Decentralized finance (DeFi) can seem daunting for newcomers, but recent innovations are making it more accessible than ever. If you’re looking for fast, cheap, and secure DeFi transactions, the Base blockchain stands out as an ideal starting point. Built by Coinbase and leveraging Ethereum’s security, Base is designed for everyday users who want to experience DeFi without the headaches of high fees or sluggish transaction times.

Why Choose Base for Your First DeFi Transactions?

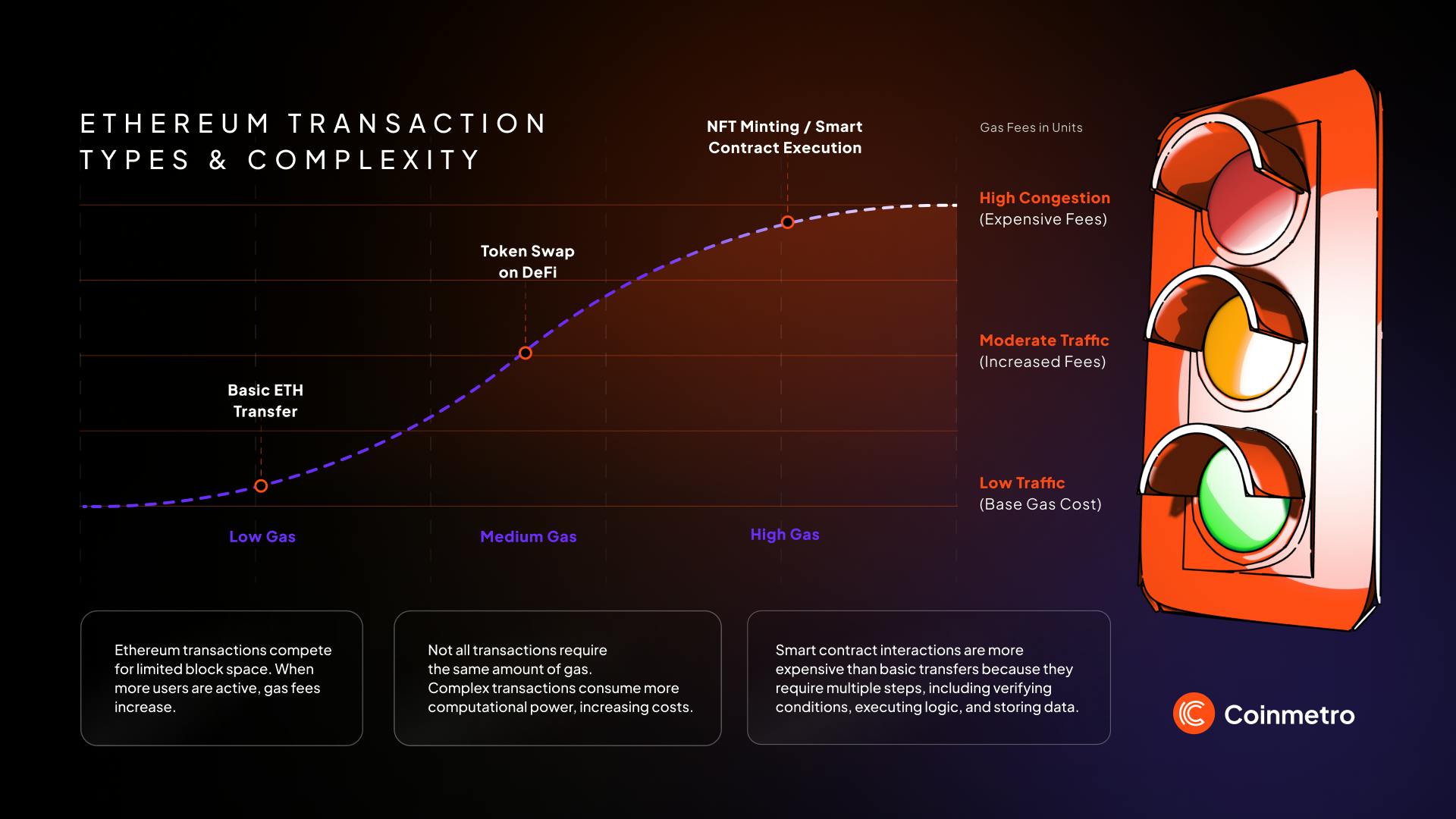

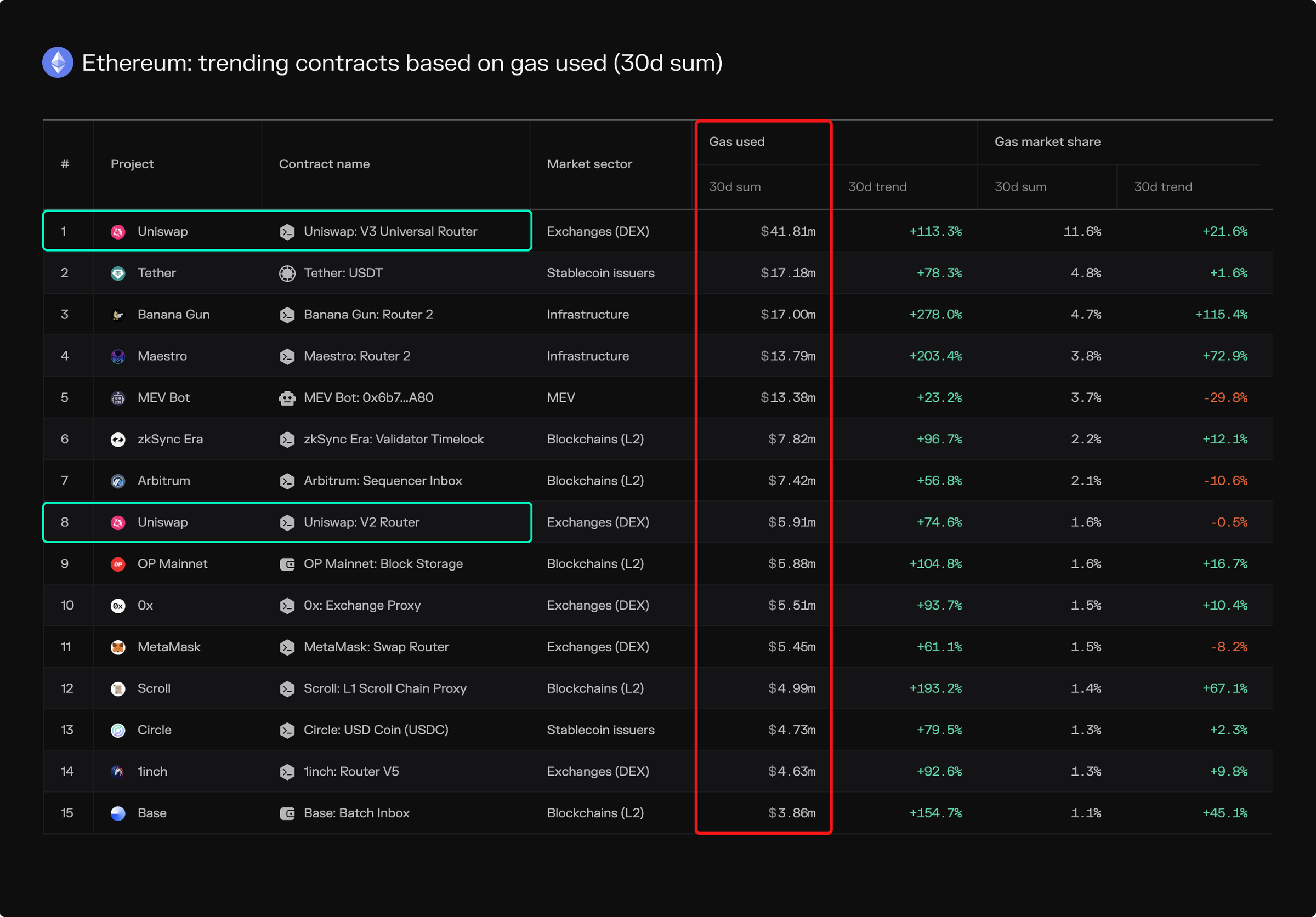

The original promise of DeFi was open access and financial empowerment. Yet, Ethereum’s mainnet often faces congestion and high gas costs, pricing out many retail users. Base solves these pain points by acting as a Layer-2 solution: it batches transactions off-chain before settling them securely on Ethereum. This means you get the best of both worlds – lightning-fast confirmations and significantly lower transaction fees.

Let’s break down what makes Base so attractive to beginners:

Key Benefits of Using Base for DeFi Beginners

-

Fast and Low-Cost Transactions: Base leverages Layer-2 technology to offer significantly cheaper and quicker transactions compared to Ethereum mainnet, making DeFi accessible for users with smaller portfolios.

-

Seamless Ethereum Compatibility: Base is fully compatible with the Ethereum Virtual Machine (EVM), allowing users to access popular DeFi apps like Uniswap, SushiSwap, and Aave without learning new tools.

-

Easy Onboarding with Popular Wallets: Beginners can use trusted wallets such as Phantom to set up and manage assets on Base, ensuring a smooth and familiar experience.

-

Access to Leading DeFi Platforms: Base supports major DeFi protocols, including Uniswap, Moonwell Finance, and Beefy Finance, enabling users to swap, lend, borrow, and yield farm efficiently.

-

Enhanced Security via Ethereum: Transactions on Base ultimately settle on Ethereum, benefiting from Ethereum’s robust security and decentralization while enjoying L2 efficiency.

-

Scalable and Growing Ecosystem: As a Coinbase-backed project, Base is rapidly expanding its ecosystem, attracting more trusted DeFi apps and services for beginners to explore.

If you want to dive deeper into how Base works under the hood, check out this overview from Chainport’s blog: Base Blockchain Explained.

Your Step-by-Step Path to Getting Started with DeFi on Base

The path to your first DeFi transaction is simpler than you might think. Here’s how retail users can get started safely:

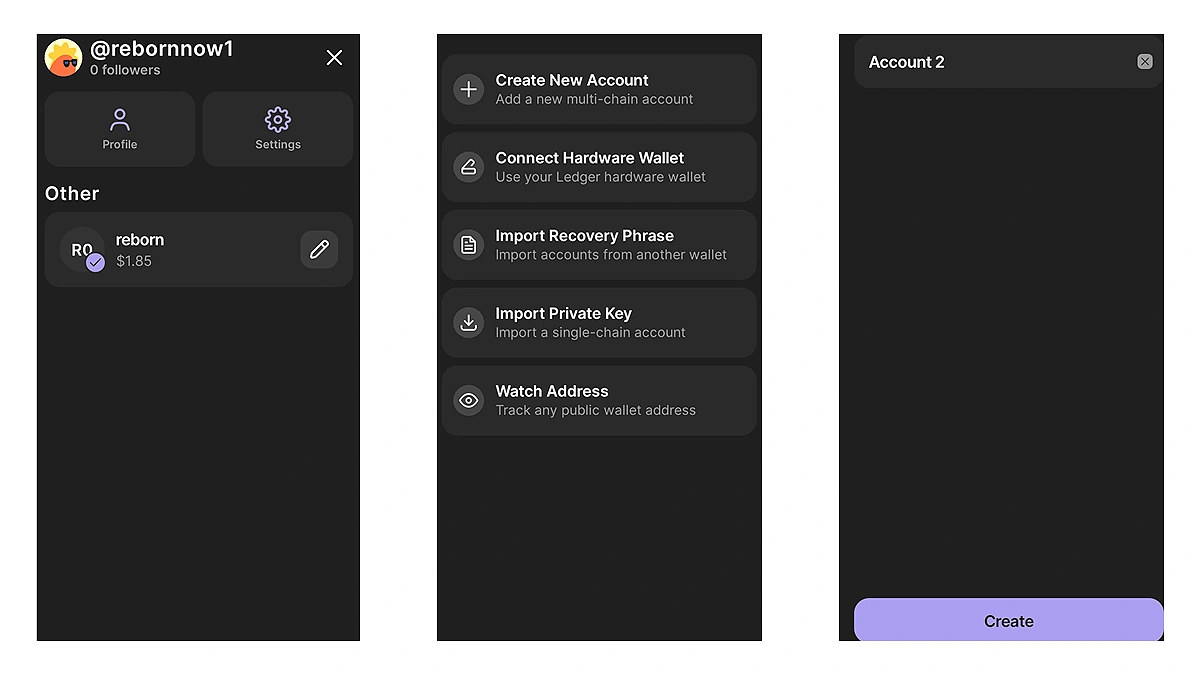

1. Set Up a Compatible Wallet: Not all wallets support every blockchain network or app. For Base, popular choices like Phantom make onboarding seamless with multi-chain support. More details are available in Phantom’s beginner guide: Phantom Wallet and Base Guide.

2. Bridge Assets Securely: Once your wallet is set up, you’ll need to move assets from Ethereum or other chains onto Base using trusted bridges like the official Base Bridge. Always double-check URLs and stick with reputable services such as Stargate Finance.

3. Explore Beginner-Friendly DeFi Apps: On Base, you’ll find familiar names like Uniswap (for token swaps), Aave (lending/borrowing), and Beefy Finance (yield farming). These platforms are optimized for low fees and smooth experience on Layer 2.

The Importance of Security in Retail-Friendly DeFi

No matter how easy or cheap transactions become, security should always be top priority – especially for beginners navigating smart contracts for the first time. The good news is that by building atop Ethereum’s proven framework and Coinbase’s infrastructure, Base inherits robust security standards. However, risks remain in any open financial system.

Key Security Tips:

- Avoid phishing sites. Only use official links when bridging or transacting.

- Diversify risk. Don’t put all your funds into one protocol, especially new ones.

- Stay informed about regulatory changes.

- Check liquidity before entering/exiting positions.

Navigating Your First Transaction: What to Expect

Your first swap or yield farm on Base should feel noticeably smoother than older blockchains. Expect near-instant confirmations at a fraction of mainnet prices, often just cents per transaction rather than dollars. This efficiency allows new users to experiment with smaller amounts without fear of losing value to fees.

As you explore DeFi on Base, you’ll notice that the network’s low fees and fast speeds aren’t just technical perks, they’re real enablers for retail users. Instead of paying $10 or more per transaction on Ethereum mainnet, you’re looking at costs that are typically measured in cents. This means you can try out swaps, lending, or yield farming without worrying about eroding your capital through excessive fees. For those just starting out, this is a game-changer.

Popular DeFi Apps to Try on Base

Base has rapidly established itself as a hub for major DeFi protocols. Here are some beginner-friendly platforms worth exploring:

Top DeFi Platforms on Base for Beginners

-

Uniswap on Base: Uniswap, the leading decentralized exchange, is now available on Base. It enables fast, low-cost token swaps with the same intuitive interface users know from Ethereum. Explore Uniswap on Base

-

Aave on Base: Aave is a trusted lending and borrowing protocol supporting Base. Users can supply or borrow assets with lower fees and faster transactions, all while benefiting from Aave’s robust risk management. Visit Aave on Base

-

Beefy Finance on Base: Beefy Finance offers automated yield farming vaults on Base, allowing users to earn optimized returns on their crypto assets with minimal effort. Access Beefy Finance on Base

Uniswap remains the go-to decentralized exchange (DEX) for quick and easy token swaps. On Base, it’s even more approachable thanks to lower fees and faster settlements. Aave offers lending and borrowing markets, perfect for those interested in earning passive income or accessing liquidity without selling their assets. Beefy Finance brings automated yield optimization to the table, letting new users earn competitive yields with minimal management.

Retail-Focused Safety Checklist

Staying safe in DeFi doesn’t have to be complicated. Here’s a practical checklist every beginner should follow before making any transaction:

Understanding Fees and Speed: The Retail Advantage

The core advantage of using Base is how it levels the playing field for smaller investors. With negligible fees and near-instant confirmations, retail users can finally participate in strategies that were previously reserved for whales or advanced traders. Whether you’re swapping tokens or depositing into a lending pool, your experience is smooth and cost-effective.

For an in-depth look at how these features make DeFi more accessible, and what sets Base apart from other Layer-2s, see this guide from CoinMarketCap Academy: What is Base? The Ultimate Guide to the Base Ecosystem.

Common Questions from New Users

If you ever feel lost or unsure about your next step, remember that most platforms have active communities ready to help, don’t hesitate to ask questions before committing funds.

The Road Ahead: DeFi for Everyone

The emergence of retail-friendly blockchains like Base signals a new era where decentralized finance isn’t just for tech-savvy early adopters but truly open to all. By following best practices around security and starting small, anyone can tap into the benefits of fast, cheap, secure transactions, and begin building their own digital wealth journey.