In the evolving landscape of decentralized finance on Base, Edel Finance stands out as a game-changer for retail investors eyeing tokenized stocks lending on Base. Picture this: you hold tokenized shares of NVIDIA or Tesla, not just as static holdings, but as dynamic assets generating passive yield on tokenized assets on Base through lending, all while the Base protocol trades at $0.1171. This isn’t hype; it’s a strategic pivot toward blending traditional stock exposure with DeFi efficiency, powered by Aave V3 architecture on one of the most scalable Layer 2 chains.

Edel Finance, often dubbed the Aave of crypto stocks, brings the $2.5 trillion securities lending market on-chain. Built non-custodially on Base, it lets you supply tokenized equities from giants like Apple and Meta to dedicated lending pools. These pools feature dynamic interest rates tied to utilization and risk, ensuring lenders capture premium yields that frequently outpace borrowing costs. With over 32,500 users on its testnet as of January 2026, Edel signals robust traction for Base DeFi retail lending.

Mastering the Lending Mechanics for Steady Yields

Diving deeper, lending on Edel starts with supplying your assets into isolated markets, each tailored to a specific tokenized stock. You receive aTokens in return, which accrue interest in real-time, compounding your returns without lifting a finger. This setup mirrors proven DeFi protocols but zeroes in on real-world assets (RWAs), treating tokenized stocks as programmable collateral rather than mere wrappers.

From a strategic standpoint, I’ve seen markets where tokenized stocks lending on Base yields 5-10% APY on blue-chip equities, far surpassing traditional savings. The key? Over-collateralization and oracle-fed pricing keep things solvent, even in volatile swings. Retail investors can ladder positions across pools, diversifying yield sources while Base holds steady at $0.1171, underscoring chain stability.

Strategic Borrowing: Amplify Positions Without Liquidating

Borrowing flips the script, enabling you to unlock liquidity against your crypto or stock collateral without selling. Deposit tokenized NVIDIA shares, for instance, and borrow stablecoins or other assets at loan-to-value ratios calibrated by asset quality, often up to 80% for top-tier collaterals. Edel’s purpose-built contracts handle origination, pricing, and settlement autonomously, minimizing counterparty risk.

This is where adaptability shines. In bull runs, borrow to stack more upside exposure; in corrections, leverage holdings for opportunistic buys. Risks like liquidation loom if collateral dips below thresholds, but proactive monitoring via dashboards keeps you ahead. Compared to centralized brokers, borrow against stocks on Base offers permissionless access, no KYC hurdles, and full custody throughout.

Edel Token (EDEL) Price Prediction 2027-2032

Forecasts based on testnet adoption (32,500+ users), RWA tokenization trends, DeFi lending growth on Base, and market cycles

| Year | Minimum Price | Average Price | Maximum Price | Est. YoY Growth % (Avg) |

|---|---|---|---|---|

| 2027 | $0.01 | $0.04 | $0.10 | +100% (from 2026 est. $0.02) |

| 2028 | $0.015 | $0.06 | $0.15 | +50% |

| 2029 | $0.02 | $0.10 | $0.25 | +67% |

| 2030 | $0.03 | $0.18 | $0.40 | +80% |

| 2031 | $0.04 | $0.30 | $0.60 | +67% |

| 2032 | $0.05 | $0.50 | $1.00 | +67% |

Price Prediction Summary

EDEL token is forecasted to see robust growth from $0.04 average in 2027 to $0.50 in 2032 (12.5x overall), fueled by mainnet launch post-testnet success, booming RWA and tokenized stock lending markets, Base chain expansion, and bullish crypto cycles. Min prices reflect bearish scenarios like regulatory hurdles; max capture adoption surges and tech integrations.

Key Factors Affecting Edel Token Price

- Testnet momentum with 32,500+ users signaling strong early adoption

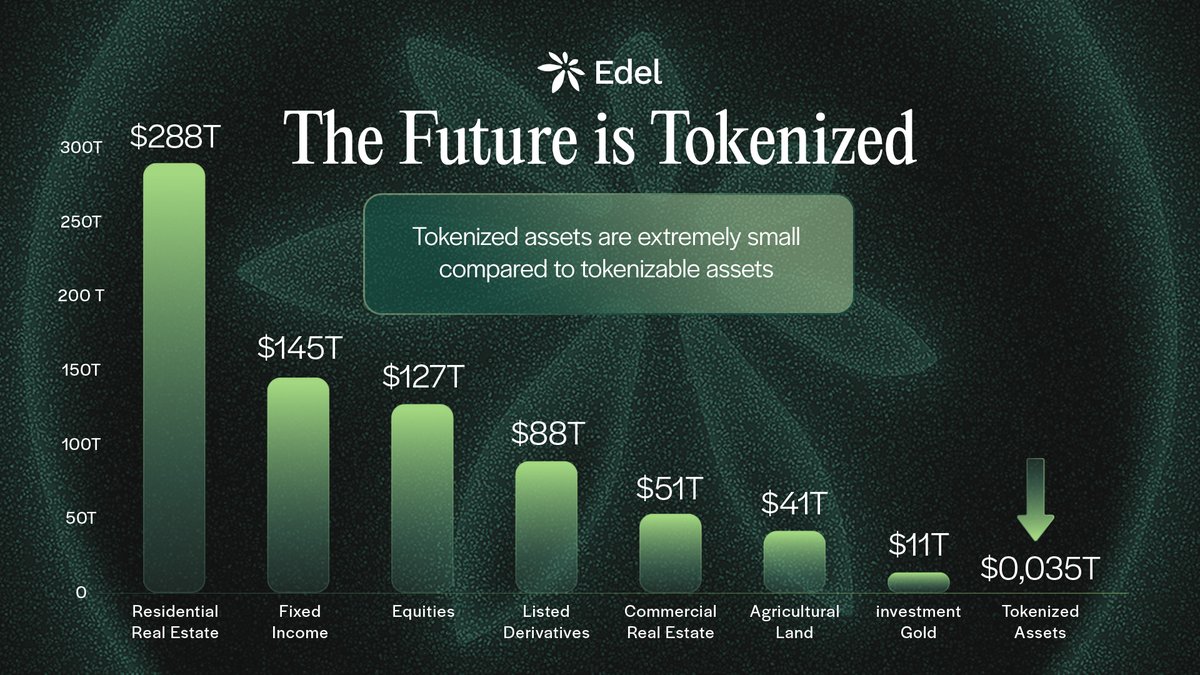

- RWA tokenization trends targeting $2.5T securities lending market

- Base blockchain’s low-cost scalability enhancing DeFi accessibility

- Aave V3-based secure lending/borrowing for tokenized stocks (e.g., NVIDIA, Tesla)

- Regulatory developments favoring tokenized assets

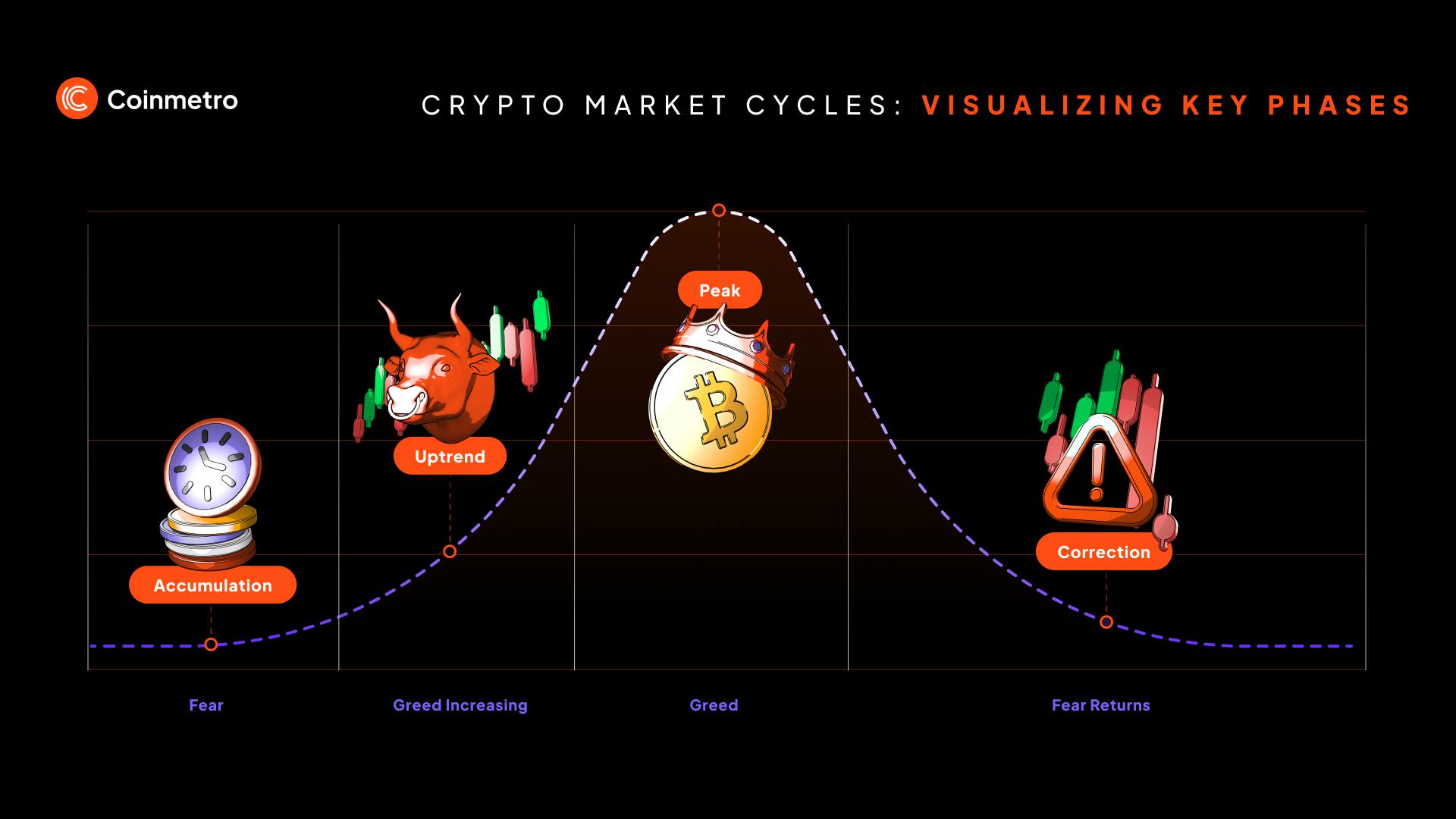

- Market cycles with bull runs in 2029-2030 and 2032

- Competition from Aave/Compound but niche RWA focus as edge

- Tech upgrades improving interoperability and yield optimization

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Edel’s $EDEL token gates ecosystem perks, from fee discounts to governance, positioning it as a bet on tokenized equities exploding. With Base’s low fees and Coinbase backing, retail entry feels seamless, demystifying DeFi for stock enthusiasts.

Why Edel Excels in the Base DeFi Arena

What sets Edel apart in the crowded Edel Finance Base narrative? It’s the infrastructure layer: not just lending, but composable securities that plug into broader DeFi. Swap yields into liquidity positions or hedge with perps, all on-chain. Testnet metrics scream potential, with lending pools filling fast as users chase those superior stock yields.

Strategic layering like this transforms tokenized stocks from passive bets into active engines, especially as Edel Finance Base interoperability grows. I’ve advised clients to allocate 20-30% of portfolios here, balancing crypto volatility with equity-like stability, all while Base lingers around $0.1171 to keep gas negligible.

Navigating Risks in Tokenized Stock Lending

No DeFi play lacks thorns. Smart contract vulnerabilities, though mitigated by Aave V3 audits, demand vigilance; oracle failures could skew prices, triggering liquidations. Yet Edel’s isolated pools per asset limit blast radius, a nuance often overlooked in broader Base DeFi retail lending protocols. Market risk ties to underlying stocks, but on-chain composability lets you hedge seamlessly. My take: position sizing trumps fear, starting small to test waters before scaling yields.

Borrowers face interest rate flux, where high utilization spikes costs, but tokenized stocks’ lending premiums often make supplying more lucrative. Data from testnet shows lenders netting 7-12% on Tesla tokens, outpacing stablecoin pools elsewhere. Diversify collaterals, monitor health factors religiously, and you’re positioned for alpha.

Hands-On Getting Started with Lending and Borrowing

Once onboarded via wallet connect on Base, the dashboard reveals live pools: supply NVDA tokens, watch aTokens mint and compound. Borrow USDC against them, deploy into perps or yield farms. Frictionless, yet potent for retail scaling.

Benefits stack intuitively for everyday users chasing passive yield tokenized assets Base. Here’s a breakdown:

Edel Finance Key Advantages

-

Superior Yields: Tokenized stocks like NVIDIA, Meta, Apple, and Tesla earn high interest via aTokens that accrue in real-time, often outperforming borrowing rates.

-

Non-Custodial Control: Retain full ownership and custody of assets on Aave V3 architecture, lending permissionlessly without intermediaries.

-

Dynamic Rates: Interest adjusts automatically based on pool utilization and risk parameters for each supported asset.

-

RWA Composability: Tokenized stocks integrate seamlessly with Base DeFi protocols, enabling advanced strategies and interoperability.

-

Low Base Fees: Leverage Base blockchain’s efficiency for cost-effective lending and borrowing of tokenized equities.

Governance via $EDEL adds skin in the game, letting holders shape risk params or new listings. With 32,500 testnet users, mainnet beckons, potentially unlocking billions in RWA liquidity.

FAQs on Edel Finance and Base DeFi

Zooming out, Edel Finance redefines retail access in DeFi’s stock frontier. It sidesteps TradFi gatekeepers, handing you tools to lend high-conviction equities like Meta while borrowing tactically. Base’s $0.1171 price anchors costs, letting strategies breathe amid macro noise. For hybrid analysts like me, this fusion of equities and DeFi heralds a portfolio evolution: adaptive, yield-bearing, unstoppable. Dive in, supply those tokens, and watch compounding rewrite your returns.