As retail investors seek stable returns in a volatile crypto market, Coinbase’s DeFi lending on Base stands out as a beacon of accessibility and security. Launched in September 2025, this feature lets eligible users deposit USDC directly in the Coinbase app to earn yields up to 10.8% through onchain markets powered by Morpho and Steakhouse Financial. With Coinbase Global Inc (COIN) trading at $269.73 after a slight 24-hour dip of -0.0153%, the timing feels right for everyday holders to dip into Base DeFi yields without the usual complexities.

This integration bridges traditional finance comforts with DeFi’s potential, all on Base, Coinbase’s efficient layer-2 blockchain. No need for external wallets or gas fee guesswork; a smart contract wallet handles the heavy lifting. Users in the U. S. (outside New York), Bermuda, and select regions can start earning immediately, withdrawing when liquidity allows. It’s a thoughtful evolution, prioritizing retail-friendly DeFi lending on Base while leveraging Coinbase’s trusted infrastructure.

How Coinbase Simplifies DeFi Lending for Everyday Users

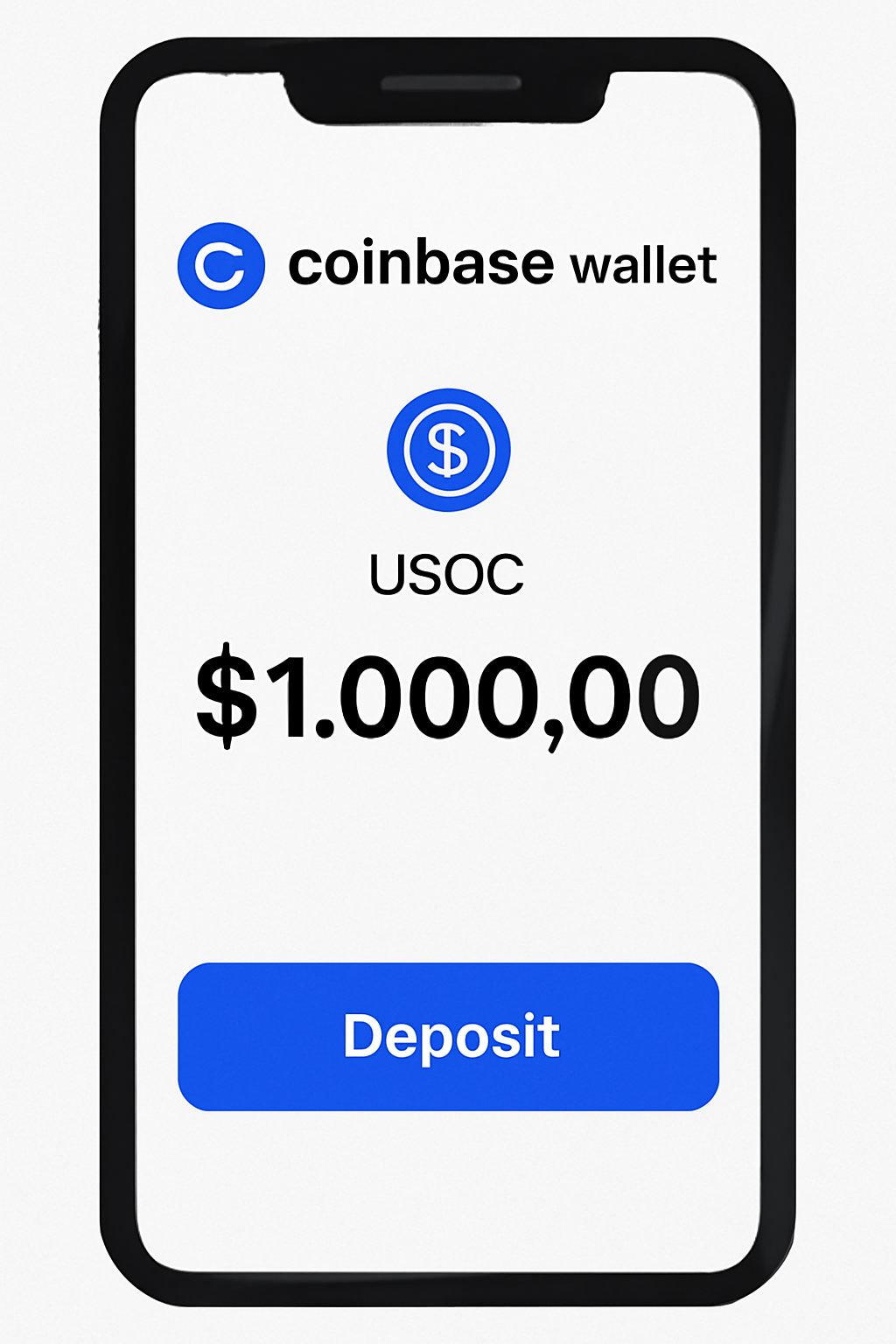

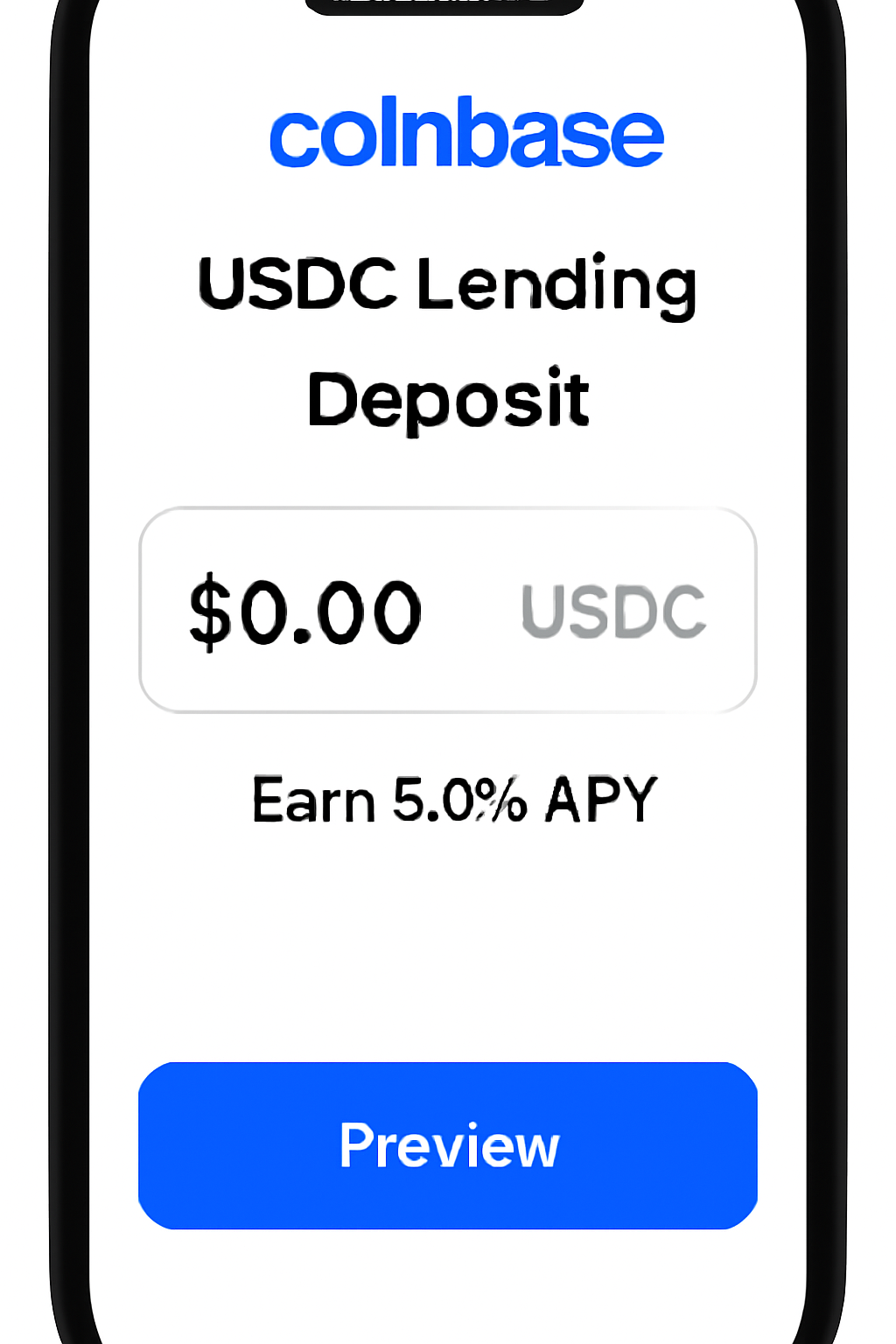

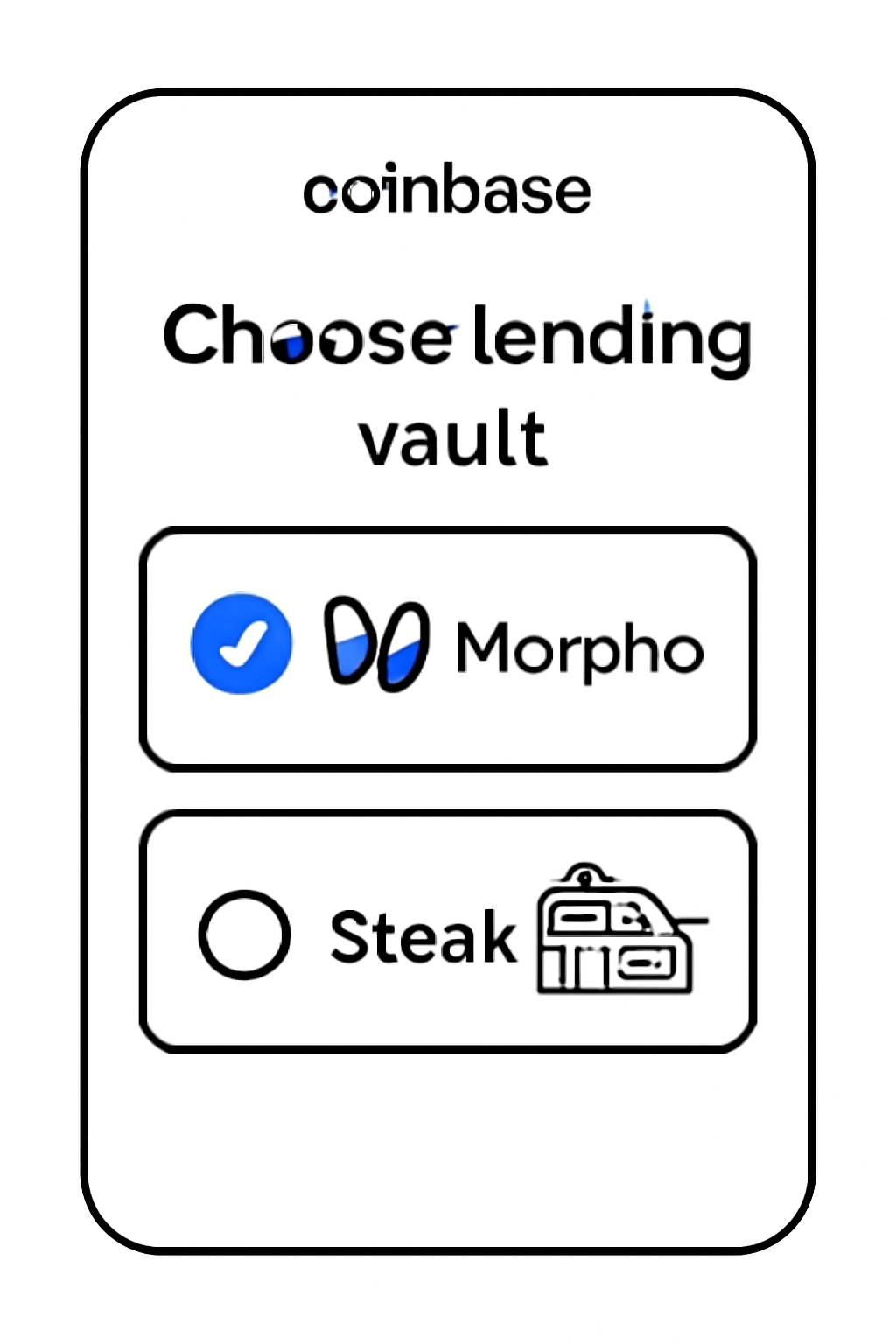

At its core, Coinbase DeFi lending on Base connects your USDC to Morpho’s optimized lending pools. Morpho, a leading DeFi protocol, matches lenders with borrowers seeking crypto-backed loans, generating yields from real onchain demand. Steakhouse Financial’s vaults, like the STEAKUSDC on Base priced at $1.07, curate these allocations for steadier returns. Think of it as parking your stablecoin in a high-yield account, but decentralized and transparent.

What sets this apart for retail investors? Seamlessness. Open the Coinbase app, navigate to USDC, and opt into lending with one tap. Behind the scenes, funds flow into Morpho vaults, earning variable APYs based on market utilization. Recent reports note rates fluctuating around 5.43% in some vaults, but peaks hit 10.8% during demand surges, as covered by sources like CoinDesk and Yahoo Finance. This variability underscores DeFi’s market-driven nature, yet Coinbase’s oversight adds a safety net absent in pure DeFi plays.

Base’s low fees and Coinbase’s scalability make it ideal for small deposits. A $1,000 USDC position could net $54-$108 annually at those rates, compounding passively. For context, traditional savings accounts lag far behind, making Base DeFi yields retail a compelling alternative in 2025.

The Technology Powering Safe Yields on Base

Morpho Labs enhances lending efficiency by allocating supply to the highest-yield pools across Base. Steakhouse Financial’s involvement ensures institutional-grade vault management, mitigating some DeFi risks like smart contract exploits. Coinbase’s smart contract wallet acts as a non-custodial bridge, giving users control while simplifying interactions.

Security is paramount here. Base inherits Ethereum’s robustness, and Morpho has undergone multiple audits. Coinbase’s track record, bolstered by COIN’s steady $269.73 price amid market wobbles (24h high $275.73, low $265.31), instills confidence. Yet, yields aren’t guaranteed; they reflect borrower demand for loans against assets like BTC or ETH.

For retail investors new to this, consider the Steakhouse USDC Morpho Vault’s slight premium at $1.07, signaling strong demand. This setup powers Coinbase’s own crypto-backed loans, creating a symbiotic ecosystem where your lending fuels broader liquidity.

Coinbase Global, Inc. (COIN) Stock Price Prediction 2026-2031

Forecasts based on DeFi lending adoption on Base offering up to 10.8% yields for retail investors

| Year | Minimum Price | Average Price | Maximum Price | YoY Growth (Avg from Prior Year) |

|---|---|---|---|---|

| 2026 | $290 | $420 | $580 | +55.6% |

| 2027 | $380 | $550 | $780 | +31.0% |

| 2028 | $480 | $720 | $1,020 | +30.9% |

| 2029 | $600 | $920 | $1,320 | +27.8% |

| 2030 | $750 | $1,180 | $1,700 | +28.3% |

| 2031 | $950 | $1,520 | $2,200 | +28.8% |

Price Prediction Summary

COIN stock is forecasted to experience robust growth from current levels (~$270) due to the DeFi lending feature on Base, attracting retail investors with competitive yields and boosting platform engagement, USDC volumes, and revenue streams. Average prices are projected to rise progressively, reaching $1,520 by 2031 amid bullish DeFi adoption, though min/max reflect bearish regulatory risks and bullish market expansions.

Key Factors Affecting Coinbase Global, Inc. Stock Price

- Seamless USDC lending integration with Morpho and Steakhouse vaults enabling 5-10.8% yields

- Surge in Base L2 activity and retail DeFi participation

- Coinbase’s market leadership in crypto exchange and wallet services

- Positive crypto market cycles and potential ETF inflows

- Earnings growth from fees, subscriptions, and staking

- Risks from regulatory scrutiny, competition, and macroeconomic downturns

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Why Retail Investors Should Consider This Now

In a year where DeFi TVL on Base surges, Coinbase’s offering democratizes access. Yields beat inflation handily, and with COIN at $269.73 reflecting optimism post-launch (shares up 7% per BeInCrypto), momentum builds. It’s not hype; it’s sustainable passive income via coinbase defi lending base.

Eligibility is straightforward: verified Coinbase users in supported regions. Start small to test waters, monitoring rates in-app. As DeFi matures, this could redefine retail strategies, blending safety with 10% and potential. Dive deeper into protocols like Morpho, and you’ll appreciate the engineering behind these base defi yields retail.

Before jumping in, understanding the step-by-step process demystifies the experience, ensuring retail investors approach coinbase defi lending base with clarity. This isn’t about blind faith in yields; it’s about informed participation in base defi yields retail.

Once enabled, your USDC joins Morpho Labs’ vaults managed by Steakhouse Financial, like the STEAKUSDC trading at $1.07. These pools lend to verified borrowers, often for crypto-backed loans against BTC or ETH, generating demand-driven returns. Rates aren’t fixed; they’ve hovered around 5.43% recently per Reddit discussions, spiking to 10.8% during peaks, as Yahoo Finance noted with Morpho’s temporary boost. This variability rewards patient holders, especially with COIN’s resilience at $269.73 despite a 24-hour low of $265.31.

Navigating Risks in Safe DeFi Lending on Base 2025

No yield comes without considerations, and safe defi lending base 2025 demands a balanced view. Smart contract vulnerabilities exist, though Morpho’s audits and Coinbase’s layered security reduce them significantly. Liquidity risk means withdrawals depend on pool availability; in high-demand periods, you might wait briefly, but Base’s efficiency minimizes this. Counterparty risk lingers since borrowers could default, yet overcollateralization, typically 150-200%: protects lenders, a staple in protocols like Morpho.

Regulatory clarity adds comfort for U. S. users outside New York. Coinbase’s compliance-first approach, evident in COIN’s steady $269.73 amid a 24-hour high of $275.73, positions this as lower-risk DeFi entry. Compare to pure protocols: no seed phrases, no bridging fees. For retail investor base lending, it’s a gateway shielding novices from DeFi’s sharper edges while delivering real alpha over bank rates.

Tax implications merit attention too. Yields count as income, reportable via Coinbase’s tools. Start with modest sums, say $500, to gauge comfort, scaling as familiarity grows. Steakhouse’s vaults exemplify thoughtful design, optimizing for stability amid Base’s rising TVL.

Yield Comparison: Coinbase Base USDC Lending vs. Alternatives

| Platform | Yield Range (APY) | Risk Level | Fees | Notes |

|---|---|---|---|---|

| Coinbase Base USDC Lending (via Morpho) | 5.43% – 10.8% | Low-Medium 🟡 | None (app-integrated) | Available in Coinbase app for eligible users (US excl. NY, etc.) |

| Bank Savings Accounts | 0.5% – 4% | Very Low 🟢 | None | FDIC-insured, traditional access |

| Aave | 4% – 8% | Medium-High 🟠 | Gas fees + protocol | DeFi wallet required, smart contract risks |

| Compound | 3% – 6% | Medium-High 🟠 | Gas fees + protocol | DeFi wallet required, smart contract risks |

Optimizing Returns with Morpho Labs and Steakhouse on Base

Morpho Labs’ edge lies in meta-morphing supply across Base pools for top yields, while Steakhouse Financial curates vaults blending security and performance. Their collaboration, integrated seamlessly by Coinbase, targets retail needs: auto-compounding where possible, transparent utilization rates viewable in-app. As DeFi adoption swells, Coinbase shares rose 7% post-launch per BeInCrypto, expect refined features like multi-asset lending.

For long-term thinkers, this fits sustainable strategies. A $10,000 deposit at average 8% yields $800 yearly, compounding to meaningful growth by 2026. Monitor via the app; dips below 5% signal reallocation opportunities, perhaps to other Base vaults. It’s active passivity, empowering users in defi lending on base via coinbase.

Looking ahead, Base’s momentum, fueled by Coinbase’s infrastructure, positions morpho labs steakhousefi base as a retail staple. With COIN at $269.73 reflecting measured optimism, this lending feature evolves DeFi from niche to norm. Everyday investors gain tools once reserved for whales: high yields, low friction, robust safeguards. Experiment responsibly, track metrics, and let onchain markets work for you, building wealth one deposit at a time on Base.