization above 90%. Hardware wallets and multi-sig for big bags add layers. Base’s Coinbase backing indirectly bolsters confidence, with instant fiat ramps if needed. Weigh these against 0% bank savings; informed risk unlocks superior returns.

Harvesting rewards varies: Aave accrues to aUSDC, redeemable anytime; Morpho may incentive with governance tokens, best held long-term. Tax implications hit on withdrawal; track basis meticulously for Uncle Sam. Tools like Zapper aggregate positions across Base, simplifying oversight without juggling tabs.

Long-Term Strategies for Retail Success

Scale thoughtfully. Start with $100 stakes to grok mechanics, then ladder into $1,000 and as comfort grows. Reinvest yields quarterly to compound at 5% netting 2.7% annualized growth on $10k. Watch Fed signals; rate cuts juice DeFi borrows, hiking APYs. For hands-off vibes, auto-compounders like Beefy integrate Base vaults seamlessly.

Community chatter flags shifts early; follow Base DeFi frames on Warpcast. My decade in markets whispers patience trumps FOMO. Retail investors thrive by prioritizing security over speed, blending DeFi yields with TradFi ballast.

Staking USDC on Base distills DeFi’s promise: reliable income, user sovereignty, minimal friction. As protocols mature through 2026, yields stabilize around inflation-beating levels, cementing Base as retail’s DeFi hub. Dive in measuredly, stay vigilant, and let compound interest work its quiet magic.