Decentralized finance (DeFi) on the Base blockchain has come a long way, making it easier than ever for everyday investors to manage, analyze, and grow their crypto portfolios. If you’re just starting out or looking to optimize your DeFi experience, knowing which tools are truly retail-friendly can make all the difference. Let’s explore the best DeFi tools on Base that combine simplicity, security, and actionable insights for retail users.

![]()

Why Retail Investors Love Base: Simplicity Meets Security

Base is quickly becoming the go-to chain for retail-friendly DeFi, thanks to its Coinbase-backed security and a thriving ecosystem of intuitive apps. Unlike earlier DeFi platforms that catered mainly to power users, today’s tools on Base are designed with everyday investors in mind. Features like one-click swaps, visual analytics, and guided onboarding are now standard – and you don’t need to be a blockchain expert to use them.

The Essential DeFi Toolkit: 13 Must-Have Apps for Base Users

13 Essential DeFi Tools for Retail Investors on Base

-

BaseSwap: A native decentralized exchange (DEX) on Base, BaseSwap offers a simple interface and low-slippage trading for major tokens. It’s ideal for fast, affordable swaps within the Base ecosystem.

-

Aerodrome Finance: Aerodrome is a leading liquidity hub on Base, enabling users to provide liquidity, earn rewards, and participate in governance for Base-based assets.

-

Beefy Finance (on Base): Beefy Finance brings automated yield optimization to Base, letting users maximize returns on their DeFi assets through secure, auto-compounding vaults.

-

MetaMask Portfolio (with Base support): The MetaMask Portfolio tool allows users to track, manage, and swap Base assets directly from their MetaMask wallet in a single, unified dashboard.

-

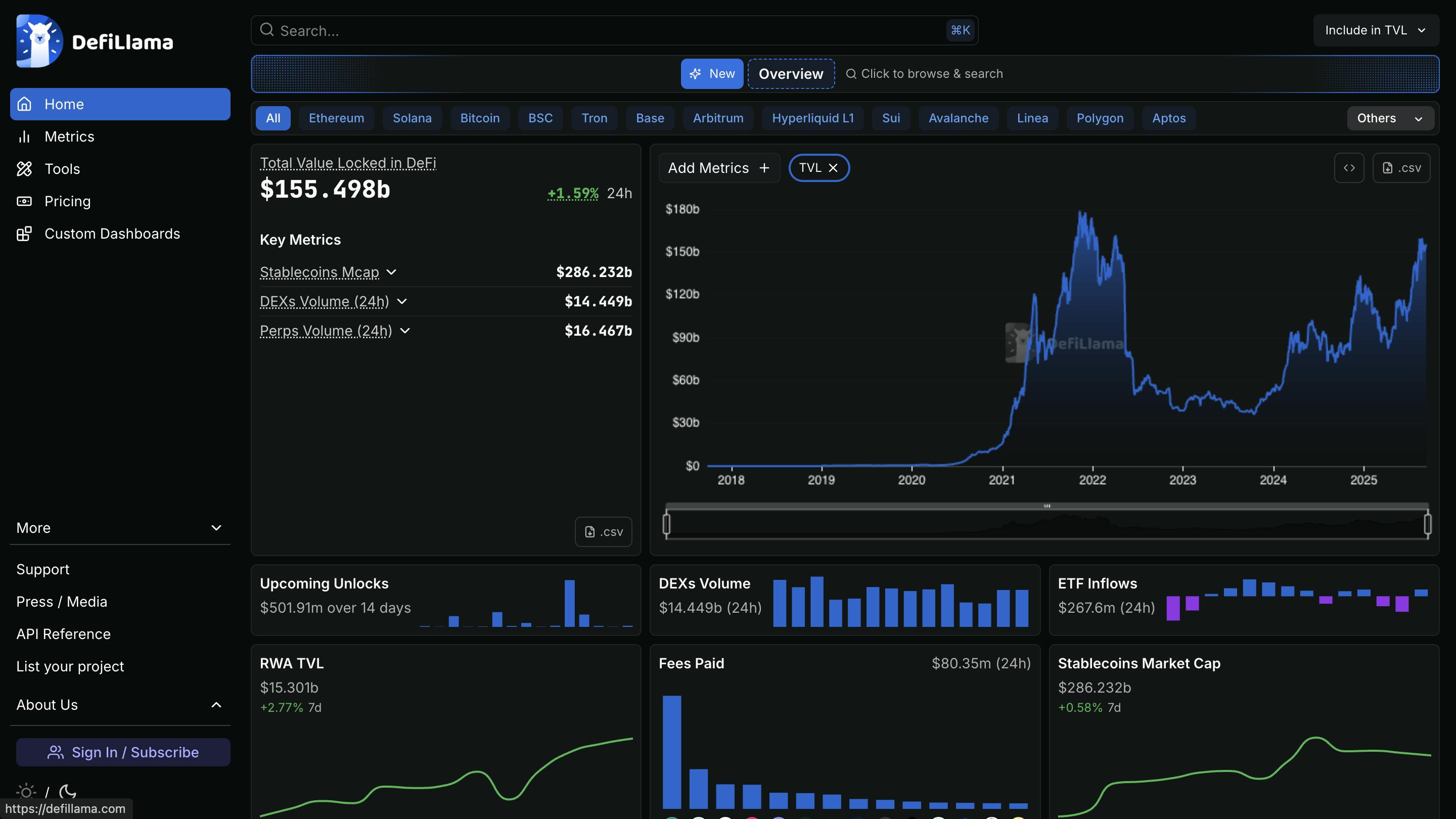

DeFiLlama Analytics (Base section): DeFiLlama’s analytics dashboard provides real-time data on Base’s DeFi protocols, including TVL, protocol rankings, and historical trends for informed decision-making.

-

Orbiter Finance (cross-chain bridge to Base): Orbiter Finance is a secure, user-friendly bridge for transferring assets between Base and other major blockchains, making cross-chain DeFi seamless.

-

DEXTools (Base integration): DEXTools offers advanced analytics, charts, and trading tools for Base-based DEXs, helping users analyze liquidity, price action, and token performance.

-

CoinGecko Portfolio Tracker (Base tokens): CoinGecko’s portfolio tracker supports Base tokens, allowing users to monitor prices, track holdings, and analyze performance in one place.

-

Safe (formerly Gnosis Safe, on Base): Safe is a multi-signature wallet platform on Base, providing secure, collaborative management of DeFi assets for individuals and teams.

-

RocketSwap: RocketSwap is a decentralized exchange on Base that offers fast swaps, yield farming, and liquidity provision with an easy-to-use interface.

-

Layer3 Quests (Base onboarding & rewards): Layer3 offers interactive quests and rewards for onboarding to Base, helping users discover DeFi tools and earn incentives for participation.

-

0x Protocol Aggregator (Base support): The 0x Protocol Aggregator routes trades across multiple DEXs on Base, ensuring users get the best prices and lowest slippage for token swaps.

-

Velodrome Finance: Velodrome is a major DEX and liquidity marketplace on Base, featuring innovative incentive models and deep liquidity for efficient trading.

Let’s break down how each of these tools empowers retail investors on Base:

Swap With Confidence: DEXes and Aggregators

BaseSwap is the native decentralized exchange (DEX) on Base, offering a straightforward interface and consistently low slippage. Whether you’re swapping stablecoins or trending tokens, BaseSwap makes the process seamless for beginners. For those who want even more options, Velodrome Finance and RocketSwap each bring unique liquidity pools and token pairs, so you can always find the right market for your needs.

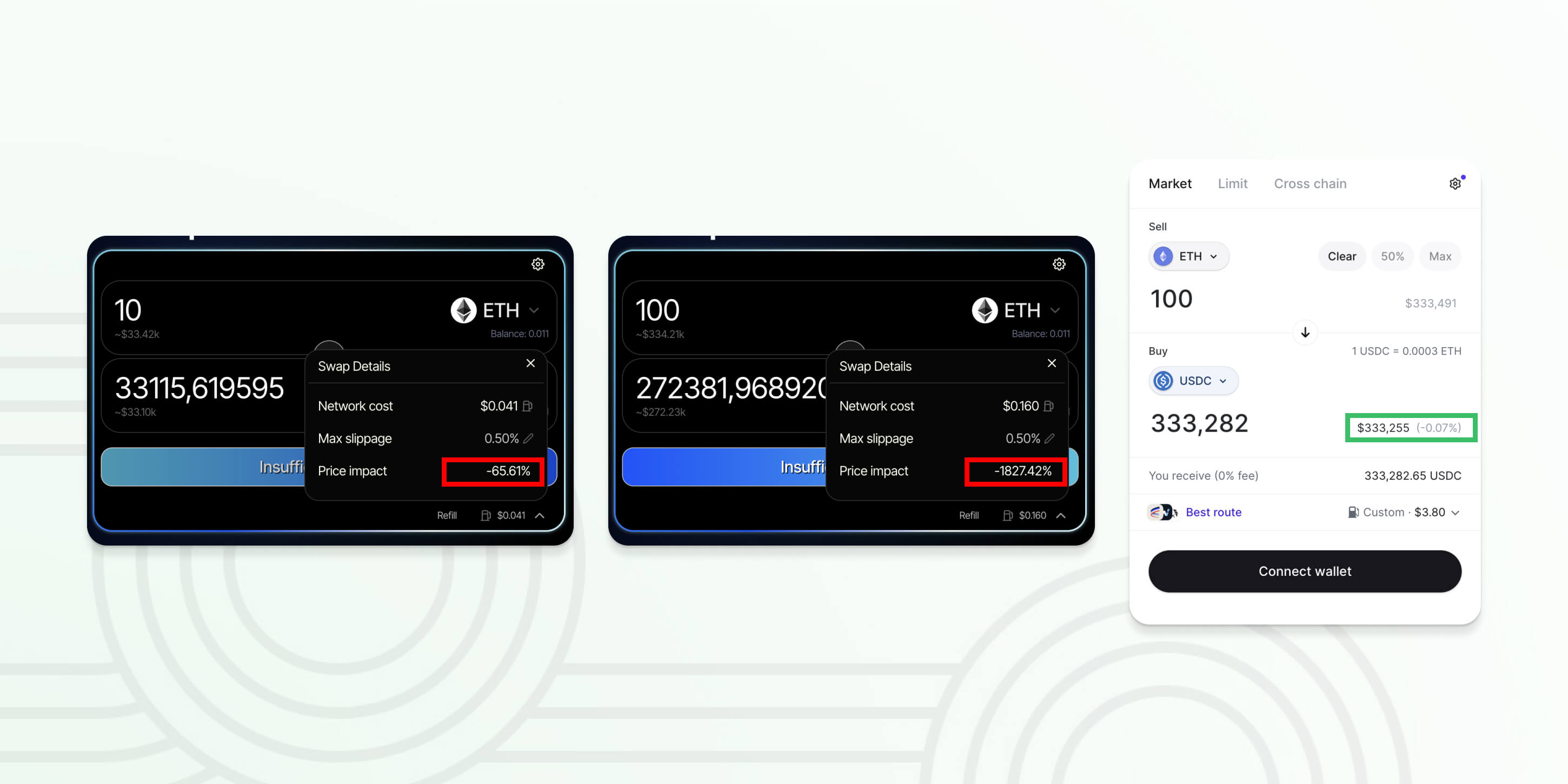

Want the best price across all DEXes? 0x Protocol Aggregator does the heavy lifting by routing your trade through multiple liquidity sources on Base, ensuring you get optimal rates with minimal hassle. This is perfect for retail traders who want to avoid manual price comparisons.

Track and Grow Your Portfolio: Analytics and Yield Tools

Keeping tabs on your assets shouldn’t be a chore. MetaMask Portfolio now supports Base, letting you view all your holdings in one place – even if you use multiple wallets. Pair this with CoinGecko Portfolio Tracker, which tracks Base tokens specifically, and you’ll never lose sight of your performance.

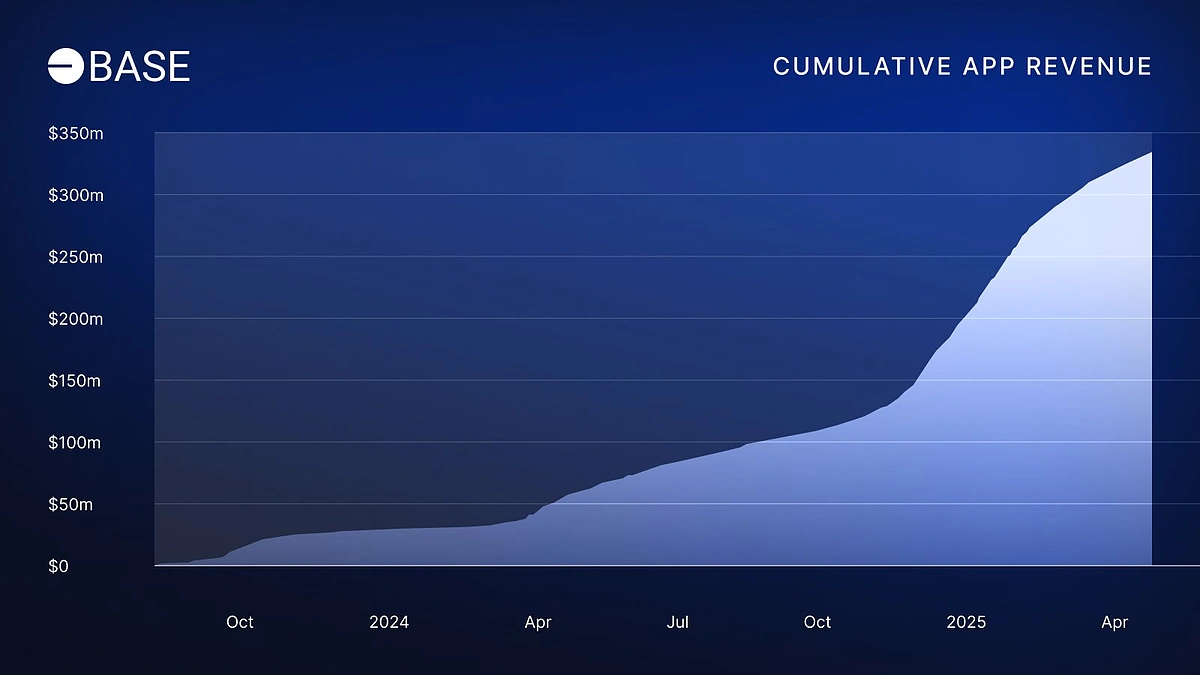

For those interested in maximizing yield without constant micromanagement, Beefy Finance (on Base) automates yield strategies across vetted farms. It’s a great way for retail users to put their assets to work while minimizing risk. If you want a bird’s-eye view of the entire DeFi landscape on Base, DeFiLlama Analytics provides up-to-date analytics on total value locked (TVL), protocol rankings, and more – all tailored to the Base ecosystem.

Bridge, Onboard, and Stay Safe: The Supporting Cast

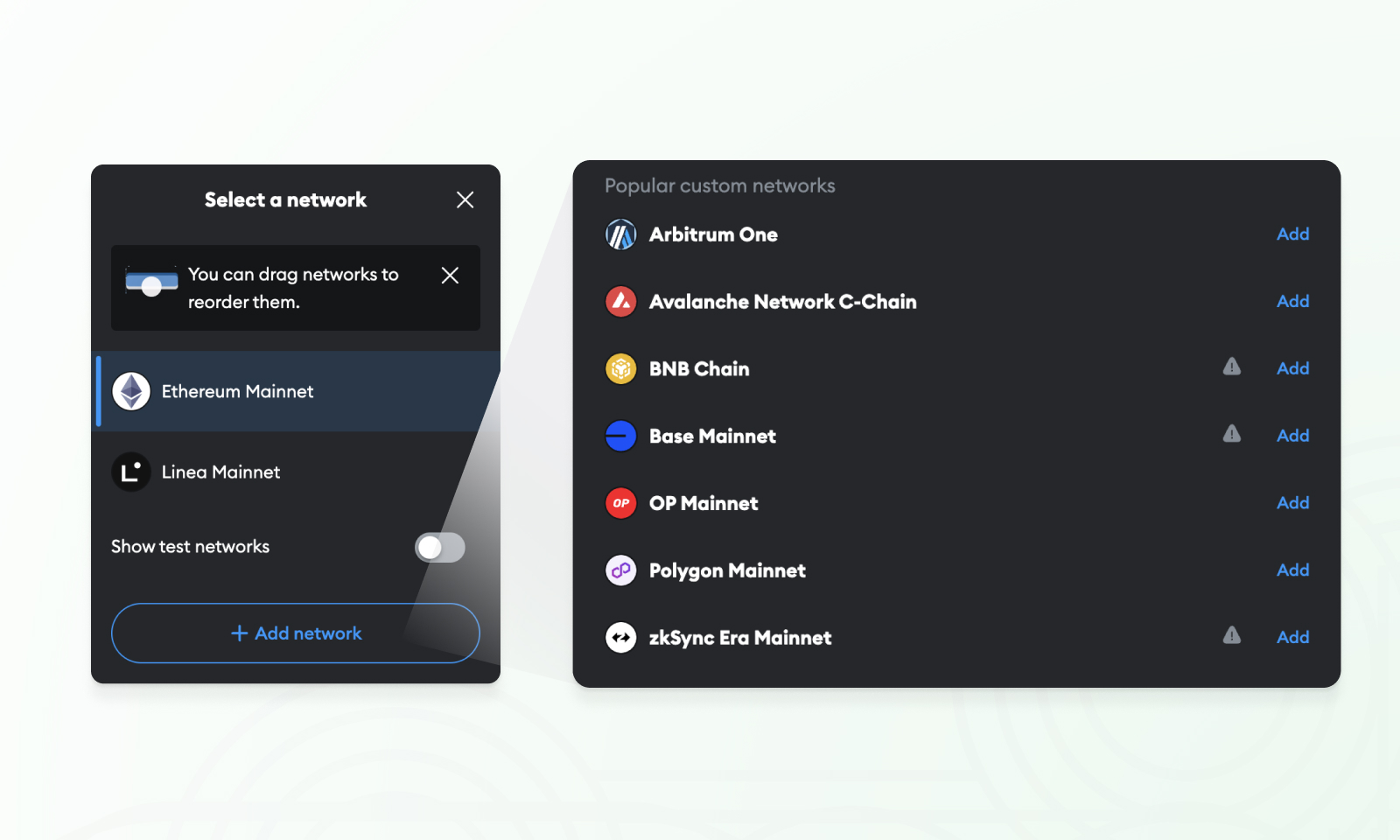

Getting assets onto Base is simple with Orbiter Finance, a cross-chain bridge that makes moving funds from other chains fast and affordable. Once you’re set up, Safe (formerly Gnosis Safe) offers multi-signature wallet functionality for those wanting extra security – perfect for managing group funds or larger portfolios.

If you’re new to DeFi or want to earn while you learn, Layer3 Quests gamifies onboarding with interactive tutorials and rewards for completing tasks on Base. And when it comes to real-time trading signals and charting, DEXTools (now with Base integration) gives retail traders the edge without overwhelming them with complexity.

Curious about more beginner-friendly DeFi apps? Check out our in-depth guide on the best beginner-friendly DeFi tools on Base for a step-by-step walkthrough.

Putting It All Together: A Retail Investor’s DeFi Workflow on Base

Let’s imagine you’re a retail investor starting your DeFi journey on Base. You bridge funds using Orbiter Finance for a low-fee transfer, then secure your assets with Safe for peace of mind. Next, you explore Layer3 Quests, picking up rewards and learning how to use Base-native tools. Ready to trade? You compare rates on BaseSwap, Velodrome Finance, and RocketSwap, or just let the 0x Protocol Aggregator find the best price automatically. Once you’ve made some swaps, you track your growing portfolio in MetaMask Portfolio and CoinGecko Portfolio Tracker, while checking performance analytics on DeFiLlama. Looking for passive income? You put idle tokens to work via Beefy Finance. And for real-time market moves, you fire up DEXTools for charts and signals tailored to Base.

Why These Tools Matter: Security, Simplicity, and Control

The real superpower of these 13 tools is how they put you in control. No more juggling spreadsheets or worrying about which bridge is safe. Each app is designed to be approachable for beginners, yet powerful enough for experienced users. With multi-chain support, one-click swaps, and transparent analytics, retail investors can finally participate confidently in DeFi on Base without feeling overwhelmed by jargon or risk.

Security is no afterthought. Tools like Safe and MetaMask Portfolio offer robust wallet management, and platforms such as Beefy Finance and DeFiLlama focus on transparency, so you always know where your funds are and how they’re performing. Plus, onboarding tools like Layer3 Quests ensure you never have to go it alone, rewarding you for learning and exploring.

Which Base DeFi tool has made the biggest impact on your crypto journey?

Base offers a growing ecosystem of DeFi tools designed for analytics, portfolio tracking, and secure swaps. From DEXs to portfolio trackers and bridges, which of these essential tools has been most valuable to you as a retail investor?

Tips for Getting the Most Out of Base DeFi: Smart, Safe, and Simple

- Start small: Use Layer3 Quests to get hands-on experience before committing large funds.

- Bridge safely: Stick with Orbiter Finance for trusted cross-chain transfers to Base.

- Diversify: Explore multiple DEXes like BaseSwap and Velodrome for the best rates.

- Automate wisely: Let Beefy Finance manage your yield strategies if you prefer a hands-off approach.

- Stay informed: Use DeFiLlama Analytics and DEXTools to monitor trends and spot opportunities.

- Secure your assets: Consider multi-sig wallets like Safe, especially for larger portfolios or group funds.

The DeFi landscape on Base is evolving rapidly, but these 13 tools are already setting the standard for what accessible, user-friendly DeFi should look like. Whether you’re swapping, tracking, bridging, or earning, each app brings unique strengths to the table. The best part? You don’t need to be a developer or crypto veteran to get started. With the right toolkit, anyone can take charge of their financial future, one simple, secure step at a time.

If you want even more hand-holding, or just want to see these tools in action, check out our full walkthrough on the best beginner-friendly DeFi tools on Base. Smart investing starts with understanding, and with these apps, you’re already ahead of the curve.