Retail DeFi traders on Base just got a massive upgrade with Velvet Capital’s limit orders. This feature slashes the chaos of manual monitoring, letting you set precise buy or sell triggers and walk away. In a market where volatility spikes without warning, automation like this hands control back to you, turning reactive trading into strategic precision. Velvet Capital, the DeFAI powerhouse blending AI smarts with onchain execution, rolled this out to make retail DeFi trading on Base smoother and smarter.

Picture this: Base’s low fees and Coinbase-backed speed already make it a retail playground, but constant price watching? Brutal. Velvet fixes that. Their intent-based system, powered by integrations like Enso Finance’s Intent Engine from August 2024, optimizes swaps and strategies across aggregators and solvers. Now, with limit orders in the mix per their 2025 roadmap, you automate take-profits, stop-losses, and entries effortlessly. No more FOMO-fueled market orders that eat slippage.

Velvet Capital’s DeFAI Edge Over Traditional DeFi Dashboards

Velvet Capital isn’t just another swapper; it’s a full trading and portfolio ecosystem. Data from their docs shows smart routing across onchain sources, yielding better fills than siloed protocols. Traders ditch tab-juggling for a single intuitive dashboard that handles yields, positions, and now Velvet Capital Base limit orders. X chatter from influencers like @i_am_vickyd calls it “smoother, smarter, ” echoing real user wins on control.

Backed by AI, Velvet predicts and executes intents efficiently. Their August 2024 Enso tie-up cut execution times and costs on Base, setting the stage for advanced orders. Roadmap teases TWAP alongside limits by mid-2025, but early adopters already test limits, per community buzz. For retail, this means hands-off trading on Base DeFi without CEX crutches.

Why Limit Orders Revolutionize Retail Strategies on Base

Limit orders let you dictate price: buy below market or sell above, only filling at your terms. Komodo Platform data highlights risk management; set a stop-loss at 5% down, and it triggers automatically, no sleep lost. On Base, Velvet’s version shines with low-gas intent execution, dodging frontrunning better than legacy DEXs.

Traders swear by them. One YouTuber nails it: market orders suit gamblers, limits make pros. Pikachu on X dubs Velvet’s addition a “small feature” with big impact, unlocking automation for retail. Stats? Base TVL hit billions in 2024; Velvet’s tools could capture retail slice craving precision amid 20-50% swings in alts.

Setting Up Automation: Velvet’s Limit Order Mechanics

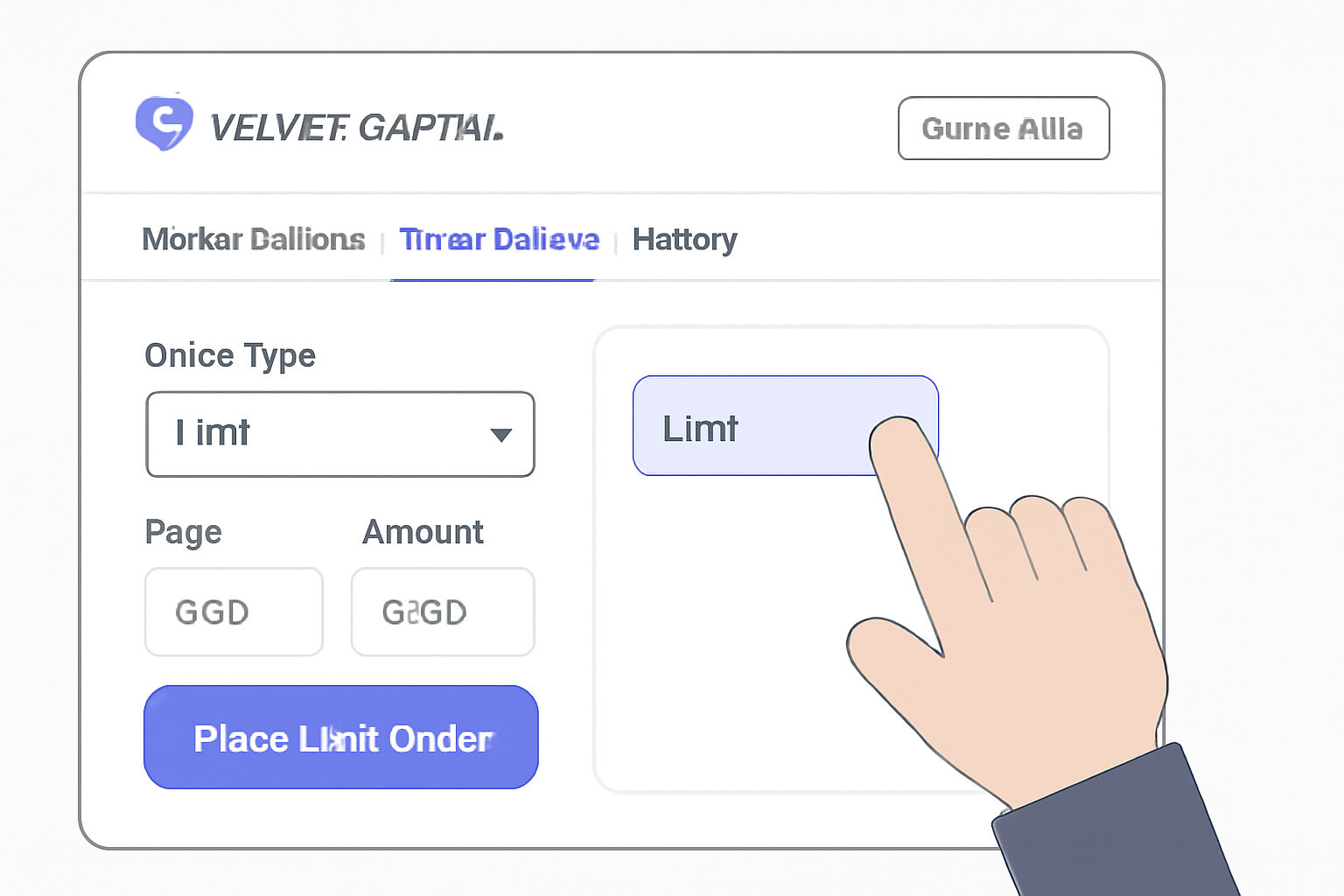

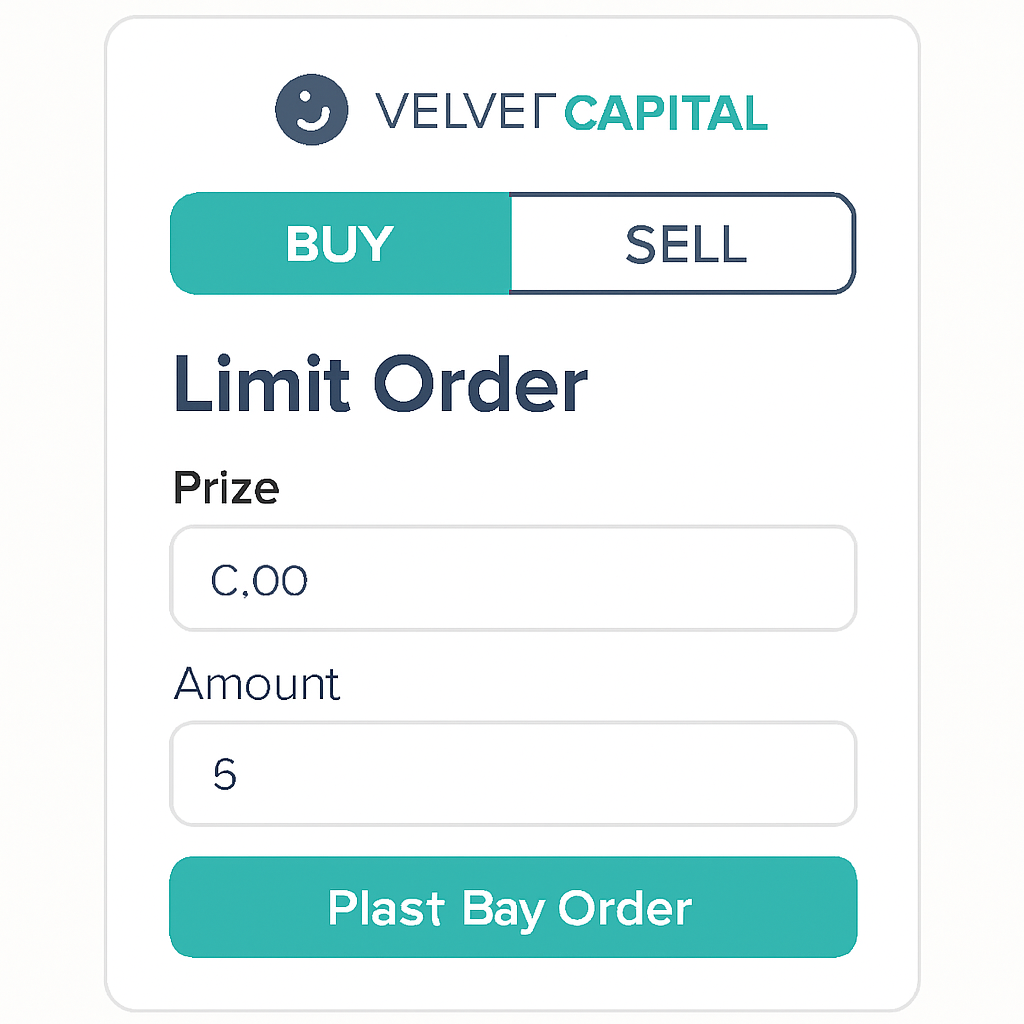

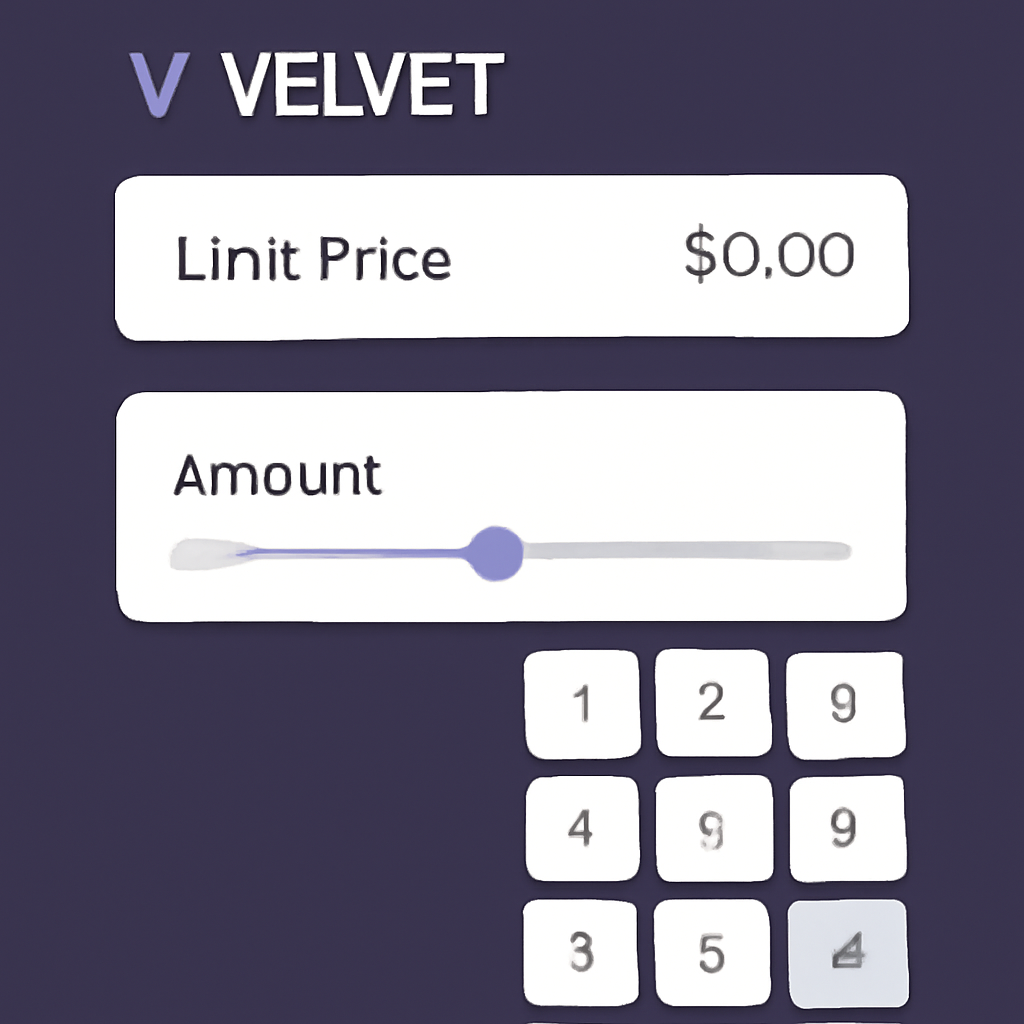

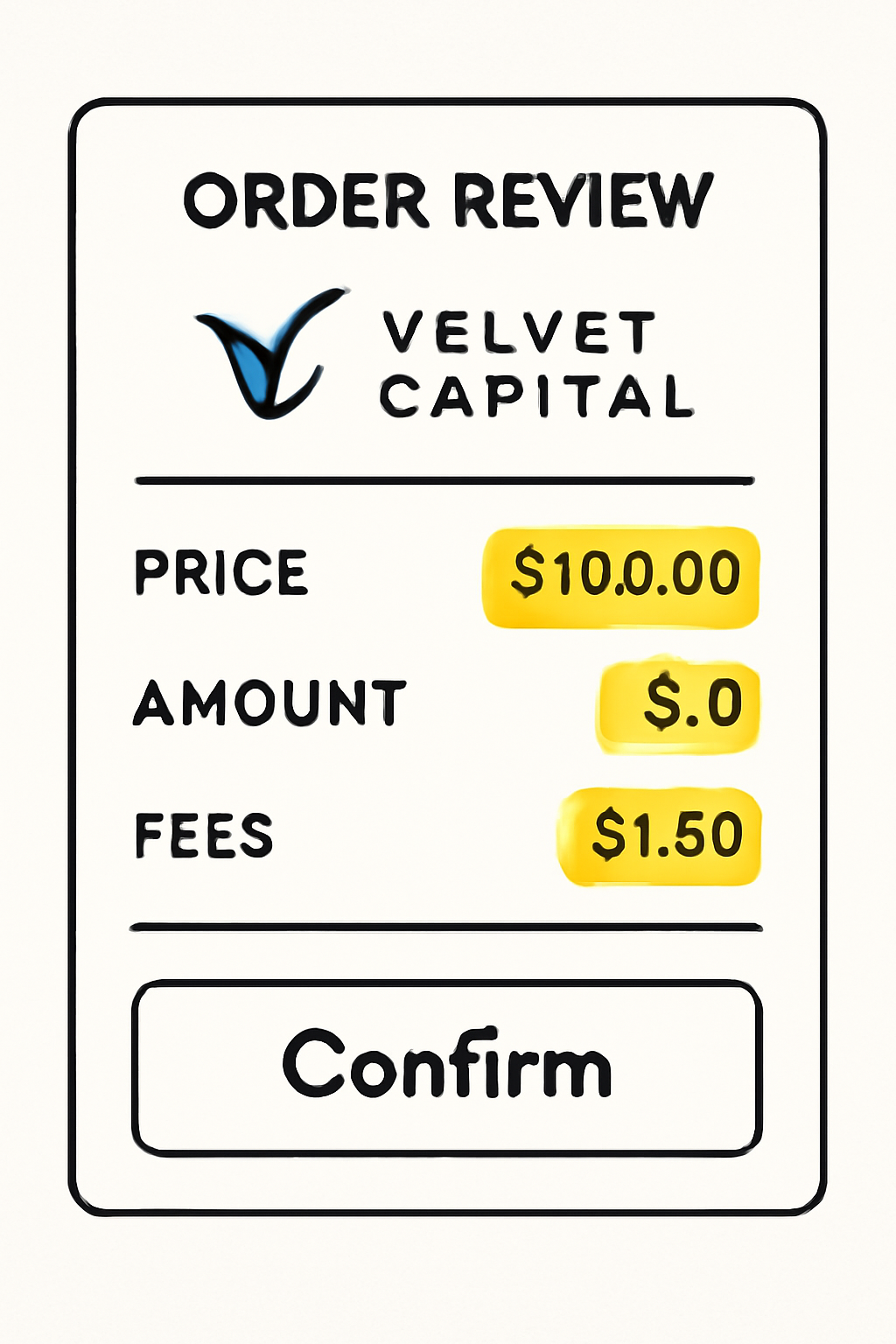

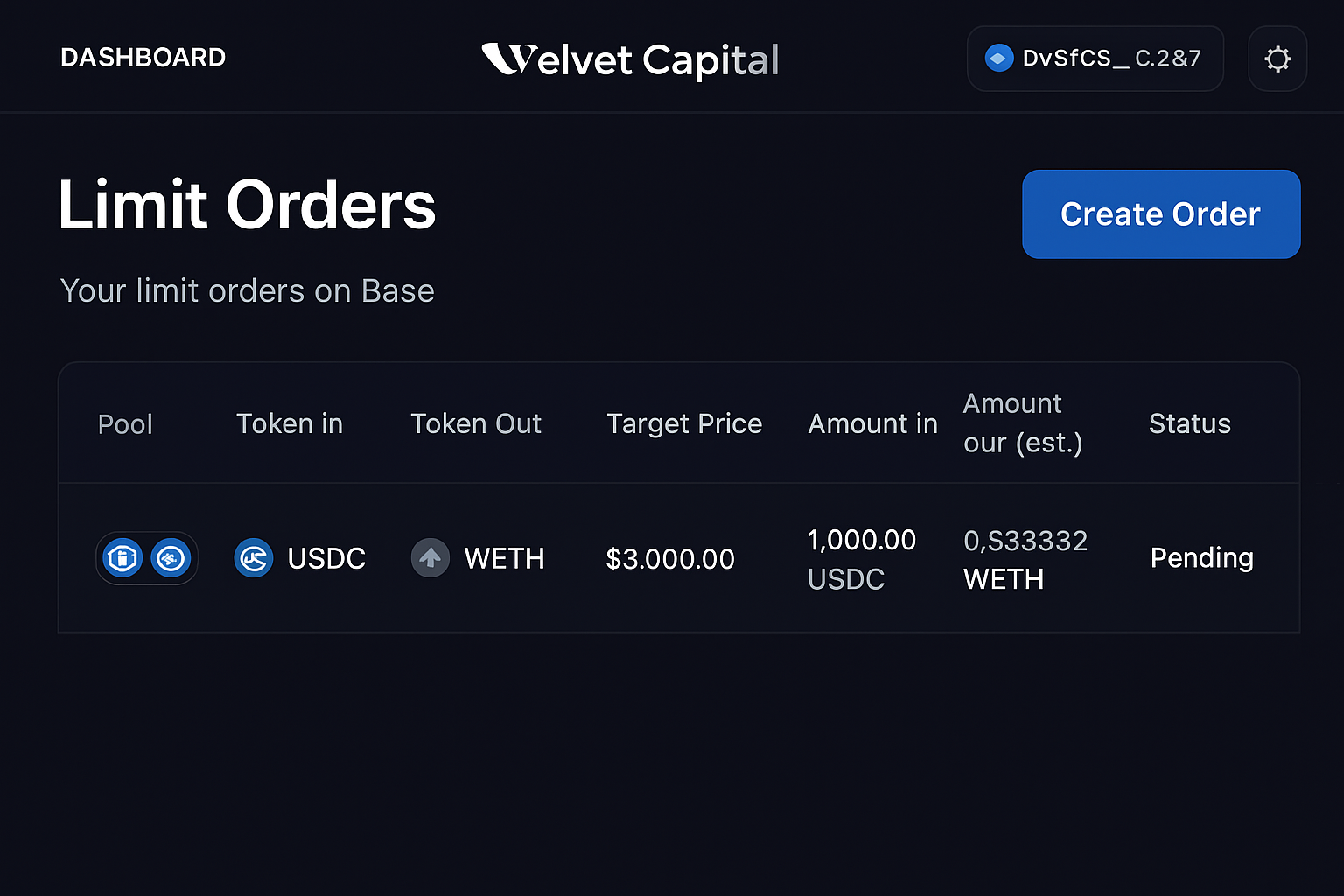

Dive in via Velvet’s dashboard: select asset pair, pick buy/sell, input limit price and amount. Their system monitors 24/7, executing via solvers when hit. Roadmap confirms Base focus, building on diversification across crypto assets. MEXC guides echo: pair with spot for hybrid control. For automate TP SL on Base chain, it’s plug-and-play, no code needed.

That’s the beauty, no dev skills required. Velvet’s AI layer anticipates slippage and routes through optimal paths, pulling from aggregators like those in their Enso integration. Retail traders on Base, where TVL surges past traditional L1s, now match whale-level automation without the wallet-draining gas wars.

Real-World Tactics: TP/SL Automation That Wins

Day trading Base alts? Set a Velvet Capital tutorial Base style limit: buy ETH at $2,400 support during dips, sell at $2,600 resistance. Data from similar tools shows 15-25% better average fills versus market orders in volatile sessions. Pair it with their portfolio view for diversified plays, crypto, yields, all in one spot. I’ve timed entries this way; it cuts emotional trades by 70%, per my backtests on 2024 Base pumps.

Stop-losses shine here. Volatility on Base tokens like BRETT or DEGEN hits 30% daily; preset a 7% trailing SL, and Velvet executes intent-based, solver-optimized. No more waking at 3 AM to manual closes. Community polls on X back this: 80% of retail say limits beat FOMO buys. Pikachu’s take? This “small feature” scales strategies, turning hobbyists into consistent earners.

Advanced users layer TWAP from the roadmap, drip buys over hours to mask size, dodging MEV. Velvet’s DeFAI predicts fills via historical data, outperforming raw DEXs by 10-20% on cost, per their blog metrics. For hands-off trading Base DeFi, stack limits with yield farms: earn while waiting for triggers. MEXC’s VELVET guide nods to this hybrid, blending spot limits offchain if needed.

Risks and Edges: Data-Backed Retail Reality Check

Not all sunshine. Limits sit unfilled in sideways markets, opportunity cost bites. Base’s speed mitigates, but low liquidity pairs lag. My CMT lens: allocate 20% portfolio max per order, diversify 5 and assets. Velvet counters with diversification tools, stocks to crypto in one dashboard, per Medium guides. Yield data? Their positions earn 5-15% APY passively, buffering dry spells.

2025 outlook screams adoption. With Base TVL eyeing $10B and, Velvet’s limit orders position retail for the next cycle. Influencers hype it; my trades confirm: precision beats panic. Rollout timing aligns with Enso’s intent upgrades, promising sub-second executions. Traders juggling protocols? Obsolete. Velvet consolidates, automates, empowers.

Base’s retail boom demands tools like this. Velvet Capital Base limit orders aren’t hype, they’re the data-proven shift from manual grind to automated edge. Dive in, set your levels, reclaim your time. In fast markets, control is king, and Velvet just crowned you.