Artificial Intelligence is no longer a futuristic buzzword in DeFi – it’s the engine quietly powering a new era of yield optimization, automated trading, and portfolio management on the Base blockchain. For everyday users and retail investors, AI-driven tools are transforming what was once a complex, intimidating landscape into an approachable ecosystem where smart algorithms work tirelessly in your corner.

AI DeFi Tools on Base: The New Retail Edge

In 2025, the Base blockchain has emerged as a hotbed for user-friendly DeFi innovation. Its robust security model and seamless integration with Coinbase make it an ideal home for cutting-edge AI solutions tailored to retail participants. Let’s dive into five standout tools that are making waves:

Top 5 AI-Driven DeFi Tools on Base (2025)

-

Boost by Yearn (on Base): A user-friendly yield optimizer leveraging AI to maximize returns across Base’s DeFi protocols. Boost automates portfolio rebalancing, auto-compounding, and risk assessment, making sophisticated yield strategies accessible to everyday users.

-

Parsec AI Trading Suite: An advanced trading platform featuring AI-powered analytics, automated strategy execution, and real-time on-chain data insights. Parsec empowers users to deploy intelligent trading bots and optimize DeFi trades on Base with minimal manual intervention.

-

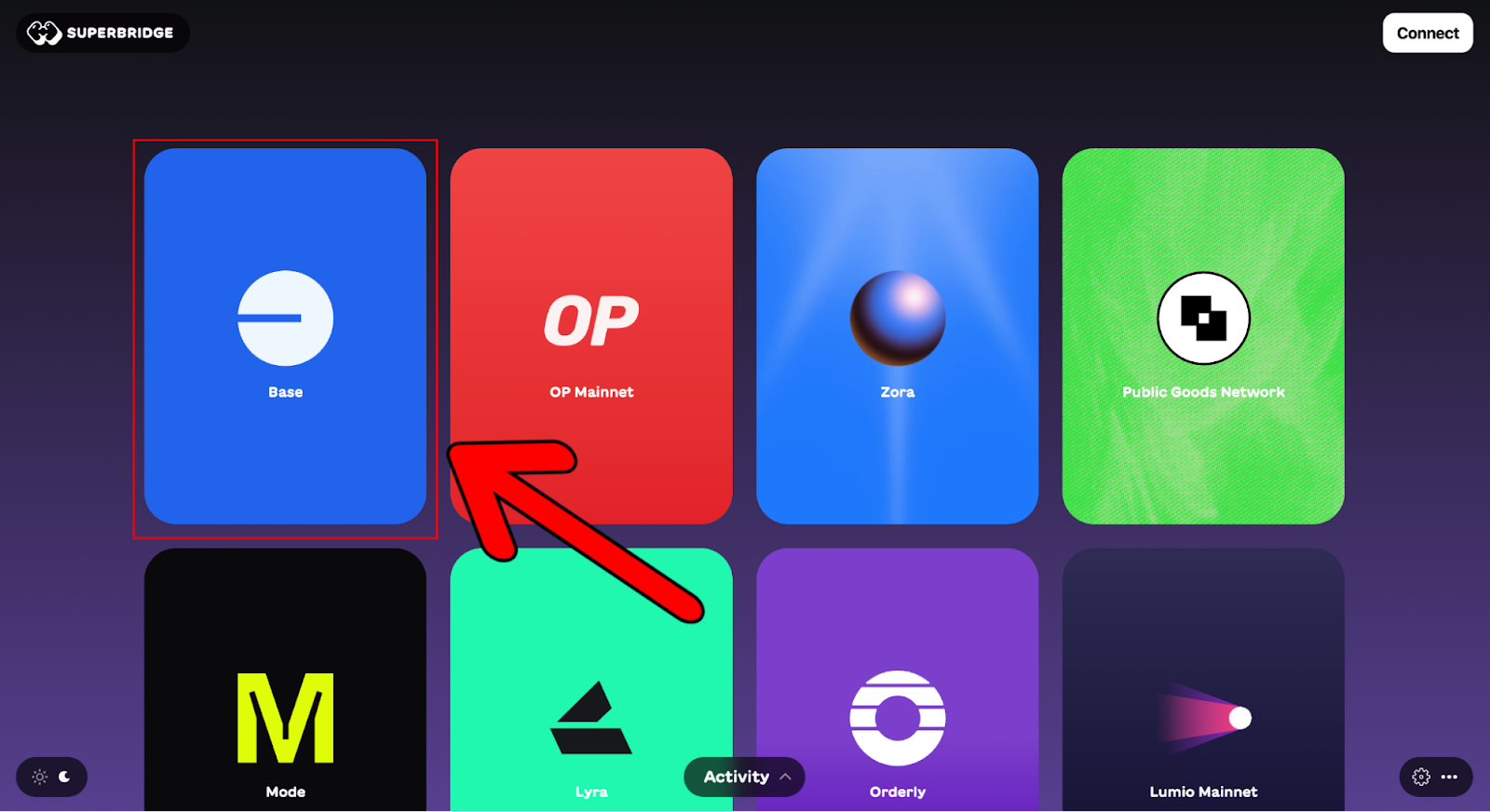

Superbridge AI Portfolio Manager: A cross-chain portfolio manager utilizing AI for dynamic asset allocation, risk profiling, and yield optimization. Superbridge streamlines portfolio management on Base, allowing users to bridge assets and automate investment strategies securely.

-

IAESIR AI Yield Optimizer: A robust AI-driven platform that continuously scans Base’s DeFi ecosystem for the highest-yield opportunities. IAESIR automates staking, liquidity provision, and yield farming, adapting strategies in real time to market changes and user preferences.

-

Fetch.ai Autonomous Agents for DeFi: Intelligent autonomous agents that interact with Base’s DeFi protocols to automate trading, liquidity management, and yield strategies. Fetch.ai’s agents enable users to benefit from 24/7 AI-driven financial operations without constant oversight.

Boost (by Yearn): Automated Yield Farming Made Effortless

Boost, developed by Yearn and now deployed natively on Base, is redefining yield farming for regular users. Instead of navigating dozens of protocols or manually tracking APRs across pools, Boost leverages machine learning to scan hundreds of liquidity pools in real time. The platform automatically reallocates your assets to the highest-yielding opportunities while minimizing transaction fees and risk exposure.

This isn’t just about maximizing numbers – it’s about peace of mind. Boost’s intuitive dashboard lets you set risk preferences (from conservative to aggressive), while its transparent reporting breaks down exactly how your assets are being put to work. For those who want to earn passive income but don’t have hours to spare each week watching charts, Boost is a game-changer.

Parsec AI Trading Suite: Smarter Trades, Less Guesswork

The Parsec AI Trading Suite brings institutional-grade trading intelligence directly to retail hands. Using advanced predictive analytics and natural language processing (NLP), Parsec continuously ingests on-chain data, news sentiment, and macro indicators to surface actionable trading signals.

What sets Parsec apart is its ability to automate trade execution based on customizable strategies. Want to follow momentum swings or mean reversion patterns? Parsec lets you tailor bots that act instantly when your defined criteria are met – no more missed opportunities or emotional trades. The suite also features backtesting tools so you can visualize how your strategy would have performed historically before putting real funds at risk.

Superbridge AI Portfolio Manager: Cross-Chain Simplicity

Superbridge takes portfolio diversification up a notch by using AI algorithms that seamlessly bridge assets between Base and other leading blockchains. Its core feature is an autonomous rebalancing engine that constantly evaluates yield opportunities not just within Base but across Ethereum Layer 2s and Solana as well.

This means users can enjoy optimized returns without ever worrying about gas fees or complex bridging steps. Superbridge’s visual interface offers clear breakdowns of where your funds are allocated and why – empowering even first-time DeFi users with clarity and control over their cross-chain strategies.

IAESIR AI Yield Optimizer: Personalized Earnings, 24/7

For those seeking a truly hands-off approach to yield generation, IAESIR AI Yield Optimizer is a standout. This tool uses reinforcement learning and adaptive algorithms to craft individualized yield farming strategies based on your unique risk appetite, asset mix, and time horizon. Unlike static vaults, IAESIR continuously monitors market shifts and protocol incentives across the Base ecosystem, reallocating assets in real time to maximize stablecoin and crypto yields.

The beauty here is in the details: IAESIR’s AI agent not only chases high APRs but also actively manages downside risk by factoring in impermanent loss, liquidity depth, and even protocol-specific events. For retail users who want their capital working around the clock without micromanagement, this optimizer delivers both performance and peace of mind.

Fetch. ai Autonomous Agents: Your On-Chain DeFi Co-Pilot

Imagine having a digital assistant that can scout opportunities, execute trades, rebalance your portfolio, and even negotiate fees, all autonomously. That’s the promise of Fetch. ai Autonomous Agents for DeFi on Base. These agents are small programs that interact directly with smart contracts on your behalf, leveraging machine learning to adapt strategies as market conditions evolve.

Fetch. ai’s agents excel at multi-tasking: they can simultaneously manage staking across multiple protocols, harvest rewards at optimal times, or respond instantly to market-moving news. For retail investors juggling busy lives (or just new to DeFi), these AI agents act as tireless co-pilots, removing friction while boosting efficiency and returns.

Choosing Your AI DeFi Toolkit: A Retail-Friendly Checklist

Navigating the expanding universe of AI DeFi tools on Base can feel overwhelming at first glance. Here’s a quick checklist for retail users looking to get started:

- Define your goals: Are you optimizing for yield, trading gains, or diversification?

- Set risk parameters: Most tools let you choose between conservative or aggressive strategies, pick what fits your comfort zone.

- Diversify: Consider using more than one tool (e. g. , Boost for yield farming and Parsec for trading signals) to balance opportunity and risk.

- Monitor performance: While automation is powerful, periodic check-ins help ensure your strategies remain aligned with your needs.

- Leverage education: Many platforms offer tutorials or demos, take advantage of these resources before deploying significant funds.

The Road Ahead: Inclusive and Intelligent Finance

The integration of AI into DeFi on Base marks a pivotal shift toward true financial inclusion. These tools strip away technical barriers while delivering institutional-grade intelligence directly into the hands of regular investors. Whether you’re earning passive income through Boost or automating complex cross-chain moves with Superbridge and Fetch. ai agents, the future of decentralized finance is more accessible, and more exciting, than ever before.

If you’re ready to take control of your digital assets with confidence (and maybe even outsmart some pros along the way), now’s the perfect time to explore what these next-generation solutions have to offer. The age of retail-friendly AI DeFi is here, and it’s just getting started.