Decentralized finance is no longer just for the crypto-savvy. Thanks to the Base blockchain, powered by Coinbase, DeFi is finally living up to its promise of being accessible, intuitive, and secure for everyday users. If you’ve ever been intimidated by clunky interfaces or sky-high gas fees, Base is rewriting the script with user-friendly design and ultra-low costs, often less than a penny per transaction.

Let’s dive into how Base is transforming the DeFi landscape for retail investors and explore real-world examples from a curated list of 13 leading tools that are making decentralized finance genuinely approachable.

Why Base Blockchain Is a Game Changer for Retail DeFi

Base isn’t just another Ethereum Layer 2. It’s built with retail adoption at its core. By combining high throughput (processing up to 1,429 transactions per second) and seamless Coinbase integration, it gives new users an onramp from familiar centralized exchanges straight into the world of decentralized apps (dApps) without technical friction. This means you can move assets from your Coinbase account directly into protocols like BaseSwap, Aerodrome Finance, or Compound Base in just a few clicks.

The result? No more sweating over gas fees or worrying about complex wallet setups. For anyone who has hesitated to try DeFi due to confusing UX or unpredictable costs, this is a breath of fresh air. Want to see how it works in practice? Here’s what retail-friendly DeFi on Base looks like:

13 Intuitive DeFi Tools Leading the Base Blockchain

-

BaseSwap: A user-friendly decentralized exchange (DEX) on Base, offering seamless token swaps, liquidity pools, and competitive trading fees for retail users.

-

Aerodrome Finance: The primary Automated Market Maker (AMM) on Base, Aerodrome enables easy token swaps and liquidity provision with clear rewards and incentives for participants.

-

Compound Base: A trusted lending and borrowing protocol, Compound’s Base deployment lets users earn interest or access liquidity using their crypto assets securely and intuitively.

-

Uniswap (Base deployment): The iconic DEX now on Base, Uniswap offers familiar, intuitive token swaps and liquidity provision with the benefits of Base’s low fees and high speed.

-

Moonwell Base: A robust lending and borrowing platform, Moonwell’s Base version brings streamlined onboarding, transparent rates, and secure DeFi lending to everyday users.

-

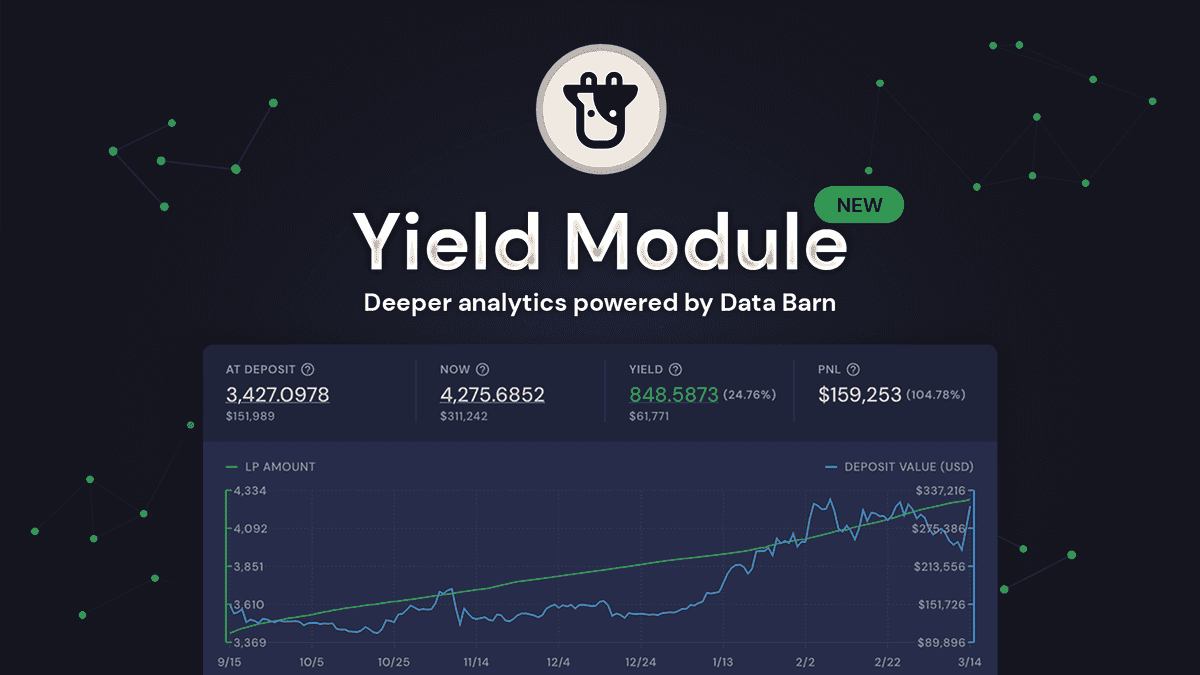

Beefy Finance (Base vaults): Beefy Finance integrates with Base to offer automated yield optimization vaults, helping users maximize returns on their assets with minimal effort.

-

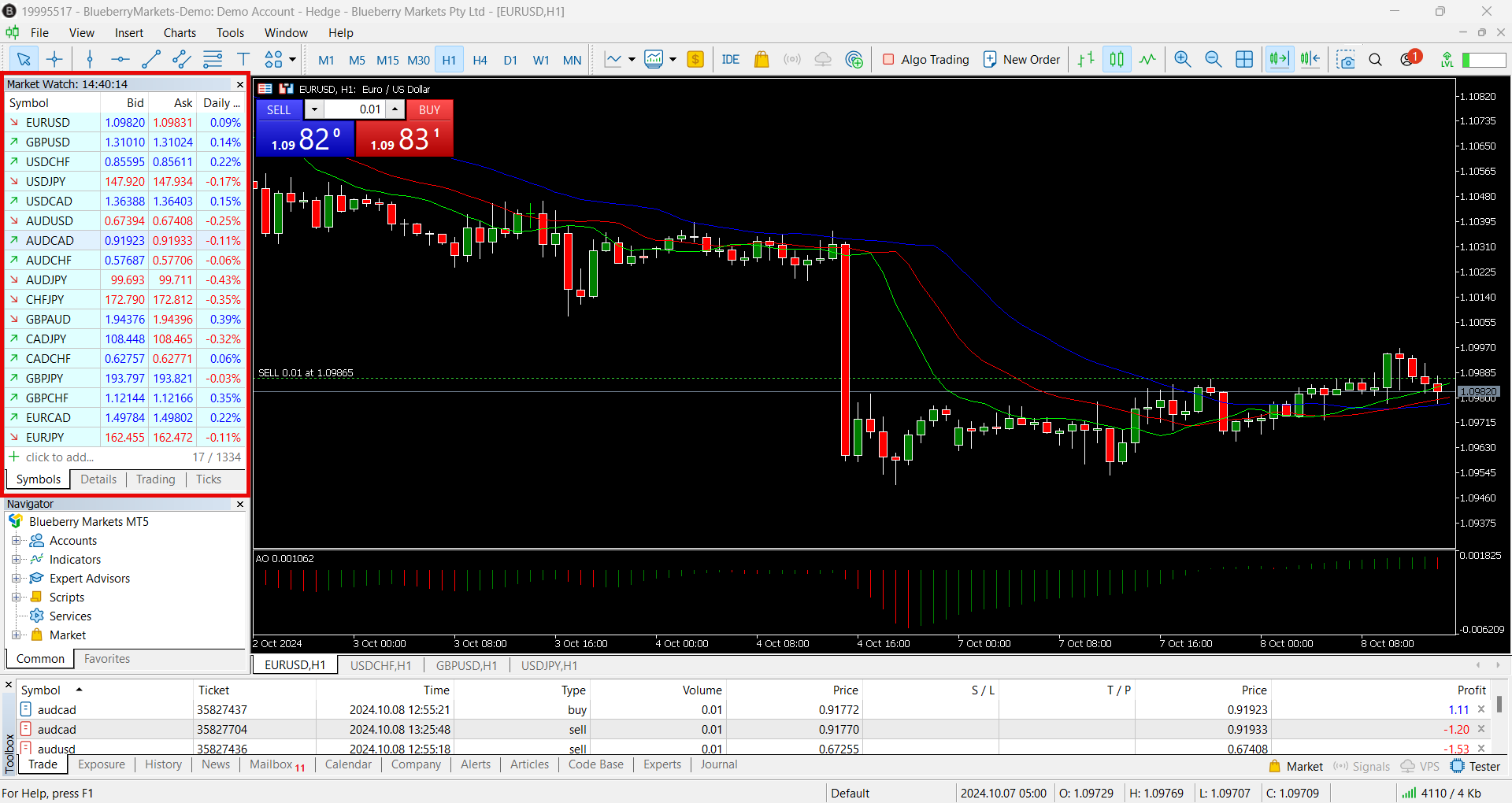

Blueberry Protocol: An intuitive leverage and lending platform on Base, Blueberry Protocol empowers users to amplify their DeFi strategies with easy-to-use tools and clear risk controls.

-

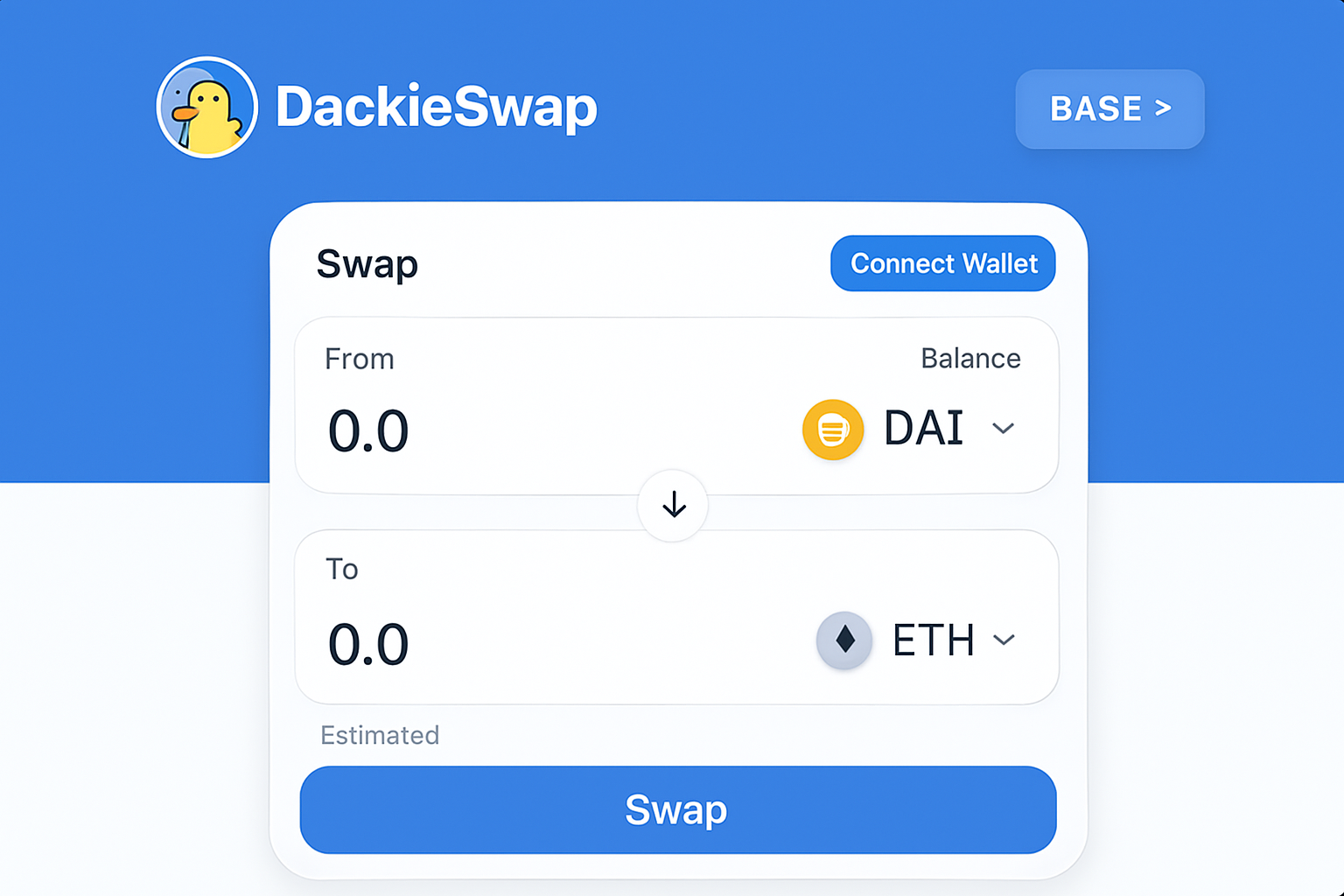

DackieSwap: A beginner-friendly DEX on Base, DackieSwap features simple token swaps, liquidity pools, and a playful interface designed for retail adoption.

-

SwapBased: SwapBased offers a straightforward DEX experience on Base, focusing on fast, low-cost swaps and clear transaction flows for new DeFi users.

-

Seamless Protocol: This lending and borrowing protocol on Base emphasizes a frictionless user experience, with transparent rates, collateral options, and a clean, modern UI.

-

LayerBank (Base): LayerBank brings intuitive DeFi lending and borrowing to Base, allowing users to supply assets, earn interest, and access liquidity with just a few clicks.

-

RocketSwap: RocketSwap is a DEX on Base that prioritizes speed, low fees, and ease of use, making it ideal for retail traders looking for efficient swaps and liquidity provision.

-

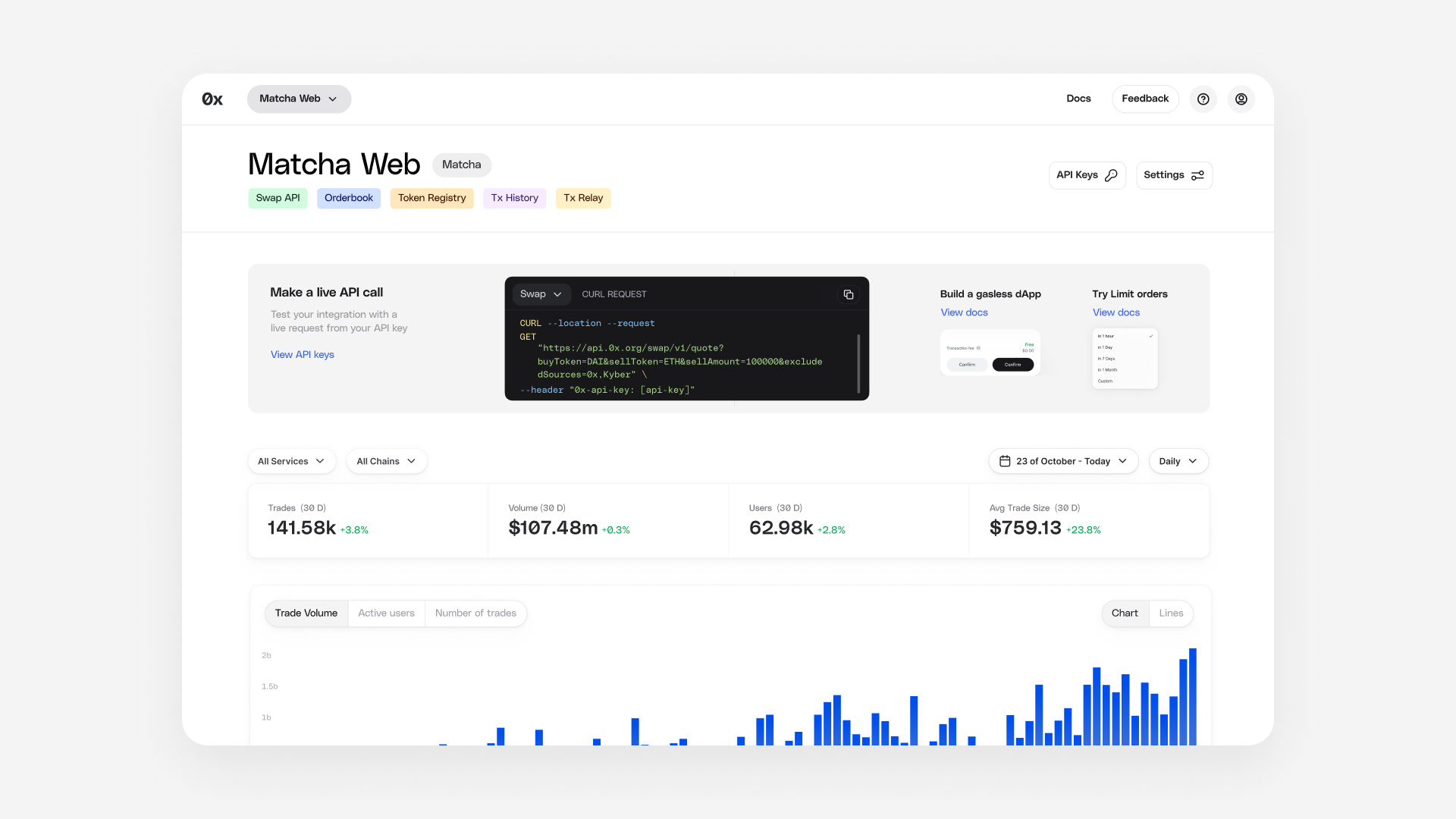

0x Protocol (Base integration): 0x Protocol’s integration with Base powers decentralized exchange functionality across multiple dApps, enabling seamless, low-cost swaps and liquidity aggregation for users.

Spotlight: Real-World User-Friendly DeFi Tools on Base

Aerodrome Finance stands out as the primary Automated Market Maker (AMM) on Base. With its clean interface and clear APR displays for liquidity providers, even newcomers can swap tokens or provide liquidity without feeling lost. The process is straightforward: connect your wallet (including Coinbase Wallet), select your tokens, and execute trades with near-instant confirmation, no technical jargon required.

BaseSwap, another flagship DEX on Base, puts simplicity first. Its dashboard focuses on essential actions, swap tokens or add liquidity, with tooltips and guides built in for every step. For those wanting to earn passive income without active trading, platforms like Beefy Finance (Base vaults) offer automated yield optimization strategies with just a single deposit click.

Lending protocols such as Compound Base, Moonwell Base, Seamless Protocol, and LayerBank (Base) make decentralized borrowing as easy as using a traditional fintech app. Users can supply assets to earn interest or borrow against their crypto, all managed through intuitive sliders and one-page summaries that demystify risk and reward.

Diversity of Tools: From Swapping to Yield Farming, All in One Ecosystem

The strength of the Base ecosystem lies in its diversity. Whether you’re interested in swapping assets (DackieSwap, SwapBased, RocketSwap, Uniswap [Base deployment]) or exploring cross-chain integrations via 0x Protocol (Base integration), everything is designed around clarity and ease-of-use. Even advanced tools like Blueberry Protocol, which offers leveraged yield farming strategies once reserved for pros only, now feature guided walkthroughs so beginners can participate safely.

This unified focus on intuitive design means there’s no need for endless tutorials or Discord troubleshooting marathons. With most apps supporting direct wallet connections from both Coinbase Wallet and MetaMask, and offering clear transaction previews before you commit, retail users are finally empowered to explore DeFi confidently.

If you want to dig deeper into getting started safely with these tools or compare them side-by-side by features and fees, check out our comprehensive guides such as Best DeFi Tools for Retail Investors on Base: Simple Apps for Everyday Crypto Users.

For retail investors who crave both simplicity and choice, Base’s DeFi toolkit covers every major use case. Imagine swapping tokens on Uniswap (Base deployment) with the same familiar interface you’d find on Ethereum, but with lightning-fast confirmations and fees so low they’re almost invisible. Or picture yourself earning yield through Beefy Finance (Base vaults), where auto-compounding strategies run in the background, letting your assets work for you without daily micromanagement.

Lending and borrowing are just as frictionless. With Compound Base, you can supply USDC or ETH to earn interest or take out a loan in minutes, no paperwork, no credit checks, just a few taps. Platforms like Moonwell Base, Seamless Protocol, and LayerBank (Base) differentiate themselves with clean UIs and transparent risk dashboards, so users always understand their positions. These protocols are built to be as intuitive as your favorite mobile banking app, but with the added power of non-custodial control.

If you’re more adventurous, tools like DackieSwap, SwapBased, and RocketSwap offer a playground for trading emerging tokens and exploring new liquidity pools, perfect for those who want to experiment without excessive risk or complexity. Meanwhile, Blueberry Protocol brings leveraged yield strategies into reach for regular users, thanks to step-by-step onboarding flows that explain each move before you commit funds.

How Cross-Chain Integrations Make DeFi Even Smoother

0x Protocol (Base integration) deserves its own spotlight for making asset movement across blockchains seamless. Instead of juggling multiple bridges or worrying about compatibility, 0x lets users access liquidity from other chains right inside the Base ecosystem. This means more trading opportunities and deeper liquidity, all while keeping things simple under the hood.

The result is an ecosystem where even complex actions, like swapping assets across chains or farming yield with leverage, feel as straightforward as sending money on Venmo. Every protocol in this curated list was chosen not just for technical innovation but for their commitment to demystifying DeFi through thoughtful design.

What Sets Retail-Friendly DeFi on Base Apart?

- No more sticker shock: With transaction fees routinely under a cent, retail users can experiment without worrying about cost overruns.

- Simplified onboarding: Direct Coinbase integration means users skip complicated wallet setups and get started in minutes.

- User-first interfaces: Every tool, from DEXs like BaseSwap to lending protocols like LayerBank, prioritizes clarity over jargon.

- Diverse choices: Whether your focus is swapping, lending, yield farming or cross-chain trading, there’s an intuitive option ready to go.

If you’re new to DeFi or just looking for a smoother experience than what legacy platforms offer, exploring these tools is well worth your time. For step-by-step walkthroughs tailored specifically for everyday users, including how to connect wallets safely and maximize rewards, browse our beginner guides like How to Use Base Blockchain for Retail-Friendly DeFi: A Step-by-Step Guide for Beginners.

The future of accessible decentralized finance is here, and it’s built on Base. Thanks to this new wave of user-centric protocols, anyone can participate confidently in DeFi’s next chapter.