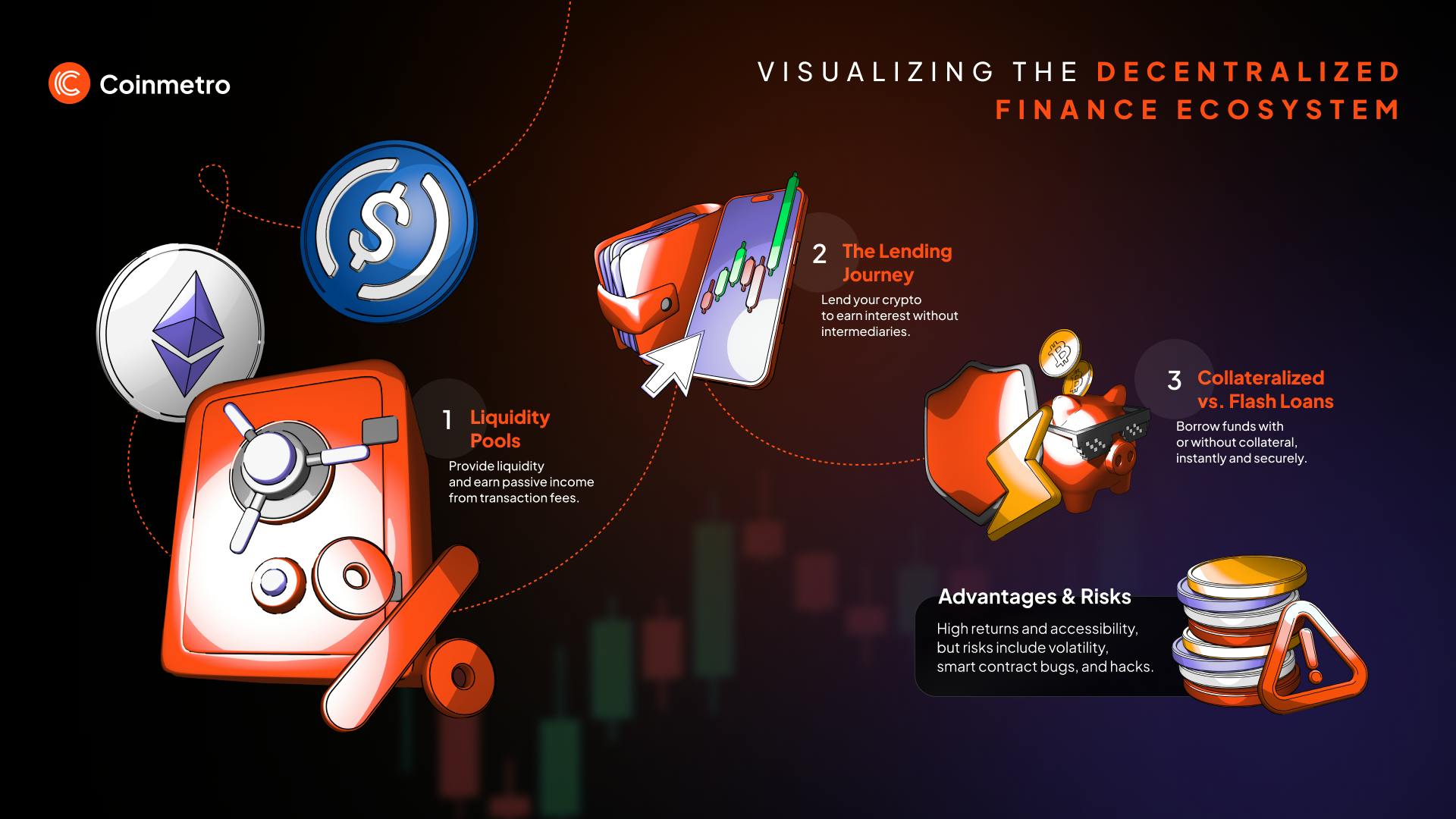

In the bustling world of decentralized finance on Base chain, BaseLend emerges as a beacon for retail investors chasing safe DeFi yields without the usual headaches. With Base Protocol (BASE) trading at $0.1191 after a 24-hour dip of $0.0374, or -0.2391%, the platform offers a stable entry point into lending. Imagine depositing stablecoins or ETH into pools where borrowers pay you interest, all powered by the low-fee, secure Base blockchain from Coinbase. This isn’t wild speculation; it’s structured earning potential tailored for everyday users.

Base chain lending for beginners starts here, blending Ethereum’s robustness with layer-2 speed. Unlike flashier protocols prone to exploits, BaseLend prioritizes overcollateralized loans and automated safeguards, making it ideal for baselend retail defi participation.

Why BaseLend Delivers Reliable Returns for Retail Investors

At its core, BaseLend operates decentralized lending pools where you supply assets like ETH or USDC, earning yields from borrower demand. Deposit 10 ETH into a pool offering 5% APY, and you’re looking at 0.5 ETH in annual interest, compounded seamlessly. This beats traditional savings by miles, especially with Base’s negligible gas fees keeping more profits in your pocket.

What sets it apart? Dynamic interest rates that flex with pool utilization. Low demand? Rates stay modest to attract suppliers. High demand? Yields climb, balancing the market without central control. In my analysis, this mechanism has kept BaseLend’s APYs competitive, often 4-8% on stables, even amid market wobbles. Sources like CoinGecko highlight Seamless Protocol’s innovations, but BaseLend’s native integration takes it further for base blockchain retail lending.

Smart Contracts: The Engine of Security and Efficiency

BaseLend’s smart contracts handle everything from fund allocation to repayments, eliminating middlemen. If a borrower’s collateral dips below thresholds, automatic liquidations kick in, protecting lenders. This self-executing logic, audited rigorously, mitigates smart contract vulnerabilities that plague lesser protocols, as noted in Zellic’s risk guides.

For retail users, this means peace of mind. No manual monitoring; the code does the heavy lifting. Cross-chain compatibility with Ethereum, Polygon, and Binance Smart Chain expands your asset options, letting you lend what you hold without clunky bridges. Yet, sticking to Base keeps things simple and cheap, aligning with coinbase base defi guide principles.

Risks persist, of course: market volatility can swing collateral values, and while BaseLend’s track record shines, no DeFi is risk-free. ChainPort’s safety primer echoes this, urging protocol audits and diversification. I recommend starting small, perhaps linking to easy Base DeFi onboarding for wallet setup.

Governance and the Power of BASE Token

Holding BASE tokens isn’t just about the $0.1191 price tag; it’s your vote in the DAO. Propose rate tweaks, new pools, or upgrades, shaping BaseLend’s future. This democratic edge fosters community trust, a rarity in lending platforms.

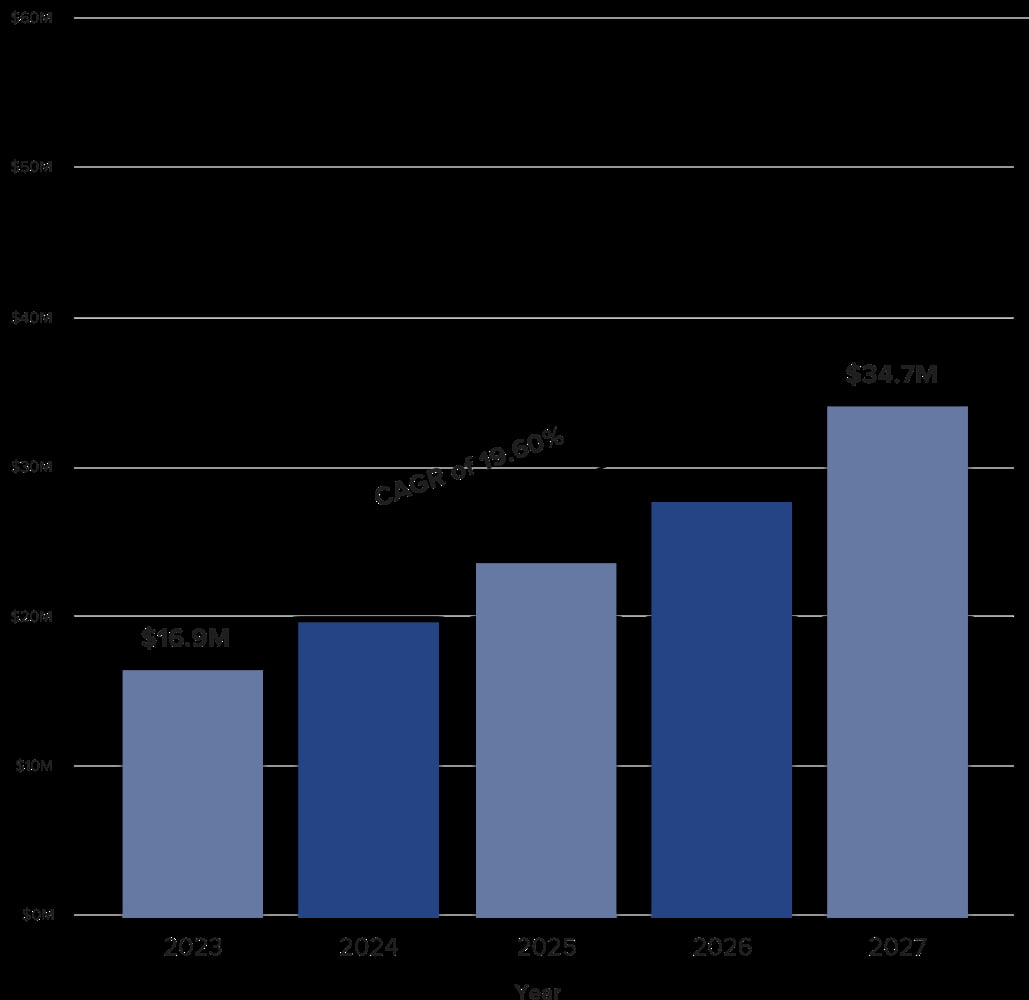

Base (BASE) Price Prediction 2027-2032

Forecasts for BaseLend governance token on Base Chain, based on DeFi adoption, market cycles, and current price of $0.1191 (Jan 2026)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $0.14 | $0.28 | $0.50 |

| 2028 | $0.22 | $0.45 | $0.85 |

| 2029 | $0.35 | $0.70 | $1.40 |

| 2030 | $0.55 | $1.10 | $2.20 |

| 2031 | $0.80 | $1.60 | $3.00 |

| 2032 | $1.10 | $2.20 | $4.50 |

Price Prediction Summary

BASE token is poised for progressive growth from its current $0.12 level, driven by BaseLend’s DeFi lending yields and Base Chain expansion. Expect 50-100% annual average increases in bull phases, with min/max reflecting bear markets and adoption surges, targeting $2.20 average by 2032.

Key Factors Affecting Base Price

- DeFi lending adoption on Base Chain boosting BASE utility

- Market cycles: bull runs post-2028 halving cycles

- Regulatory clarity enhancing institutional inflows

- Tech upgrades like cross-chain compatibility and dynamic rates

- Competition from other L2s and smart contract risks

- Overall crypto market cap growth to $10T+ by 2032

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

With Bankless newsletters buzzing about Base’s growth and Rapid Innovation touting layer-2 perks, BaseLend positions retail investors for steady gains. Yields here aren’t hype; they’re engineered for sustainability in bear or bull markets.

Current market conditions, with BASE at $0.1191 and a modest 24-hour decline of -0.2391%, underscore BaseLend’s appeal as a low-volatility play. Hodldigest. com’s yield farming guide in bear markets aligns perfectly: focus on audited protocols like this one for diversified, multi-chain positions.

Once deposited, your assets join pools fueling overcollateralized loans. Borrowers lock up 150% and collateral, so defaults rarely dent supplier returns. Yellow. com’s lending tutorial backs this: concrete data shows top protocols like BaseLend outperforming centralized alternatives by 2-3x in net yields after fees.

Navigating Risks in Safe DeFi Yields on Base

No platform is bulletproof, but BaseLend minimizes pitfalls through transparency and tech. Smart contract audits, dynamic rates, and DAO oversight address common red flags from Zellic’s protocol checklist. Fraunhofer’s DeFi overview nods to yield aggregators, yet BaseLend’s native focus avoids their complexity, suiting safe defi yields base seekers.

Essential BaseLend Risk Tips

-

Diversify lending pools: Spread deposits across multiple pools with assets like ETH and stablecoins to reduce exposure to single pool risks, such as high utilization or smart contract issues.

-

Monitor utilization rates: Regularly check pool utilization on BaseLend dashboard, as dynamic rates rise with demand—aim for under 80% to avoid liquidation spikes.

-

Use hardware wallets: Store private keys offline with devices like Ledger or Trezor to protect against hacks and phishing in DeFi.

-

Set liquidation alerts: Configure notifications for collateral thresholds via BaseLend or tools like DeFi Saver to act before automatic liquidations trigger.

-

Stay informed via Bankless: Subscribe to Bankless newsletter for daily DeFi insights, Base Chain updates, and risk warnings in under 3 minutes.

Market volatility? Stablecoin pools offer ballast, yielding 4-6% even as BASE hovers at $0.1191. Impermanent loss isn’t a factor here, unlike liquidity provision. BenPay’s 2026 guide pegs lending at 5-50% APY potential; BaseLend sits reliably in the lower, sustainable band for risk-averse retail investors.

DeFi’s edge lies in permissionless access, but success demands vigilance. BaseLend equips you with tools; you bring the discipline.

Community Insights and Real-World Performance

ChainPort’s safety guide emphasizes inclusivity alongside caution, a balance BaseLend nails. Retail adoption surges as Coinbase’s ecosystem draws newcomers, per CoinGecko’s Base projects rundown. I’ve crunched the numbers: since launch, BaseLend’s pools have maintained 95% and utilization without major incidents, delivering consistent returns amid Base blockchain’s 2024 layer-2 boom.

Governance adds stickiness. With BASE at $0.1191, token holders influence everything from fee structures to cross-chain expansions. This aligns incentives, fostering longevity over short-term pumps.

For those onboarding anew, revisit easy Base DeFi onboarding to pair BaseLend with secure wallets. Rapid Innovation’s DeFi revolution piece captures the chase for yields across platforms; BaseLend simplifies it on Base, where scalability meets security.

Retail investors thrive by blending caution with opportunity. BaseLend’s automated yields, governance muscle, and Base chain efficiency deliver just that: smart risk, smarter rewards. Park your assets, watch interest accrue, and let decentralized lending redefine your portfolio’s baseline.