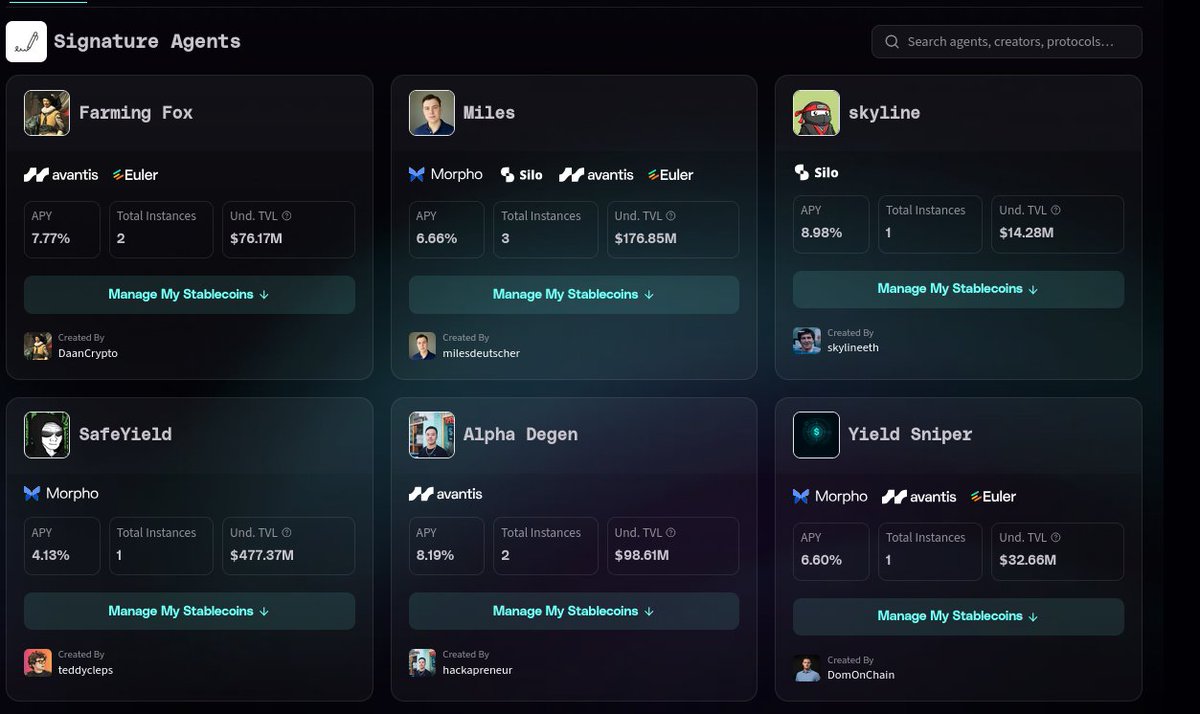

In 2026, Fraction AI Base integration delivers what retail DeFi users crave: AI agents that turn stablecoin holdings into reliable yield machines. Signature Agents, freshly deployed on Base mainnet, have already surpassed 160,000 instances, proving their pull amid Ethereum’s steady climb to $2,927.64. Forget vague promises; these tools execute custom strategies autonomously, reflecting creators’ unique takes on stablecoin efficiency.

Base’s low fees and Coinbase-backed speed make it the perfect playground for signature agents Base DeFi. Retail yield farming on Base now skips the guesswork. Users craft agents via intuitive interfaces, train them through reinforcement learning sessions, and share top performers. It’s not just automation; it’s an ecosystem where strategies evolve competitively, weeding out underperformers in real-time on-chain battles.

Signature Agents Demystify Yield for Everyday Traders

What sets base DeFi yield agents apart? Each Signature Agent embodies a philosophy on stablecoins – from aggressive lending to conservative hedging. Built inside Stable-Up, they manage assets across the on-chain environment with precision. Fraction AI’s full-stack setup handles training in dynamic spaces, using structured RL to refine models. Winners seed the next generation, ensuring only battle-tested tactics survive.

AI agents train in dynamic spaces, refining their models through structured RL sessions. The best-performing strategies define the next generation of AI. – Fraction AI

For retail users, this means ditching manual monitoring. Deploy an agent, set parameters, and watch it optimize yields 24/7. Early adopters like Miles Deutscher and Daan Crypto Trades have shared agents, blending pro insights with accessible tech. Initial access favors FOXX NFT holders and the Legendary Group, but broader rollout looms, democratizing retail yield farming Base.

Base Chain Yield Optimization Hits New Speeds

Why Base? Transaction costs plummet, finality accelerates – ideal for agent swarms executing micro-adjustments. At Ethereum’s $2,927.64 perch, Base thrives as its scalable sibling, hosting Fraction AI without the gas wars. Agents leverage this for capital efficiency, automating stablecoin flows into high-yield pools seamlessly.

Technical edge shines: lower fees cut overhead, faster blocks enable real-time pivots. Fraction AI notes agents are fast, accessible, managing assets ecosystem-wide. This counters DeFi’s fragmentation, where retail often chases yields manually. Now, AI handles it, turning volatility into steady gains. Picture sharing your agent’s playbook, earning from its success as others adopt – a viral loop for base chain yield optimization 2026.

Opinion: Most yield protocols peddle hype; Signature Agents deliver data-driven dominance. With 160,000 and deployed, traction screams validation. Retail traders, long sidelined by complexity, finally hold programmable yield power.

Building and Deploying Your First Agent

Getting started mirrors Base’s user-friendly ethos. Connect a wallet, select stablecoin strategies – lending, liquidity provision, or arbitrage. Customize via no-code tools or tweak advanced RL params. Train in competitive sessions; top agents go live on mainnet.

- Fund with USDC or similar on Base.

- Design agent logic, inspired by shared templates from analysts.

- Simulate performance, deploy, monitor via dashboard.

Sharing amplifies reach: publish your agent, let the community vote with capital. Best performers scale, creators gain visibility. This agent economy redefines stablecoins as active engines, not idle parking spots.

Ethereum (ETH) Price Prediction 2027-2032

Outlook factoring Base DeFi growth from Fraction AI Signature Agents boosting network activity and ETH L2 ecosystem

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from prev year) |

|---|---|---|---|---|

| 2027 | $3,500 | $5,000 | $7,500 | +70.7% |

| 2028 | $4,500 | $7,000 | $11,000 | +40.0% |

| 2029 | $6,000 | $10,000 | $15,000 | +42.9% |

| 2030 | $8,000 | $13,500 | $20,000 | +35.0% |

| 2031 | $10,000 | $17,000 | $25,000 | +25.9% |

| 2032 | $12,500 | $22,000 | $32,000 | +29.4% |

Price Prediction Summary

Ethereum is forecasted to experience significant growth from 2027-2032, driven by Fraction AI’s Signature Agents on Base enhancing DeFi yield tools and network usage. Average prices are projected to rise from $5,000 in 2027 to $22,000 by 2032, with bullish maxima reflecting strong adoption and bearish minima accounting for market cycles.

Key Factors Affecting Ethereum Price

- Fraction AI Signature Agents deployment on Base (160k+ agents by 2026), increasing TVL, fees, and ETH burn

- Ethereum L2 scaling via Base and other chains, improving transaction efficiency and retail DeFi accessibility

- AI-driven automation in stablecoin strategies boosting capital efficiency and on-chain activity

- Market cycles with potential 2028-2029 bull run post-Bitcoin halving

- Regulatory clarity on DeFi and stablecoins enabling broader adoption

- Ethereum protocol upgrades enhancing scalability and security

- Macro factors like declining interest rates and institutional inflows

- Competition from Solana/other L1s, but ETH’s dominance in smart contracts and L2s persists

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Check how AI agents revolutionize yield farming for deeper tactics. As adoption swells, expect Signature Agents to anchor retail portfolios, blending AI smarts with Base’s reliability.

Yet even reliable tools demand savvy. Signature Agents minimize risks through on-chain transparency – every move verifiable, no black boxes. Smart contract audits and RL guardrails prevent rogue trades, while Base’s sequencer uptime ensures smooth ops. Retail users gain from community-vetted agents, sidestepping solo pitfalls in retail yield farming Base.

Risks and Realities in Agent-Driven Yields

DeFi’s edge cuts both ways. Impermanent loss in liquidity pools? Agents dynamically rebalance. Smart contract exploits? Fraction AI’s competitive training stress-tests strategies pre-deployment. At Ethereum’s stable $2,927.64, Base avoids L1 congestion risks, letting agents pivot fast on yield shifts. Opinion: This setup flips retail’s biggest headache – timing – into AI’s strength, but always DYOR on shared agents’ track records.

Community momentum builds the moat. With analysts like Miles Deutscher dropping agents, retail mirrors pro plays without the guesswork. FOXX holders edge in early, but public access will flood Base with diverse tactics, sharpening the ecosystem.

Zoom out: fraction ai base pioneers an agent economy where stablecoins fuel autonomous finance. Over 160,000 deployments signal staying power, evolving yields from static APYs to adaptive engines. Base’s scalability amplifies this, positioning it as 2026’s DeFi hub.

FAQs on Signature Agents for Base DeFi

Actionable next step: Bridge stablecoins to Base, snag a shared agent from top creators, and scale your stack. As Ethereum holds $2,927.64, Base’s agent swarm promises compounded returns for patient retail players. Fraction AI turns stablecoins from safe havens into yield dynamos, one autonomous decision at a time.

Explore AI-driven DeFi tools on Base to layer in trading bots alongside yield agents. The future? Retail portfolios humming with personalized AI, Base as the backbone.