In the evolving world of decentralized finance, prediction markets stand out as a powerful tool for retail investors seeking to capitalize on real-world events without traditional barriers. On the Base blockchain, BaseCase DeFi emerges as a standout platform, making prediction markets on Base chain accessible and efficient for everyday users. This beginner guide explores how BaseCase empowers retail investor base defi participation through innovative design and low-cost entry points.

Prediction markets have surged in popularity, blending speculation with crowd-sourced wisdom. Platforms like BaseCase allow you to wager on outcomes ranging from election results to cryptocurrency price movements or sports victories. Unlike centralized betting sites, these on-chain markets settle transparently via smart contracts, ensuring fairness and verifiability. For those new to base blockchain prediction trading, BaseCase simplifies the process by removing the need for upfront liquidity, a common hurdle in DeFi.

Why Prediction Markets Matter for Retail Traders on Base

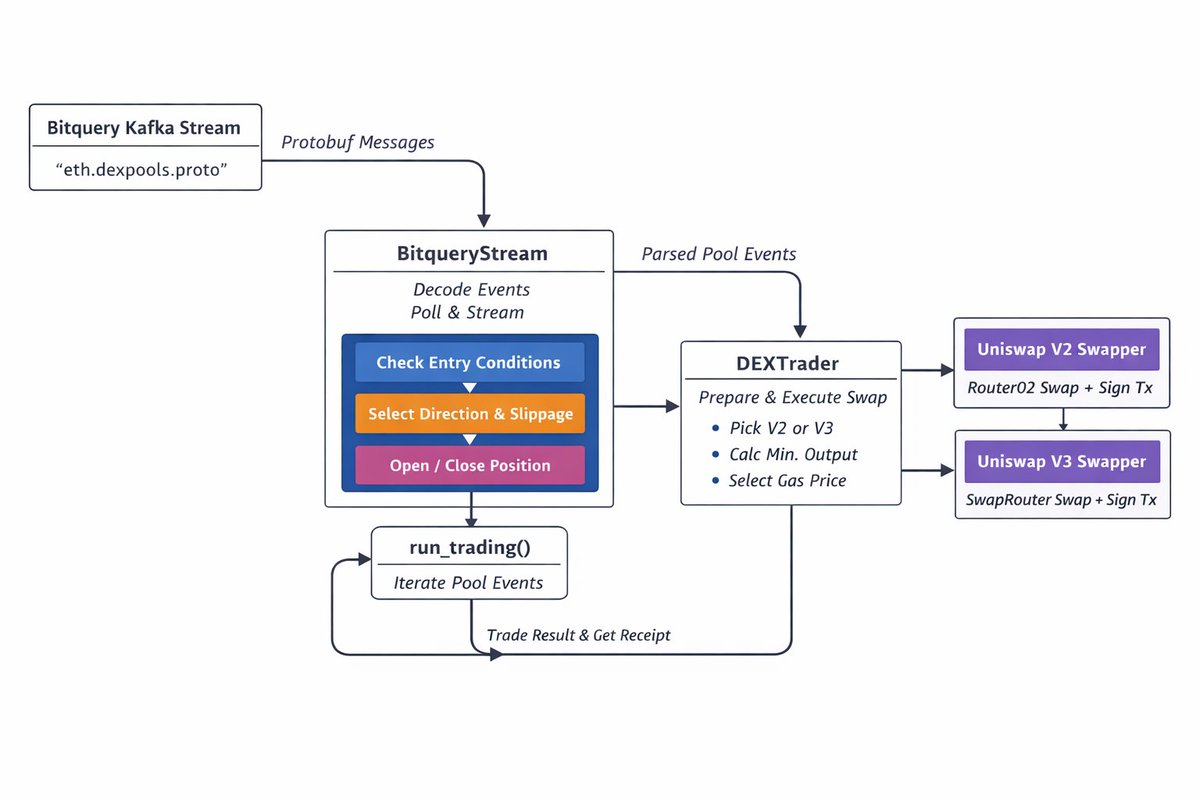

Retail investors often feel sidelined in complex DeFi ecosystems, but BaseCase changes that narrative. Built on Base, Coinbase’s Layer 2 network, it leverages low fees and high throughput to make easy prediction markets base a reality. The protocol’s ‘Shadow Liquidity’ mechanism bootstraps markets with virtual reserves, enabling trading from the start. As participation grows, markets graduate to fully solvent order books backed by real ERC-20 outcome tokens.

This design not only democratizes access but also minimizes risks associated with thin liquidity, a frequent pitfall in emerging DeFi protocols.

Consider the appeal: markets on BaseCase resolve using UMA’s optimistic oracle, which posts verifiable data on-chain without centralized intermediaries. This transparency builds trust, crucial for retail users dipping into basecase defi retail. Fees remain minimal, a small graduation charge when markets go live and a 0.1% trading fee, ensuring more profits stay in your pocket compared to high-overhead alternatives.

Mastering the Core Mechanics of BaseCase

At its heart, BaseCase operates on a binary outcome model: each market contract pays $1 if the predicted event occurs, $0 otherwise. Traders buy shares in ‘Yes’ or ‘No’ outcomes, with prices reflecting collective probability. Trading at 60 cents for ‘Yes’ implies a 60% chance of the event happening, a direct gauge of market sentiment.

Top 5 BaseCase Advantages

-

1. Low FeesBaseCase offers minimal fees, including a small graduation fee for markets going live and a 0.1% trading fee, making it cost-effective for retail traders.

-

2. No Upfront LiquidityUsers can create and trade markets without providing upfront liquidity, thanks to the innovative Shadow Liquidity mechanism with virtual reserves.

-

3. On-Chain SettlementAll outcomes are settled fully on-chain, ensuring markets are backed and winnings are claimable non-custodially without permission.

-

4. UMA Oracle SecurityLeverages UMA’s optimistic oracle for transparent, decentralized outcome resolution, free from centralized intermediaries.

-

5. Diverse Event CoverageSupports trading on real-world events like elections, cryptocurrency prices, sports, and more, expanding opportunities for retail investors.

Shadow Liquidity deserves special attention. Initially, virtual reserves simulate deep liquidity, allowing price discovery through automated market makers. Once solvency thresholds are met, typically through accumulated collateral, markets transition seamlessly to order book trading. This hybrid approach fosters organic growth, rewarding early participants while protecting latecomers from manipulation.

Non-custodial by design, BaseCase lets you retain control of funds at all times. Winnings claim instantly post-resolution, no permissions required. As of early 2026, the platform continues refining its UI for smoother onboarding, aligning with Base’s mission to onboard millions into DeFi safely. For beginners, this means exploring markets on elections, sports, or even niche crypto forecasts without technical overload.

Navigating Risks and Rewards in BaseCase Trading

While enticing, prediction markets carry inherent risks, amplified in DeFi’s volatile environment. Oracle disputes, though rare with UMA’s robust system, can delay resolutions. Liquidity in nascent markets might lead to slippage, so starting small in established pools proves wise. Diversification across multiple events mitigates exposure to any single outcome.

Yet the rewards shine brightly. Accurate predictions yield returns uncorrelated to broader markets, offering portfolio diversification. Retail traders gain insights rivaling professionals, as prices aggregate global intelligence. BaseCase’s focus on short- to medium-term events suits active investors, with potential for high-frequency strategies akin to those on platforms like Limitless, but tailored for broader accessibility.

Experienced traders appreciate how BaseCase’s structure encourages disciplined approaches. By blending automated market making with order books, it captures efficient pricing while scaling with demand. This evolution positions prediction markets base chain as a staple for retail portfolios, distinct from high-frequency niches like Limitless Exchange’s short-term bets.

Step-by-Step: Launching Your BaseCase Journey

Getting hands-on with BaseCase requires minimal setup, thanks to Base’s seamless integration with Coinbase wallets. Begin by bridging funds from Ethereum or buying USDC directly on Base via Coinbase. Connect a compatible wallet like MetaMask or Coinbase Wallet, then navigate to BaseCase’s interface for market creation or trading.

Once in, scan active markets or propose your own event, from quarterly crypto targets to global sports finals. Collateralize with USDC, set resolution parameters via UMA oracle, and watch liquidity build organically. Early movers benefit from thin market premiums, but patience pays as volumes swell.

For those wary of direct exposure, liquidity provision offers passive yields. Stake in Shadow Liquidity pools to earn from fees and graduation bonuses, a savvy way to bootstrap without picking sides. This mirrors broader retail investor base defi trends, where yield farming meets event speculation.

Safely onboarding to Base DeFi platforms unlocks these opportunities without the friction of legacy chains.

Advanced Strategies for Retail Edge

Beyond basics, savvy users layer tactics. Arbitrage discrepancies between BaseCase odds and external bookmakers yields low-risk gains. Hedge correlated events, like pairing election outcomes with policy-impacted assets. Or employ Kelly Criterion sizing: bet proportional to your edge, calculated as (p*b – q)/b, where p is probability, q=1-p, b=odds.

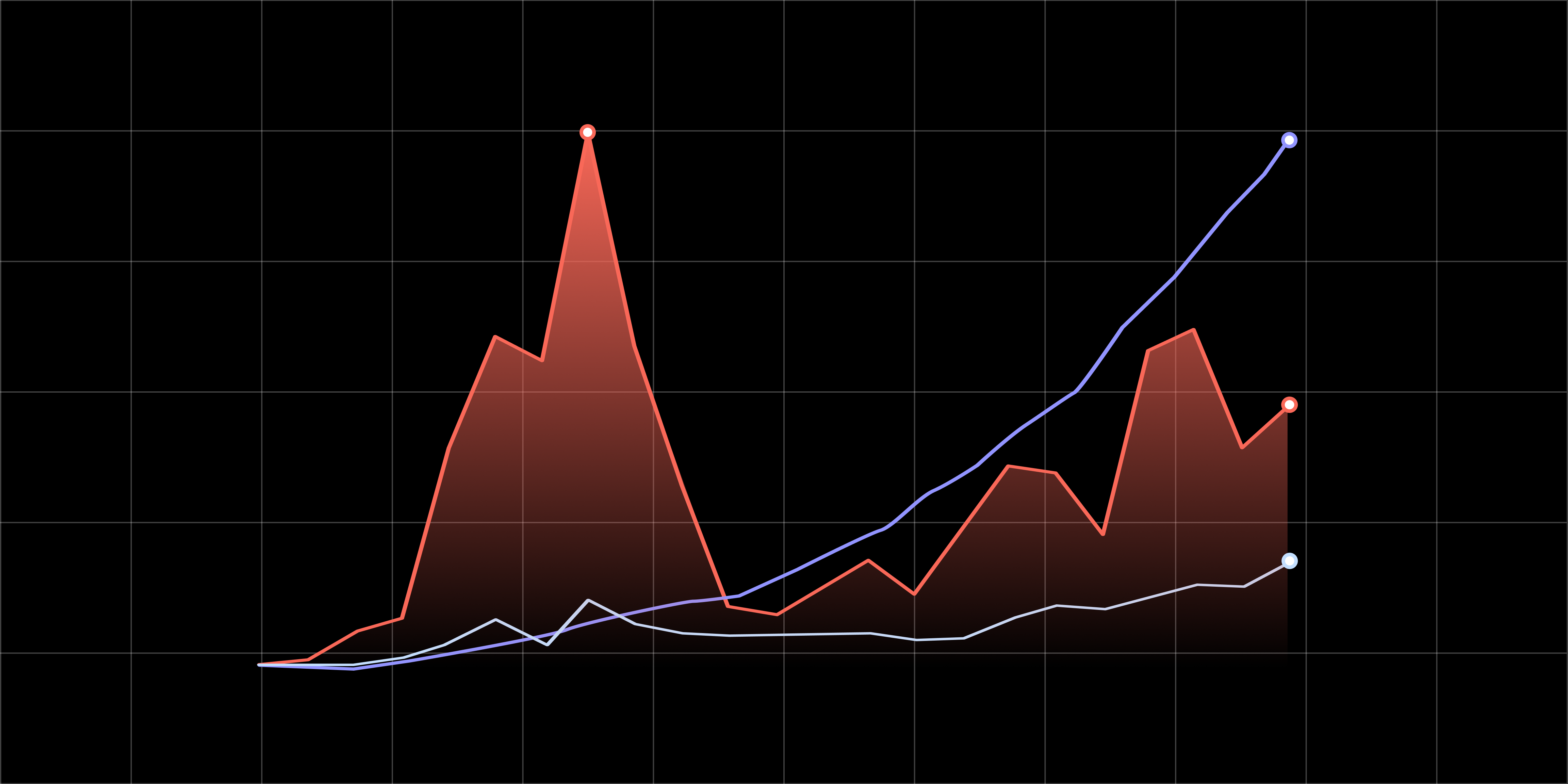

Monitor oracle feeds closely; UMA’s dispute window adds a tactical layer, where bond posters can challenge faulty data for rewards. In 2026’s maturing landscape, BaseCase’s growth forecasts align with DeFi’s expansion, potentially mirroring AUM trajectories in on-chain asset management.

Combine with Base’s ecosystem for compounded value. Pair predictions with perpetuals on other protocols or stablecoin yields, crafting resilient strategies amid volatility.

FAQs and Final Insights

BaseCase exemplifies how Base blockchain refines DeFi for the masses. Its permissionless creation, on-chain verifiability, and cost efficiency lower entry barriers, empowering retail voices in collective forecasting. As volumes climb and events diversify, expect sharper probabilities and richer insights. Dive in thoughtfully, diversify bets, and let market wisdom guide your moves on this vibrant platform.