With Coinbase Global Inc (COIN) surging 16.47% to $164.32 in the last 24 hours, eyes are on its Layer 2 network, Base, as whispers of a 2026 native token airdrop intensify. Retail investors stand to gain big by base airdrop farming – but only if they prioritize safety over haste. Forget reckless multi-wallet schemes; smart positioning means consistent, organic activity on-chain, dodging Sybil detectors while stacking points.

Why Base Airdrop Farming Favors Patient Retail Traders

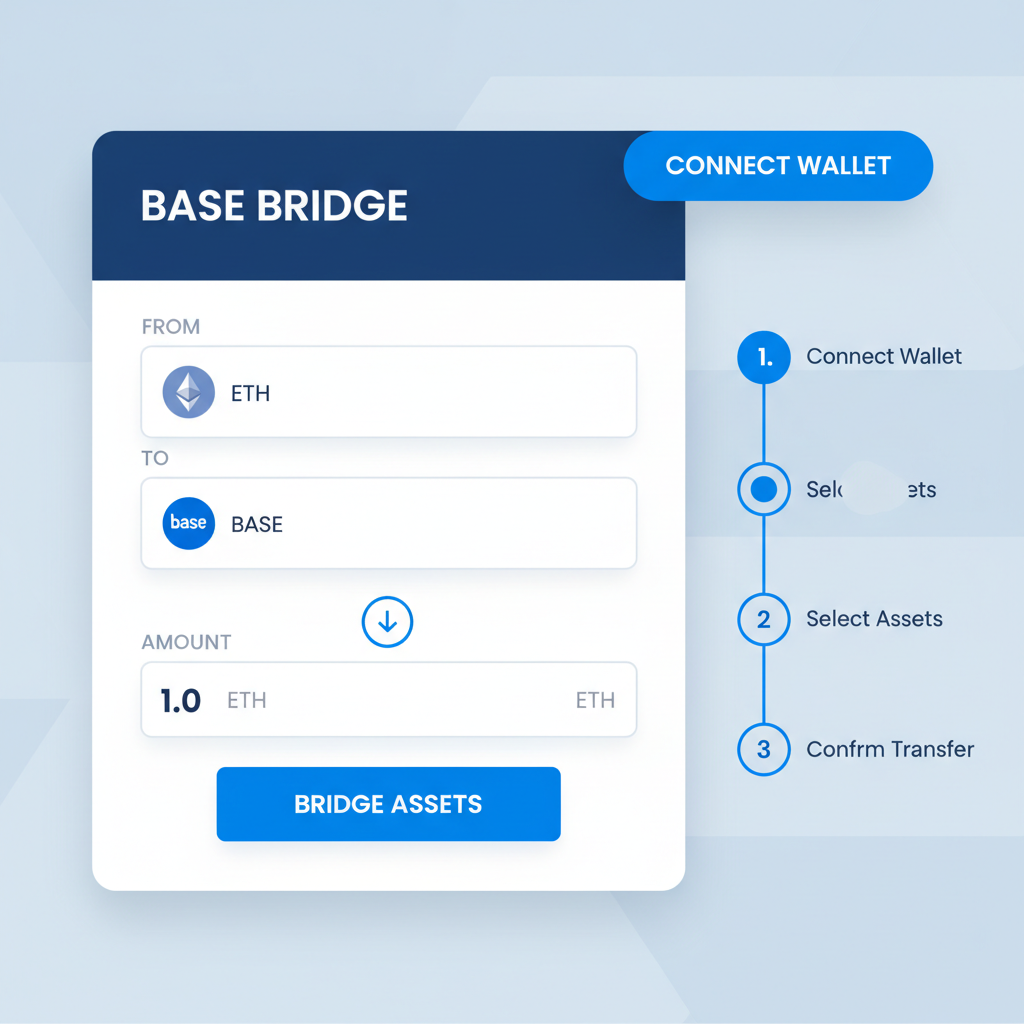

Base, built on Coinbase’s secure infrastructure, rewards genuine users over bots. As of February 2026, eligibility hinges on bridging ETH, swapping on DEXes, and engaging dApps – activities that build real ecosystem value. I see this as volatility turned opportunity: COIN’s climb to $164.32 signals institutional buy-in, amplifying retail upside. Unlike speculative memecoins, coinbase base airdrop 2026 potential ties to proven scaling, with low fees making it ideal for everyday wallets.

Avoid the trap of over-optimizing. Projects deploy advanced Sybil tools, flagging farmed accounts. My strategy? One wallet, diversified touches across protocols. This nets points without red flags, positioning you for boosts convertible to tokens.

Step One: Secure Onboarding and Bridging to Base

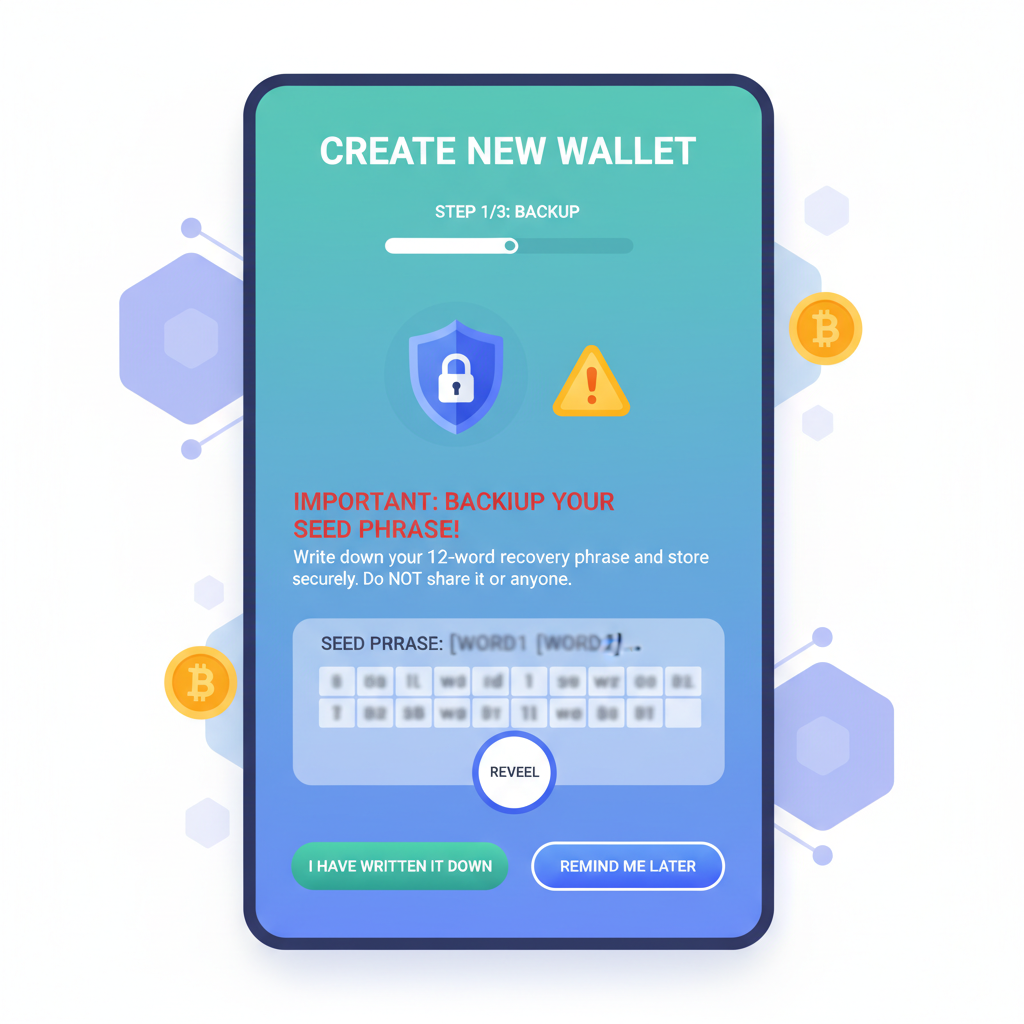

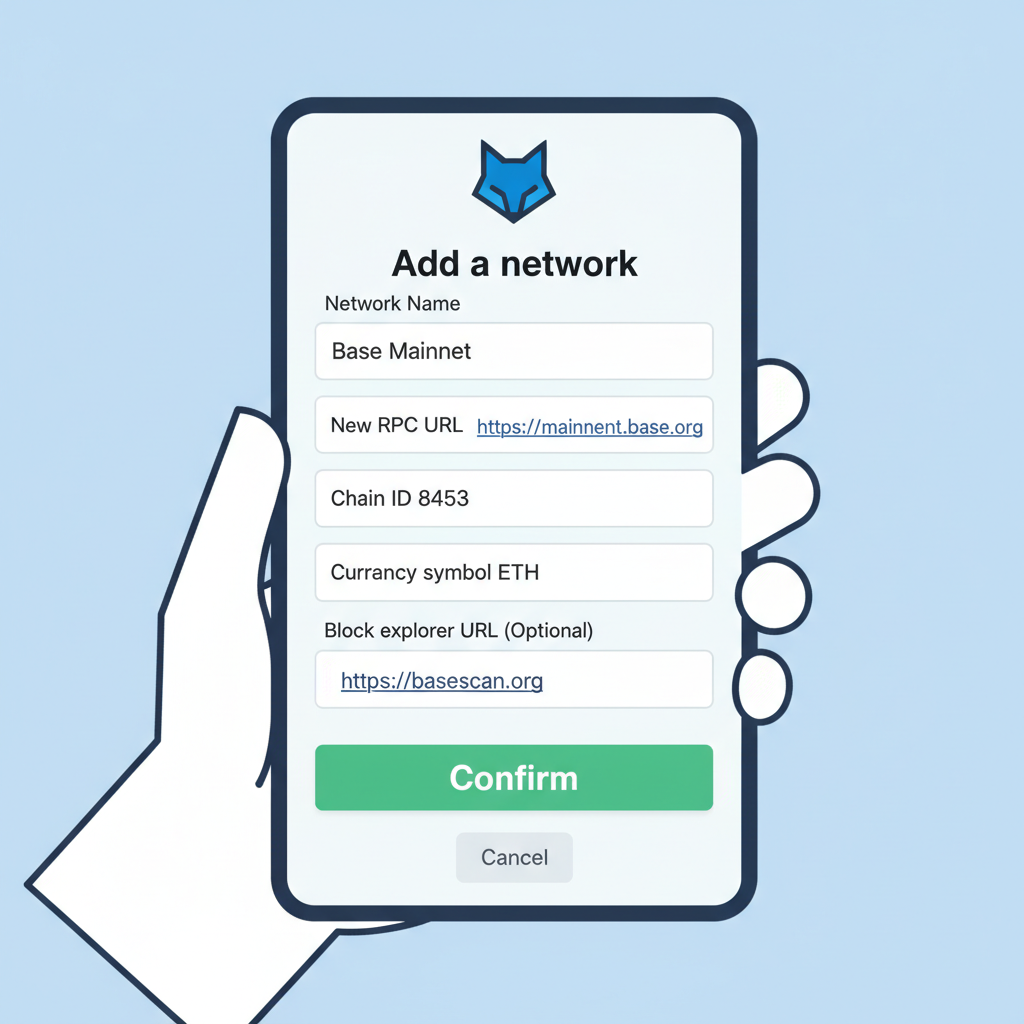

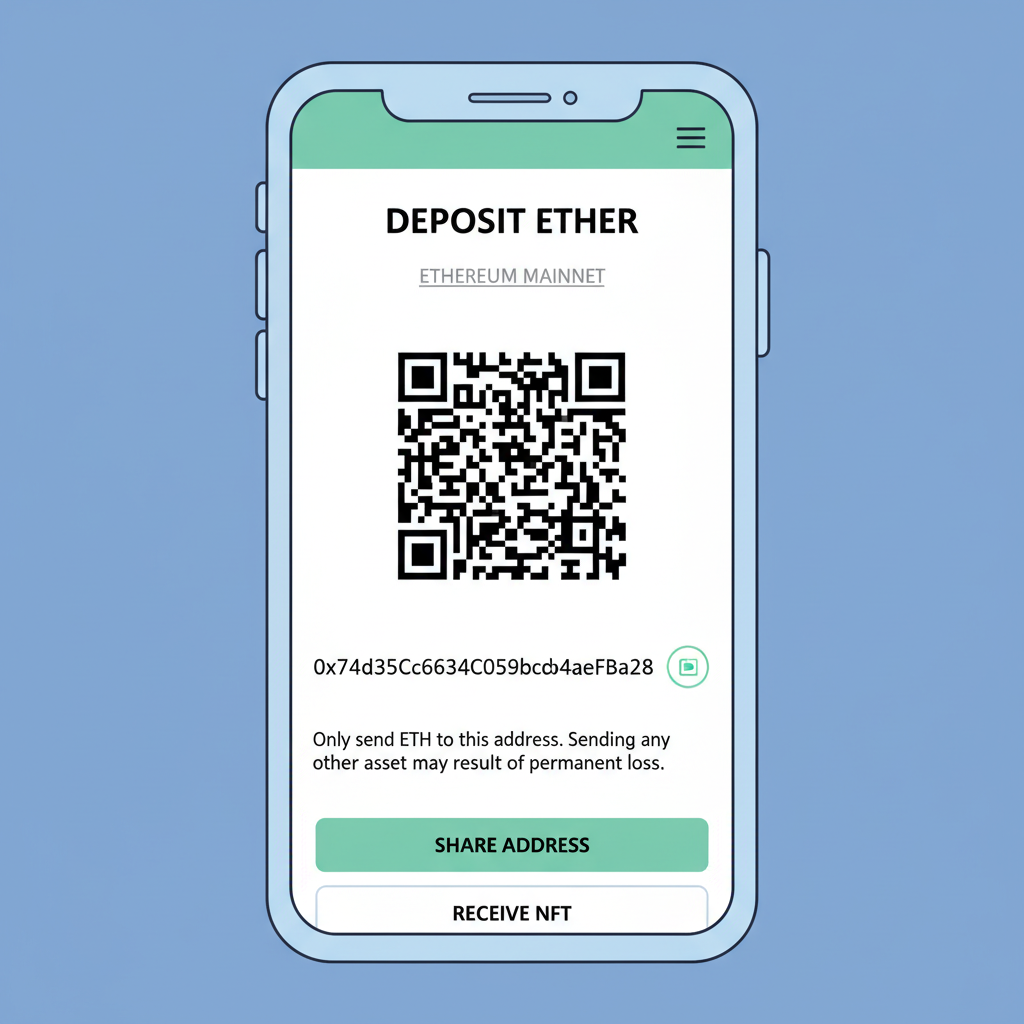

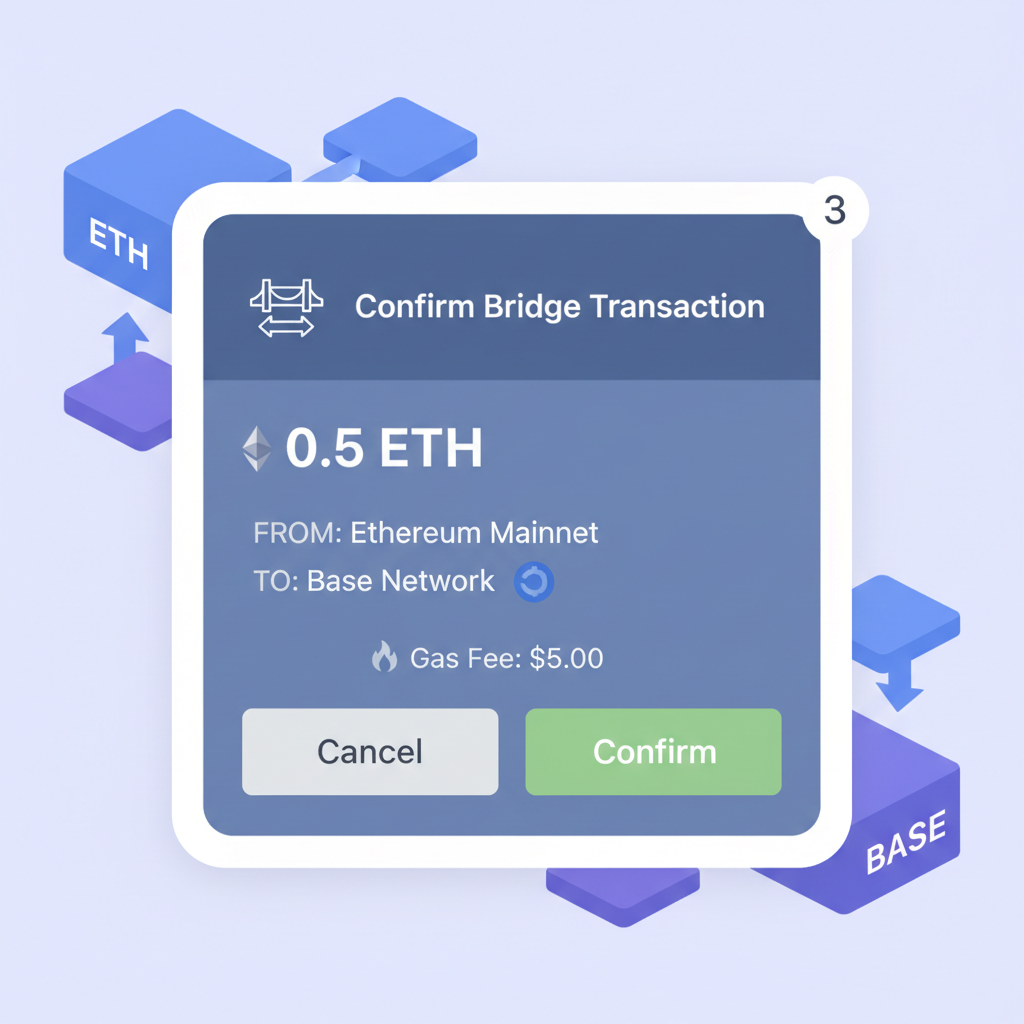

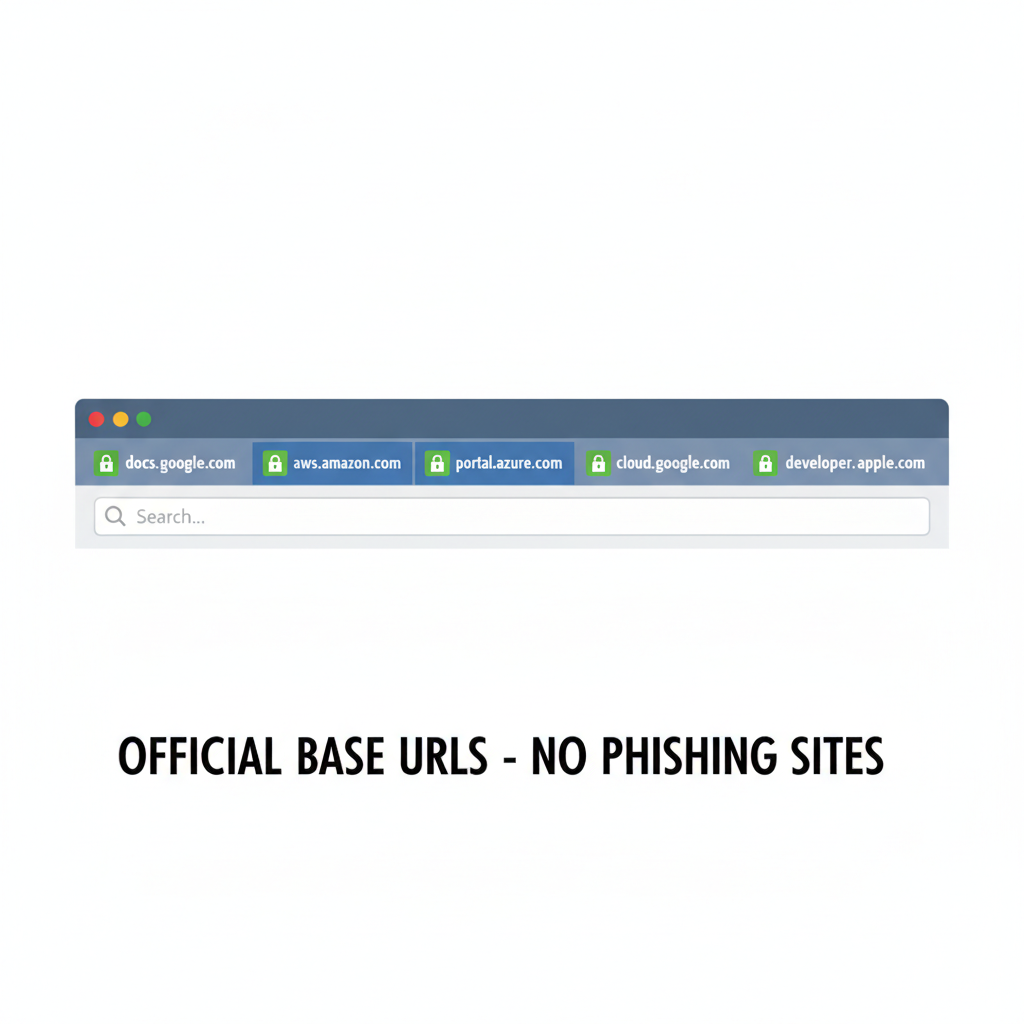

Start clean. Download the official Base App or use Base-compatible wallets like Coinbase Wallet. Bridge 0.01-0.1 ETH via the official bridge at bridge. base. org – gas is pennies. Verify URLs; scams lurk everywhere.

- Connect your wallet to Base explorer (basescan. org) for transparency.

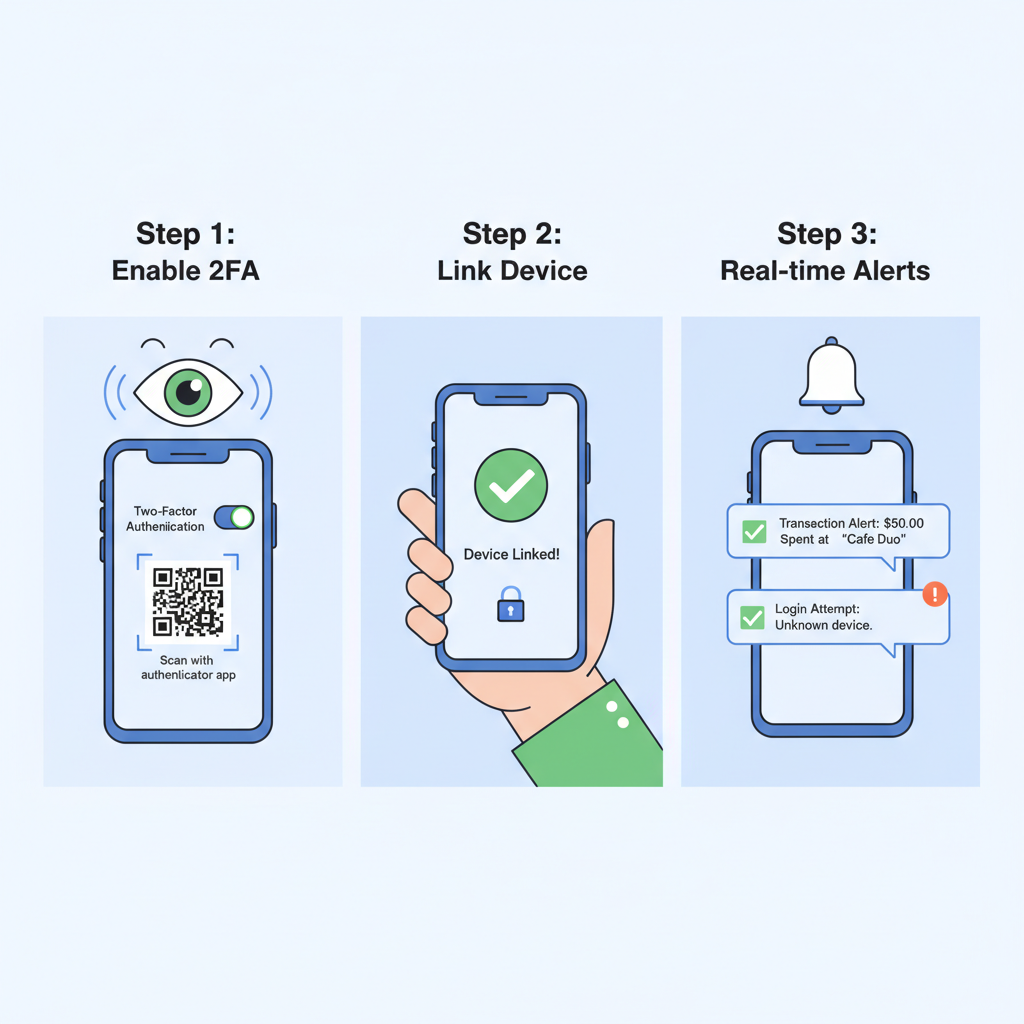

- Enable two-factor on exchanges; never share seeds.

- Track activity via DeFiLlama or Dune dashboards.

This foundation prevents 90% of risks. Once bridged, you’re live on Base, ready for points accrual.

Core Activities to Rack Up Airdrop Points

Diversify to mimic organic use. Swap on Aerodrome and Uniswap V3 – provide liquidity in stable pairs like USDC/ETH for fees plus points. Mint an NFT on Zora; even free drops count as interaction. Join Base Guild for daily quests: predict markets on Polymarket, lend on platforms like Moonwell.

Frequency trumps volume. Aim for 5-10 tx/week: swaps, LP adds, NFT mints. This evades detection while qualifying for multi-project airdrops. Per recent guides, prediction markets and DeFi yield farms yield highest multipliers.

Base Token (BASE) Price Prediction 2027-2032

Post-Airdrop Scenarios: Realistic Projections Based on Adoption, Market Cycles, and Coinbase Ecosystem Growth

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.75 | $2.10 | $4.50 | +110% (from 2026 est. $1.00) |

| 2028 | $1.20 | $3.80 | $7.20 | +81% |

| 2029 | $1.80 | $5.50 | $11.00 | +45% |

| 2030 | $2.50 | $8.00 | $15.50 | +45% |

| 2031 | $3.20 | $11.20 | $22.00 | +40% |

| 2032 | $4.00 | $15.00 | $30.00 | +34% |

Price Prediction Summary

Following the anticipated 2026 airdrop and token launch, BASE is poised for strong growth driven by Base chain’s rising TVL, Coinbase user onboarding, and DeFi/NFT ecosystem expansion. Average prices are projected to grow progressively from $2.10 in 2027 to $15.00 by 2032, with min/max reflecting bearish corrections and bullish adoption surges. Overall bullish outlook tempered by L2 competition and macro cycles.

Key Factors Affecting Base Token Price

- Mass adoption via Coinbase retail users and Base App integrations

- Post-airdrop liquidity and farming rewards boosting TVL

- Regulatory clarity for U.S.-based L2s enhancing confidence

- Technological upgrades like improved scalability and ZK proofs

- Market cycles: Bull runs in 2028-2029 and 2031-2032

- Competition from Arbitrum, Optimism, and Solana ecosystems

- Sybil-resistant airdrop mechanics ensuring fair distribution

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Pro tip: Use hardware wallets for sums over $500. Monitor COIN at $164.32 as a sentiment proxy – its 24h high of $167.65 hints at more Base hype ahead. Next, we’ll dive into advanced protocols and scam shields.

| Activity | Points Potential | Risk Level |

|---|---|---|

| Bridge ETH | Medium | Low |

| Aerodrome LP | High | Medium |

| Zora Mint | Low-Medium | Low |

Layer deeper with prediction markets on Polymarket – bet small on events tied to crypto sentiment. Each wager logs on-chain proof of activity, stacking base chain eligibility guide points. Lend stables on Moonwell; yields compound while qualifying for dual rewards. These aren’t gimmicks; they’re ecosystem pillars where retail volume signals commitment.

Daily Routine for Consistent Safe Base Points Farming

Consistency beats intensity. Script your week: Monday swaps on Aerodrome, Wednesday Zora mints, Friday Polymarket plays. Track via Base Guild dashboard – quests refresh daily, offering 2x multipliers for completers. With COIN holding at $164.32 after a 24h low of $144.48, Base’s momentum favors early, steady farmers over late sprinters.

One wallet keeps it clean. Rotate protocols to spread activity, mimicking a power user. I’ve seen accounts disqualified for 20 and tx/day patterns; space yours for authenticity.

Final Layer: Scam Defense and Long-Term Positioning

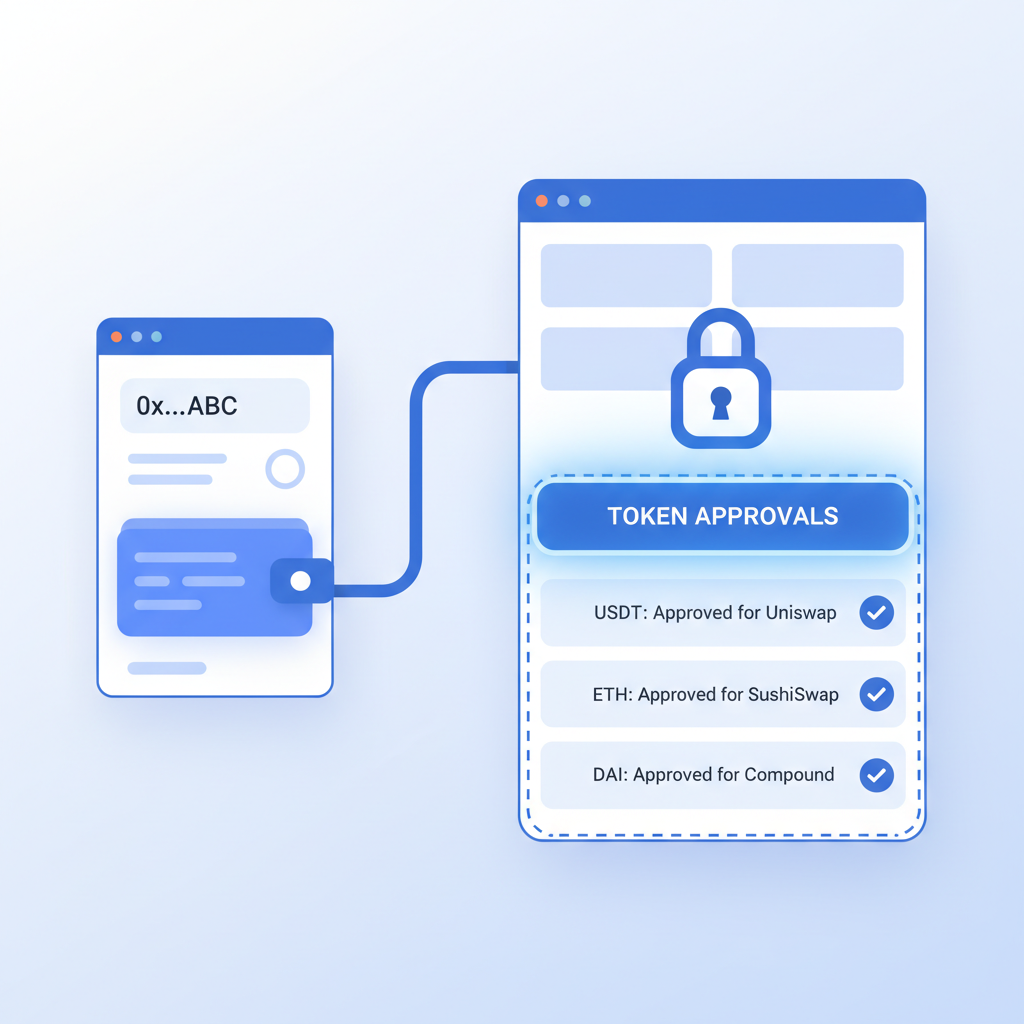

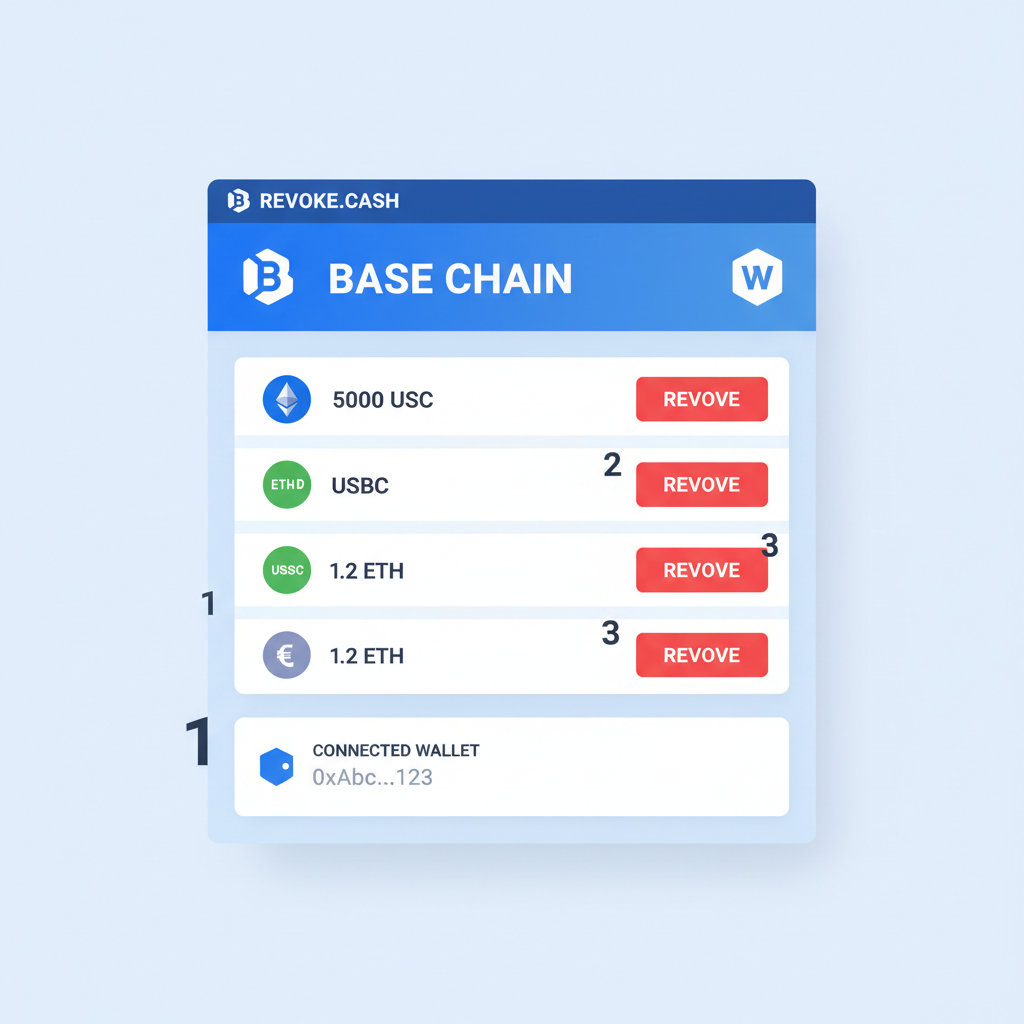

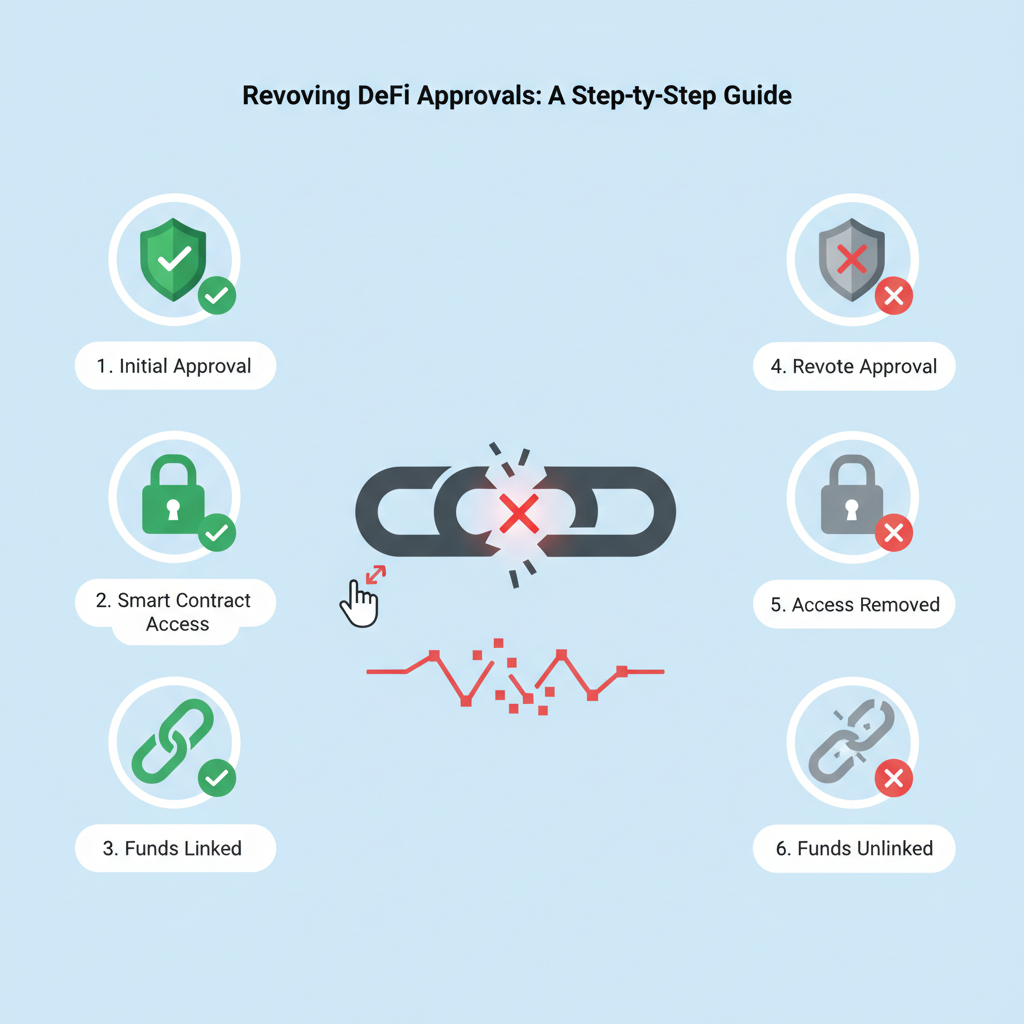

Scams explode during hype. Fake Base apps promise ‘instant points’ – ignore. Stick to bridge. base. org, aerodrome. finance, zora. co. Verify via @base Twitter or base. org. Never approve unlimited spends; revoke via basescan. org/revoke.

- Whitelist dApps only.

- Monitor for phishing via official Discord.

- Use multisig for larger bridges post-$500.

Post-farming, prepare for claims. Snapshots likely reward tx count, volume, diversity. Holding COIN at $164.32? Its 24h high of $167.65 underscores Base’s breakout potential. Diversify into Base token claim prep now.

Retail wins by playing smart, not hard. Bridge today, engage weekly, shield fiercely. As Base scales under Coinbase’s wing, your organic footprint converts to tokens worth thousands. COIN’s 16.47% surge to $164.32 validates the bet – position now, harvest later.

| Protocol | Key Action | Points Multiplier |

|---|---|---|

| Polymarket | Event Bets | 2x |

| Moonwell | Lending | 1.5x |

| Base Guild | Quests | 2-3x |

Equip yourself against Sybil hunters. Projects like Aerodrome cross-check with Nansen labels; genuine retail shines. Farm with intent, and 2026’s coinbase base airdrop 2026 becomes your edge in DeFi’s retail revolution.