Decentralized finance has come a long way since its early days. In 2025, the Base blockchain stands out as a leading platform for retail DeFi adoption, thanks to its user-centric approach and deep integration with Coinbase. If you’re new to crypto or just starting your DeFi journey, Base offers a safe and approachable onramp, without sacrificing the power of Ethereum’s security or scalability. Here’s how you can confidently get started.

Why Base Blockchain? Security, Speed, and Simplicity

Base is an Ethereum Layer-2 network designed by Coinbase to make DeFi accessible for everyone. With over 1.74 million weekly active users and the ability to process more than 1,500 transactions per second, Base delivers both speed and scale. As of today, Base Protocol (BASE) trades at $0.1901, reflecting both its utility and growing ecosystem.

The main reasons retail users are flocking to Base include:

- Lower Fees: Transactions cost a fraction of what you’d pay on Ethereum mainnet.

- User-Friendly Onboarding: Coinbase’s wallet integration means you can move from fiat to DeFi in just a few taps.

- Intuitive Tools: From bridges to swap interfaces, everything is designed with clarity in mind.

Your First Steps: Wallet Setup and Asset Bridging

The foundation of any DeFi experience is your wallet. For Base, popular options like MetaMask and Trust Wallet provide seamless support, and setting them up is easier than ever before.

Once your wallet is ready, the next step is bringing assets onto the Base network. Trusted bridging services such as Orbiter Finance or Superbridge let you move funds from Ethereum or other blockchains onto Base securely. Always double-check addresses before confirming any bridge transaction, this simple habit protects you from costly errors.

User-Friendly DeFi Apps for Everyday Investors

The real magic happens when you start exploring what’s possible on Base. Unlike earlier DeFi ecosystems that catered mainly to tech-savvy users, Base emphasizes simplicity without compromising on features.

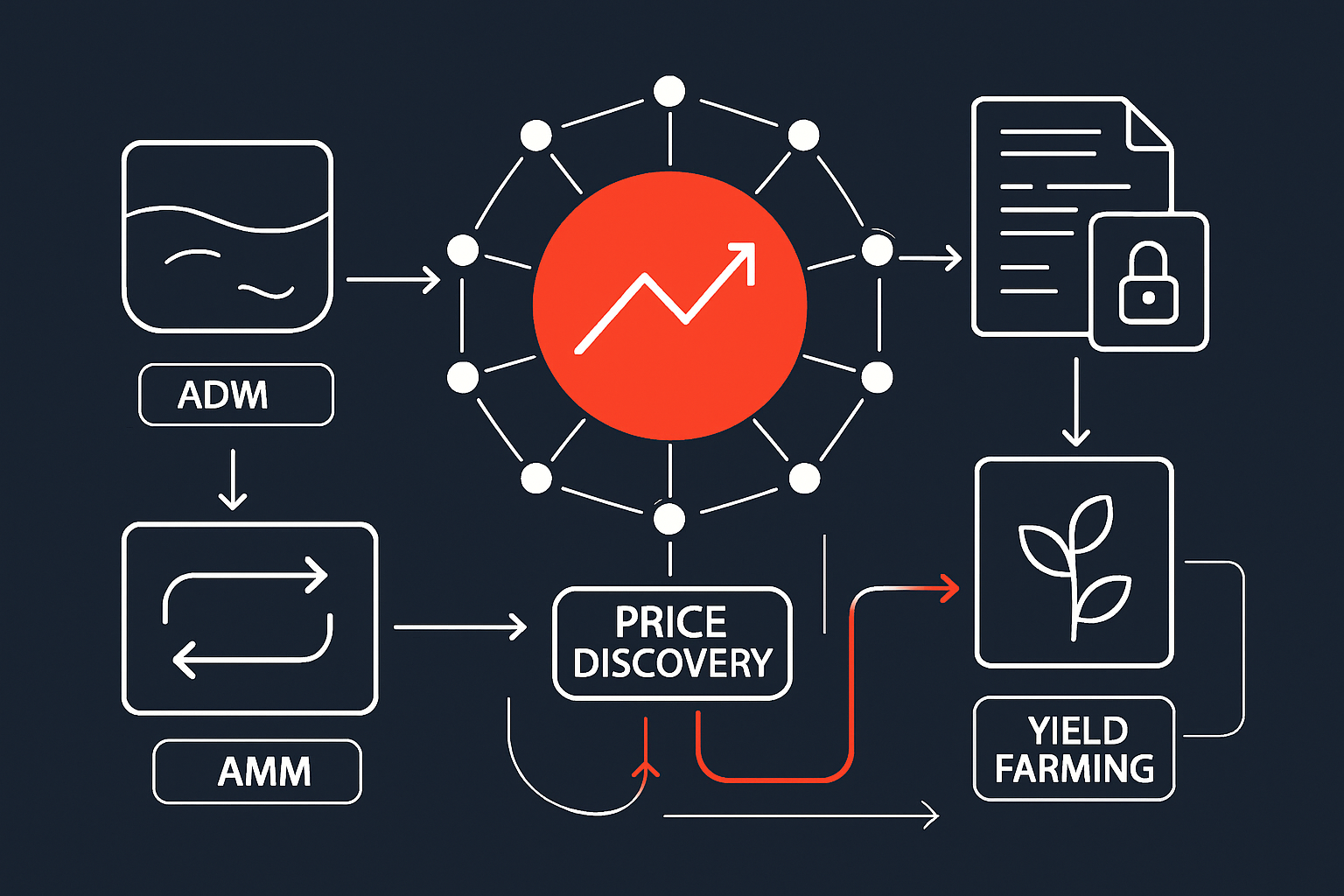

- Aerodrome Finance: A leading automated market maker (AMM) offering liquidity incentives and vote-escrow tokenomics, all through an interface designed for clarity.

- BaseSwap: Guided onboarding for token swaps makes it ideal for beginners looking for their first trade.

- RocketSwap: Another intuitive trading platform with clear instructions and helpful prompts throughout each step.

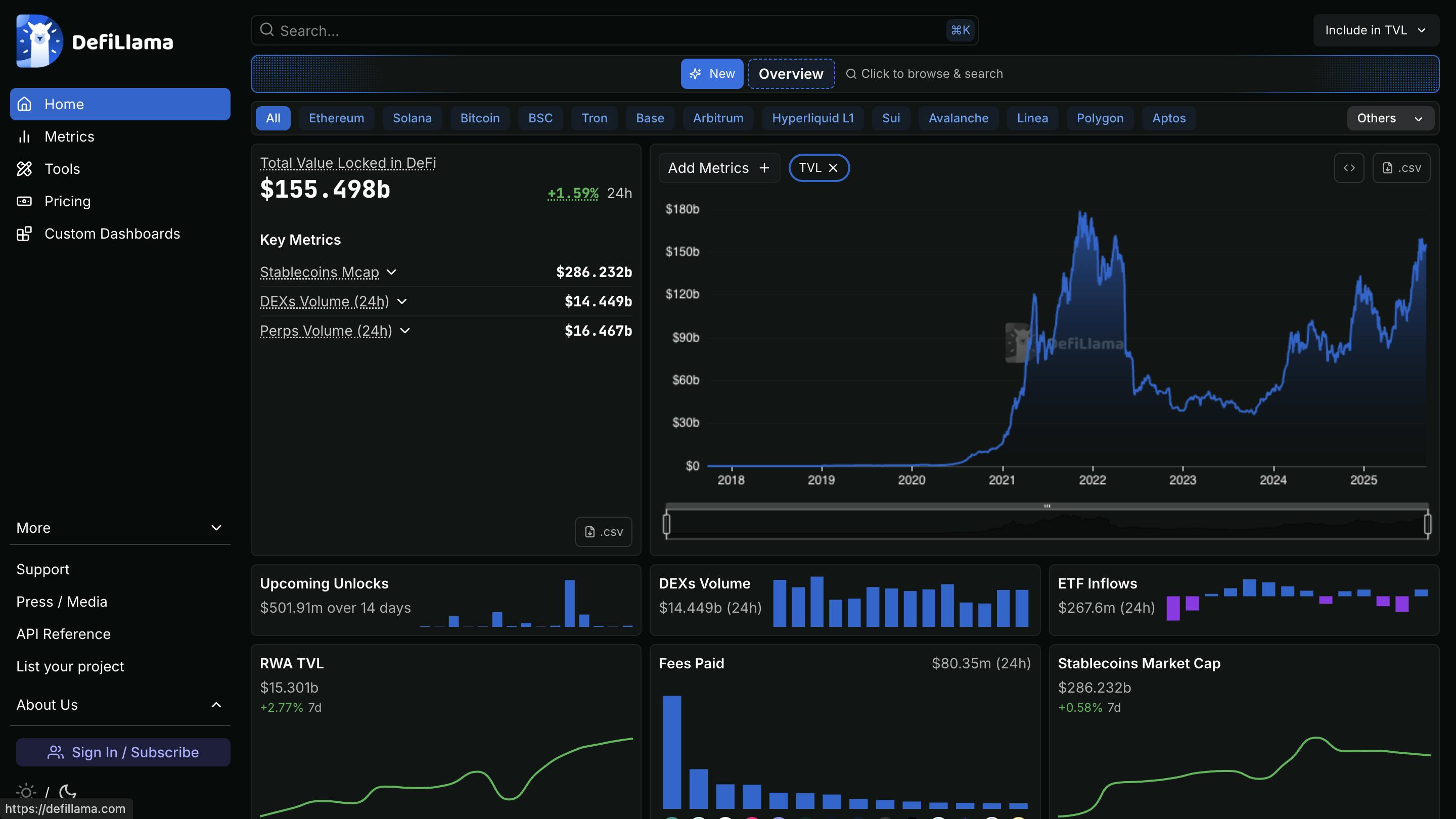

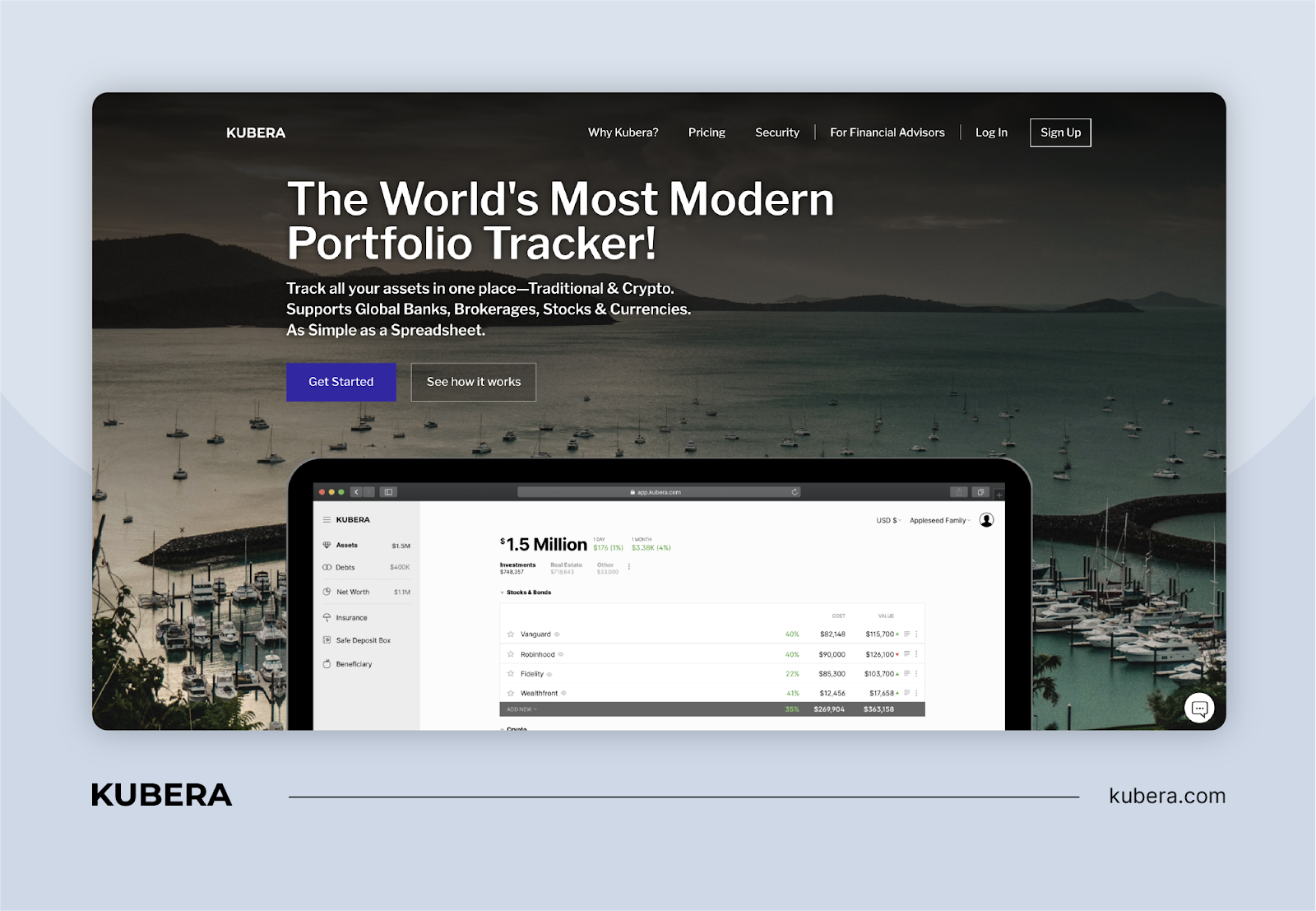

- DeFiLlama and Parsec: Portfolio tracking tools that help you monitor performance without getting lost in spreadsheets or jargon-heavy dashboards.

If you’re interested in more detailed walkthroughs or want tips on optimizing safety during onboarding, check out our comprehensive guides such as How Retail Investors Can Safely Get Started with DeFi on Base: A Step-by-Step Guide for 2025.

A Few Best Practices Before You Dive In

Navigating DeFi safely requires some basic precautions, especially when dealing with real money:

- Start Small: Test new apps or strategies with modest amounts until you’re confident in how everything works.

- Diversify Tools: Use both a secure wallet (MetaMask or Rainbow) and a portfolio tracker like DeFiLlama for full visibility into your holdings across platforms.

- Stay Informed: Join community forums and read educational materials regularly, DeFi evolves fast!

This proactive approach helps minimize risk while maximizing learning opportunities as you build your confidence within the ecosystem. For more hands-on advice about secure onboarding steps, visit our guide: How to Safely Onboard to Base DeFi: A Step-by-Step Guide for Retail Investors.

As you grow more comfortable with Base, you’ll notice that the ecosystem is designed to reward curiosity and caution in equal measure. The network’s rapid growth, now supporting 1.74 million weekly active users, means new DeFi apps and opportunities appear regularly. However, it’s essential to approach each new protocol with a critical eye, especially when real money is involved.

Managing Your Base DeFi Portfolio: Track, Learn, and Adapt

Portfolio management tools have become indispensable for retail users on Base. Platforms like DeFiLlama and Parsec provide real-time analytics so you can track your assets, monitor yields, and analyze risk exposure, all without the headache of spreadsheets or manual updates. These tools are especially useful if you’re experimenting with liquidity pools or yield farming on protocols like Aerodrome Finance.

Top 3 User-Friendly DeFi Portfolio Trackers on Base (2025)

-

DeFiLlama: Renowned for its intuitive dashboard and comprehensive analytics, DeFiLlama lets users seamlessly track their DeFi positions, yields, and portfolio performance across the Base blockchain. Its real-time data and easy navigation make it ideal for both beginners and experienced users.

-

Parsec: Parsec offers a visual, customizable portfolio tracker that integrates with Base. Users benefit from advanced charts, real-time alerts, and detailed transaction histories, all in a user-friendly interface tailored for retail DeFi participants.

-

Zapper: Zapper provides a simple, unified portfolio overview for Base users, supporting wallet connections and automatic DeFi position tracking. Its streamlined design and actionable insights help users monitor assets and manage DeFi investments with confidence.

Remember: Markets move quickly. For example, as of today, Base Protocol (BASE) is priced at $0.1901, down 0.1780% over the last 24 hours. Staying aware of these shifts helps you make informed decisions and avoid emotional trading.

Staying Safe: Security Tips for Retail DeFi Users

The best defense against scams or accidental loss is a combination of caution and education:

- Double-Check URLs: Only interact with official app links, phishing sites are rampant in crypto.

- Avoid Sharing Private Keys: No legitimate app or support agent will ever ask for your seed phrase or private key.

- Use Hardware Wallets: For larger balances, consider a hardware wallet for an extra layer of protection.

- Stay Updated: Regularly check trusted community channels for news about potential exploits or risky projects.

If you’re unsure about a step, whether bridging assets or connecting to a new protocol, pause and research first. The Base community is active on forums and social media; don’t hesitate to ask questions before making moves.

What’s Next? Growing With the Base Ecosystem

The future of retail DeFi on Base looks promising. As Coinbase continues to onboard millions into Web3, expect even more intuitive tools, educational resources, and security improvements tailored specifically for everyday investors. With transaction fees remaining low and onboarding as simple as linking your Coinbase account, there’s never been a better time to experiment responsibly.

If you want deeper insights into how Base is lowering barriers for retail investors, including UX improvements and instant access strategies, our resource How Base Blockchain Is Lowering Retail Barriers to DeFi Adoption: UX, Security and Instant Access covers these trends in detail.

The most successful retail investors treat DeFi as both an opportunity and a learning journey. By starting small, leveraging user-friendly tools, staying informed about price movements (like BASE at $0.1901), and following basic security practices, you’ll be well-positioned to benefit from everything the Base blockchain has to offer in 2025, and beyond.