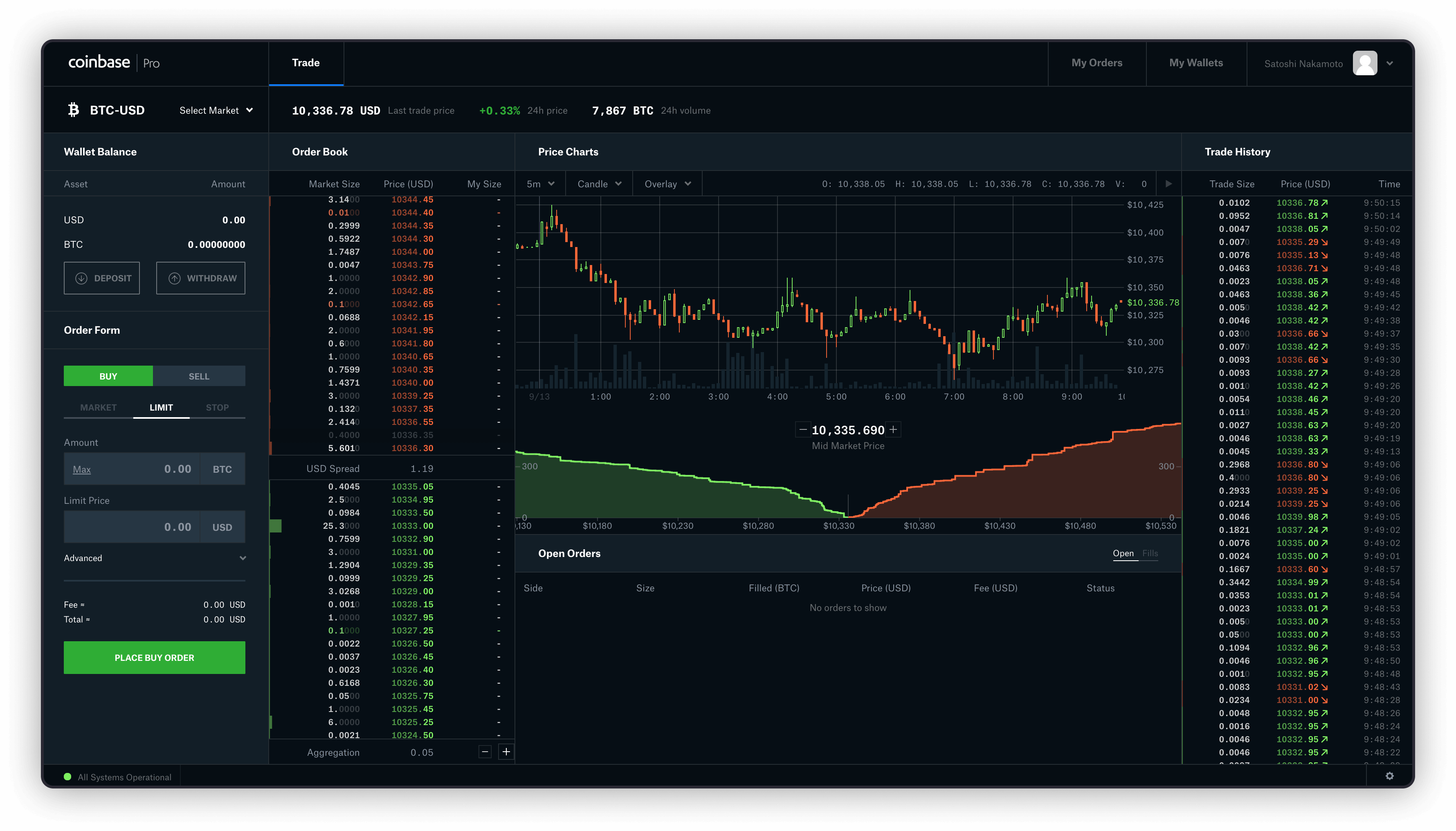

Imagine dipping your toes into decentralized finance without the usual headaches of sky-high gas fees or confusing interfaces. That’s the reality of retail-friendly DeFi on Base in 2025. With Base Protocol (BASE) trading at $0.2037, down just 0.0523% over the last 24 hours from a high of $0.2178 and low of $0.2013, this Coinbase-backed Layer-2 network is making waves. It’s bridging everyday retail investors to Web3 through ultra-low fees and seamless base blockchain onboarding.

Built on the Optimism OP Stack, Base delivers lightning-fast 200ms block times via Flashblocks, perfect for low fee DeFi on Base. No more waiting ages for transactions or draining your wallet on Ethereum mainnet costs. Retail users love how it integrates directly with Coinbase, turning centralized holdings into DeFi action effortlessly. As Jesse Pollak and Coinbase push the Base app to everyone, onboarding millions becomes straightforward.

Why Base Stands Out for Beginner Base DeFi Guide

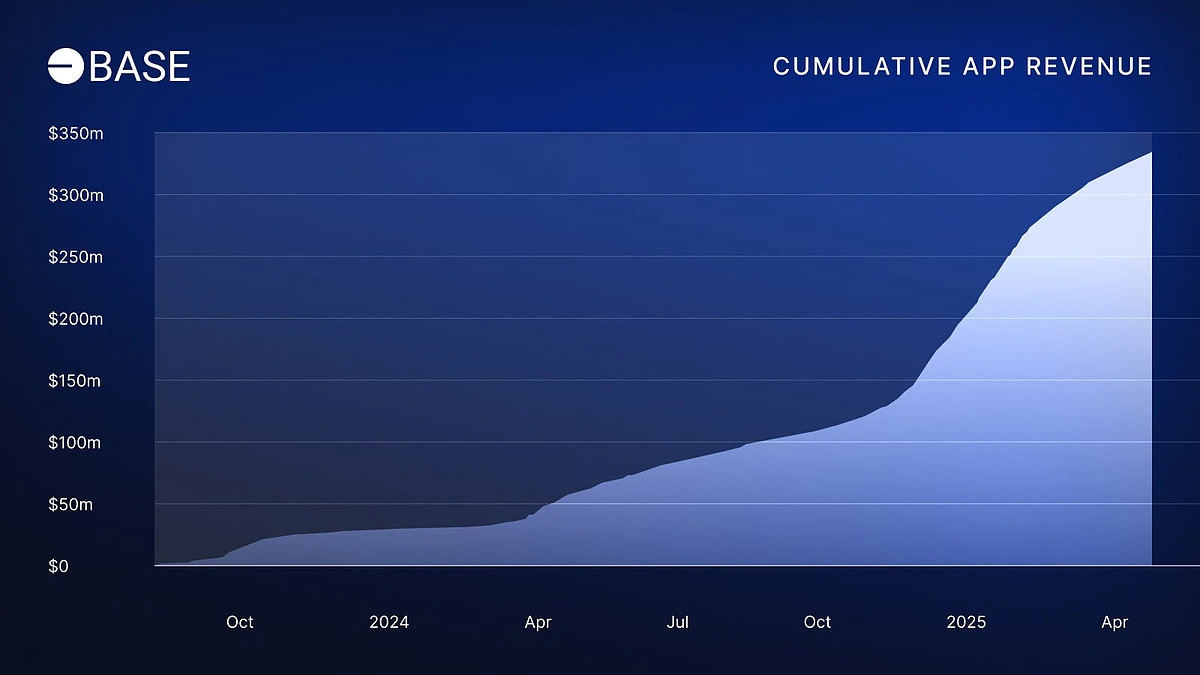

Base isn’t just another L2; it’s Coinbase’s secret weapon for Coinbase Base DeFi. Designed to onboard billions, it houses on-chain products while fostering an open dApp ecosystem. Picture this: trading volumes have topped $200B, proving real demand from retail and institutions alike. For newcomers, the magic lies in simplicity. Connect your Coinbase wallet, and you’re in. No seed phrases to lose sleep over if you use Rainbow Wallet’s social recovery.

What sets Base apart? Ultra-low fees mean a simple token swap costs pennies, not dollars. Yield farming on platforms like BaseSwap feels intuitive, with clear interfaces guiding you to passive income. Aerodrome Finance takes it further with auto-compounding rewards, so your yields grow hands-free. This retail DeFi Base 2025 vibe is sustainable, riding the altcoin cycle toward Layer-2 dominance.

Streamlined Onboarding: Your Path to Base DeFi for Retail

Getting started shouldn’t feel like solving a puzzle. Coinbase Business slashed complexity with fee-free sign-ups in a few steps. From there, the Base app revolutionizes access. Download, link your account, and deposit funds. Boom: you’re ready for DeFi. This guide mirrors that ease, but here’s a quick rundown:

- Fund your Coinbase account fiat or crypto.

- Switch to Base network in-app.

- Connect to a dApp like BaseSwap.

- Swap or provide liquidity with one-click approvals.

Rainbow Wallet shines here, offering mobile swaps and NFT management on Base. It’s like having a crypto Swiss Army knife for daily use. Institutions eye Base too, with 50 and choosing it for DeFi, signaling trust.

Low barriers fuel adoption. Retail benefits from familiar Coinbase flows, stripping away Web3 friction. Coinbase even acquired a team to supercharge consumer on-chain tools, focusing on DeFi simplicity.

Base (BASE) Price Prediction 2026-2031

Forecasts amid retail DeFi adoption, low-fee onboarding, and altcoin cycles on Coinbase’s Layer 2

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2026 | $0.30 | $0.70 | $1.80 | +250% |

| 2027 | $0.50 | $1.20 | $3.00 | +71% |

| 2028 | $0.80 | $1.80 | $4.50 | +50% |

| 2029 | $1.10 | $2.50 | $6.50 | +39% |

| 2030 | $1.50 | $3.50 | $9.00 | +40% |

| 2031 | $2.00 | $5.00 | $12.00 | +43% |

Price Prediction Summary

Base (BASE) is set for strong growth from its 2025 baseline of ~$0.20, fueled by retail-friendly DeFi tools, Coinbase integration, and L2 adoption. Bullish scenarios reflect altcoin cycles and ecosystem expansion, with averages climbing to $5.00 by 2031; bearish mins account for market corrections and competition.

Key Factors Affecting Base Price

- Retail onboarding via Coinbase Base app and simplified wallets like Rainbow

- Ultra-low fees and fast transactions on OP Stack with Flashblocks

- Beginner DeFi platforms (BaseSwap, Aerodrome Finance) driving TVL growth

- Token launch hype and institutional adoption (50+ institutions)

- 2025-2026 altcoin supercycle and on-chain consumer apps

- Regulatory tailwinds from Coinbase and potential RWA integrations

- Competition from other L2s balanced by Base’s retail focus and $200B+ volume

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Spotlight on User-Friendly DeFi Platforms Powering Retail Growth

BaseSwap leads as a DEX for effortless swaps and farming. Pick tokens, add liquidity, earn yields; no PhD required. Its interface rivals centralized exchanges but keeps you in control of funds.

Aerodrome Finance simplifies liquidity provision. Add to pools, watch auto-compounds work. Transparent risk breakdowns help you decide confidently. These tools embody base DeFi for retail, blending power with approachability.

Rainbow Wallet rounds it out, integrating Base for storage, swaps, and more. Social recovery means no panic if you forget details. Together, they make retail DeFi Base 2025 thrive, with Base poised to connect Coinbase’s user base to Web3 fully.

These platforms aren’t just shiny apps; they’re your ticket to real yields without the guesswork. Take BaseSwap: a quick liquidity add can net you APYs in the double digits, all while fees stay under a cent. At BASE’s current $0.2037 price, with that mild 24-hour dip of -0.0523%, momentum feels steady for retail plays. Aerodrome’s auto-compounds turn one-time deposits into growing stacks, ideal if you’re juggling a day job and crypto side hustles.

Practical Plays: Earning on Base Without the Drama

I live by ‘ride the trend, respect the risk, ‘ and Base nails both. Start small: swap stablecoins for liquidity pairs on BaseSwap, earning fees from trades you enable. Platforms like these use on-chain data for transparent APYs, so you spot opportunities early. No more FOMO-driven mistakes; Base’s speed lets you enter and exit positions fast. For low fee DeFi Base fans, this means testing strategies without bleeding profits to gas.

Risks? Impermanent loss in pools or smart contract glitches exist everywhere in DeFi. But Base’s ecosystem audits and Coinbase oversight add layers of comfort. Stick to vetted pools, diversify, and never ape more than you can lose. Rainbow Wallet’s portfolio tracker helps monitor it all from your phone. This setup empowers base DeFi for retail users to build habits that scale.

Scaling up, consider yield optimizers on Aerodrome. They route your liquidity for max returns automatically. Pair this with Base’s Flashblocks for near-instant confirms, and you’re farming efficiently. Real-world adoption surges as Coinbase pushes the Base app globally, onboarding retail hordes seamlessly. Trading volumes over $200B underscore the traction.

Risk-Smart Strategies: Thrive in Retail DeFi Base 2025

Here’s my no-BS take: DeFi shines when you treat it like swing trading. Watch on-chain metrics for pool health, time entries during low volatility. Base’s integration with Coinbase Business means fiat ramps are instant, fueling quick pivots. For yields, this yields guide breaks it down further, but prioritize stables first to learn the ropes.

Key Base Benefits for Retail DeFi

-

Ultra-low fees under $0.01 enable cost-effective transactions on Base’s OP Stack, perfect for beginners.

-

Seamless Coinbase onboarding lets users easily transition from CEX to DeFi with familiar tools and no-fee setup.

-

Intuitive DEX like BaseSwap offers simple token swaps and yield farming for effortless DeFi entry.

-

Auto-rewards on Aerodrome with auto-compounding yields simplify liquidity provision and passive income.

-

Mobile-friendly Rainbow Wallet supports easy asset management, swaps, and NFTs on the go.

Institutions piling in-50 and by some counts-validates the tech. Yet retail wins big with tools tailored for us: simple UIs, educational pop-ups, even social recovery. As BASE holds at $0.2037, eyeing that 24-hour range from $0.2013 to $0.2178, the altcoin cycle favors L2s like this. Coinbase’s acquisitions signal more consumer-friendly updates ahead.

Flash forward: Base bridges Coinbase’s millions to on-chain life, powering dApps that feel like everyday banking. Low fees unlock micro-transactions, from tipping creators to micro-yield farming. Beginners graduate fast, spotting trends via on-chain analytics baked into apps. It’s not hype; it’s practical DeFi evolution.

Grab your Coinbase app, flip to Base, and start swapping. With platforms lowering every barrier, beginner base DeFi guide essentials are now just taps away. Ride this trend smartly-your portfolio will thank you.