Decentralized Finance (DeFi) is no longer the exclusive playground of crypto insiders and risk-hungry traders. With the rise of user-centric blockchains like Base, retail investors are finally gaining secure, intuitive access to high-yield opportunities once reserved for early adopters. In 2025, Base – a Layer 2 solution developed by Coinbase and built on Ethereum – stands out for its low fees, rapid transactions, and robust security, making it an ideal starting point for everyday users seeking to demystify DeFi.

Why Base Blockchain Is Changing the Game for Retail DeFi

The most significant barriers to DeFi adoption have always been complexity and risk. Base addresses both: it leverages Ethereum’s battle-tested security while offering a streamlined interface and integrations with trusted platforms like Coinbase. This means you get faster transactions, significantly lower fees, and a more approachable experience than traditional Ethereum mainnet DeFi.

But what really sets Base apart in 2025?

- Simplified onboarding: Seamless wallet integration with MetaMask or Coinbase Wallet

- Lower costs: Drastically reduced gas fees compared to Ethereum mainnet

- User-first design: Intuitive interfaces built for non-technical users

If you’re new to crypto or have been sidelined by clunky DeFi tools in the past, Base offers a rare combination of accessibility and safety that’s hard to beat.

The Retail Investor’s Step-by-Step Onboarding Guide (2025 Edition)

Navigating your first DeFi steps on Base doesn’t require technical expertise – just a focus on security fundamentals and an understanding of how assets move between networks. Here’s how you can start safely:

1. Set Up Your Wallet Securely

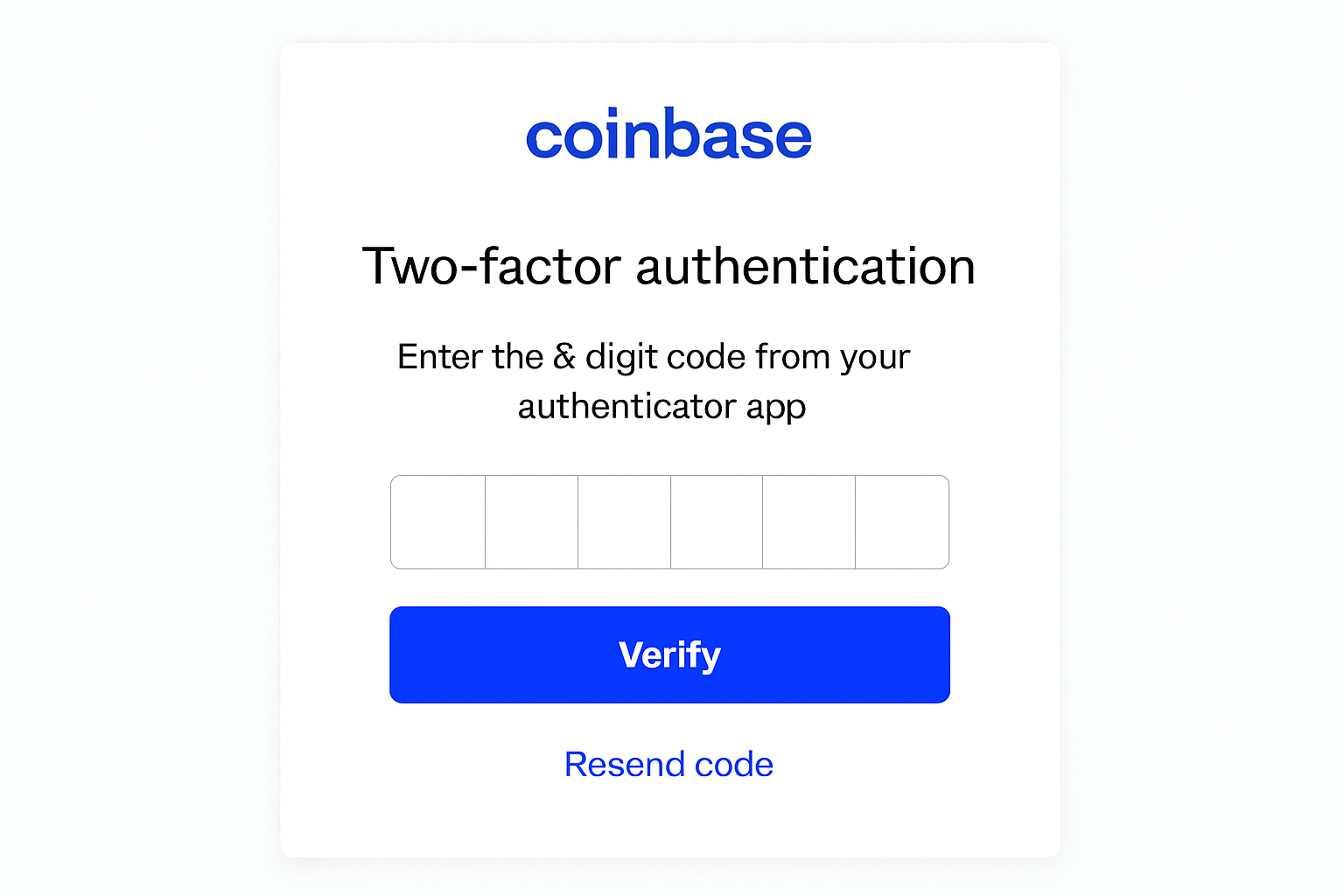

Your journey begins with creating a compatible crypto wallet. MetaMask and Coinbase Wallet are top picks – both support seamless interaction with Base dApps. During setup, write down your recovery phrase offline (never digitally) and enable two-factor authentication if available. This single step protects your assets from most common attacks.

2. Acquire ETH or USDC at Current Market Prices

You’ll need either Ethereum (ETH) or stablecoins like USDC to participate in DeFi activities on Base. As of October 20,2025, Ethereum is trading at $3,975.18 USD. Purchase your preferred asset through a reputable exchange such as Coinbase, then transfer them directly into your wallet. Double-check addresses before sending funds – mistakes are permanent.

Bridging Assets: The Key to Low-Fee DeFi Access

The real magic happens when you bridge your assets from Ethereum mainnet onto the Base network. This process unlocks lower fees and faster transaction speeds without sacrificing security. Most wallets now offer integrated bridging tools; alternatively, use official interfaces provided by Coinbase or verified partners.

Essential Safety Tips for DeFi Beginners on Base

-

Enable Two-Factor Authentication (2FA) on your Coinbase and wallet accounts for an extra layer of security. This helps prevent unauthorized access even if your password is compromised.

-

Use Reputable Wallets Like MetaMask or Coinbase Wallet to store your assets. Always safeguard your private keys and recovery phrases—never share them with anyone.

-

Double-Check Official URLs before connecting your wallet to any DeFi platform. Phishing sites can mimic real platforms like Aave or Uniswap, so always verify you’re on the correct website.

-

Stick to Audited and Well-Known DeFi Platforms such as Aave for lending and Uniswap for swapping tokens. Security audits reduce the risk of vulnerabilities.

-

Start With Small Amounts when testing new DeFi protocols or features. This minimizes potential losses if you make a mistake or encounter a bug.

-

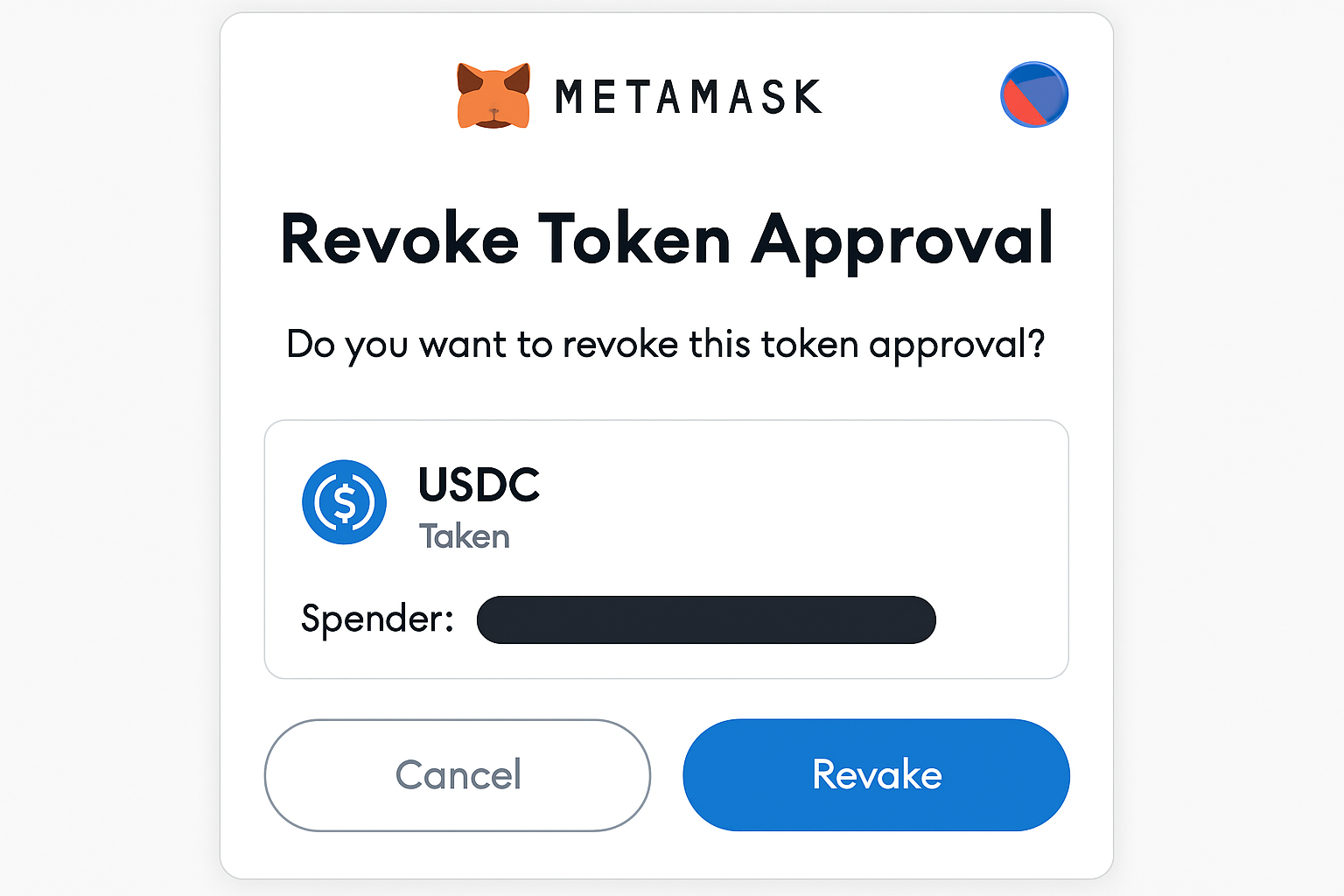

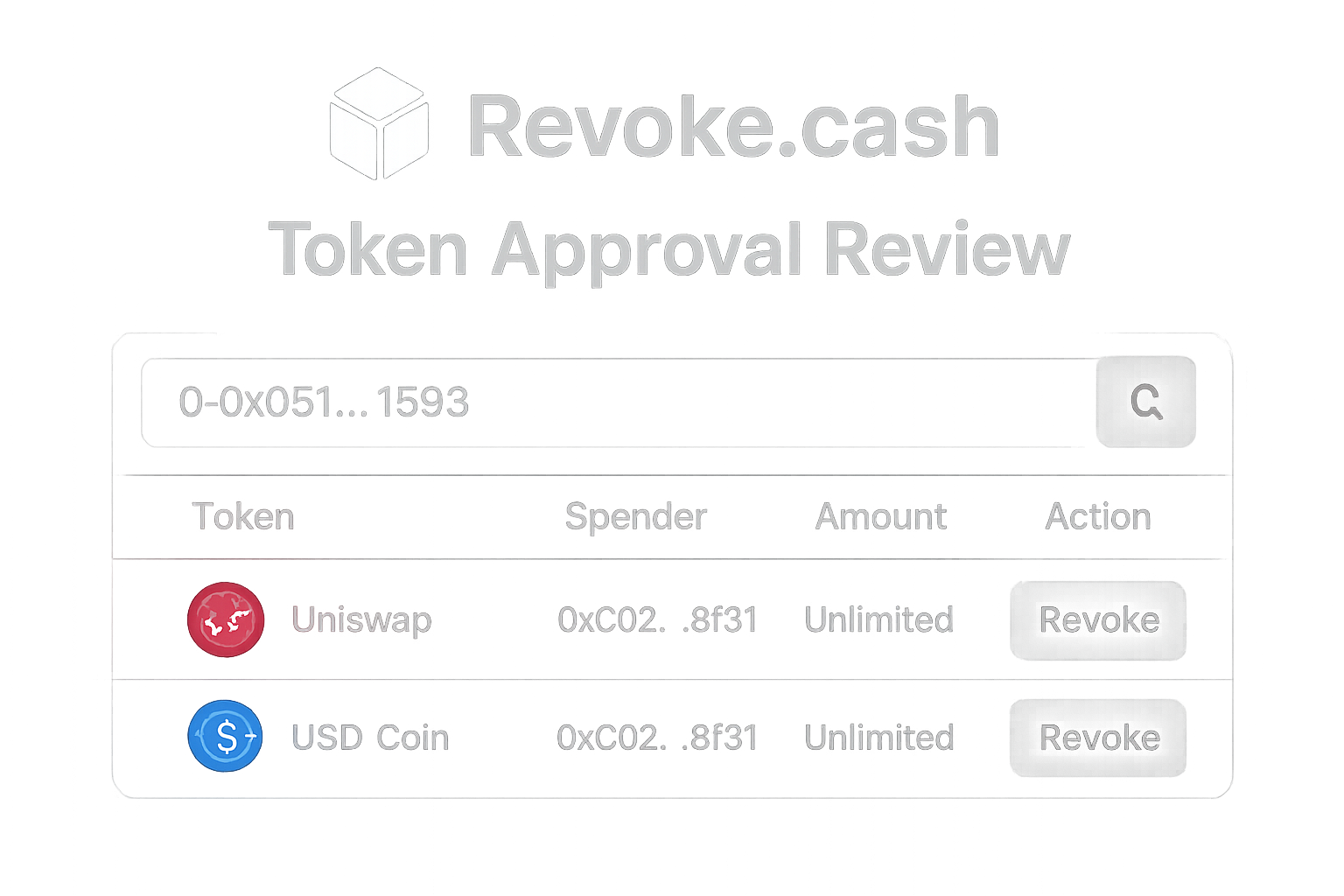

Review Token Approvals Regularly in your wallet settings to revoke permissions for apps you no longer use. This limits potential exposure if a platform is compromised.

-

Stay Updated on DeFi Trends and Risks by following trusted sources like basetoken.org and official Base announcements. Knowledge is your best defense.

If you want more detailed instructions or visual walkthroughs, check our comprehensive guide at How to Safely Onboard to Base DeFi for Retail Investors: Step-by-Step Guide.

Choosing and Connecting to DeFi Platforms on Base

Once your assets are bridged, you’re ready to explore the growing ecosystem of retail-friendly DeFi platforms on Base. Start with established protocols known for their transparency and security audits. Aave is a leader in decentralized lending and borrowing, while Uniswap remains the go-to for simple token swaps. Always connect your wallet directly from the platform’s official site, look for clear indicators that you’re on the correct domain, and never approve transactions you don’t understand.

As a retail investor, it’s wise to begin with small amounts. This approach minimizes risk while giving you hands-on experience with different DeFi activities:

- Lending: Deposit USDC or ETH into lending pools to earn competitive yields, interest rates fluctuate but remain transparent.

- Swapping: Use Uniswap’s Base interface for instant token exchanges at market rates.

- Staking: Lock up tokens in staking contracts to earn rewards, always read the terms before committing funds.

Smart Safety Habits for Everyday DeFi Users

The best defense against scams and loss is a healthy dose of skepticism and routine safety checks. Here are actionable habits every retail user should adopt in 2025:

Essential DeFi Safety Tips for Base Retail Investors

-

Enable Two-Factor Authentication (2FA) on Coinbase and Wallets: Secure your accounts by activating 2FA, especially on Coinbase and Coinbase Wallet, to add an extra layer of protection against unauthorized access.

-

Safeguard Private Keys and Recovery Phrases: Store your wallet’s private keys and recovery phrases offline in a secure location. Never share these details with anyone or store them digitally where they could be compromised.

-

Use Only Audited and Reputable DeFi Platforms: Interact exclusively with well-established DeFi protocols on Base, such as Aave and Uniswap, that have undergone independent security audits.

-

Double-Check URLs to Avoid Phishing: Always verify the official website addresses of DeFi platforms before connecting your wallet. Bookmark trusted sites and beware of lookalike phishing domains.

-

Start Small and Diversify: Begin with modest investments to test processes and understand risks. Avoid putting all your assets into a single protocol or token.

-

Regularly Review Token Approvals: Use tools like Revoke.cash to monitor and revoke unnecessary token permissions granted to DeFi apps, reducing the risk of malicious contract access.

-

Stay Updated on DeFi Security Best Practices: Follow trusted sources such as Coinbase Blog and Coinpaprika for the latest security tips and DeFi news relevant to the Base ecosystem.

If you’re ever unsure about a transaction or tool, pause and consult community resources or official documentation. For more beginner-focused tips on safe onboarding, visit our step-by-step onboarding guide.

Maximizing Your DeFi Experience: Tools and Resources

The Base blockchain isn’t just about access, it’s about empowerment through education and support. Leverage user-friendly dashboards, portfolio trackers, and educational modules designed specifically for non-technical investors. Many platforms now offer demo modes or testnets where you can practice without risking real assets.

Stay informed by following trusted sources on social media and joining reputable Discord or Telegram communities dedicated to Base DeFi. Regularly review your wallet permissions (token approvals) and revoke access from apps you no longer use, a simple but powerful habit that protects your funds.

What Sets Retail-Friendly DeFi Apart in 2025?

The convergence of robust security, intuitive design, and transparent yield opportunities makes Base blockchain an inflection point for retail adoption. For those seeking straightforward access without sacrificing safety or control, this is where mainstream finance meets decentralized innovation.

The future of finance isn’t just decentralized, it’s accessible to everyone willing to learn the basics and adopt smart habits early.

If you’re ready to take the next step, explore our curated reviews of the best beginner-friendly DeFi tools on Base. And remember: adaptability, and ongoing education, are your greatest allies as this ecosystem evolves.