Perpetual decentralized exchanges (DEXs) on the Base blockchain are shaking up the DeFi landscape by making advanced trading strategies accessible to everyone. If you’ve ever wanted to trade crypto with leverage, hedge your risks, or simply explore more dynamic markets, all while keeping fees minimal, Base is quickly becoming the go-to ecosystem for retail-friendly perpetual DEX activity. In this beginner’s guide, we’ll break down exactly what perpetual DEXs are, how they work on Base, and what you need to know to start trading safely and confidently.

What Are Perpetual DEXs and Why Are They Popular on Base?

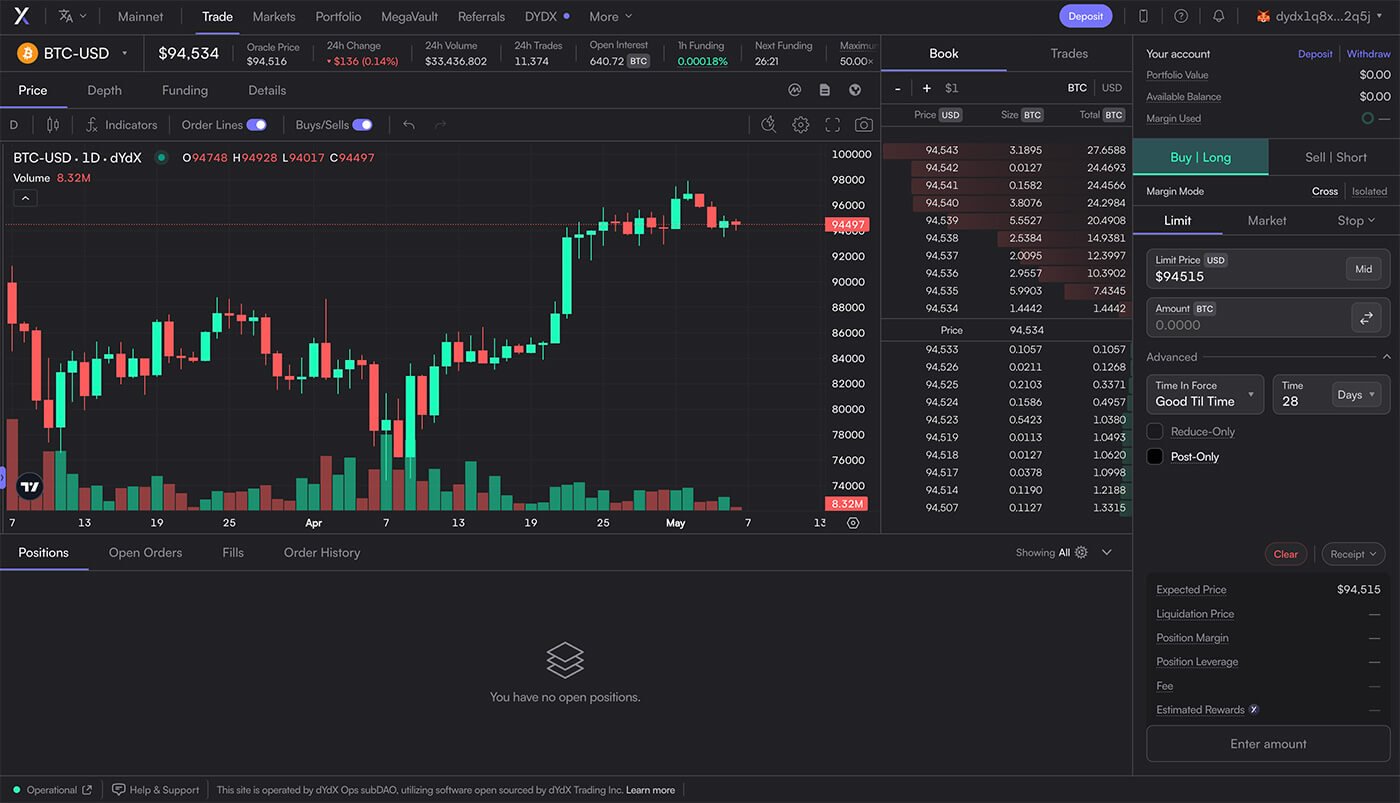

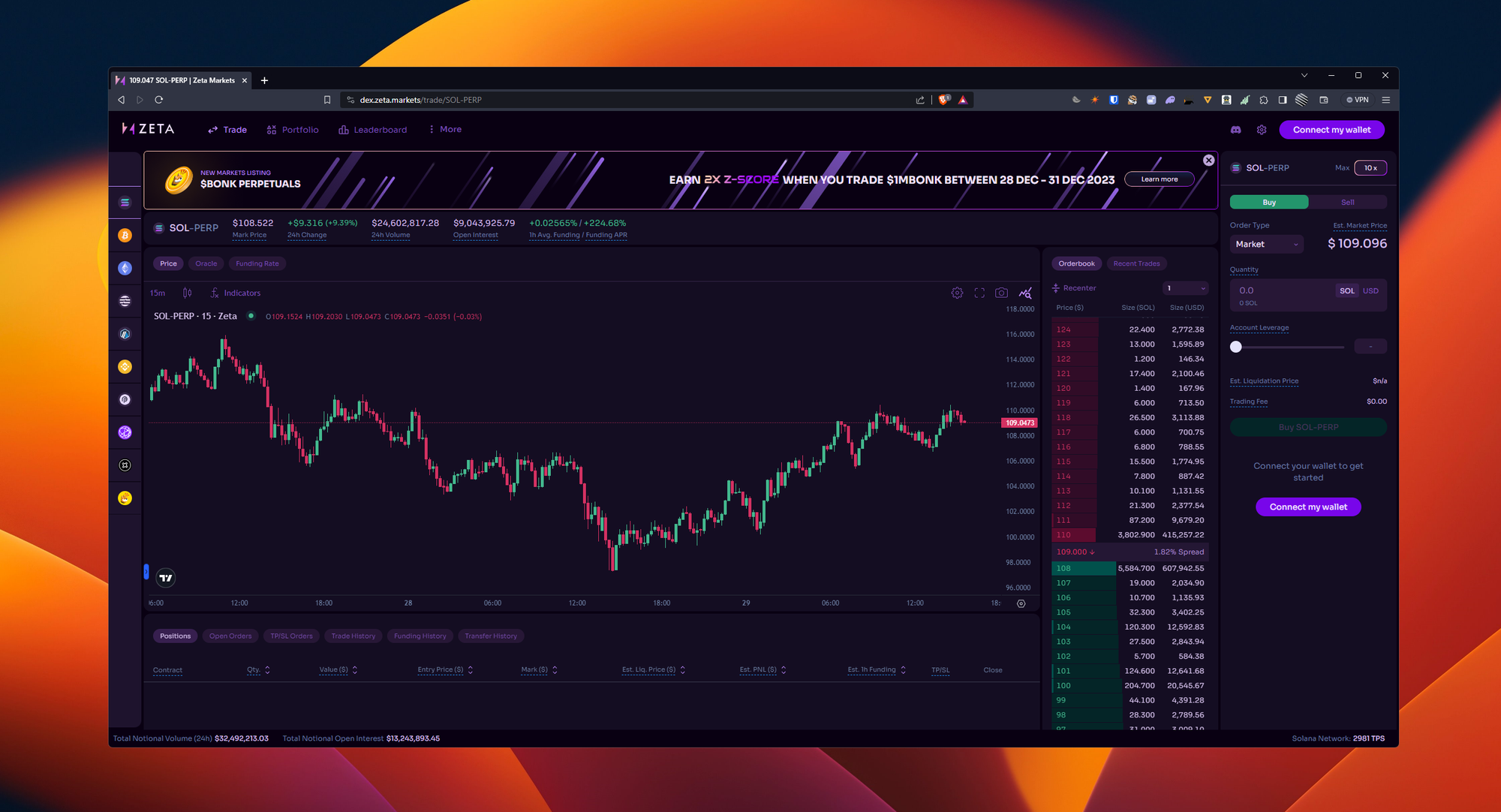

A perpetual DEX lets you trade crypto derivatives, contracts that track the price of assets like ETH or BTC but don’t require you to actually own them. The “perpetual” part means these contracts never expire, so you can hold positions as long as you want. This opens up opportunities for both long (betting on price increases) and short (betting on price drops) trades with leverage, sometimes up to 50x or even 75x.

Base’s unique infrastructure supercharges this experience by offering:

- Low transaction fees: Thanks to its Ethereum Layer 2 design, gas costs are a fraction of mainnet prices.

- High throughput: Thousands of transactions per second mean no more waiting for trades to settle.

- Security: Built atop Ethereum’s security guarantees, giving peace of mind while trading.

This combination attracts both first-time traders and seasoned DeFi users looking for efficiency and cost savings. For a deeper dive into how perpetual trading is evolving on Base, check out the detailed breakdown at ZEUS Exchange’s Medium article.

Key Features of Leading Perpetual DEXs on Base

Zeus Exchange vs. Avantis: Key Features for Beginners

-

Leverage Options: Zeus Exchange offers up to 50x leverage on perpetual contracts, while Avantis supports higher leverage up to 75x. This allows traders to amplify potential gains (and losses) depending on their risk appetite.

-

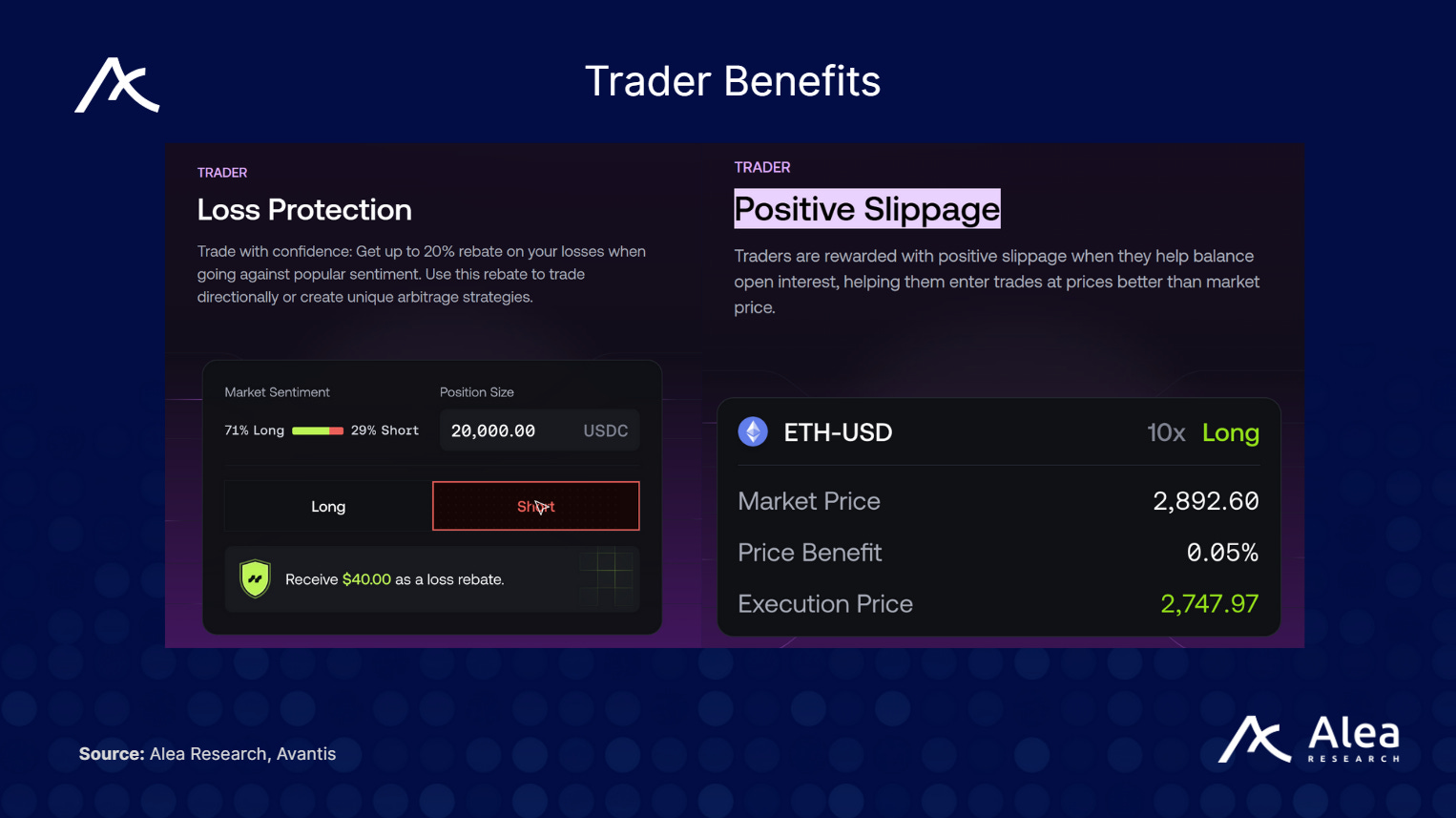

Unique Risk Management: Avantis features a risk protector mechanism that compensates traders for a portion of losses when the market moves against them—an innovative safety net for beginners. Zeus Exchange offers automated take profit and stop loss tools to help manage risk.

-

Trading Pairs: Zeus Exchange focuses on major crypto perpetuals, ensuring deep liquidity. Avantis stands out by offering perpetual futures on forex and commodities in addition to crypto, expanding trading opportunities for users.

-

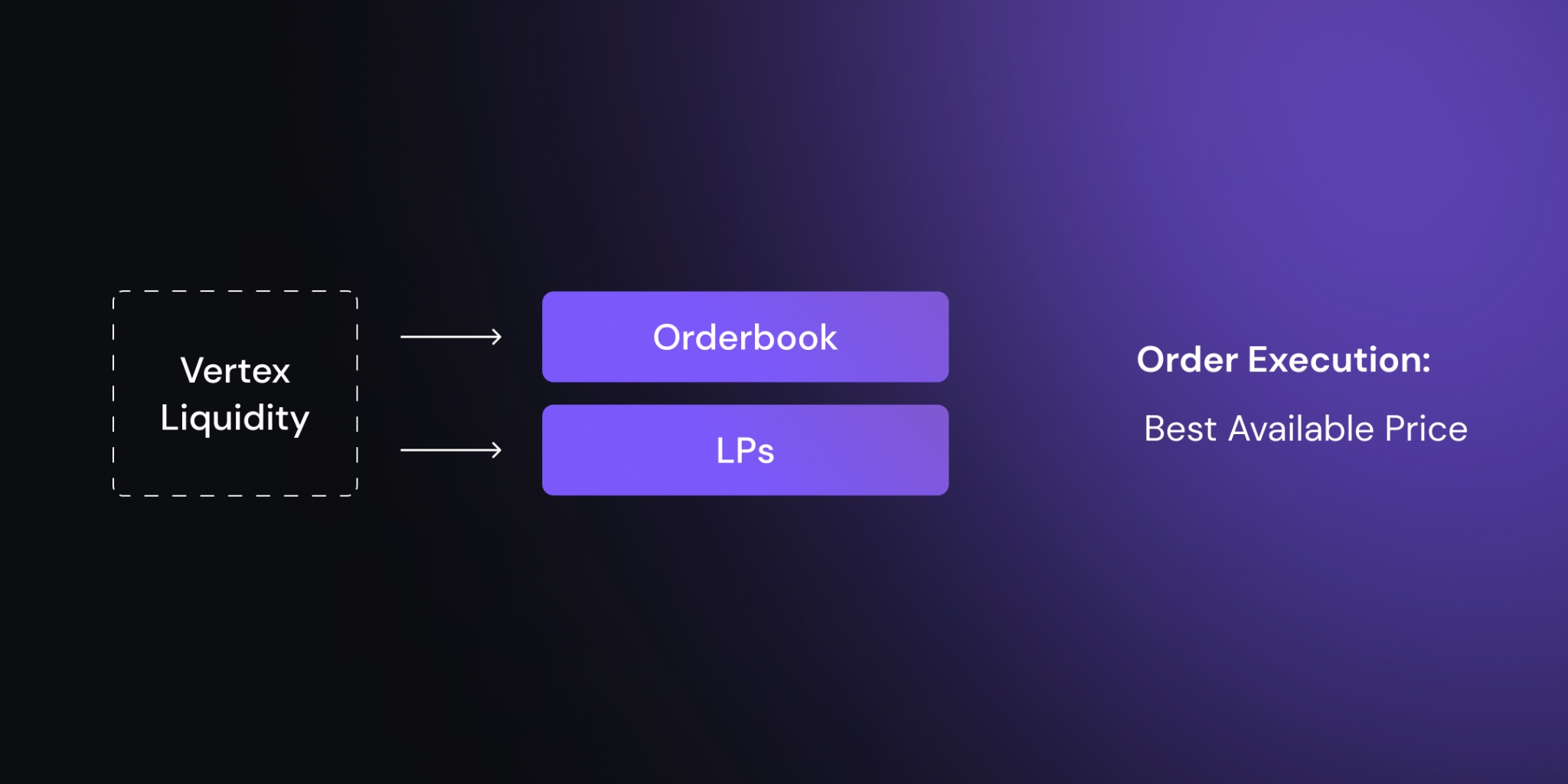

Liquidity and Slippage: Zeus Exchange uses a hybrid liquidity engine that combines on-chain pools with external sources, minimizing slippage and ensuring smooth trade execution. Avantis also maintains competitive liquidity, but its unique risk features are a primary draw for new users.

-

User Experience & Fees: Both platforms leverage Base’s low-fee, high-speed network, making trading affordable and efficient. Beginners will find intuitive interfaces and accessible onboarding on both Zeus Exchange and Avantis.

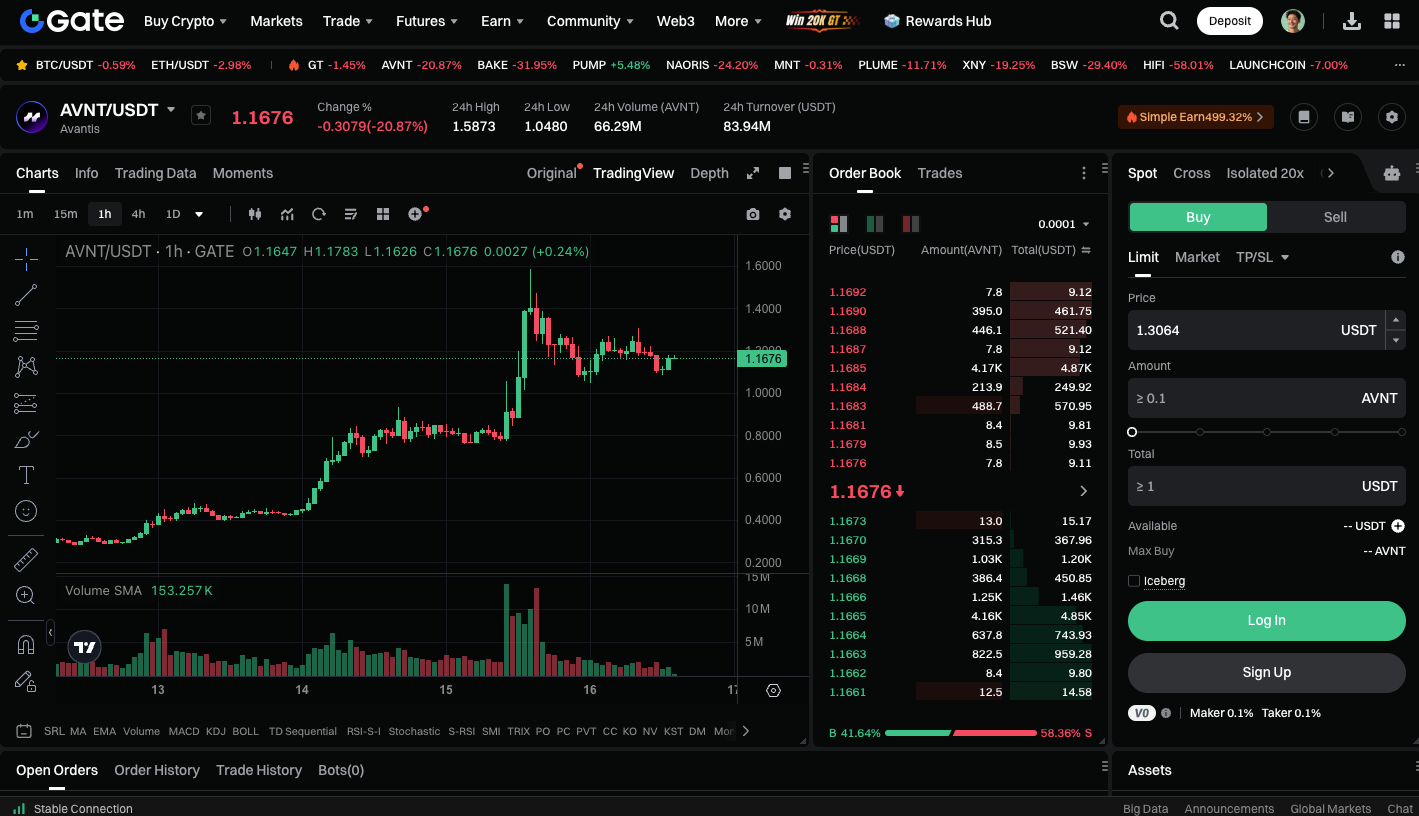

Several platforms have emerged as leaders in this space. Two standouts are:

- Zeus Exchange: Known for deep liquidity via its hybrid engine (on-chain and external sources), automated risk tools like take profit/stop loss orders, and up to 50x leverage.

- Avantis: Launched in early 2024 with a unique “risk protector” feature that partially compensates traders when things go sideways. Supports forex and commodity futures alongside crypto pairs, with leverage as high as 75x (see Avantis research here).

The flexibility these platforms offer is game-changing: you can trade around the clock, access diverse markets, and experiment with advanced strategies, all without the custodial risks of centralized exchanges.

How To Start Trading Perps Safely On Base: Step-By-Step

If you’re new to DeFi or coming from traditional finance, getting started might seem intimidating, but it doesn’t have to be! Here’s a quick overview:

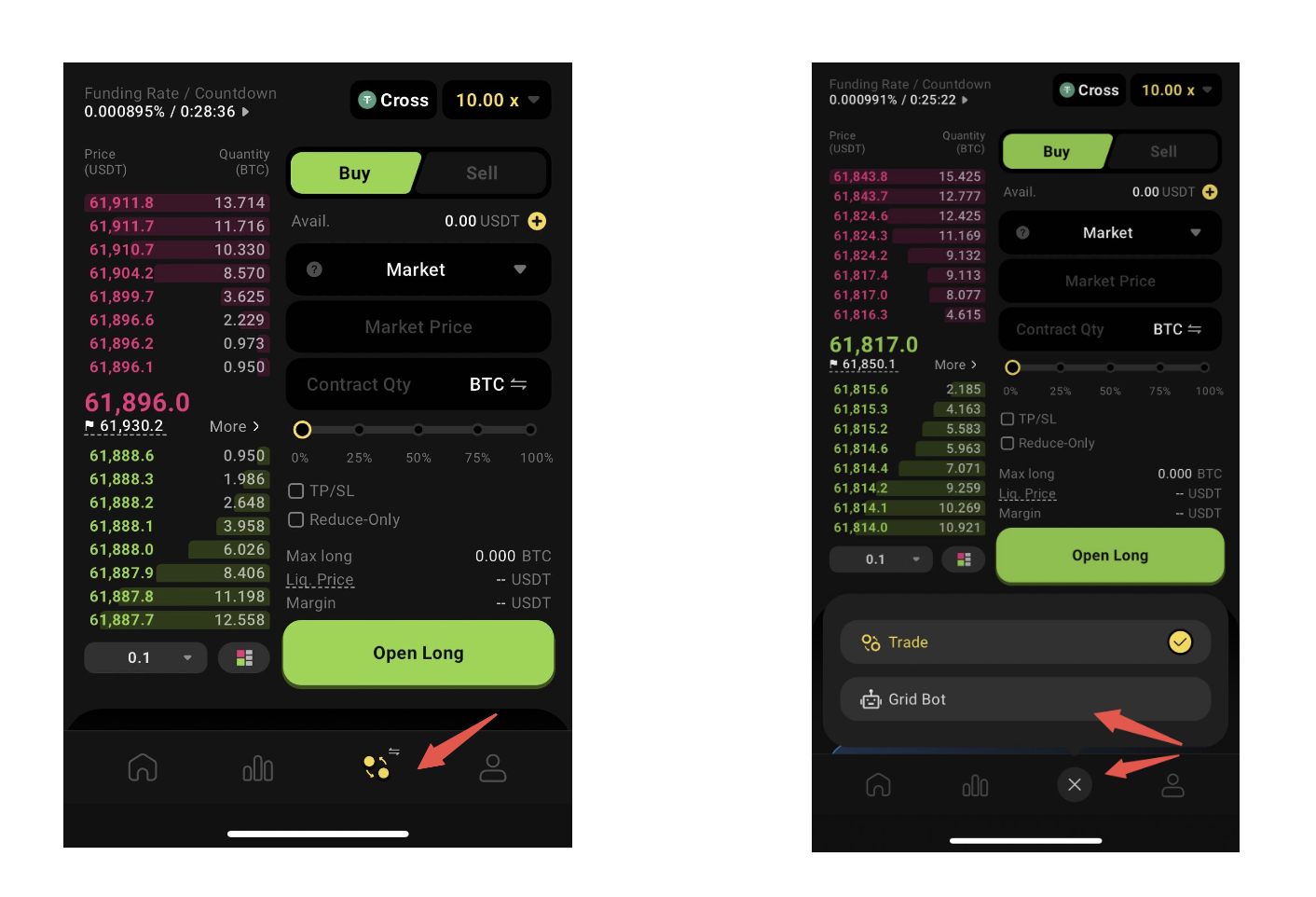

- Set Up Your Wallet: Choose a Web3 wallet like MetaMask or Coinbase Wallet that supports Base network integration.

- Add Funds: Transfer ETH or another supported asset onto your wallet via an exchange or bridge service.

- Select Your DEX: Navigate directly to Zeus Exchange or Avantis’ official site, always double-check URLs!

- Connect and Explore: Link your wallet, browse available pairs/leverage options, and get familiar with risk management tools before opening any positions.

The best traders always start small, use demo modes if available and never risk more than you can afford to lose while learning. For real-time community tips and market updates from experienced traders using Base perps DEXs, see this tweet below:

Pitfalls To Avoid: Safety First in DeFi Trading

The allure of high leverage can be strong, but remember: it amplifies both gains and losses. Here are three golden rules every beginner should follow when exploring perpetual DEXs on Base:

- Pace Yourself With Leverage: Start low (like 2x-5x) until you fully understand liquidation risks.

- Diversify and Protect Capital: Don’t put all your funds into one position; use stop-loss orders whenever possible.

- Avoid Unverified Platforms: Only use audited DEXs with transparent documentation and active communities, security comes first!

Staying informed and practicing discipline are your best defenses against the pitfalls of DeFi trading. While Base’s architecture offers robust security, the volatile nature of crypto markets means risk is always present. Make sure to review each DEX’s documentation, join their communities for updates, and never connect your wallet to suspicious links or sign unexplained transactions.

Smart Risk Management: Tools and Tips

Modern perpetual DEXs on Base provide a toolkit for managing risk more effectively than ever before. Here are some of the most useful features you should take advantage of:

Essential Risk Management Tools on Base Perpetual DEXs

-

Stop-Loss Orders: Most Base DEXs, including Zeus Exchange and Avantis, let you set automatic stop-loss orders to limit potential losses by closing your position if the price hits a predetermined level.

-

Take-Profit Orders: Platforms like Zeus Exchange support take-profit orders, which automatically secure profits by closing your position when the asset reaches your target price.

-

Risk Protector Mechanism: Avantis offers a unique risk protector tool that compensates traders for a portion of losses when trades move against them, adding an extra layer of safety for beginners.

-

Margin Calculators: Both Zeus Exchange and Avantis provide integrated margin calculators, helping you determine the required collateral and potential liquidation prices before entering a leveraged position.

-

Automated Position Management: Advanced platforms like Zeus Exchange feature automated tools that let you set multiple risk parameters (like stop-loss and take-profit) simultaneously, streamlining your risk management strategy.

Using these features not only helps protect your capital but also allows you to trade with greater confidence. Remember, even experienced traders rely on automation and clear rules to avoid emotional decisions during market swings.

For those looking to deepen their understanding or troubleshoot issues in real-time, community forums and official Discord channels are invaluable resources. You’ll often find walkthroughs, AMAs with developers, and peer support that can make all the difference when learning a new platform.

Frequently Asked Questions About Perpetual DEX Trading on Base

If you’re still unsure about leverage mechanics or how liquidations work on these platforms, don’t hesitate to ask questions, most communities are welcoming to newcomers who show a willingness to learn. Safe DeFi trading starts with knowledge!

Want a visual breakdown? This quick video explains perpetual contracts and how they work specifically on Base:

Why Now Is an Exciting Time for Retail Traders

The arrival of retail-friendly perpetual DEXs on Base signals a new chapter in decentralized finance, one where everyday users can access sophisticated tools without prohibitive fees or technical barriers. Whether you’re building a hedge against price swings or experimenting with leverage for the first time, these platforms empower you to participate in global markets 24/7.

The key is starting small, using every protective feature at your disposal, and learning by doing, always guided by data rather than hype. As more innovative projects launch atop Base’s scalable foundation, expect even more accessible DeFi solutions tailored for retail investors.

Ready to explore? Check out this research spotlighting top perpetual DEX platforms for point farming opportunities and platform comparisons.