In the evolving landscape of decentralized finance on Base, lending USDC has emerged as a cornerstone for retail investors seeking stable, competitive yields without the complexities of traditional yield farming. As of February 13,2026, Coinbase’s seamless integration of the Morpho lending protocol allows users to deposit USDC directly in the app and earn up to 10.8% APY, transforming passive holdings into productive assets on this Ethereum Layer-2 network. This guide breaks down the essentials for everyday users, highlighting lending USDC Base DeFi opportunities tailored for retail participation.

Base’s scalability, backed by Coinbase’s infrastructure, positions it as a prime venue for base DeFi lending retail strategies. USDC, with its peg to the dollar and native support across 29 blockchains including Base, dominates lending pools. Over 87 million unique wallets held USDC by Q1 2025, fueling liquidity in protocols like Aave V3 and Morpho. Yields accrue from borrowers posting overcollateralized crypto assets, creating a market where suppliers like you earn interest dynamically.

Mechanics of Lending Protocols on Base

DeFi lending protocols function as peer-to-pool marketplaces, where depositors supply USDC to earn yields while borrowers access liquidity against collateral such as ETH or BTC variants. On Base, these platforms optimize for low fees and high efficiency. A typical flow involves depositing USDC into a lending pool, receiving aTokens or similar receipts that accrue interest in real-time, and withdrawing principal plus earnings at any moment, subject to liquidity availability.

Risk controls, including liquidation thresholds at 80-85% loan-to-value ratios, safeguard lenders, though smart contract vulnerabilities remain a consideration.

Morpho, now embedded in Coinbase, refines this model with peer-to-peer matching for better rates, often exceeding Aave’s pool-based averages. This hybrid approach minimizes slippage and boosts base blockchain DeFi yields for retail users, who can start with as little as $10.

USD Coin (USDC) Price Prediction 2027-2032

Forecasts for USDC price stability in the context of Base DeFi lending protocols, considering peg maintenance amid market cycles and adoption growth

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.96 | $1.00 | $1.02 |

| 2028 | $0.97 | $1.00 | $1.025 |

| 2029 | $0.98 | $1.00 | $1.03 |

| 2030 | $0.985 | $1.00 | $1.035 |

| 2031 | $0.99 | $1.00 | $1.04 |

| 2032 | $0.995 | $1.00 | $1.045 |

Price Prediction Summary

USDC is projected to robustly maintain its $1.00 peg through 2027-2032, with minimum prices capturing bearish depeg risks from regulatory shocks or liquidity crunches (improving over time with enhanced stability), average prices holding steady at parity, and maximum prices reflecting bullish premiums from surging DeFi lending demand on Base and broader adoption. Year-over-year changes near 0%, underscoring stablecoin reliability.

Key Factors Affecting USD Coin Price

- Growing DeFi lending volumes on Base (e.g., Morpho, Aave integrations boosting demand)

- Regulatory advancements favoring regulated stablecoins like USDC from Circle

- Technological upgrades in L2 liquidity and cross-chain support reducing depeg risks

- Market cycles: Bull markets increase premiums, bear markets test peg floors

- Competition from USDT and emerging stablecoins impacting supply dynamics

- Macro factors: USD strength, reserve audits, and black swan events (e.g., banking crises)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why Morpho and Aave V3 Lead Base DeFi Lending

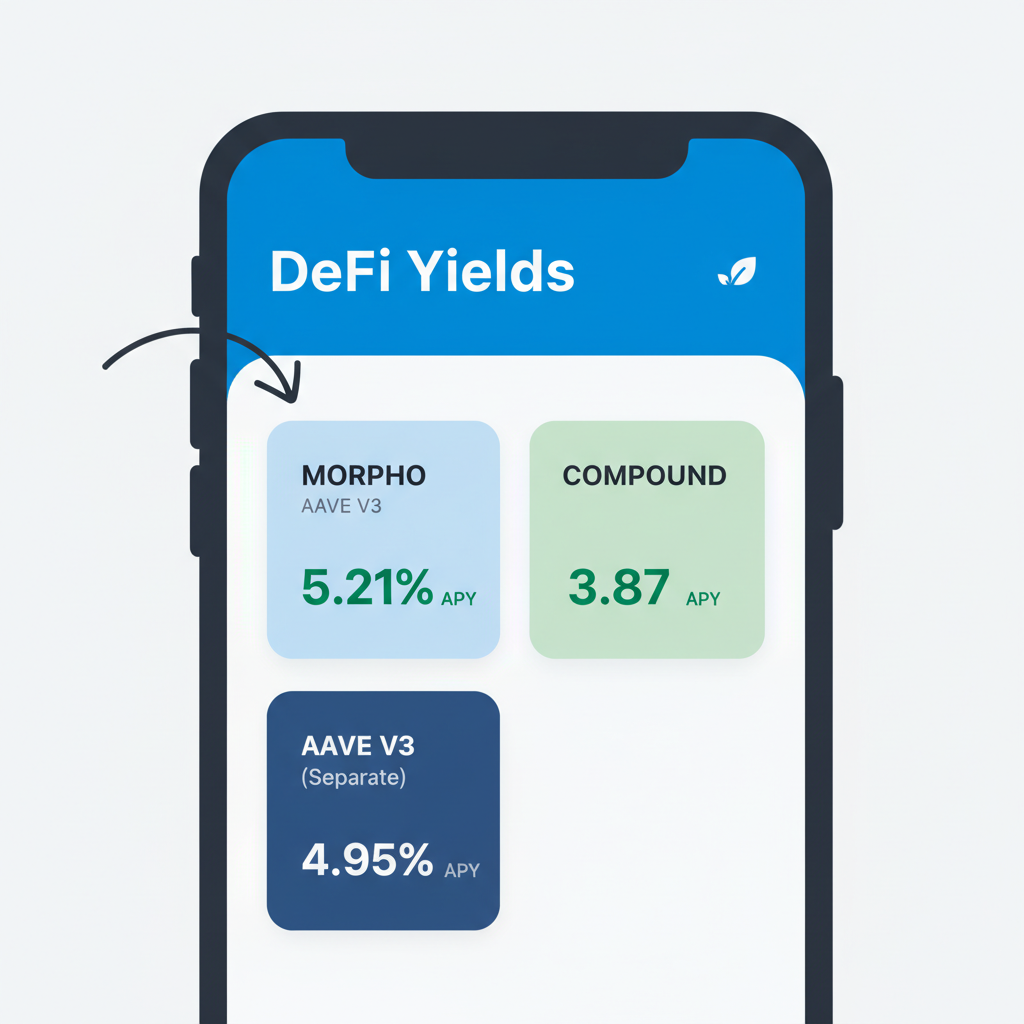

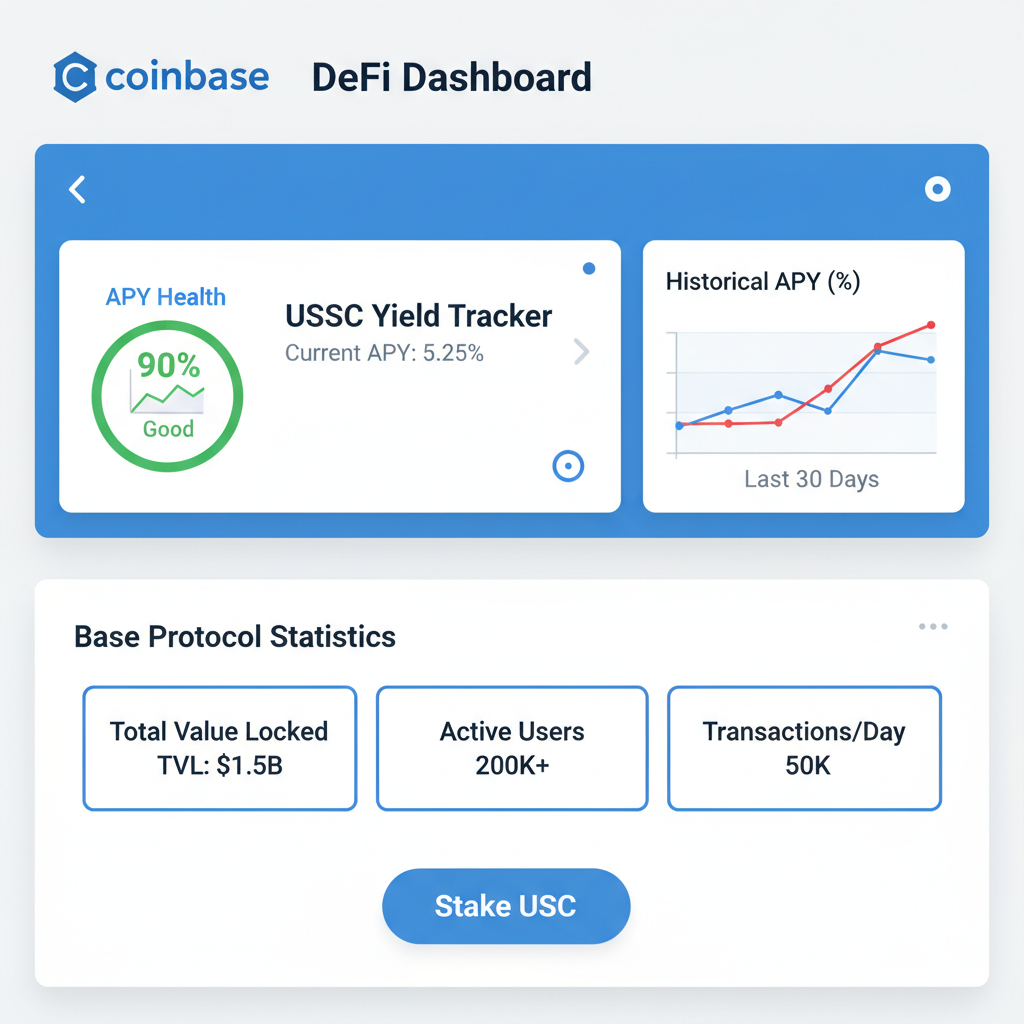

Morpho stands out for its permissionless vaults and optimized lending, powering Coinbase’s crypto-backed USDC loans. Retail investors benefit from one-tap deposits yielding up to 10.8% APY, far surpassing traditional savings accounts. Aave V3, meanwhile, hosts popular pools for USDC, WETH, and cbBTC staking, with USDC as the top asset by total value locked.

Coinbase’s Stablecoin Bootstrap Fund further bolsters these protocols by injecting liquidity into Morpho and Aave on Base, reducing borrow rates and enhancing stability. For safe USDC lending Base, these integrations lower entry barriers, enabling seamless onchain earning without wallet swaps or gas fee worries.

Navigating Yields and Risks in 2026

Current market dynamics show USDC lending APYs fluctuating between 5-11%, influenced by borrow demand and protocol incentives. Multichain Bridged USDC (Fantom) trades at $0.0187, reflecting niche bridged variants, but core USDC maintains its peg, ensuring predictable principal returns. Strategic lenders monitor utilization rates above 80% for peak yields, yet diversify across protocols to mitigate temporary illiquidity.

While yields tempt, impermanent loss in paired pools or oracle failures pose risks. Opinion: Prioritize audited protocols like those on Base, where Coinbase oversight adds a layer of trust absent in wilder chains. Retail success hinges on starting small, understanding liquidation cascades, and reinvesting earnings compoundingly.

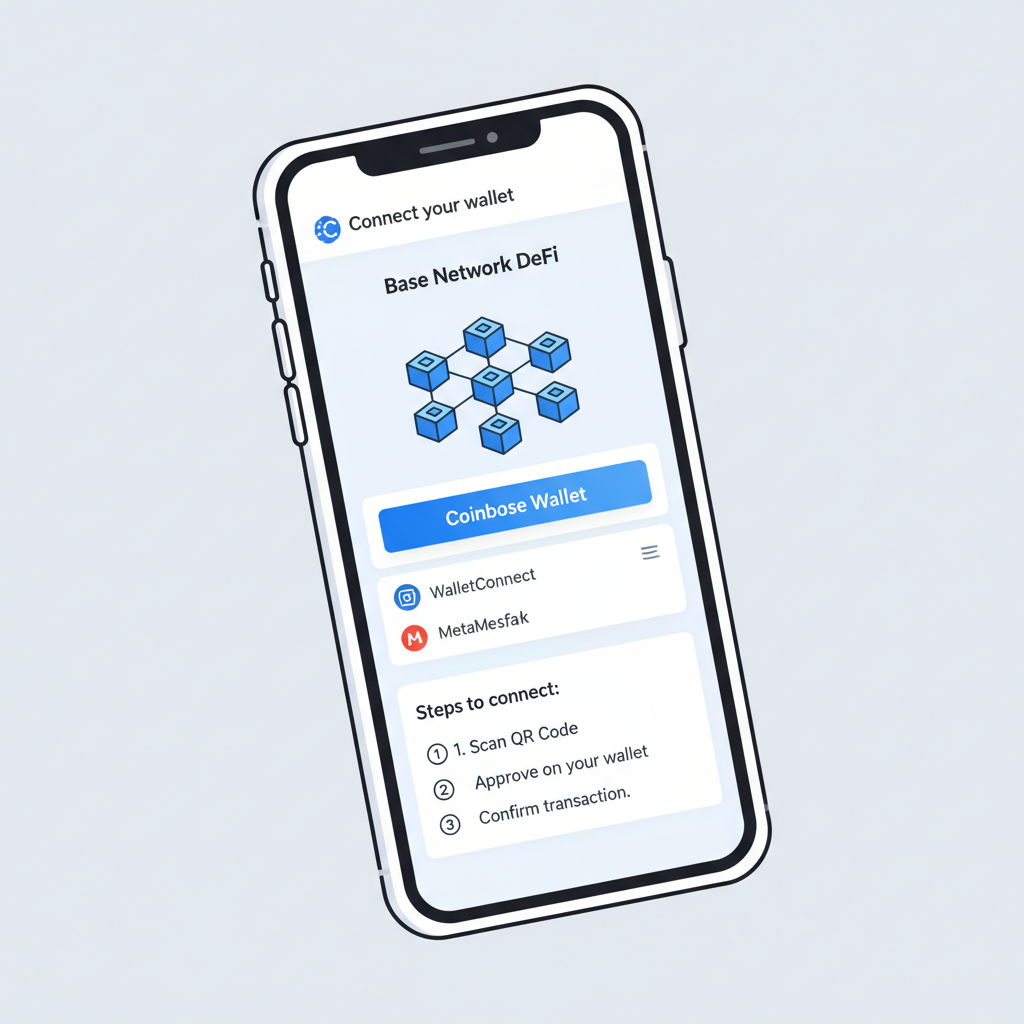

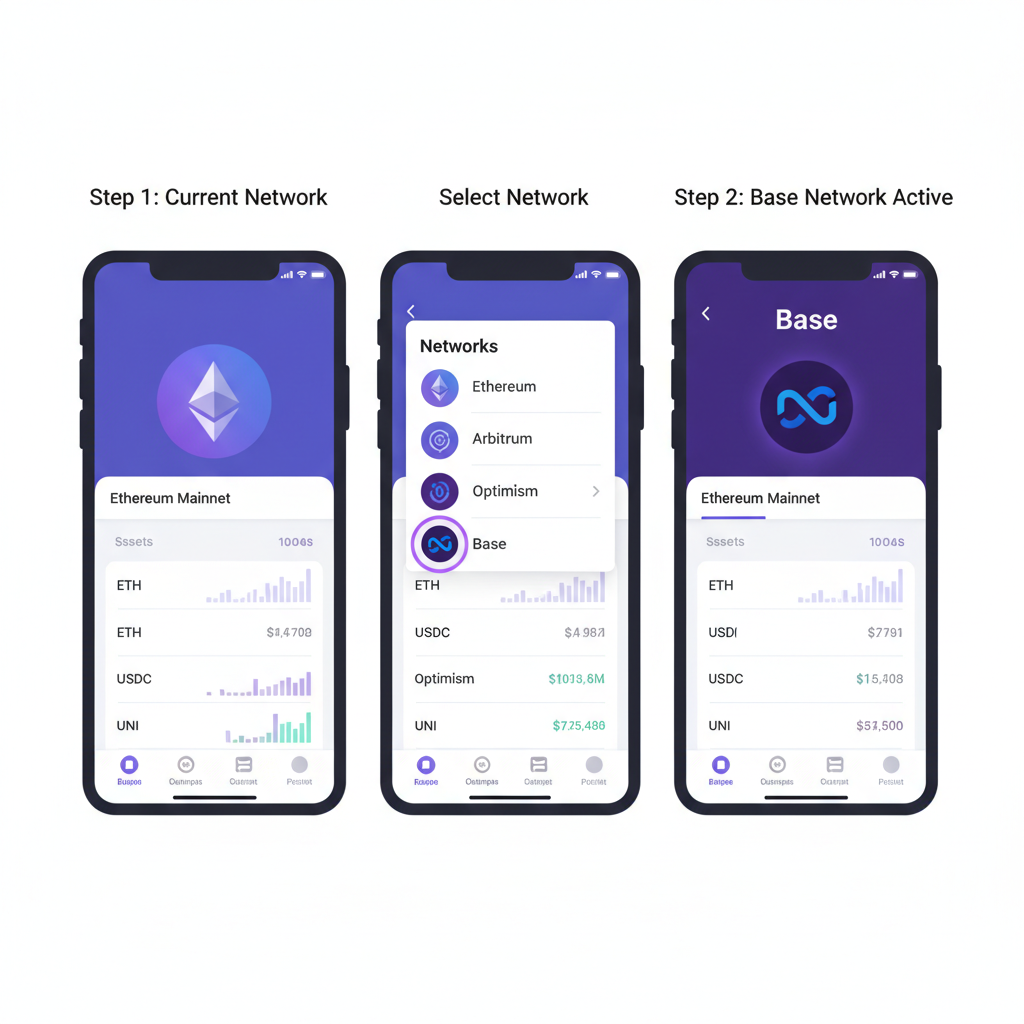

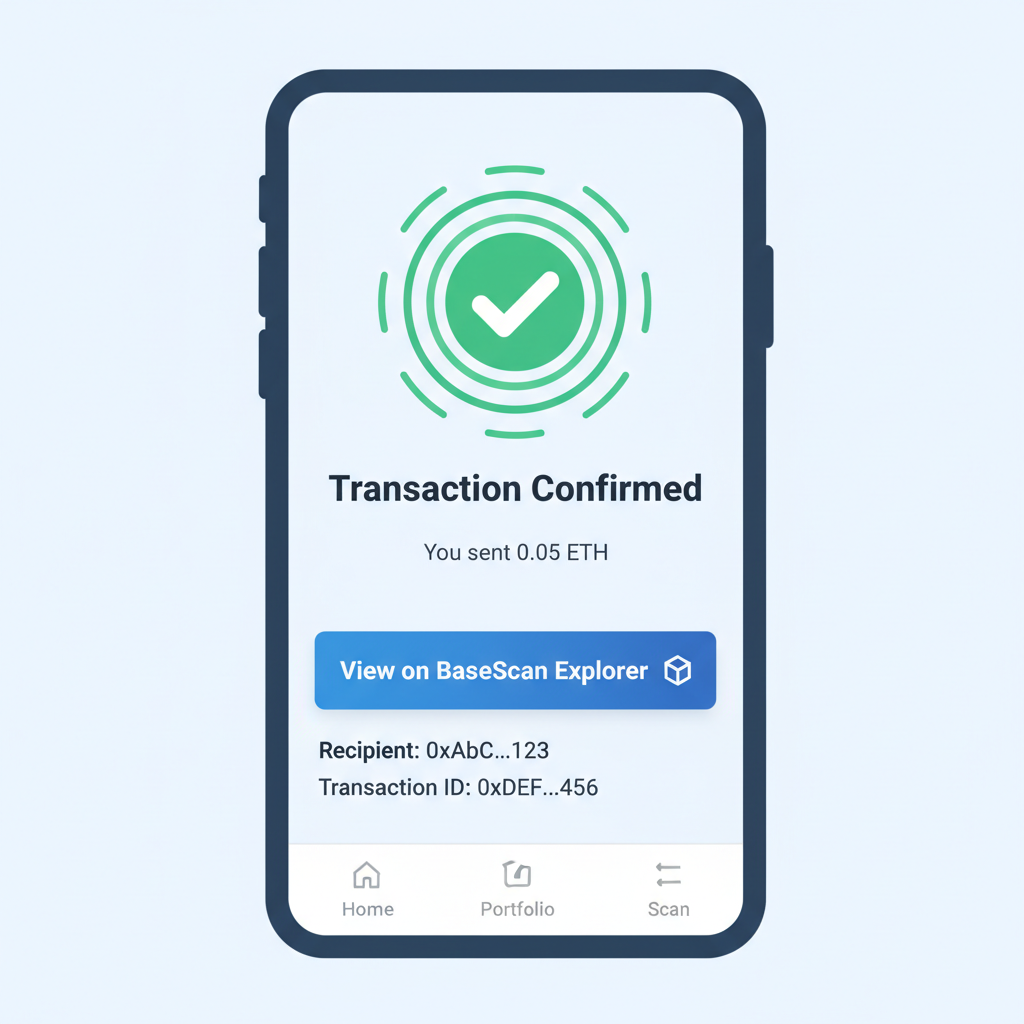

To get started, connect your Coinbase wallet, select USDC, and supply to Morpho or Aave via the app. Track performance with onchain dashboards, and always DYOR on current rates. This positions you at the forefront of retail DeFi Base protocols, capitalizing on Base’s growth trajectory.

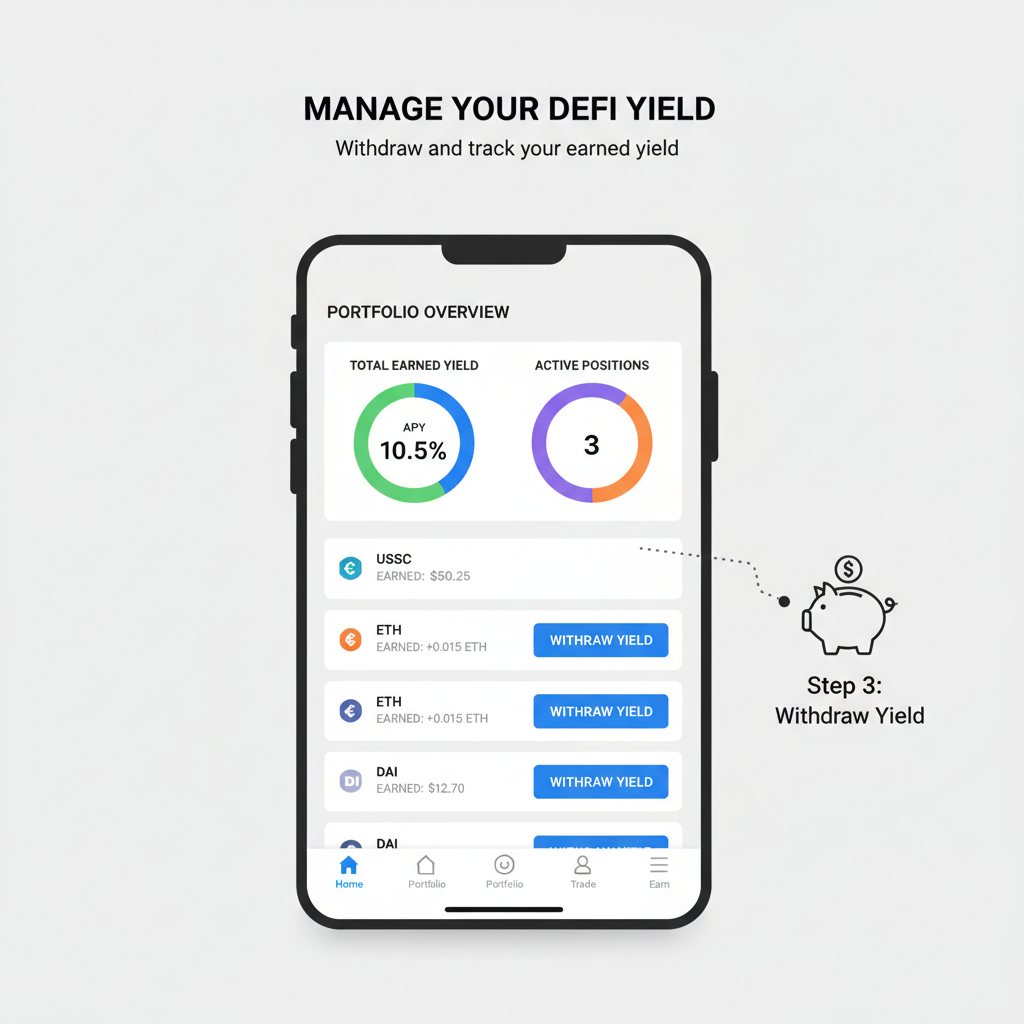

Expanding on that foundation, let’s dissect the practical steps and comparative edges that define lending USDC Base DeFi success. Retail investors thrive by layering strategies atop these protocols, blending automation with vigilant monitoring to capture upside while sidestepping pitfalls.

Step-by-Step: Depositing USDC into Base Lending Pools

Once deposited, your USDC generates aTokens in Aave or vault shares in Morpho, compounding yields continuously. Withdrawals remain flexible, but high utilization periods demand patience for full liquidity. This process, streamlined by Coinbase, circumvents the usual DeFi friction, making base DeFi lending retail accessible even for those juggling day jobs and portfolios.

In my view, Morpho’s peer-to-peer optimization edges out pure pool models during low-volume stretches, delivering tighter spreads. Pair this with Aave’s battle-tested risk engine, and you’ve got a duo that anchors safe USDC lending Base portfolios.

Protocol Comparison: Yields, TVL, and Retail Fit

Morpho vs Aave V3 on Base: USDC Lending Comparison

| Protocol | Current USDC APY | TVL | Utilization Rate | Min Deposit | Key Risks |

|---|---|---|---|---|---|

| Morpho | 10.8% | $850M | 88% | None | Protocol complexity ⚠️, High utilization 🔥 |

| Aave V3 | 8.2% | $2.1B | 75% | None | Oracle risks 🔭, Liquidation cascades 💥 |

Reviewing the table reveals Morpho’s lead in raw APY at up to 10.8%, fueled by Coinbase’s liquidity injections via the Stablecoin Bootstrap Fund. Aave V3 counters with deeper pools, ideal for scaling positions beyond $1,000. Both hover around 80% utilization, signaling robust borrow demand without overextension. For retail, prioritize Morpho for quick entries, Aave for long-haul stability.

These metrics shift with market pulses; a surge in ETH collateral borrowing, for instance, lifts USDC rates. Track via DefiLlama or protocol dashboards, adjusting allocations quarterly. Diversification here isn’t optional; it’s the adaptive edge that turns volatile yields into steady compounding.

Risks warrant nuance beyond surface warnings. Smart contract exploits, though rare on audited Base protocols, underscore the need for insurance like Nexus Mutual. Oracle divergences could trigger premature liquidations, yet Base’s sequencer uptime minimizes this. Peg deviations in bridged variants, like Multichain Bridged USDC (Fantom) at $0.0187, highlight why sticking to native USDC matters. Strategically, cap exposure at 20-30% of your crypto stack, harvesting yields monthly to derisk.

Forward-looking, Base’s TVL trajectory, bolstered by USDC’s 87 million wallets, points to sustained base blockchain DeFi yields. Coinbase’s Morpho push, alongside Aave expansions, could normalize 8-12% APYs as adoption scales. Retail pioneers who master these now position for protocol airdrops and governance perks, amplifying returns organically.

Layer in tactics like auto-compounding via Beefy or yield aggregators on Base for hands-off gains. Monitor borrow APRs; when they spike past 12%, that’s your signal to supply more USDC. This isn’t set-it-and-forget-it; it’s strategic rotation attuned to onchain flows. For retail DeFi Base protocols, the payoff lies in blending Coinbase ease with DeFi potency, forging yields that outpace fiat alternatives year after year.

Armed with these insights, dive in judiciously. Base DeFi rewards the prepared, turning USDC from static savings into a dynamic engine for wealth building.