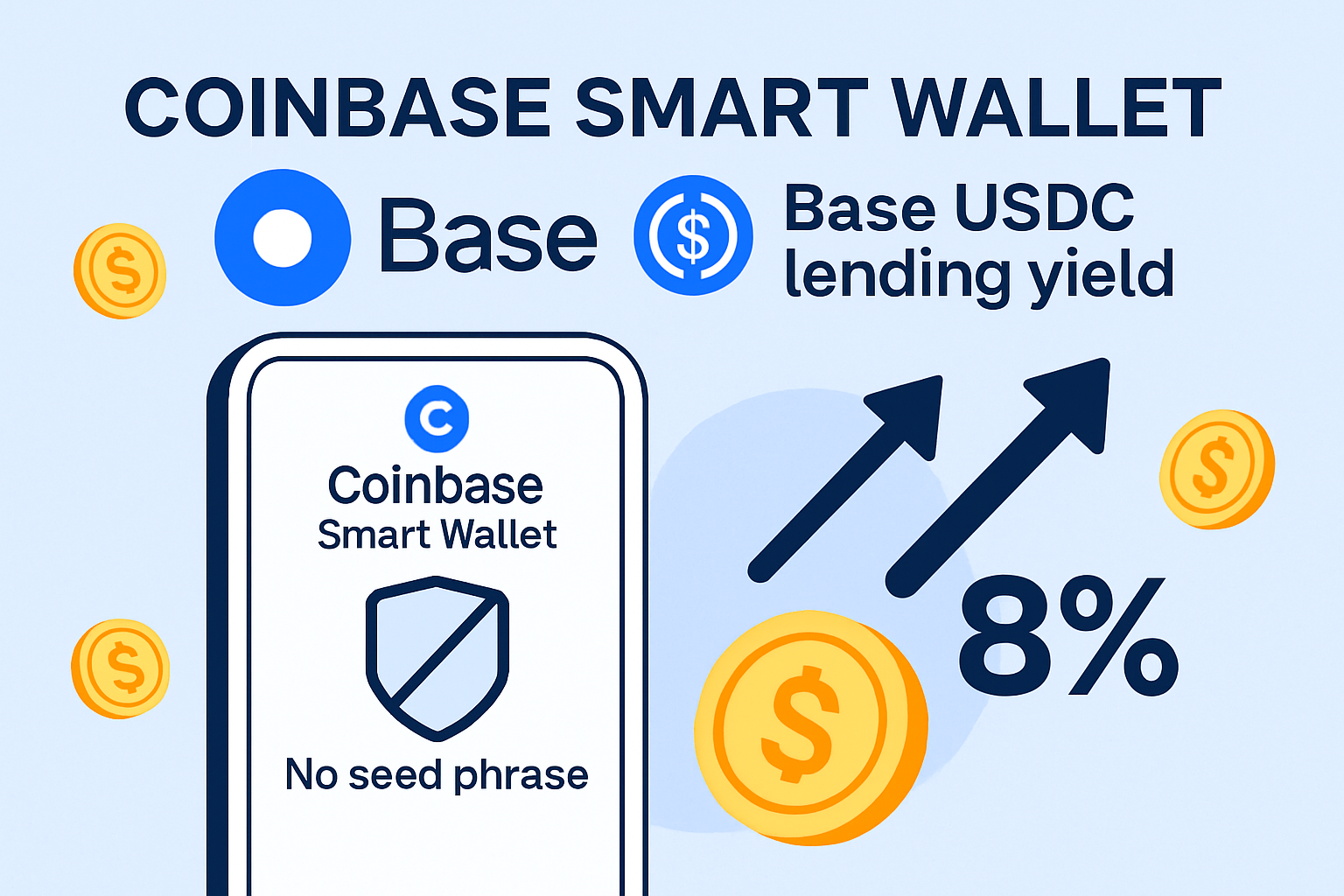

As a retail investor dipping your toes into DeFi, you’ve likely wrestled with the usual suspects: sky-high gas fees, cryptic wallet setups, and the ever-looming dread of losing your seed phrase. But on Base, Coinbase’s efficient layer-2 network, those barriers are crumbling. Imagine supplying USDC through Coinbase Wallet to earn yields like the current 4.1% return, all without touching a 12-word seed phrase. Thanks to Coinbase’s Smart Wallets and Embedded Wallets, you log in with email or socials, and you’re lending on Morpho in minutes. This is base defi lending retail style – straightforward, secure, and built for everyday users like you.

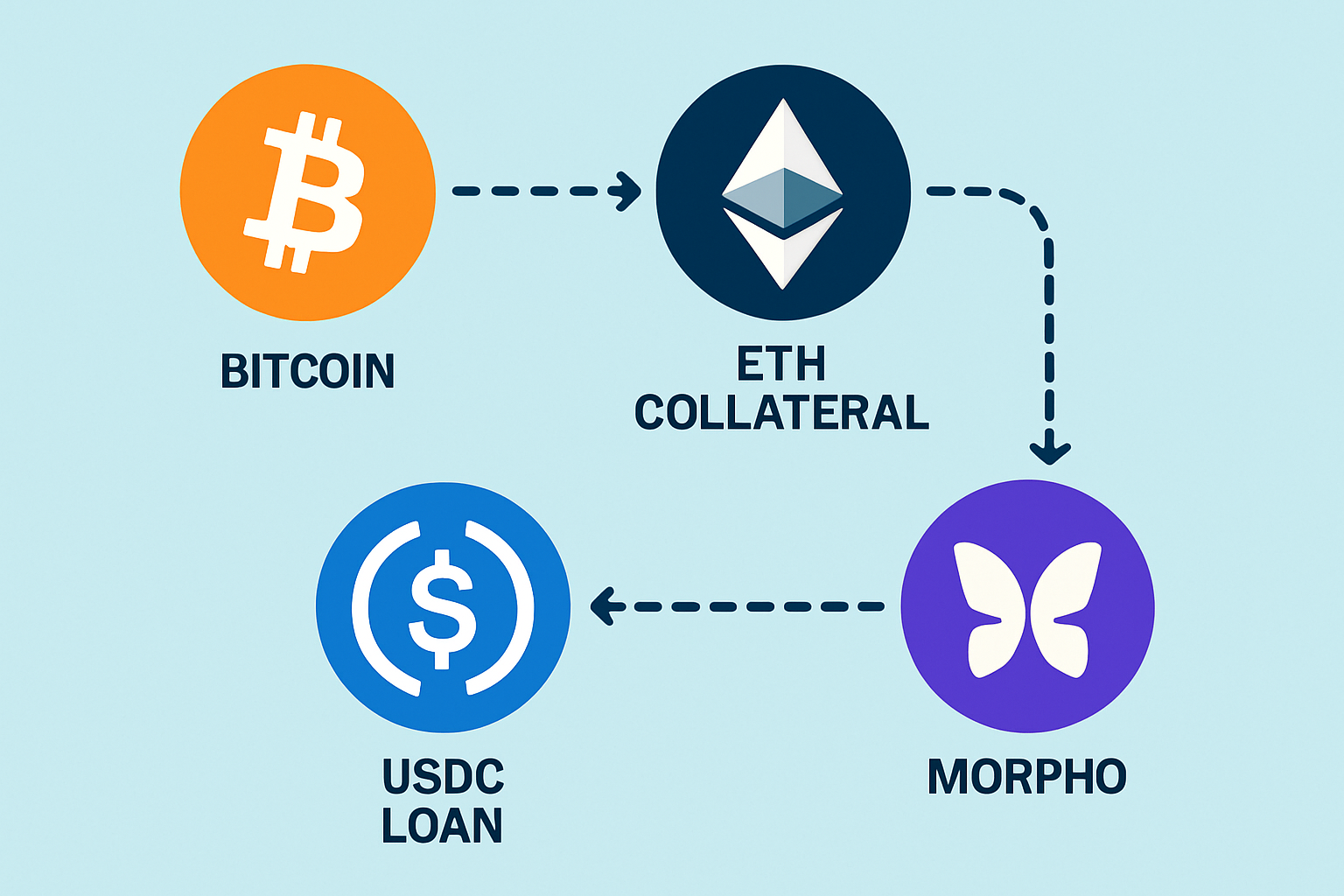

Base stands out because it leverages Coinbase’s infrastructure for low costs and high speed. Transactions settle for pennies, not dollars, making it ideal for frequent lending adjustments. Morpho, the DeFi protocol powering this, optimizes rates by matching lenders directly with borrowers – think institutions posting Bitcoin or ETH as collateral for USDC loans. As a lender, you capture that demand, earning competitive yields from real activity, not speculative hype.

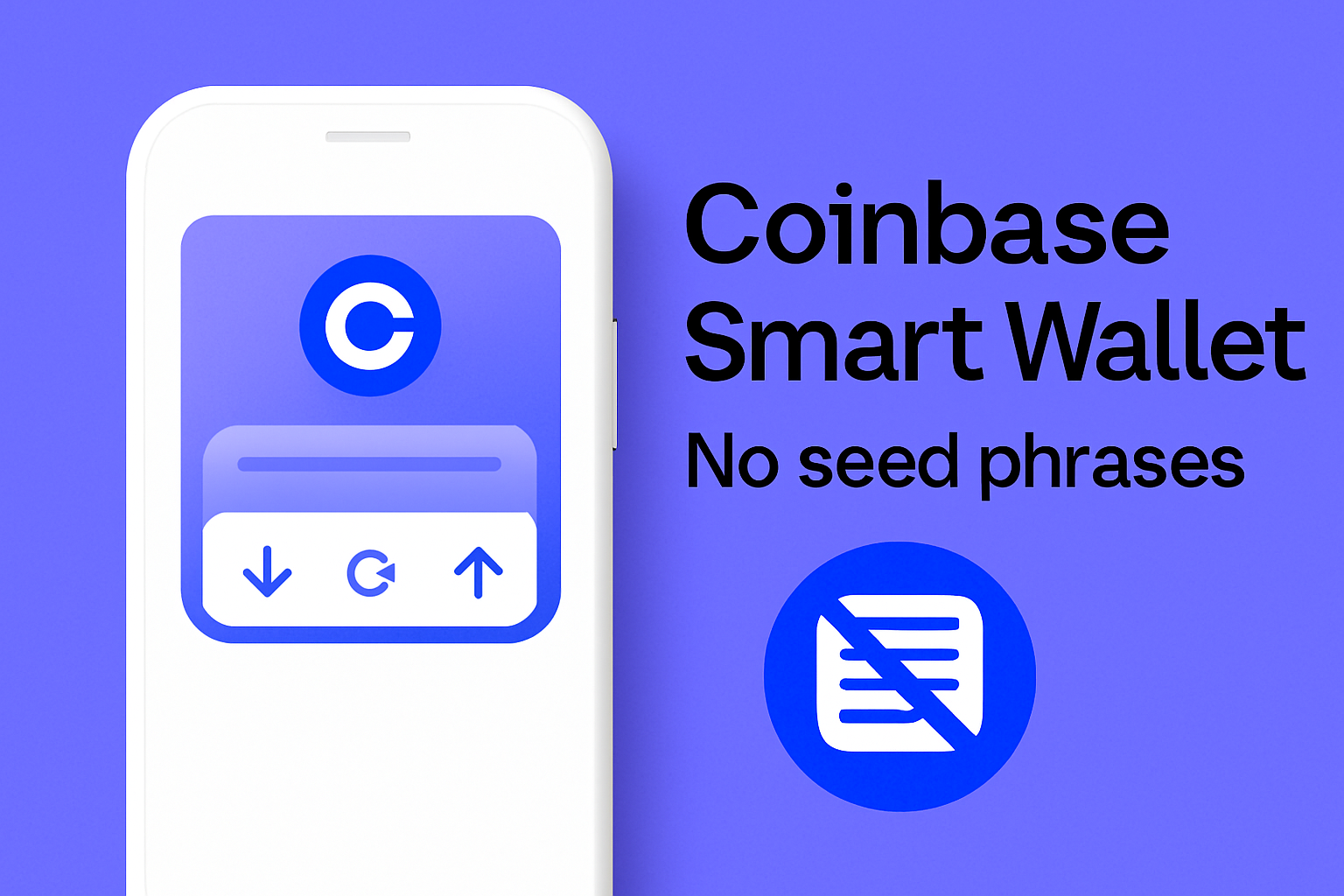

Coinbase Wallet’s Seedless Revolution Simplifies DeFi Entry

Traditional wallets demand you guard a seed phrase like Fort Knox; one slip-up, and your funds vanish. Coinbase flips the script with coinbase wallet base lending via Smart Wallets. These use passkeys tied to your device or biometrics, recovering access through familiar channels if needed. No more scribbling phrases on paper or storing them in password managers that could betray you.

Launched amid 2025’s DeFi surge, this ties into Coinbase’s broader push. In January, they rolled out Bitcoin-backed loans on Morpho, drawing millions into the ecosystem. Lenders like you benefit as borrowers – from retail folks to whales – post collateral like BTC for USDC at rates as low as 5%. Fast-forward to October, and USDC lending opened to all eligible users, powering easy defi yields base with MORPHO token rewards on top.

Key USDC Lending Advantages on Base

-

No Seed Phrases Needed: Coinbase Smart Wallets use email or social logins for seamless DeFi access.

-

4.1% Competitive Yields: Earn steady returns on USDC via onchain lending.

-

Low Fees on Base L2: Ethereum layer-2 keeps transaction costs minimal.

-

Morpho Optimization: DeFi protocol maximizes lender rates efficiently.

-

BTC/ETH Borrower Demand: Loans backed by Bitcoin and ETH drive high utilization.

I’ve guided countless retail investors through forex and crypto volatility, and this setup echoes the best of centralized ease with DeFi’s upside. Yields adjust dynamically – higher when borrowing spikes, like during ETH-backed loans up to $1 million. It’s not get-rich-quick; it’s steady compounding for your stack.

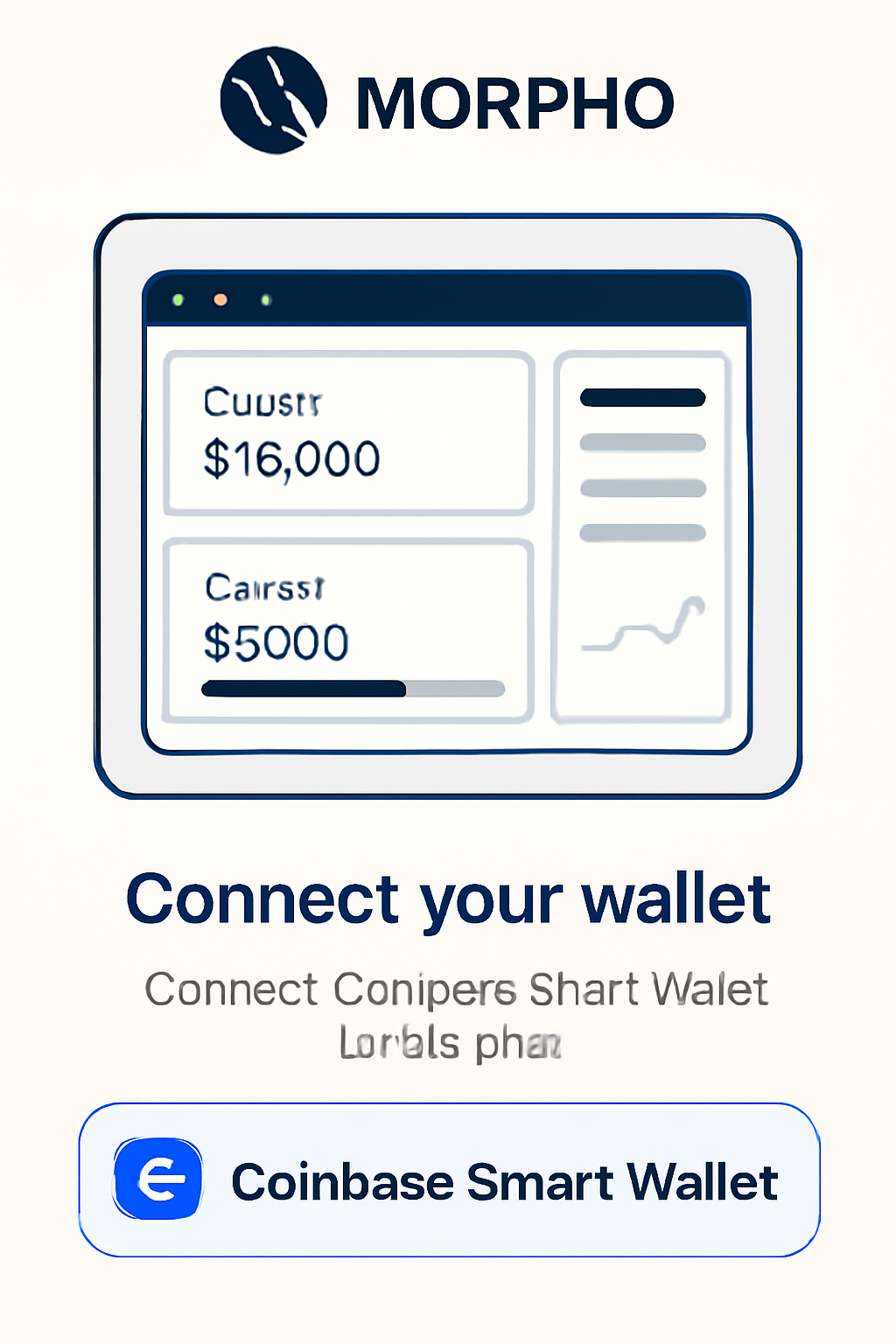

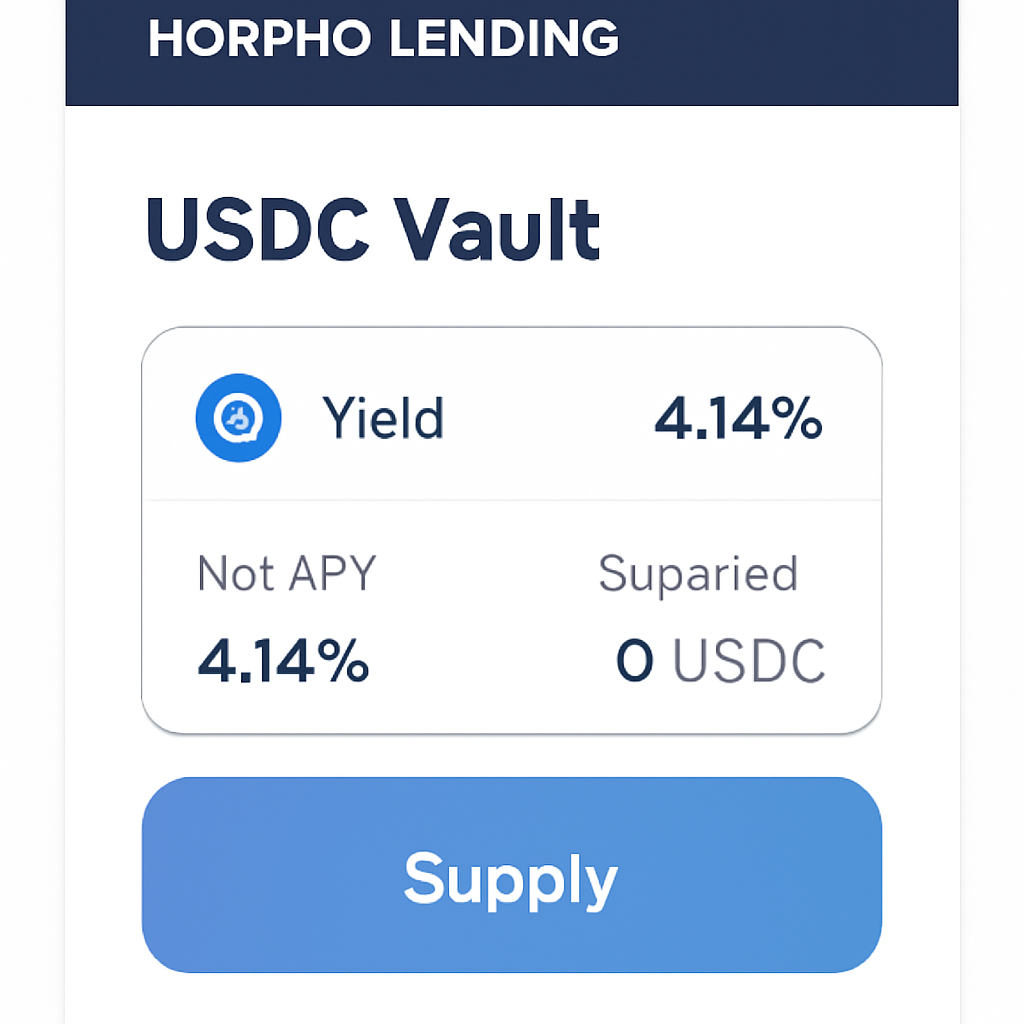

Morpho’s Efficiency Drives Superior Yields for Retail Lenders

Morpho isn’t just another lending protocol; it’s a meta-layer that vaults traditional pools like Aave or Compound. By enabling peer-to-peer matching within those, it squeezes out inefficiencies, delivering better rates for suppliers. On Base, Coinbase’s integration means your USDC flows into vaults backing everything from BTC loans to ETH positions, all settled onchain without intermediaries skimming fees.

Consider the scale: Coinbase’s move disrupted the space, prompting rivals like Crypto. com to follow with Morpho-powered offerings. For retail investor base protocols, this means access to $1 billion and in lending activity. Deposit USDC, watch it earn from borrowers paying 5% or more, and withdraw anytime with Base’s sub-second finality. Plus, those MORPHO rewards add governance perks, letting you shape the protocol if you choose.

As of late 2025, eligible customers lend USDC for competitive yields through the onchain ecosystem – a game-changer for passive income.

Security? Base inherits Ethereum’s robustness, audited to the hilt, while Coinbase’s wallets add institutional-grade custody options. No overcollateralization worries for you as a lender; Morpho vaults maintain healthy ratios automatically.

Real-World Yields: From 4.1% to Morpho Rewards

Numbers don’t lie. Right now, USDC suppliers pull 4.1% APY, but vaults targeting BTC or ETH collateral often edge higher during demand peaks. Compare that to savings accounts languishing under 1%, and it’s clear why morpho base lending guide seekers flock here. Borrowers fuel this – posting BTC for loans since January, ETH up to $1 million recently – creating a virtuous cycle.

For retail, the beauty lies in seamlessness. Link your Coinbase account, select a Morpho vault, supply USDC, and yields accrue automatically. No impermanent loss, no complex strategies; just deposit and delegate the rest to smart contracts. I’ve seen clients turn idle stablecoins into reliable earners, hedging against market dips while BTC and ETH rally.

This convergence of Coinbase’s user focus and Base’s tech makes DeFi lending viable for the masses. Stay tuned as we dive deeper into setup and strategies next.

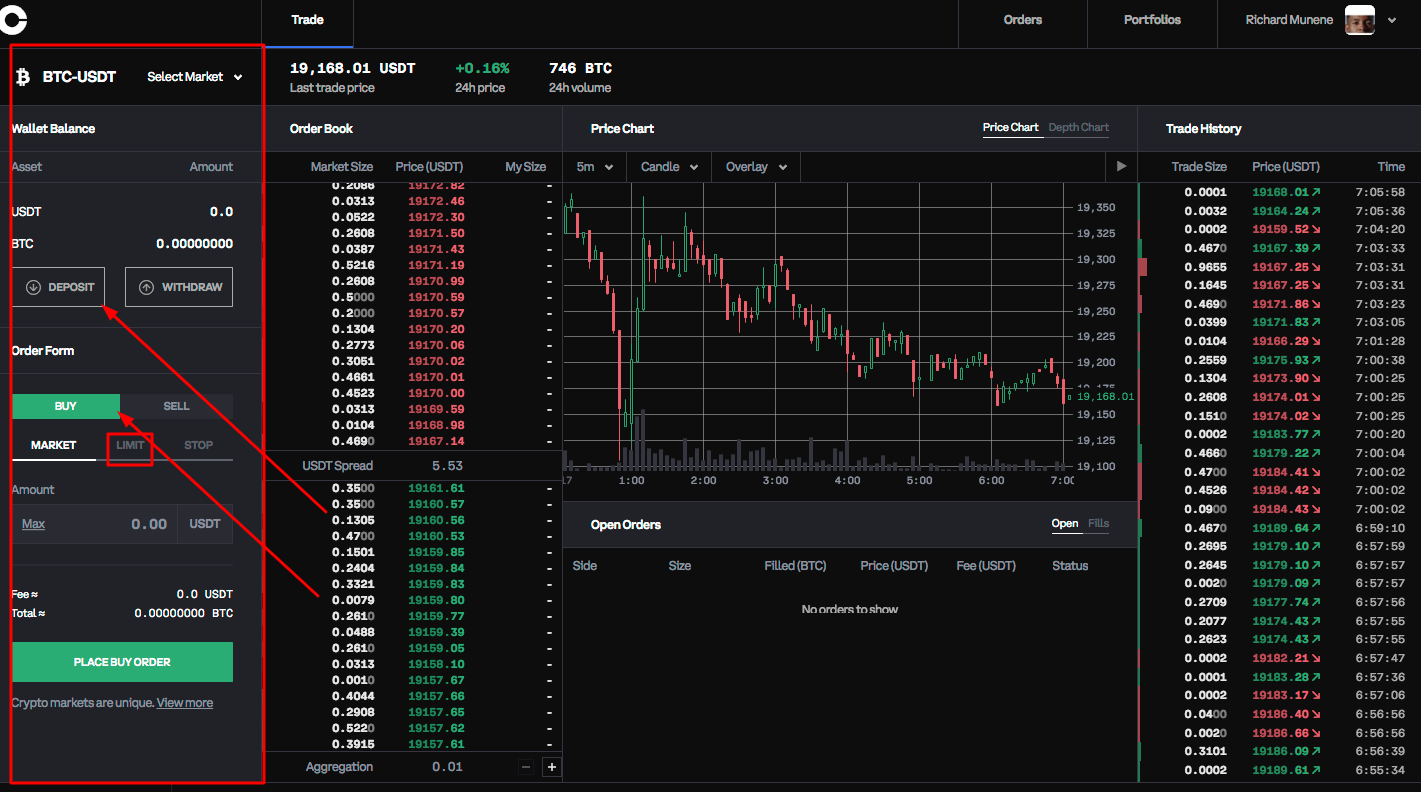

Setting up your first lending position on Base takes less than 10 minutes, turning idle USDC into a yield-generating asset. With Coinbase Wallet’s embedded setup, you bypass the technical hurdles that deter most retail investors. Let’s walk through it practically, focusing on morpho base lending guide essentials tailored for beginners.

Step-by-Step: Lending USDC on Morpho via Coinbase Wallet

Once supplied, your dashboard shows real-time accruals. Monitor via the Coinbase app, where yields from BTC or ETH borrowers compound seamlessly. This base defi lending retail flow supports LTV ratios up to 86% for borrowers, ensuring lender safety without manual oversight. For detailed visuals and troubleshooting, check our onboarding guide.

Strategies elevate this from basic to optimized. Start conservative: allocate 20-30% of your portfolio to USDC vaults for stability. As confidence builds, diversify into BTC or ETH collateral vaults when rates climb above 5%. Timing matters – supply during low borrow demand for entry, or chase peaks fueled by Coinbase’s loan expansions. I’ve advised clients to ladder positions, splitting supplies across maturities to capture variable rates without full exposure.

| Collateral Type | Borrow Rate Range | Lender APY | Min Borrow |

|---|---|---|---|

| BTC | 5% and | 4.1% and | $100 |

| ETH | 5-7% | 4.5% and | $1,000 |

| USDC General | Variable | 4.1% | $10 |

This table highlights current opportunities on Morpho, where BTC-backed demand from January’s launch keeps supplier rates firm. Compare to top platforms like Aave (often 2-3% on Base) or centralized options under 5%, and Morpho’s edge shines for retail investor base protocols.

Risks exist, but they’re mitigated smartly. Smart contract vulnerabilities? Morpho and Base undergo relentless audits, with Coinbase’s billions in TVL as a buffer. Liquidation cascades? Overcollateralization (150% and ) and auto-rebalancing protect principals. Market volatility affects yields, not capital – withdraw anytime. As a hybrid analyst, I stress position sizing: never lend more than you can afford idle for months, and enable notifications for rate shifts.

Regulatory clarity adds comfort. Operating on Base, these activities comply with U. S. standards, unlike shadier offshore platforms. Yields include USDC interest plus MORPHO tokens, vesting potential upside if the protocol grows with Crypto. com’s entry.

Explore deeper with our 2025 yields guide, but the core takeaway is accessibility. Platforms like this democratize DeFi, letting you earn easy defi yields base alongside pros. Fund your wallet today, supply to Morpho, and watch compounding work its quiet magic. Your portfolio will thank you as Base’s ecosystem expands.