Decentralized finance is no longer reserved for crypto veterans or tech insiders. Thanks to the Base blockchain’s focus on user experience and Coinbase’s trusted ecosystem, retail investors can now access DeFi with greater simplicity and security than ever before. If you’re new to DeFi or just Base, this guide will walk you through safe onboarding, step by step, so you can confidently explore decentralized finance on your own terms.

Why Choose Base for Retail-Friendly DeFi?

Base is an Ethereum Layer 2 solution designed specifically to make decentralized finance faster, cheaper, and more accessible. Its integration with Coinbase provides an added layer of trust, while tools like GasZero remove friction by sponsoring transaction fees for users. As of October 6,2025, Ethereum (ETH) is trading at $4,499.47, giving you a sense of the robust activity in the wider ecosystem that Base taps into.

The rapid growth of retail-friendly DeFi tools on Base means everyday investors no longer need to worry about complex interfaces or unpredictable gas fees. Instead, they can focus on learning and participating in protocols that were once out of reach.

Step 1: Setting Up Your Wallet

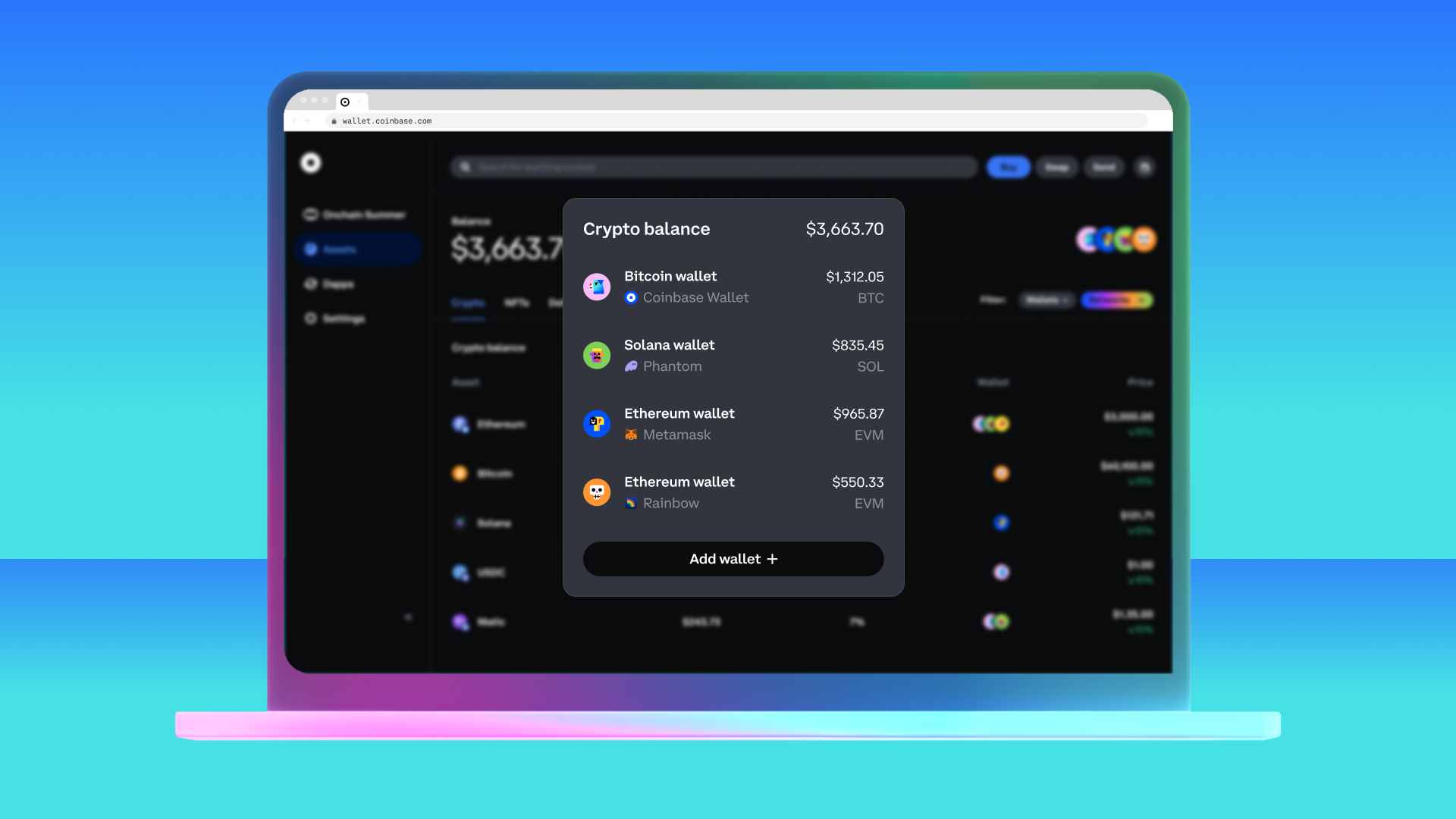

Your journey begins with a secure crypto wallet compatible with Base and its DeFi apps. Popular options include Coinbase Wallet and other wallets supporting Ethereum Layer 2s. Setting up your wallet is essential, it acts as your digital bank account for interacting with DeFi protocols.

Pro Tip: Always back up your seed phrase in multiple secure locations. This is your only way to recover funds if you lose access to your device.

Step 2: Funding Your Wallet With Crypto

Once your wallet is ready, it’s time to add funds. You’ll need ETH or USDC, both widely accepted on Base, to get started. Use Coinbase or another reputable exchange to purchase crypto, then transfer it directly to your new wallet address on the Base network.

Checklist: Essentials for Moving Funds to Base

-

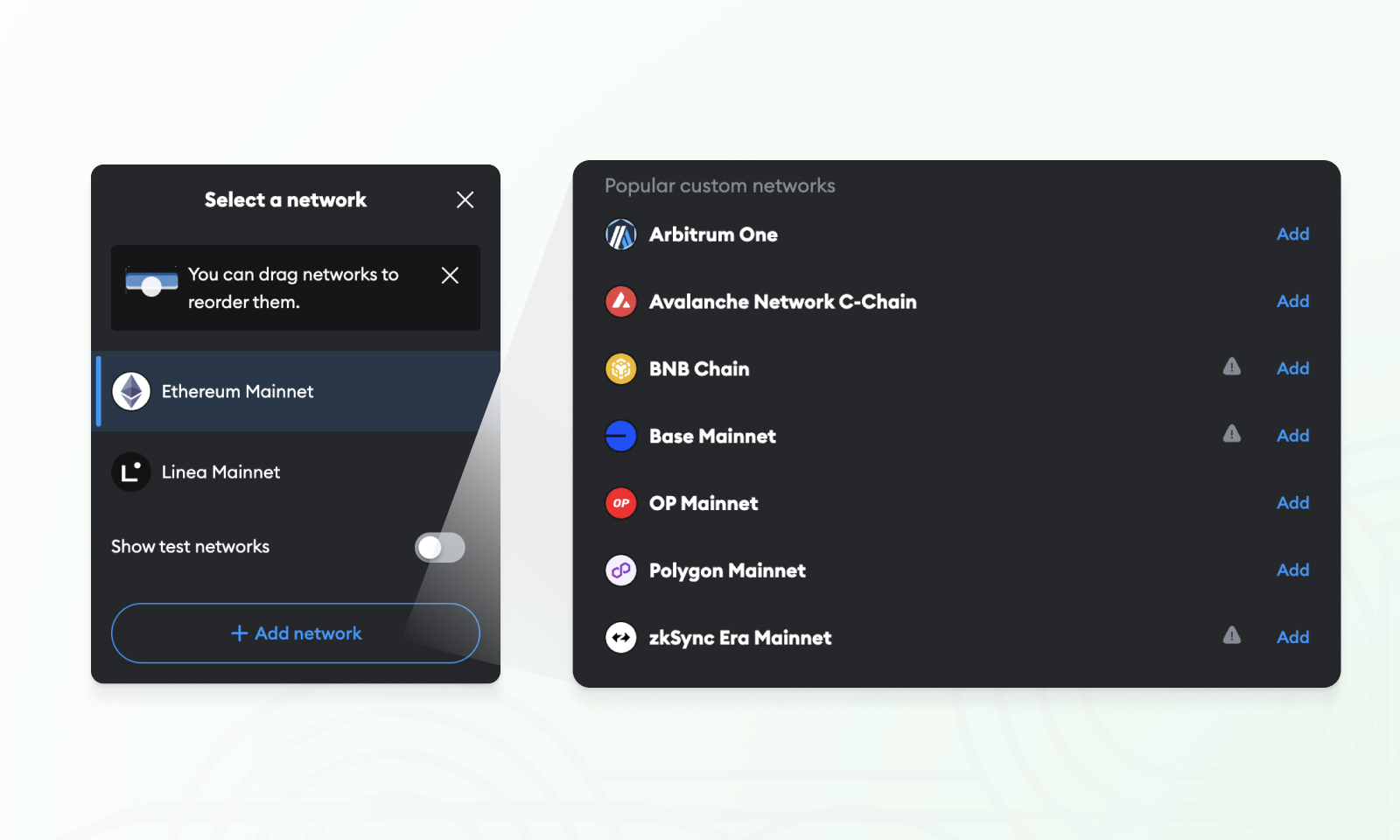

DeFi-Compatible Crypto Wallet: Set up a wallet that supports Base, such as Coinbase Wallet, MetaMask, or Rabby Wallet.

-

Ethereum (ETH) for Gas Fees: Ensure you have a small amount of Ethereum (ETH) in your wallet to pay for transaction fees when bridging or interacting with DeFi apps. As of October 6, 2025, ETH is trading at $4,499.47.

-

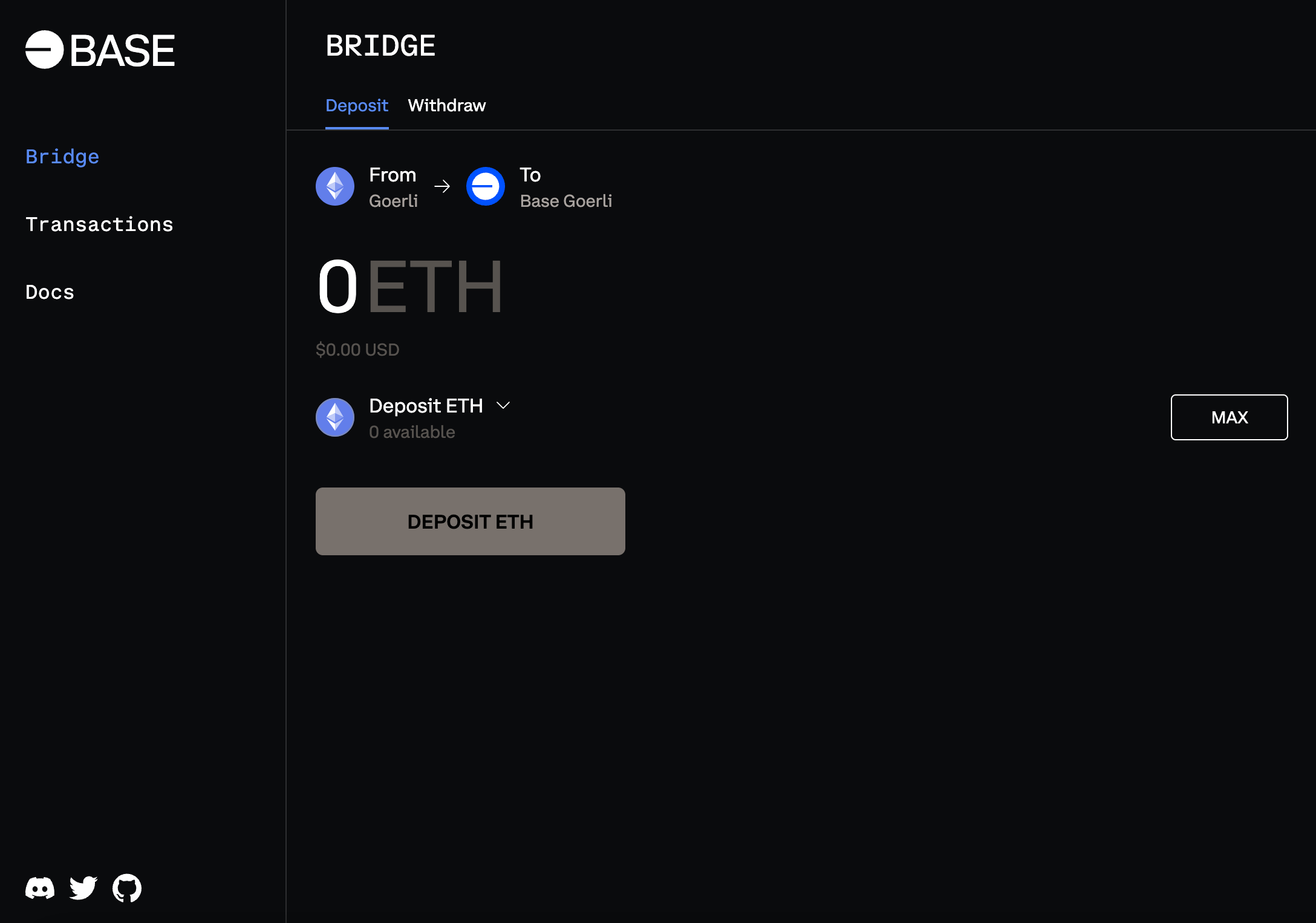

Supported Bridging Service: Use a reputable bridge, like Base Bridge or Orbiter Finance, to move funds from Ethereum or other chains to Base.

-

Base Network Configuration: Add the Base network to your wallet using official RPC details. Many wallets offer a one-click setup for Base.

Current Market Snapshot:

Navigating Fees With GasZero and Smart Batching

The fear of high gas fees has held many retail investors back from exploring DeFi. On Base, innovative solutions like GasZero sponsor transaction costs so users can interact with dapps without worrying about fluctuating fees. Smart batching further reduces expenses by grouping transactions efficiently, a game-changer for newcomers looking to test the waters without breaking the bank.

Start Small: Testing Apps Safely

The golden rule in decentralized finance, especially when starting out, is to begin with small amounts. Test each app or protocol with modest sums before scaling up your investments. This approach not only protects you from unexpected risks but also helps build confidence as you learn how different platforms operate within the Base ecosystem.

- KYC-free onboarding: Most retail-friendly apps on Base don’t require lengthy verification processes.

- User education: Many dapps offer tutorials right inside their interface, take advantage!

- Sustainable yield strategies: Look for protocols that emphasize risk management and transparency over flashy returns.

If you want more details about this process or step-by-step visuals, check out our full guide at How to Safely Onboard to Base DeFi: A Step-by-Step Guide for Retail Investors.

Mitigating Risks: Security Best Practices for DeFi Beginners

Security is paramount when venturing into decentralized finance. Unlike traditional financial platforms, DeFi protocols operate without a central authority, which means you are responsible for safeguarding your assets. Here are some actionable steps to keep your funds secure:

Top Security Tips for New Base DeFi Users

-

Use a reputable, non-custodial wallet like Coinbase Wallet or MetaMask. Always download wallets from official sources to avoid malicious copies. Enable all available security features, such as biometric authentication and strong passwords.

-

Beware of phishing attacks—always verify URLs and never click suspicious links. Bookmark official Base DeFi sites and double-check addresses before connecting your wallet. Phishing is a leading cause of crypto theft.

-

Keep your wallet recovery phrase offline and private. Never share your seed phrase with anyone or store it digitally. Write it down and keep it in a secure, offline location to prevent unauthorized access.

-

Start with small transactions when using new DeFi apps. Test Base DeFi protocols like Uniswap or Aave with modest amounts before committing larger funds. This helps identify potential issues safely.

-

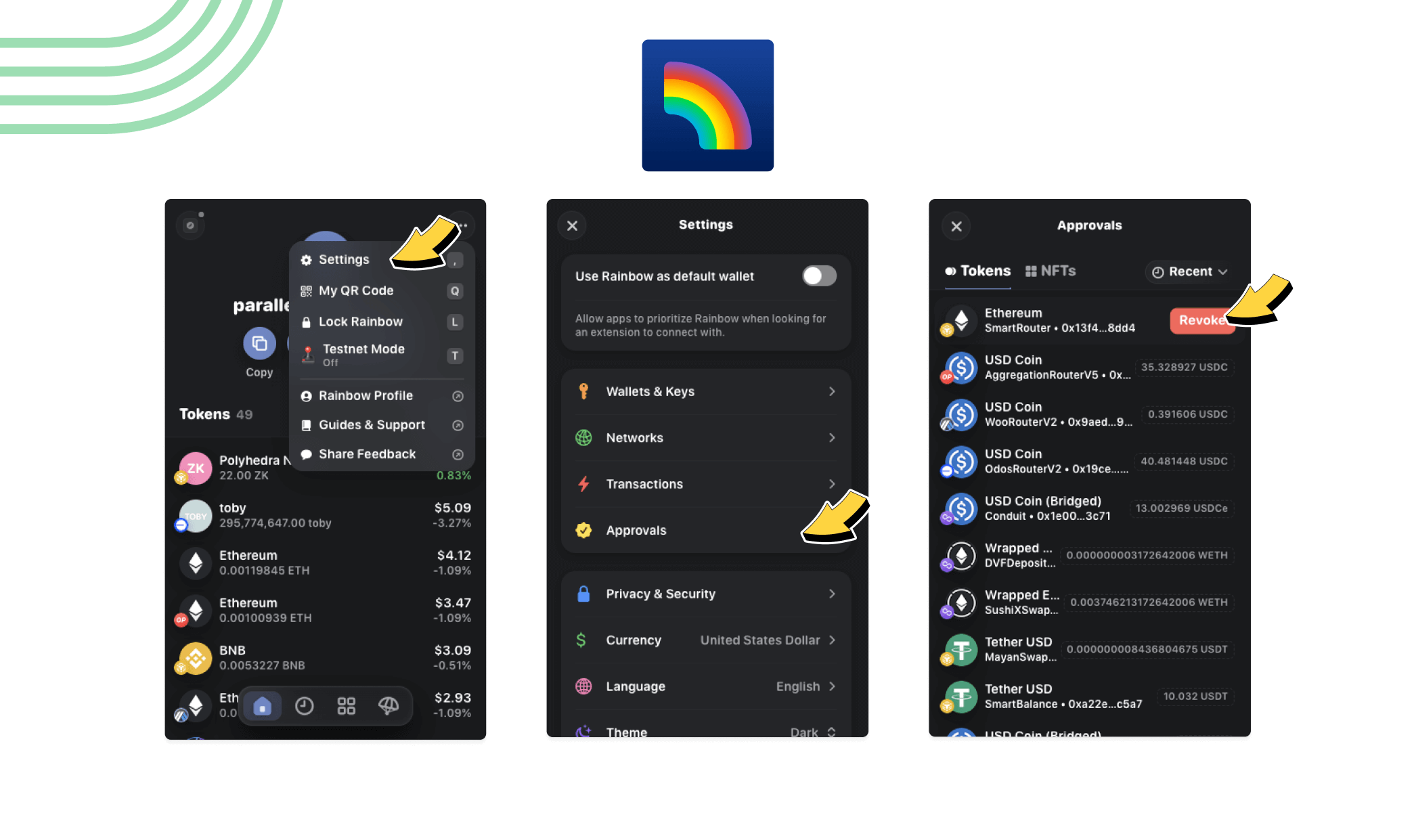

Regularly review wallet permissions and revoke unnecessary approvals. Use tools like Revoke.cash to manage and remove token permissions granted to DeFi apps, reducing risk if a protocol is compromised.

-

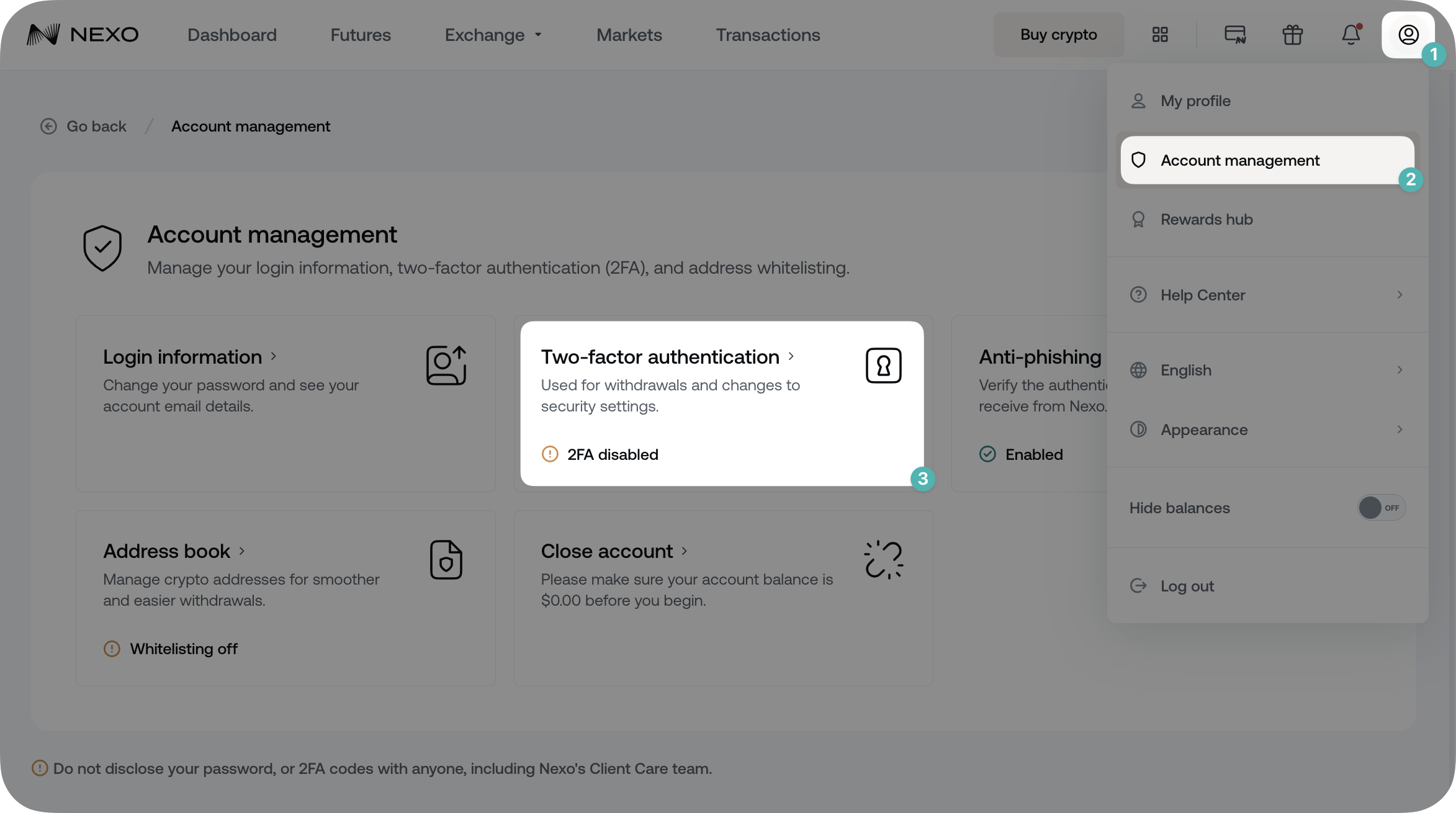

Enable two-factor authentication (2FA) on all associated accounts. For platforms like Coinbase, always activate 2FA to add an extra layer of protection to your exchange and wallet logins.

-

Stay updated on Base DeFi security news and best practices. Follow official Base, Coinbase, and major DeFi project channels on platforms like X (Twitter) and Discord to learn about new threats and recommended actions.

Always verify you’re using official dapp URLs and double-check smart contract addresses before approving any transaction. Enable two-factor authentication (2FA) on your exchange accounts and avoid sharing private keys or seed phrases with anyone. Remember, legitimate support teams will never ask for these details.

Tracking Your Portfolio and Staying Informed

Once you’ve started experimenting with DeFi protocols on Base, the next challenge is tracking your investments and understanding your yield. Fortunately, several tools now cater specifically to retail investors:

- Kubera: Aggregate all your DeFi holdings alongside traditional assets for a comprehensive snapshot.

- Dapp dashboards: Many Base-based apps provide real-time analytics of your deposits, rewards, and risks.

- Community forums: Engage with other users to share tips and learn about new opportunities or potential risks.

The more you track and analyze your positions, the more confidently you can adjust strategies as the market evolves. With Ethereum currently at $4,499.47, even small moves in the market can impact DeFi yields, staying alert is key.

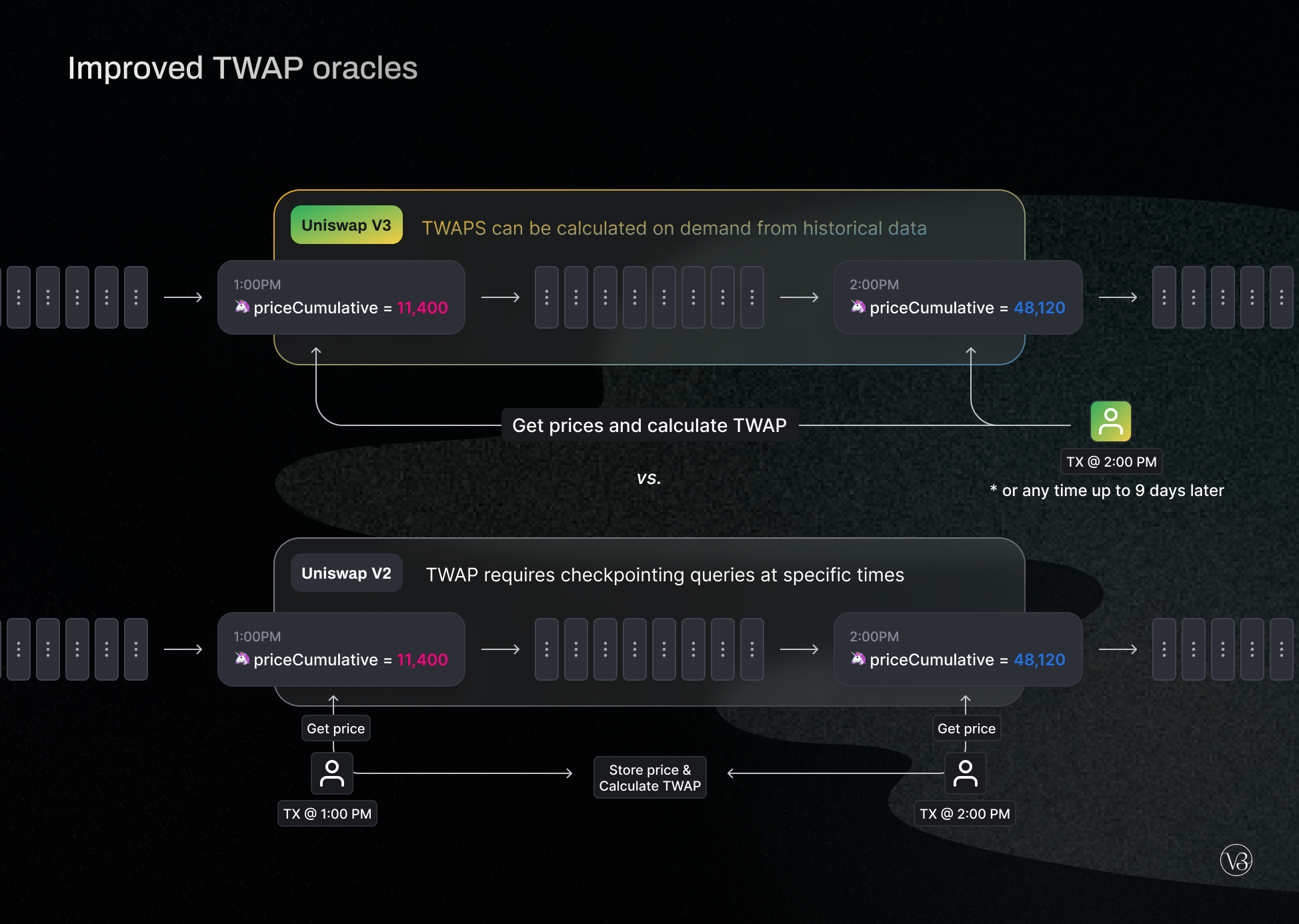

Expanding Your Horizons: Exploring New Protocols Safely

The Base ecosystem continues to expand with innovative protocols offering lending, borrowing, staking, and automated yield strategies. As a retail investor, it’s tempting to chase high returns, but always research before committing significant funds. Check audits, read community feedback, and start with trial amounts before scaling up. Look for transparent projects that openly share risk disclosures and have active developer teams.

“DeFi isn’t about overnight riches, it’s about building sustainable wealth through informed participation. ”

Learning as You Go: Education Is Your Edge

The most successful retail investors in DeFi are those who keep learning. Take advantage of educational resources built into many Base dapps or join online communities focused on decentralized finance for retail users. If you ever feel overwhelmed by jargon or complex mechanics, step back, there’s no rush in DeFi. The best opportunities are those you fully understand.

Ready to Begin? Your Next Steps in Retail-Friendly DeFi

The future of decentralized finance is inclusive, and with solutions like GasZero and intuitive onboarding via Coinbase Wallets on Base, anyone can participate safely. Start small, emphasize security at every step, track your progress diligently, and never hesitate to seek out education or support from the community.

If you’d like a deeper dive into each step discussed here, including illustrated walkthroughs, visit our comprehensive guide at How to Safely Onboard to Base DeFi: A Step-by-Step Guide for Retail Investors.