Decentralized finance (DeFi) is rapidly shifting the investment landscape, offering retail investors unparalleled access to financial tools once reserved for institutions. Yet, for many, DeFi’s complexity and security risks have been barriers to entry. Enter Base blockchain: a Layer 2 solution developed by Coinbase, designed to make secure and simple DeFi transactions a reality for everyday users. Whether you’re exploring digital assets for the first time or seeking yield opportunities beyond traditional banking, understanding how to safely navigate the Base ecosystem is essential.

Why Base Blockchain is Attracting Retail Investors

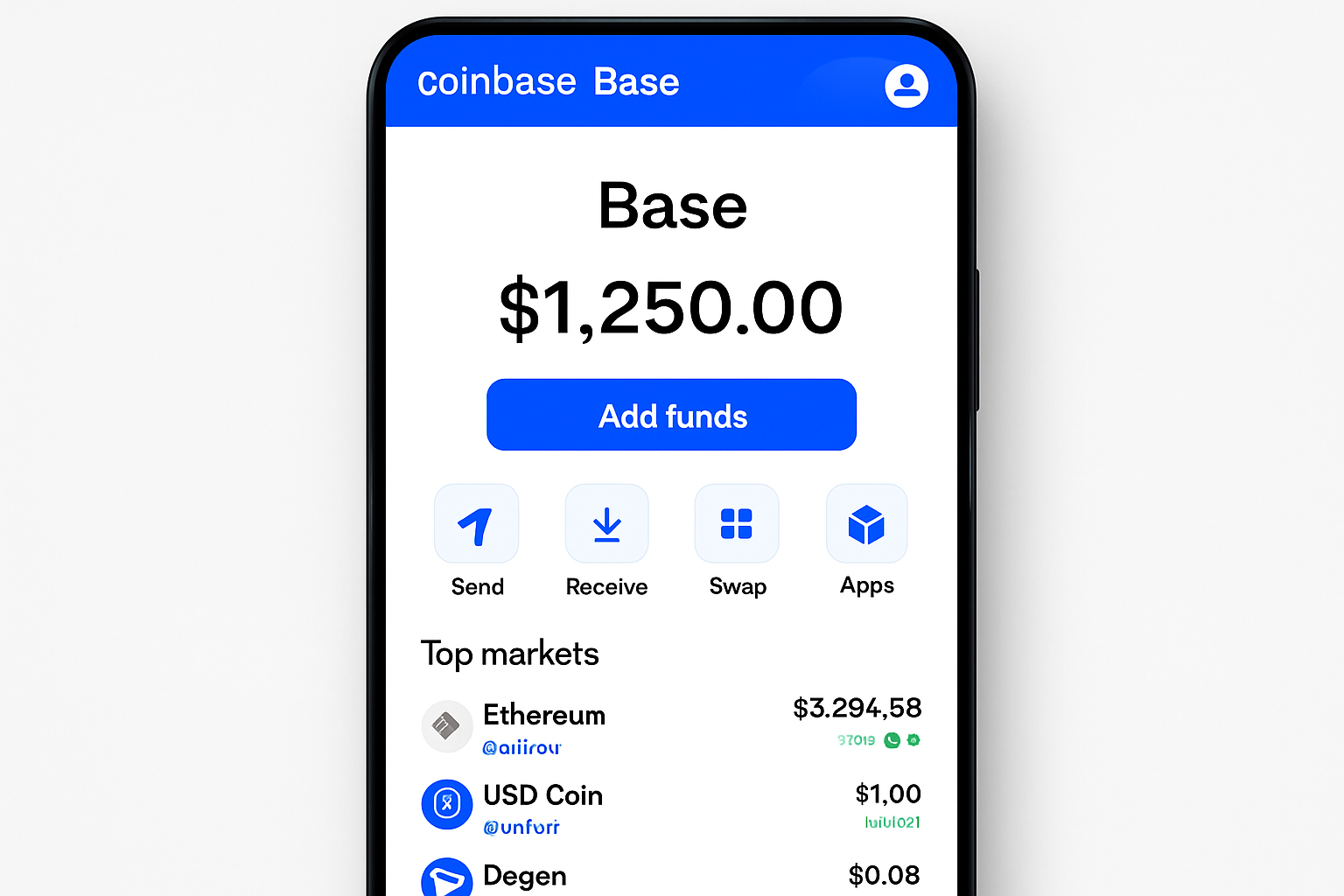

Base stands out for its strategic focus on user experience and security. Integrated directly with the Coinbase app, Base streamlines onboarding, reduces transaction fees, and provides access to a curated set of DeFi tools. For retail investors, this means you can move from fiat to DeFi in just a few taps, no technical background required. The platform’s transparent pricing and robust security infrastructure are especially appealing in an industry where trust is paramount.

Unlike many blockchains that can overwhelm newcomers, Base is built to be retail-friendly. Whether you’re looking to earn yield, swap tokens, or participate in new decentralized offerings, Base’s ecosystem eliminates much of the friction that has historically kept everyday investors on the sidelines.

Step-by-Step: Onboarding to Base DeFi Safely

Getting started on Base is more straightforward than ever. Here’s a methodical approach to onboarding securely:

Key Steps for Secure Base DeFi Onboarding

-

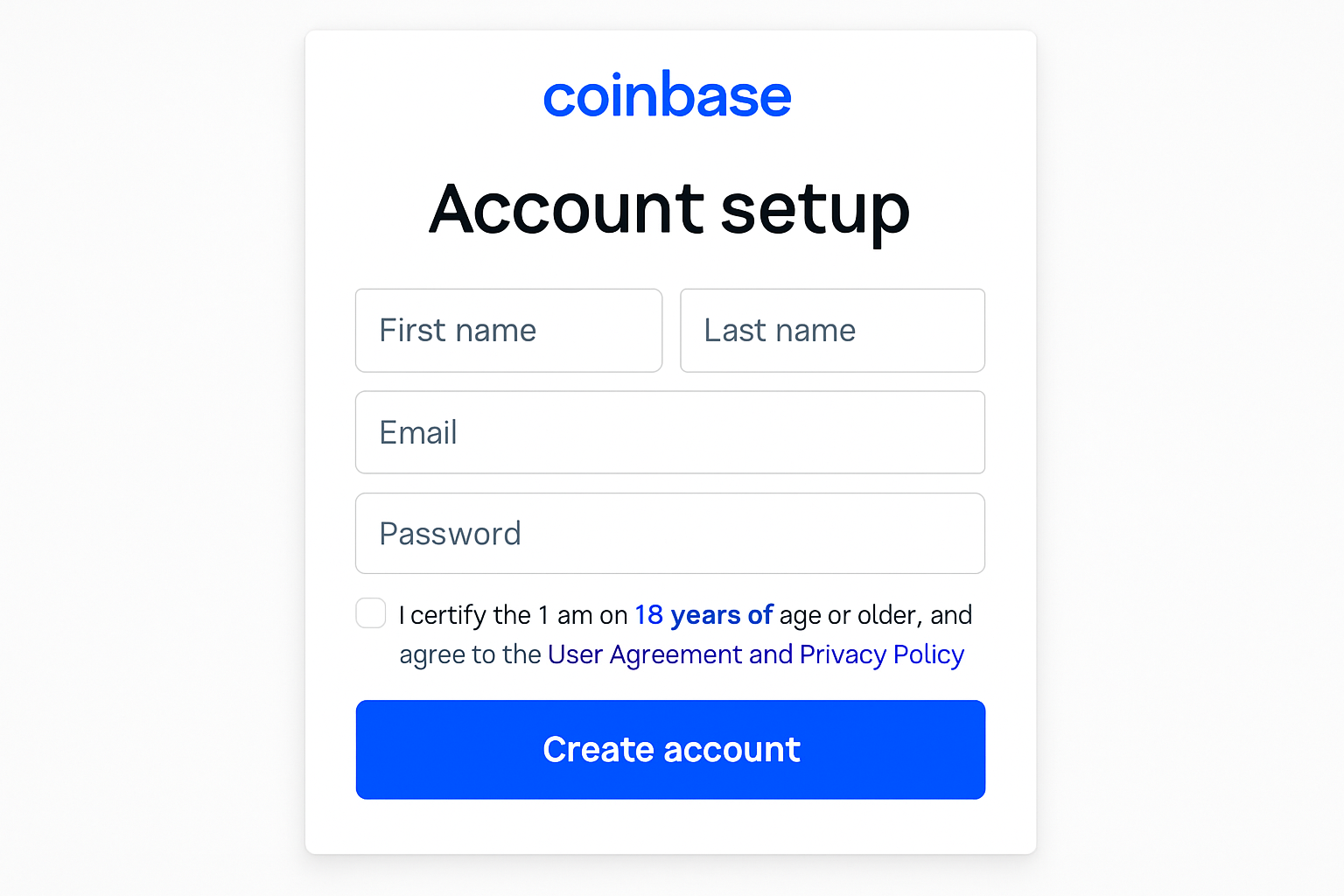

Create a Coinbase Account: Begin by registering on Coinbase, which serves as your primary gateway to the Base network and DeFi ecosystem.

-

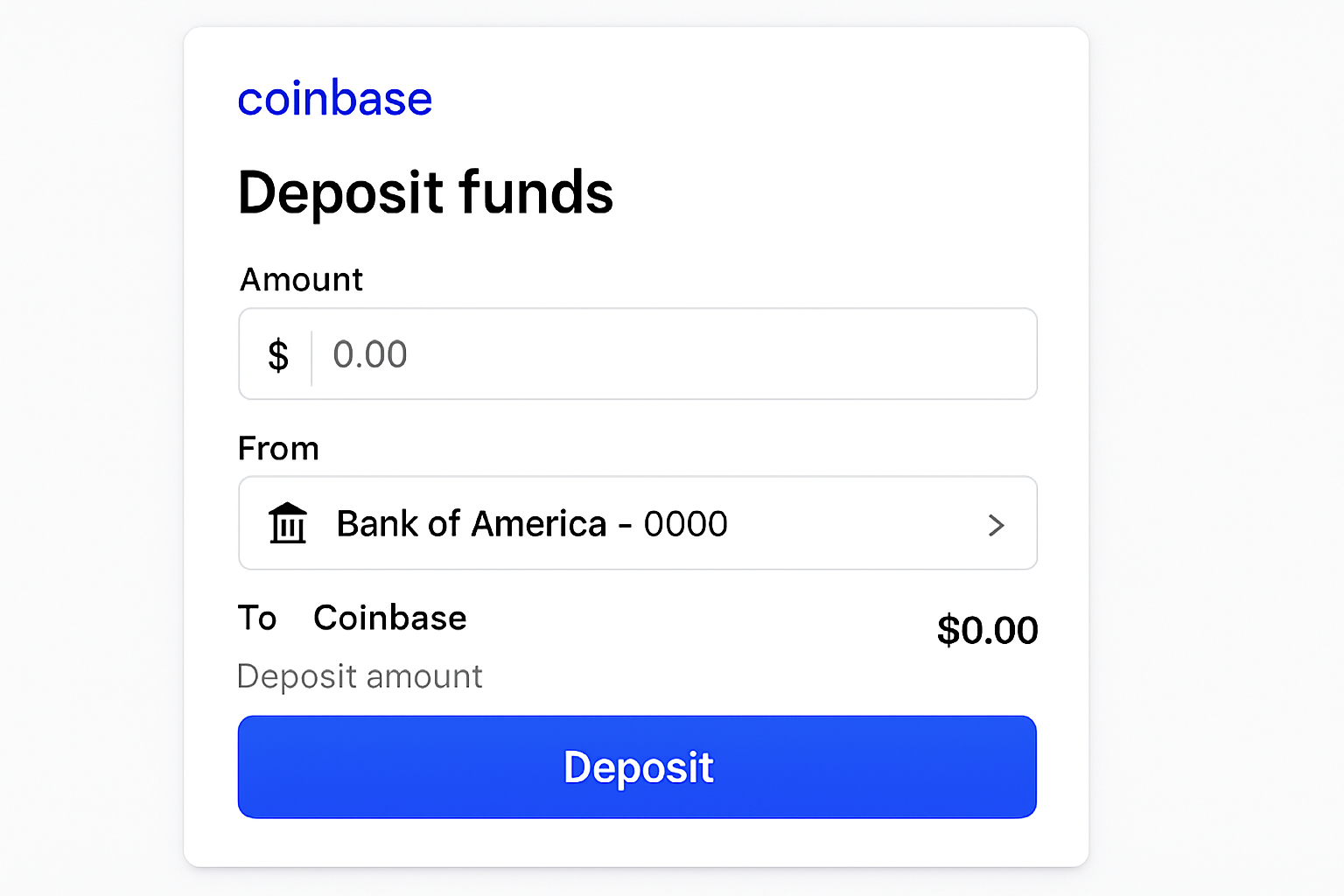

Deposit Funds Securely: Add funds to your Coinbase account using trusted payment methods, ensuring your transactions are protected by Coinbase’s security measures.

-

Transfer Assets to Base: Use Coinbase’s integrated features to move your assets onto the Base network, enabling access to DeFi apps with lower fees and seamless connectivity.

-

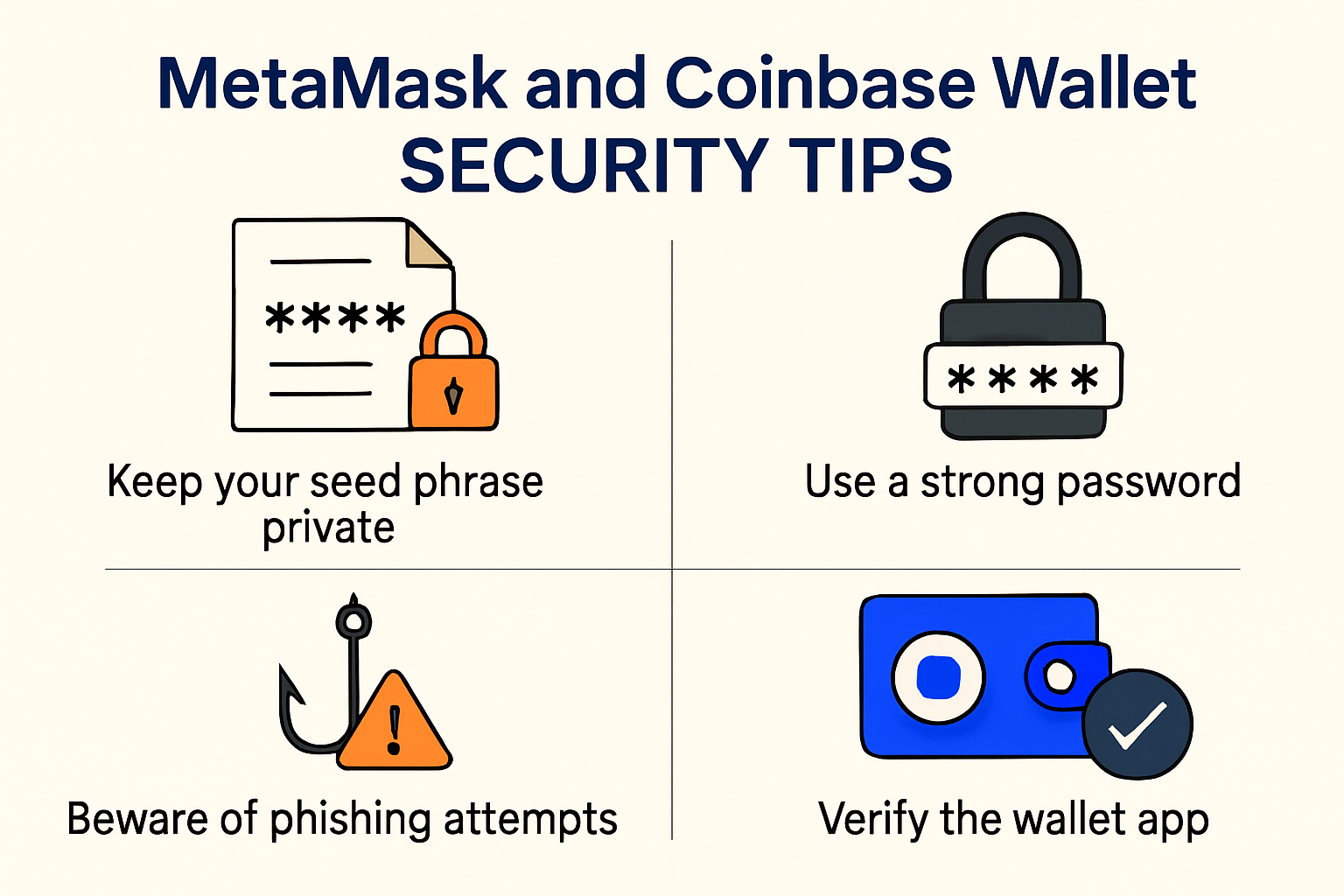

Select a Compatible Wallet: Choose a wallet that supports Base, such as Coinbase Wallet or MetaMask, for secure storage and easy DeFi access.

-

Safeguard Your Private Keys: Securely store your private keys and recovery phrases offline; never share them to prevent unauthorized access to your assets.

-

Verify Authenticity of Platforms and Links: Always double-check URLs and only use official sources to avoid phishing scams and fraudulent DeFi applications.

-

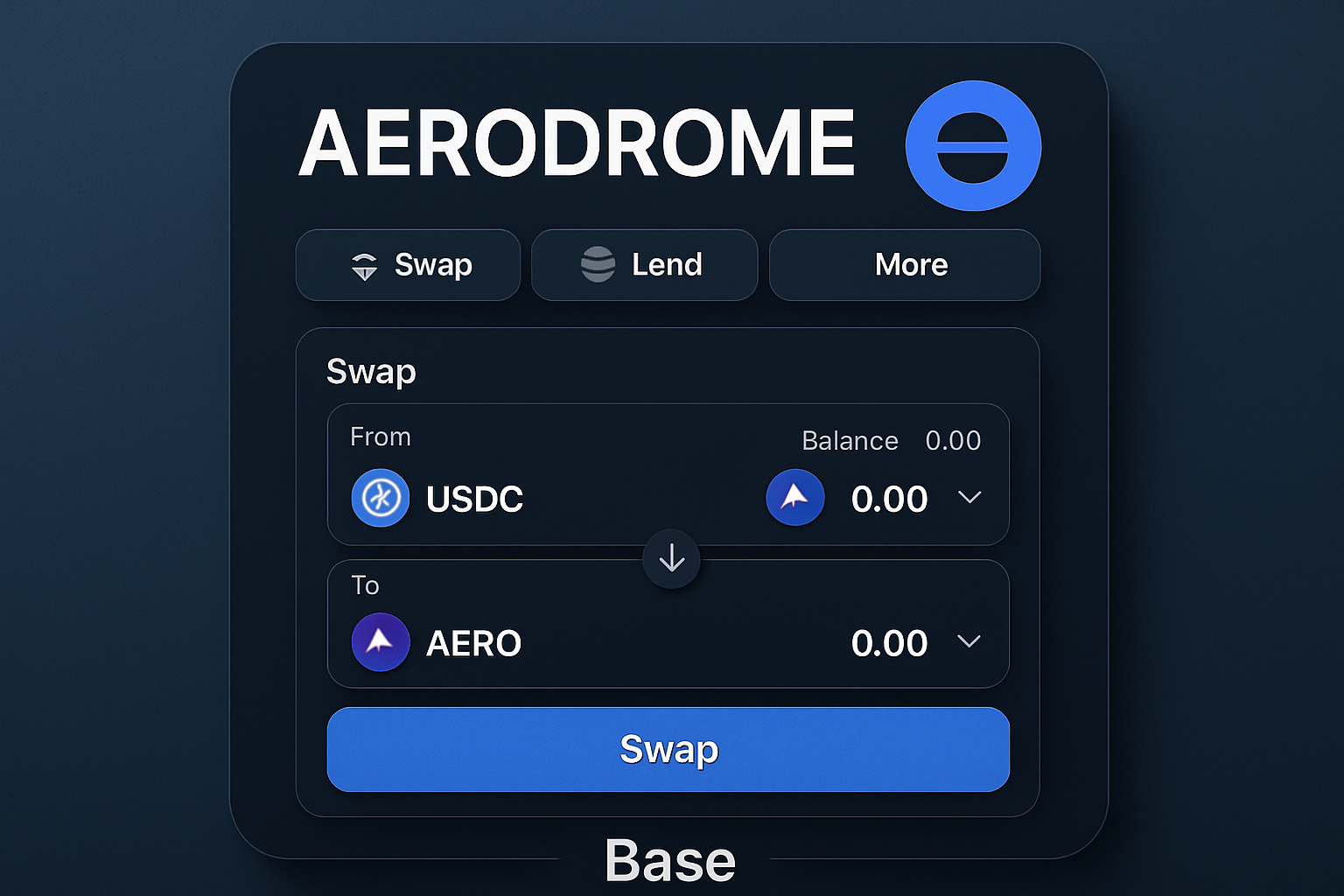

Engage Only with Audited DeFi Apps: Interact exclusively with DeFi protocols on Base that have undergone thorough security audits, such as Aerodrome and other verified Base ecosystem apps.

-

Conduct Thorough Research: Investigate the reputation, team, and security history of DeFi projects before investing or transacting.

-

Understand DeFi Risks: Familiarize yourself with potential vulnerabilities, market volatility, and evolving regulations to make informed decisions.

-

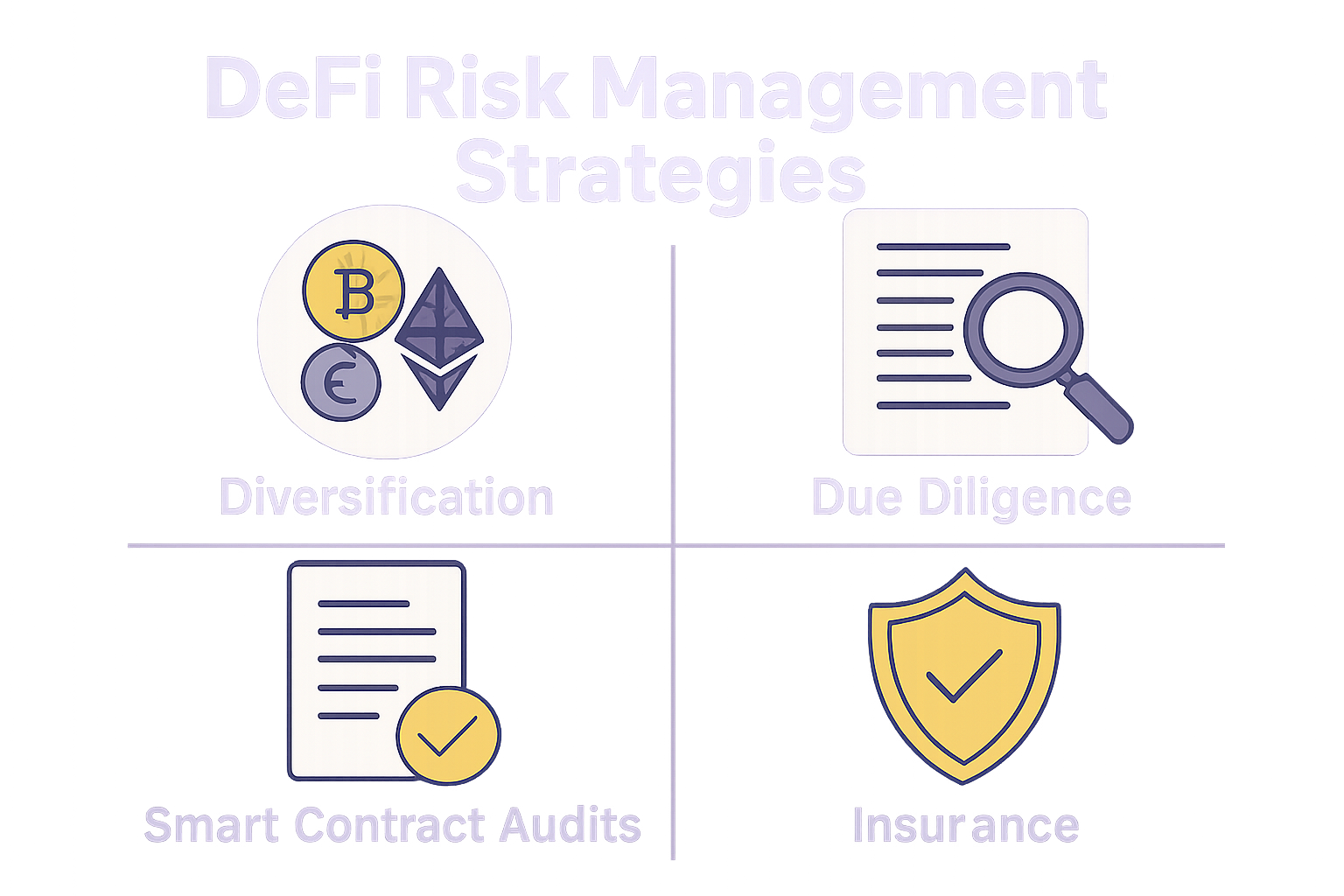

Implement Risk Management Strategies: Only invest what you can afford to lose, diversify your portfolio, and stay updated on regulatory developments affecting DeFi.

1. Create a Coinbase Account: Your journey begins with setting up a Coinbase account. This acts as your bridge to the Base network and ensures regulatory compliance. 2. Deposit Funds: Add fiat or crypto assets to your account using trusted payment methods. 3. Transfer Assets to Base: Seamlessly move funds from your Coinbase account to the Base blockchain with integrated transfer features. 4. Choose a Compatible Wallet: Select a wallet that supports Base, such as Coinbase Wallet or MetaMask. 5. Secure Your Private Keys: Store your recovery phrase offline. Never share your private keys, this is your ultimate line of defense. 6. Verify Platforms and Links: Engage only with official platforms and double-check URLs to avoid phishing attempts. 7. Engage with Audited DeFi Apps: Stick to DeFi protocols that have undergone independent security audits for maximum peace of mind.

For a detailed walkthrough, Coinbase offers an accessible primer on how to get started in DeFi, ensuring your first steps are both safe and informed.

Retail-Friendly DeFi Opportunities on Base

Base isn’t just about making DeFi safer, it’s about making it practical and profitable for retail investors. The platform’s low fees and seamless integration open the door to several high-potential opportunities:

- Yield Farming and Liquidity Provision: Supply liquidity to DeFi protocols and earn returns through trading fees and bonus tokens. Base’s reduced transaction costs make these strategies accessible even for smaller portfolios.

- Initial DEX Offerings (IDOs): Participate early in new token launches for a chance at outsized returns as projects gain traction on the Base network.

- Perpetual Decentralized Exchanges: Access user-friendly perpetual DEXs for low-fee trading and leverage, no advanced trading desk required.

For an in-depth look at these strategies and how to approach them confidently, see this guide to DeFi investor opportunities on Base.

Security Essentials: Protecting Your Assets on Base

Security is non-negotiable in DeFi, especially for retail participants. Base’s integration with Coinbase means you benefit from industry-leading protections, but your vigilance is still required:

- Research Every Project: Investigate the reputation, team, and audit history of any DeFi protocol before committing funds.

- Understand the Risks: DeFi is innovative but not risk-free, software bugs, market volatility, and regulatory shifts can all impact your investments.

- Implement Risk Management: Only invest what you can afford to lose. Diversify across protocols and stay updated on evolving regulations.

For more actionable best practices, see this comprehensive guide to DeFi security for retail investors.

Base’s design philosophy is all about removing the fear factor for newcomers while providing the robust infrastructure seasoned users expect. By focusing on transparency and auditability, Base ensures that users can verify the safety of their transactions and the legitimacy of the protocols they interact with. This is especially critical as DeFi continues to attract more retail capital, and the stakes for personal security rise accordingly.

Staying Ahead: Navigating DeFi Safely as a Retail Investor

Proactive education and ongoing vigilance are your best defenses. As you explore new opportunities on Base, keep these core habits in mind:

Essential Habits for Safe DeFi on Base

-

Secure Your Wallet and Private Keys: Choose reputable wallets such as Coinbase Wallet or MetaMask. Store your private keys and recovery phrases offline, and never share them with anyone.

-

Conduct Thorough Research Before Investing: Investigate the reputation, security audits, and development teams of any DeFi project before committing funds. Use resources like DeFiLlama to review project data and audits.

-

Understand and Manage Risks: Be aware of market volatility and smart contract risks. Only invest what you can afford to lose and diversify your DeFi portfolio to minimize exposure.

-

Stay Updated on Regulatory Changes: Monitor regulatory news and updates relevant to DeFi and the Base network to ensure ongoing compliance and protect your investments.

• Double-check URLs and platform authenticity. Phishing attacks remain one of the most common threats. Bookmark official sites and avoid clicking links from untrusted sources.

• Regularly update your wallet software to patch vulnerabilities and take advantage of new security features.

• Monitor your transaction history and wallet balances. Unexpected activity can be a red flag for compromise.

• Engage with the Base community. Forums and Discord channels often surface issues or opportunities early, giving you a strategic edge.

Base’s retail-friendly approach also means that if you do run into trouble, support resources are more accessible than with typical DeFi protocols. The Coinbase integration provides a familiar safety net, reducing the risk of costly mistakes during onboarding or asset transfers.

Evaluating DeFi Projects on Base: What to Look For

With a growing ecosystem, not all DeFi projects on Base are created equal. Use these criteria to vet opportunities before committing your capital:

- Audit Reports: Has the protocol undergone recent, independent security audits? Transparent publication of these reports is a strong indicator of credibility.

- Community Activity: Active, responsive communities signal long-term viability and rapid issue resolution.

- Development Track Record: Consistent updates and open-source development foster trust and adaptability.

- Clear Documentation: Projects that provide accessible guides, FAQs, and support channels prioritize user success.

For a curated list of the most reliable and user-friendly apps, explore Base’s featured DeFi tools. These platforms are selected for their focus on transparency, ease of use, and security.

Building Confidence as a Retail DeFi Investor

The Base blockchain is lowering the barrier to entry for millions of retail investors, but your journey doesn’t end after onboarding. Take time to learn, experiment with small amounts, and gradually expand your participation as your confidence grows. Remember, the most successful DeFi investors are those who combine curiosity with caution.

For those ready to deepen their engagement, resources such as step-by-step onboarding guides and community-driven forums are invaluable. By leveraging these tools and following best practices, you can turn Base into your secure gateway to the evolving world of decentralized finance.